A Hawaii Memorandum of Trust Agreement is a legal document that establishes a trust and outlines the key provisions and terms associated with it. This agreement serves as a concise reference for the trust's key elements, providing important details to both the trustee and beneficiaries involved. In Hawaii, there are different types of Memorandum of Trust Agreements that cater to specific needs and purposes. These agreements include: 1. Revocable Living Trust Memorandum: This type of agreement is commonly used in estate planning, allowing individuals to transfer their assets and property into a trust during their lifetime. By creating a revocable living trust, individuals retain control over their assets while alive and can make changes or revoke the trust if needed. 2. Irrevocable Trust Memorandum: An irrevocable trust agreement establishes a trust that cannot be modified, amended, or terminated without the consent of the beneficiaries and trustee. Such trusts are often utilized for asset protection, estate tax planning, or Medicaid planning purposes. 3. Special Needs Trust Memorandum: These agreements create a trust to benefit individuals with special needs or disabilities. The purpose of this memorandum is to provide financial support while ensuring that the beneficiary remains eligible for essential government programs and benefits. 4. Testamentary Trust Memorandum: A testamentary trust is created as part of a will and takes effect upon the testator's death. This memorandum outlines the distribution of assets, appointment of trustees, and instructions for managing the trust after the testator's passing. 5. Charitable Trust Memorandum: This type of Memorandum of Trust Agreement focuses on establishing a trust for charitable purposes. It specifies the purpose of the trust, the management of funds, and the beneficiaries who will benefit from the trust's assets. In all these agreements, the Memorandum of Trust serves as a condensed version of the trust instrument, providing an overview of the trust's provisions without disclosing sensitive information. It often includes details like the names of the parties involved, the purpose of the trust, the powers and duties of the trustee, and the rights and responsibilities of the beneficiaries. Overall, a Hawaii Memorandum of Trust Agreement provides a convenient and comprehensive summary of a trust, ensuring that all relevant parties have a clear understanding of the trust's terms and conditions.

Hawaii Memorandum of Trust Agreement

Description

How to fill out Hawaii Memorandum Of Trust Agreement?

US Legal Forms - among the biggest libraries of authorized types in the States - delivers an array of authorized papers themes you are able to acquire or produce. While using website, you may get a large number of types for business and person reasons, categorized by groups, suggests, or key phrases.You can find the newest models of types just like the Hawaii Memorandum of Trust Agreement in seconds.

If you already possess a registration, log in and acquire Hawaii Memorandum of Trust Agreement in the US Legal Forms local library. The Down load option will appear on each form you see. You get access to all earlier delivered electronically types inside the My Forms tab of your profile.

In order to use US Legal Forms initially, listed here are straightforward directions to get you started off:

- Ensure you have picked the proper form for the city/area. Click on the Review option to analyze the form`s articles. See the form description to ensure that you have selected the proper form.

- In case the form does not suit your demands, utilize the Lookup field at the top of the display screen to get the one that does.

- When you are satisfied with the shape, confirm your selection by clicking on the Get now option. Then, pick the prices strategy you like and provide your qualifications to register to have an profile.

- Process the purchase. Use your credit card or PayPal profile to accomplish the purchase.

- Select the file format and acquire the shape in your product.

- Make alterations. Complete, change and produce and indication the delivered electronically Hawaii Memorandum of Trust Agreement.

Every design you put into your money does not have an expiration time which is yours for a long time. So, if you wish to acquire or produce one more copy, just go to the My Forms segment and click about the form you want.

Get access to the Hawaii Memorandum of Trust Agreement with US Legal Forms, the most considerable local library of authorized papers themes. Use a large number of professional and condition-specific themes that satisfy your organization or person needs and demands.

