Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest is a legal agreement that involves the transfer and conversion of ownership interests in oil, gas, or mineral rights in Hawaii. In this type of agreement, the assignor (the party assigning the working interest) transfers their rights to another party, known as the assignee. The assignee then becomes the new owner of the working interest in the oil, gas, or mineral rights and assumes all responsibilities and benefits associated with it. The Assignment of After Payout Working Interest enables the assignee to acquire the working interest only after the assigned project reaches a certain level of profitability or achieves a specific payout threshold. Until then, the assignor retains the working interest ownership. The Right to Convert Overriding Royalty Interest to A Working Interest provides the assignee with the option to convert their overriding royalty interest (ORRIS) into a working interest at a later stage. An overriding royalty interest is a share of revenue or profits received from a production project that is separate from the working interest ownership. There can be different types of Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest. Some variations include: 1. Fixed-term Assignment: This type of agreement specifies a specific period during which the assignee holds the working interest. After the agreed term expires, the ownership reverts to the assignor. 2. Conditional Assignment: Here, the allocation of the working interest to the assignee is contingent upon certain conditions or milestones being met. These conditions are typically related to project profitability, production volumes, or revenue targets. 3. Partial Assignment: It is possible to assign only a portion of the working interest, allowing both the assignor and the assignee to maintain co-ownership. This way, both parties share the risks and rewards of the project. 4. Convertible ORRIS: The right to convert overriding royalty interest to a working interest is included as an exclusive option, which can be exercised by the assignee at a later date. This type of agreement provides flexibility to the assignee in choosing their ownership structure based on project performance. Overall, Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest is a nuanced legal arrangement that allows for the transfer and conversion of ownership interests in oil, gas, or mineral rights in Hawaii.

Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest

Description

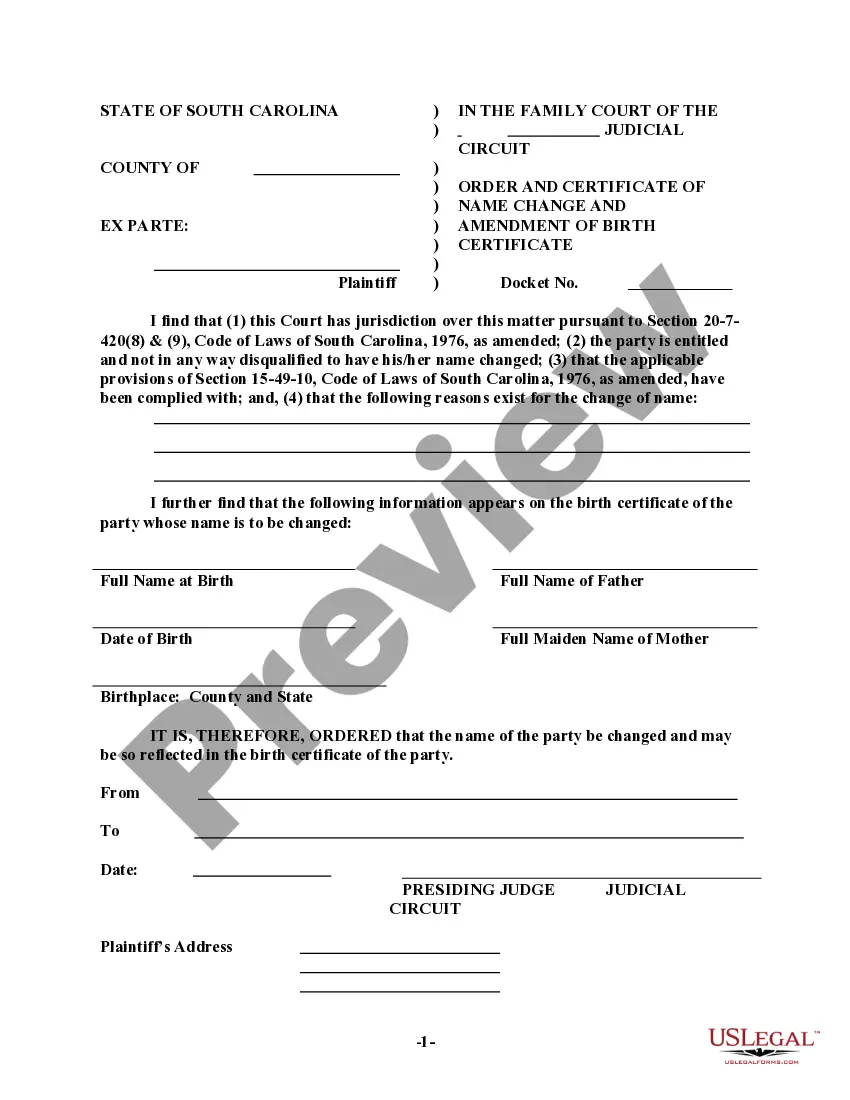

How to fill out Hawaii Assignment Of After Payout Working Interest And The Right To Convert Overriding Royalty Interest To A Working Interest?

Discovering the right authorized papers design can be a have difficulties. Needless to say, there are a lot of layouts accessible on the Internet, but how would you get the authorized type you need? Use the US Legal Forms web site. The support provides a large number of layouts, such as the Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest, that you can use for organization and personal requirements. Every one of the kinds are checked by pros and meet up with federal and state demands.

Should you be currently registered, log in to your accounts and click on the Acquire option to have the Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest. Utilize your accounts to appear with the authorized kinds you have purchased in the past. Go to the My Forms tab of your respective accounts and have another duplicate in the papers you need.

Should you be a brand new user of US Legal Forms, listed below are easy directions for you to follow:

- Initially, be sure you have selected the right type for the area/region. You are able to look over the shape while using Preview option and browse the shape description to make certain it will be the right one for you.

- When the type fails to meet up with your expectations, take advantage of the Seach industry to obtain the proper type.

- When you are sure that the shape is suitable, go through the Purchase now option to have the type.

- Select the rates plan you want and enter in the required info. Build your accounts and pay for the order making use of your PayPal accounts or charge card.

- Opt for the submit formatting and download the authorized papers design to your device.

- Total, modify and print and indication the acquired Hawaii Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest.

US Legal Forms is the greatest local library of authorized kinds that you can find different papers layouts. Use the company to download appropriately-made documents that follow status demands.

Form popularity

FAQ

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.