Hawaii Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

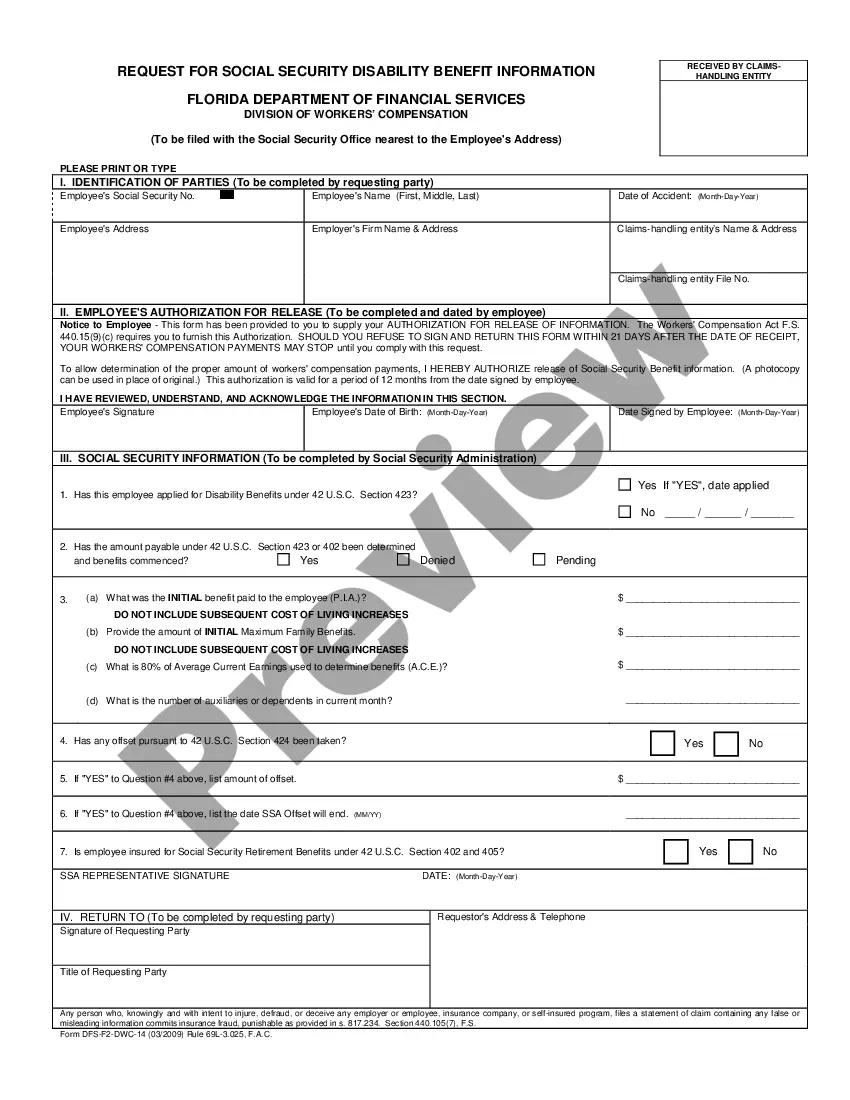

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

Are you in a placement the place you will need paperwork for either enterprise or person reasons nearly every day time? There are a lot of legitimate record layouts accessible on the Internet, but getting types you can depend on is not easy. US Legal Forms gives a large number of kind layouts, just like the Hawaii Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which can be written to satisfy federal and state demands.

Should you be presently familiar with US Legal Forms internet site and possess an account, basically log in. Following that, it is possible to down load the Hawaii Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease design.

If you do not provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is for the right metropolis/region.

- Utilize the Review key to analyze the form.

- Browse the outline to ensure that you have chosen the appropriate kind.

- If the kind is not what you are looking for, take advantage of the Research discipline to find the kind that meets your requirements and demands.

- Whenever you find the right kind, simply click Purchase now.

- Select the prices strategy you need, complete the specified information to create your money, and pay for the transaction utilizing your PayPal or charge card.

- Select a hassle-free file format and down load your duplicate.

Locate all of the record layouts you may have purchased in the My Forms food selection. You may get a more duplicate of Hawaii Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease whenever, if required. Just click the needed kind to down load or print the record design.

Use US Legal Forms, by far the most substantial collection of legitimate forms, in order to save time and steer clear of mistakes. The assistance gives expertly made legitimate record layouts which can be used for an array of reasons. Produce an account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

An NPRI owner also does not have the right to produce the minerals by himself, and they are not responsible for the operational costs associated with production or drilling. An NPRI has fewer rights than a 'regular' mineral rights owner as they do not have the right to make decisions related to the execution of leases.

Non-operating working interests include overriding royalty interests, production payments, and net profit interests. Unlike royalty interests, non-operating working interest must include a portion of the costs associated with the day-to-day operation of the well.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

An ORRI is an undivided interest in a mineral lease that gives you the right to a proportional share of the gas and oil that is produced. The overriding royalty interest is carved from the lease or working interest.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

The term ?non-participating? indicates that the interest owner does not share in the bonus, rentals from a lease, nor the right (or obligation) to make decisions regarding execution of those leases (i.e., no executive rights).