Hawaii Dissolution of Unit

Description

How to fill out Dissolution Of Unit?

You can commit several hours online attempting to find the authorized papers web template that fits the state and federal demands you require. US Legal Forms supplies thousands of authorized types that are examined by experts. You can actually acquire or printing the Hawaii Dissolution of Unit from the services.

If you already have a US Legal Forms profile, you are able to log in and then click the Download switch. Afterward, you are able to comprehensive, modify, printing, or indicator the Hawaii Dissolution of Unit. Each authorized papers web template you get is yours eternally. To obtain one more duplicate of any acquired develop, visit the My Forms tab and then click the related switch.

Should you use the US Legal Forms web site the very first time, stick to the basic recommendations below:

- Very first, ensure that you have selected the best papers web template for the area/metropolis of your liking. Read the develop description to ensure you have picked out the correct develop. If available, utilize the Preview switch to check throughout the papers web template at the same time.

- If you want to discover one more model in the develop, utilize the Search discipline to obtain the web template that fits your needs and demands.

- When you have found the web template you desire, just click Buy now to move forward.

- Pick the costs program you desire, type in your accreditations, and sign up for your account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal profile to pay for the authorized develop.

- Pick the formatting in the papers and acquire it to the system.

- Make adjustments to the papers if required. You can comprehensive, modify and indicator and printing Hawaii Dissolution of Unit.

Download and printing thousands of papers templates using the US Legal Forms web site, that offers the greatest assortment of authorized types. Use expert and status-specific templates to take on your business or person requirements.

Form popularity

FAQ

Dissolution of a company is when a company is dissolved by order of a Tribunal, i.e. National Company Law Tribunal (NCLT), after the completion of its winding-up process. The company's dissolution brings its existence to an end, and its name is struck off by the Registrar of Companies (ROC).

Hear this out loud PauseAfter dissolution, a corporation is generally expected to pay all its existing debts and then liquidate its remaining assets to its shareholders. This sometimes becomes difficult, however, where there are unknown claims that may exist against the corporation.

Hear this out loud PauseTo dissolve your Hawaii Corporation, file Form DC-13, Hawaii Articles of Dissolution with the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division (BREG) by mail, fax, or in person. The articles of dissolution cannot be filed online.

Hear this out loud PauseFirst, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

Hear this out loud PauseThese terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

