Hawaii Further Assurances

Description

How to fill out Further Assurances?

Are you currently in the placement that you need to have papers for both organization or individual uses just about every day time? There are tons of legitimate record themes available on the net, but getting versions you can trust isn`t straightforward. US Legal Forms offers 1000s of kind themes, such as the Hawaii Further Assurances, that happen to be created to meet state and federal specifications.

In case you are presently knowledgeable about US Legal Forms site and also have a free account, basically log in. Afterward, you can download the Hawaii Further Assurances web template.

Unless you offer an accounts and need to begin using US Legal Forms, adopt these measures:

- Obtain the kind you will need and ensure it is to the appropriate city/state.

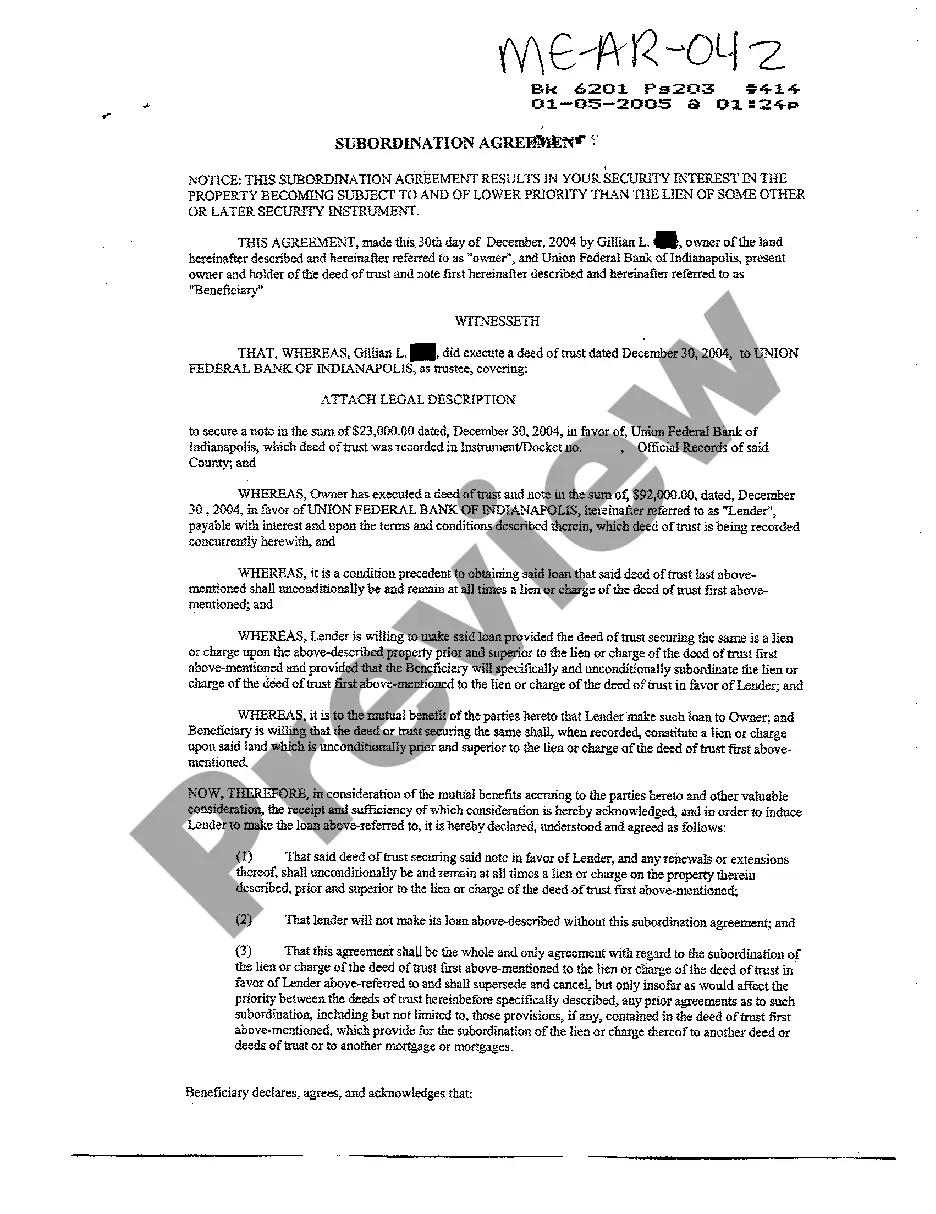

- Make use of the Review option to analyze the form.

- See the information to actually have selected the correct kind.

- In the event the kind isn`t what you`re seeking, utilize the Search discipline to get the kind that suits you and specifications.

- If you discover the appropriate kind, just click Get now.

- Choose the pricing program you need, fill in the specified details to produce your account, and pay money for your order utilizing your PayPal or bank card.

- Select a handy document file format and download your duplicate.

Discover every one of the record themes you might have bought in the My Forms food list. You can aquire a further duplicate of Hawaii Further Assurances whenever, if possible. Just click the required kind to download or print the record web template.

Use US Legal Forms, one of the most substantial selection of legitimate kinds, in order to save efforts and steer clear of blunders. The service offers appropriately made legitimate record themes which you can use for an array of uses. Make a free account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

A Standard Clause commonly found in the miscellaneous section of a contract, in which the parties agree to cooperate with one another to take any actions not expressly specified in the agreement to carry out the intent of the agreement or implement its provisions.

Without a further assurances clause one party might try to escape the contract by withholding assistance to the other party where that assistance is either necessary or of great importance.

A covenant of further assurances is the related promise that the grantor will do whatever is necessary to remove a defect associated with title, such as an encumbrance, if it arises, and if the problem is not fixed, damages will be awarded. The express promise of doing whatever is necessary is a huge promise.

This clause provides a buyer with the assurance that their right to possess the property won't be negatively impacted by any legal claims made against the property by a third party.

Such clauses are used to cure defects or cover matters that may not have been expressly dealt with in the agreement.

Q: What is the difference between Land Court and Regular System? A: Regular System serves to give 'notice that a document is on public record. Land Court System provides State certification for the ownership of a property. Property is in Land Court if it was registered with the State at some point since the 1900's.

By Practical Law Commercial. A boilerplate further assurance clause that seeks to ensure that the parties carry out any additional acts necessary to give effect to the contract, including the procuring of such acts by third parties.

A covenant of further assurances is the related promise that the grantor will do whatever is necessary to remove a defect associated with title, such as an encumbrance, if it arises, and if the problem is not fixed, damages will be awarded. The express promise of doing whatever is necessary is a huge promise.