Form popularity

FAQ

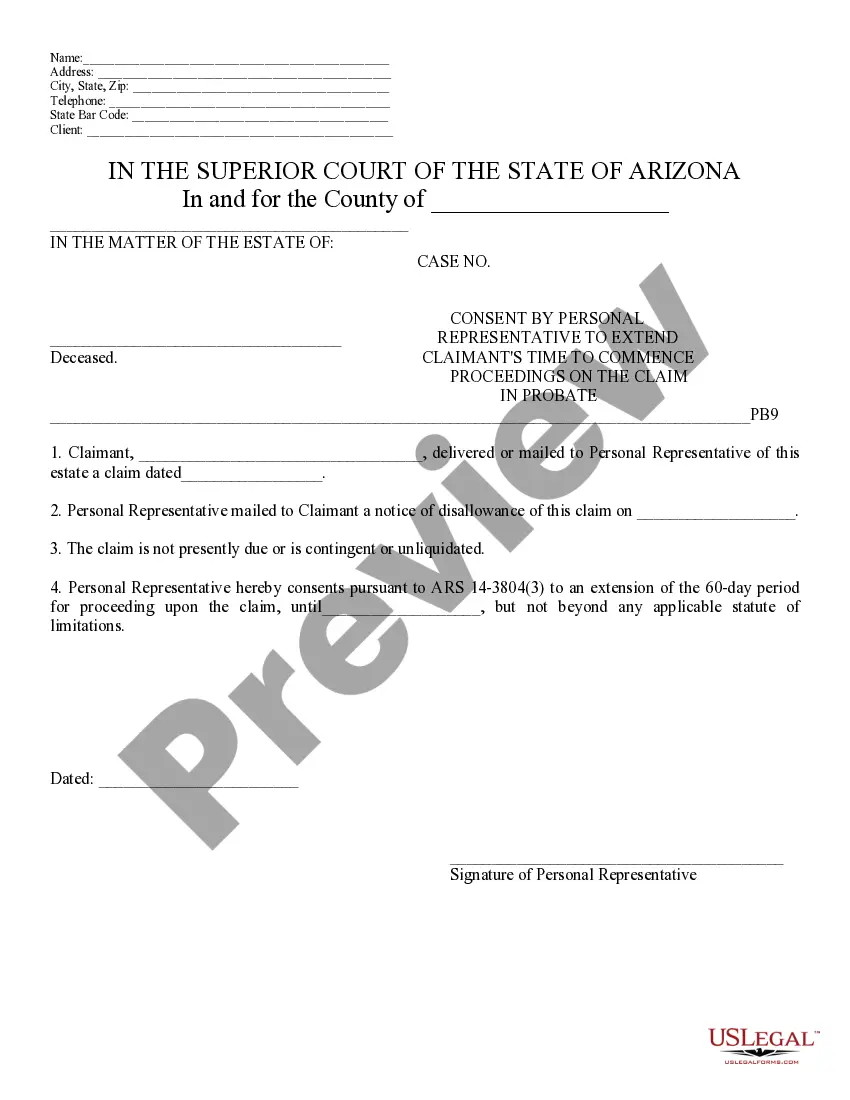

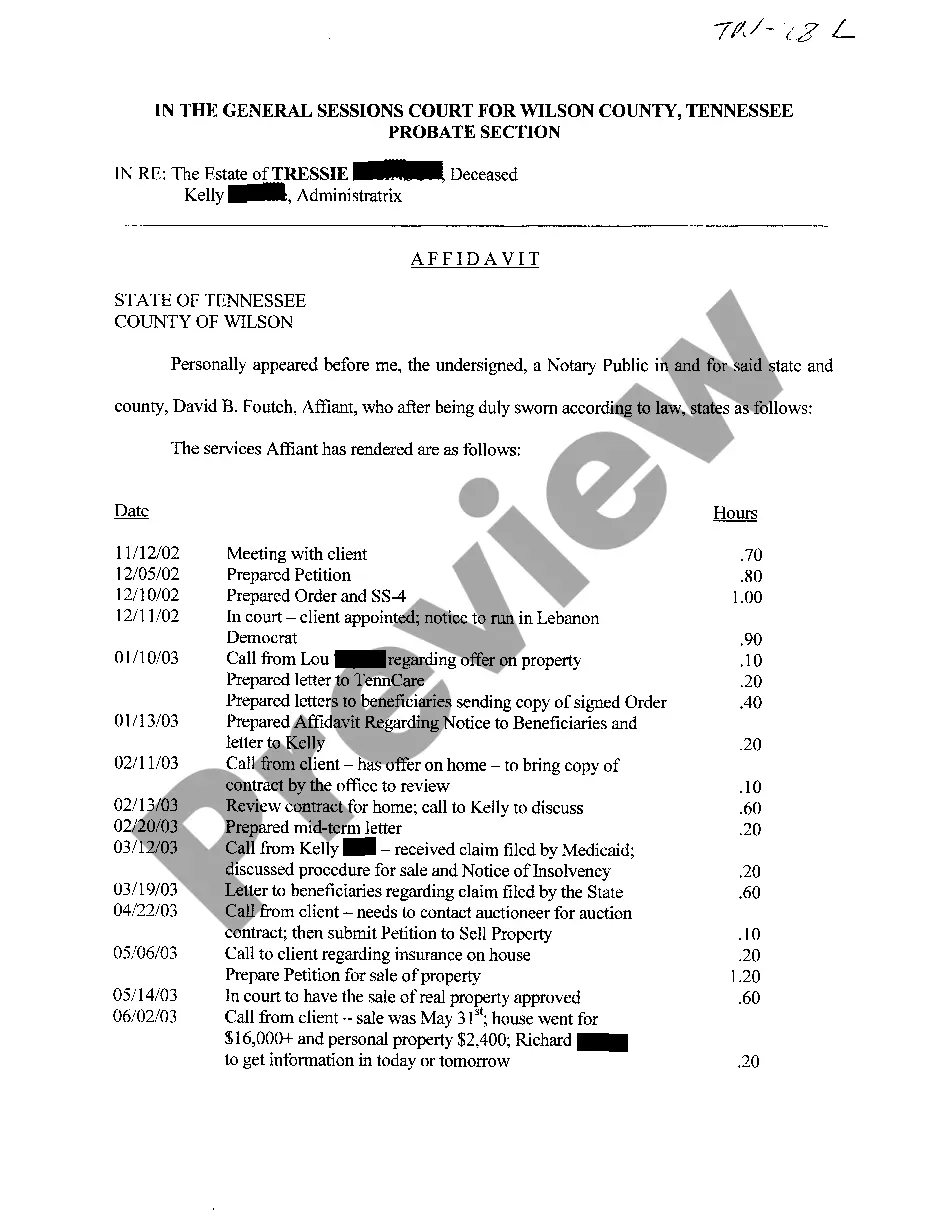

Memorandum of Trusts Are Typically Comprised of the Following The name of the Trust. The date the Trust was established. The fact that you're the Trustmaker. The name of the initial Trustee. The name of the Successor Trustee(s) The identities of those who signed the Trust Agreement. The powers given to the Trustee.

The cost of setting up a trust in Hawaii varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Create the trust document. You can get help from an attorney or use Willmaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document?such as your house or car?to reflect that you now own the property as trustee of the trust.

Your rights as the beneficiary of an estate plan in Hawaii As a beneficiary in Hawaii, you have several rights. At the most basic level, you are entitled to receive information about the estate and its administration. You also have a right to an accounting of the estate's assets, debts, and distributions.

The main advantage of a Revocable Trust is that you are still able to benefit from any income that your property and/or real estate generates. An Irrevocable Trust has no such advantage, but instead offers you protection from estate tax as ownership of your assets will be in the name of the trust.

The Trust is administered by trustees for the benefit of beneficiaries (usually the settlors and their family). The MOW's sets out the settlors wishes, and although not legally binding, is usually highly persuasive and can guide the trustee's actions.

A memorandum of trust is also a certification, abstract, or certificate of trust. It is a shorter version of the trust certificate. It provides institutions with information they need, but allows you to keep some components confidential. You are not required to provide the names of beneficiaries.

The letter should be written in non-technical language by you. It should communicate to the reader your heartfelt desires. A letter of intent is not legally binding like your trust. However, its contents should not contradict your trust.

To set up a trust you need to have a trust document prepared with all of your details and specifications. You sign the document before a notary public.

A trust may be created only to the extent its purposes are lawful, not contrary to public policy, and possible to achieve. A trust and its terms shall be for the benefit of its beneficiaries, subject to the provisions of the trust.