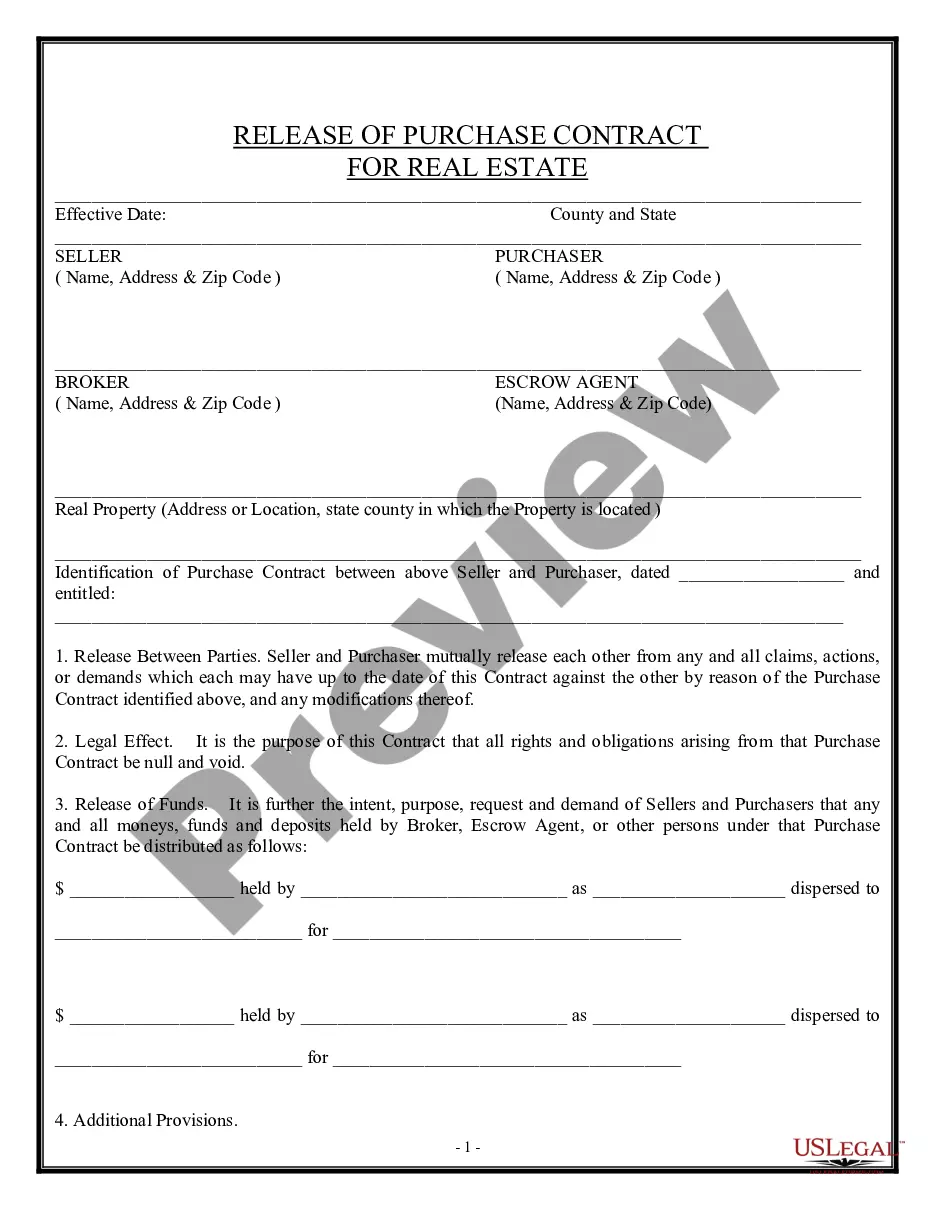

Articles of dissolution are the reverse of organization or incorporation articles ? they end your business entity's existence.

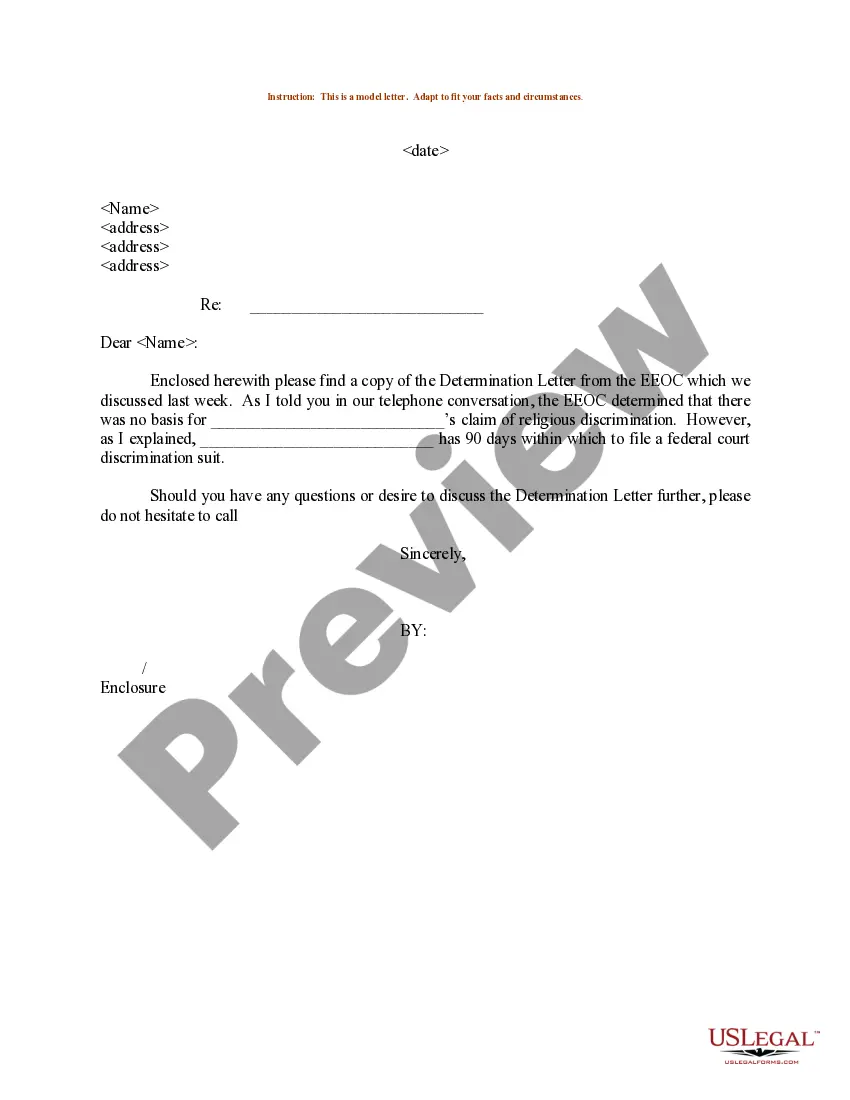

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.