This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Hawaii Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

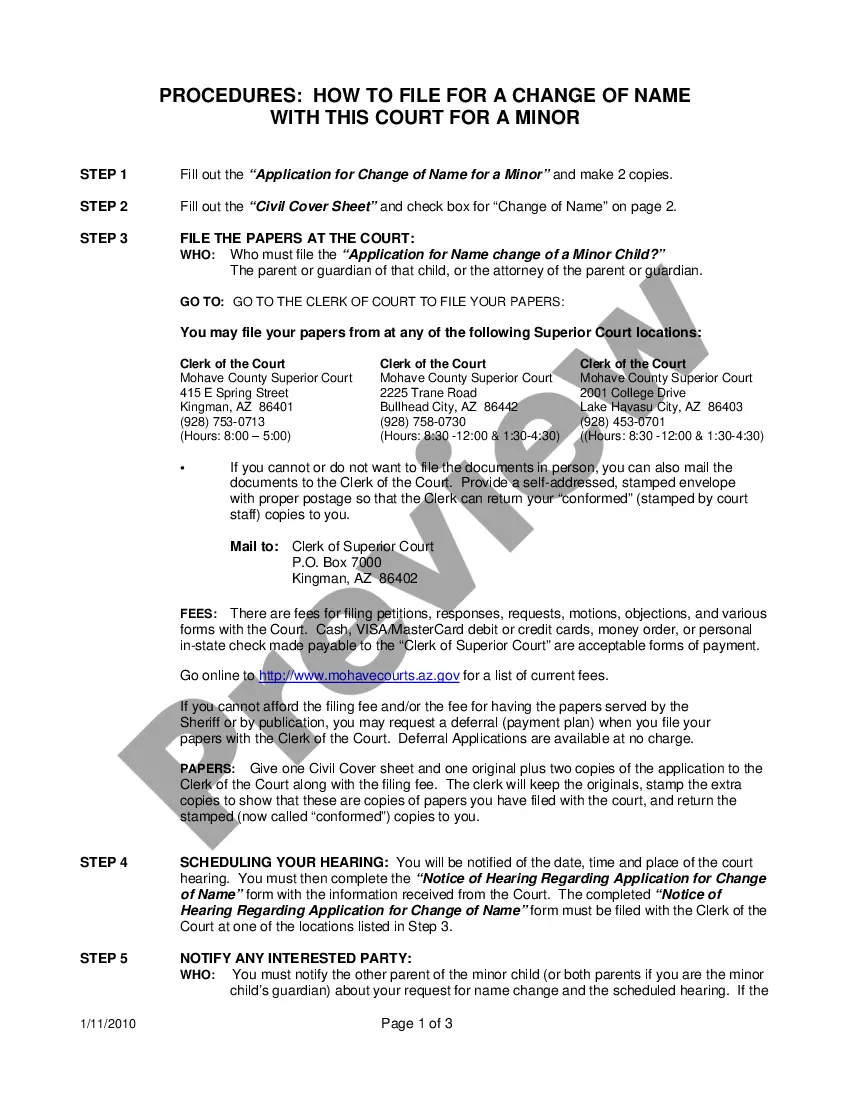

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

If you want to total, down load, or print out authorized record web templates, use US Legal Forms, the most important collection of authorized forms, that can be found on the web. Take advantage of the site`s easy and handy look for to obtain the files you will need. Numerous web templates for organization and personal reasons are categorized by types and says, or keywords. Use US Legal Forms to obtain the Hawaii Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries with a couple of click throughs.

If you are currently a US Legal Forms client, log in to your accounts and then click the Down load switch to obtain the Hawaii Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. You may also entry forms you earlier saved inside the My Forms tab of your accounts.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape to the appropriate metropolis/region.

- Step 2. Take advantage of the Review option to check out the form`s content. Do not overlook to see the explanation.

- Step 3. If you are unhappy with the kind, use the Search area on top of the display to find other versions in the authorized kind web template.

- Step 4. Upon having discovered the shape you will need, click on the Get now switch. Select the rates program you choose and put your credentials to register to have an accounts.

- Step 5. Procedure the purchase. You can use your charge card or PayPal accounts to perform the purchase.

- Step 6. Choose the structure in the authorized kind and down load it on your product.

- Step 7. Complete, change and print out or indication the Hawaii Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

Every authorized record web template you get is your own eternally. You might have acces to every kind you saved with your acccount. Click on the My Forms segment and decide on a kind to print out or down load once again.

Contend and down load, and print out the Hawaii Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries with US Legal Forms. There are thousands of professional and state-certain forms you may use for your organization or personal requirements.

Form popularity

FAQ

The beneficiary is usually the trustee of their own trust, but a third party can be appointed in place or or as a joint trustee if necessary. This might include when the beneficiary is looking down the barrel of bankruptcy, there are marriage problems or there is limited capacity to manage ones own finances. Testamentary trusts explained in plain English - Victoria - Vanessa Ash Law vanessaash.com.au ? testamentary-trusts-explained... vanessaash.com.au ? testamentary-trusts-explained...

Any individual who has control over the trust. Who is the Ultimate Beneficial Owner? The term Ultimate Beneficial Owner (UBO) is applied to individuals or entities who meet the beneficial owner definition and their ownership or voting rights are greater than 25%.

Experience and Knowledge. Another key consideration is whether the individual or entity is qualified to act as trustee. If the trust has substantial assets, an individual with experience managing significant assets or with a background in finance or investments may be better suited to the role of trustee.

Name a Trust Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word ?trustee,? or if you cannot provide a trustee, ETF may accept another contact person. How To Fill Out Beneficiary Designation - Alternate (ET-2321) wi.gov ? resource ? how-fill-out-beneficiary-d... wi.gov ? resource ? how-fill-out-beneficiary-d...

There's a significant difference between being a beneficiary or trustee of a trust. If you're named as a beneficiary then you stand to benefit from the assets in the trust. On the other hand, if you're the trustee it's your job to manage those assets ing to the wishes of the trust creator.

So, now you know that the Trust Maker holds the most power before the Trust is established, but the Trustee holds the most power after the Trust is established.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations. Can a Trustee Withhold Money From a Beneficiary? mpopc.com ? blog ? trustee-withhold-money-fro... mpopc.com ? blog ? trustee-withhold-money-fro...

A trustee has all the powers listed in the trust document, unless they conflict with California law or unless a court order says otherwise. The trustee must collect, preserve and protect the trust assets. Probate Trusts - The Superior Court of California, County of Santa Clara scscourt.org ? self_help ? probate ? property scscourt.org ? self_help ? probate ? property