Hawaii Clauses Relating to Dividends, Distributions: A Detailed Description In Hawaii, there are several clauses related to dividends and distributions that play a crucial role in the legal and financial aspects of business operations. These clauses are designed to ensure fairness, transparency, and the protection of shareholders' rights. Let's explore these clauses in detail: 1. Dividend Authorization Clause: The Dividend Authorization Clause is a provision typically included in a corporation's articles of incorporation or bylaws. It outlines the process by which dividends are authorized to be distributed to shareholders. This clause often specifies the required approvals, such as the board of directors' resolution, the minimum retained earnings, and any limitations or restrictions regarding dividend payments. 2. Dividend Payment Clause: The Dividend Payment Clause details the mechanism for distributing dividends to shareholders. It typically includes provisions such as the frequency of dividend payments, the method of payment (e.g., cash, stock dividends), and the determination of dividend amounts (e.g., a fixed percentage of profits or discretionary decisions by the board of directors). 3. Cumulative Dividend Clause: In cases where regular dividends cannot be declared or paid due to financial constraints or low profitability, the Cumulative Dividend Clause comes into play. This clause allows for unpaid dividends to accumulate as arrears or cumulative dividends, which must be paid to shareholders before any future dividends can be distributed. 4. Preferred Dividend Clause: The Preferred Dividend Clause is particularly relevant to preferred stockholders. It outlines the rights associated with preferred shares and specifies preferential dividend rates or amounts that must be paid out to preferred shareholders before any dividends can be distributed to common stockholders. 5. Dividend Waiver Clause: In certain situations, shareholders may voluntarily waive their right to receive dividends. The Dividend Waiver Clause provides a legal framework for such waivers, ensuring that they are properly documented and executed. This clause may also specify the conditions or considerations for the waiver. 6. Distribution Restriction Clause: In entities like partnerships or limited liability companies (LCS), a Distribution Restriction Clause may be included in the governing agreements (e.g., partnership agreement, operating agreement). This clause places limitations on the ability of the entity to distribute profits or assets to partners or members, ensuring that the entity's financial stability and obligations are adequately maintained. It is important to note that the specific language and provisions of these clauses may vary depending on the company's governance documents, such as the articles of incorporation, bylaws, shareholder agreements, or partnership agreements. It is advisable to seek legal counsel or consult the applicable statutes and regulations for precise and up-to-date information regarding Hawaii clauses relating to dividends and distributions.

Hawaii Clauses Relating to Dividends, Distributions

Description

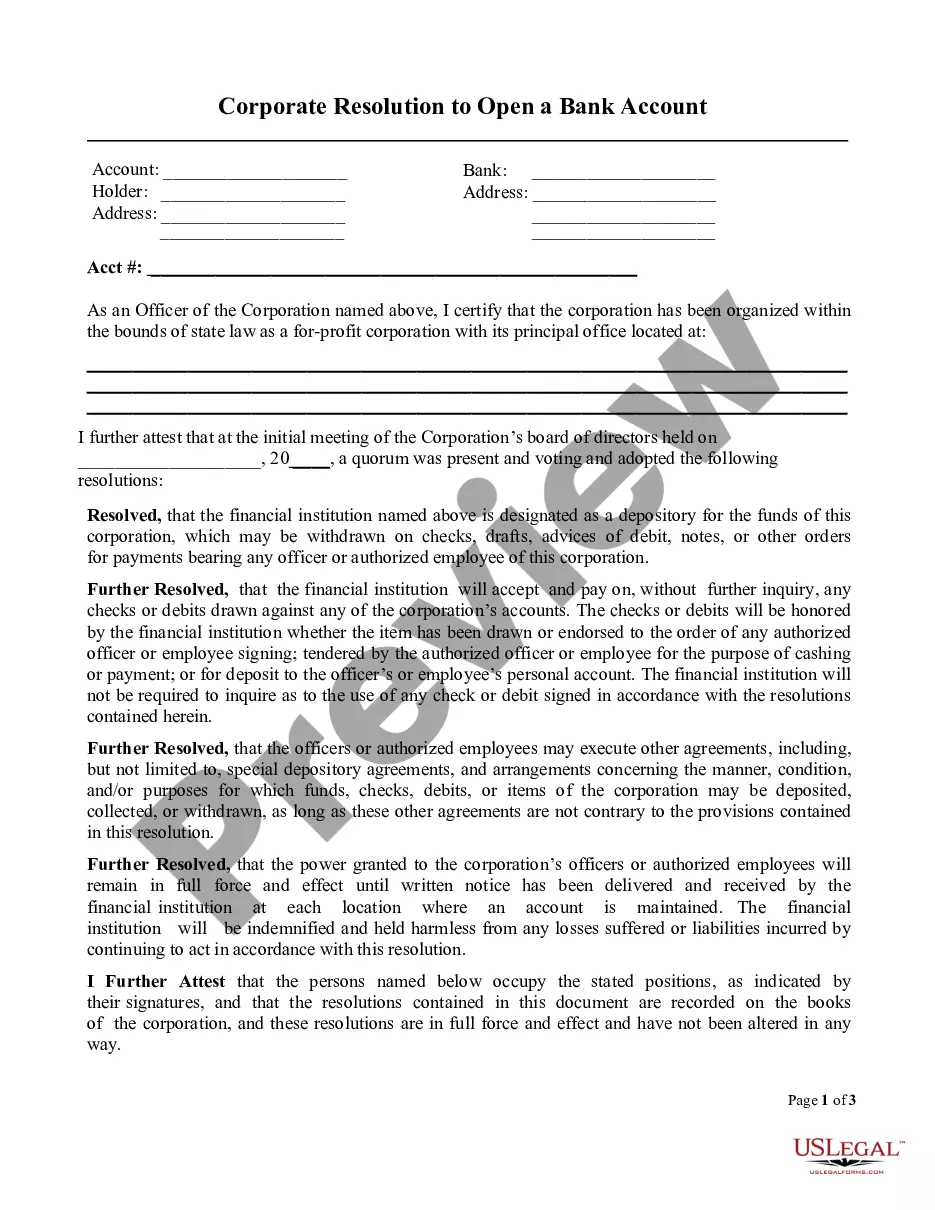

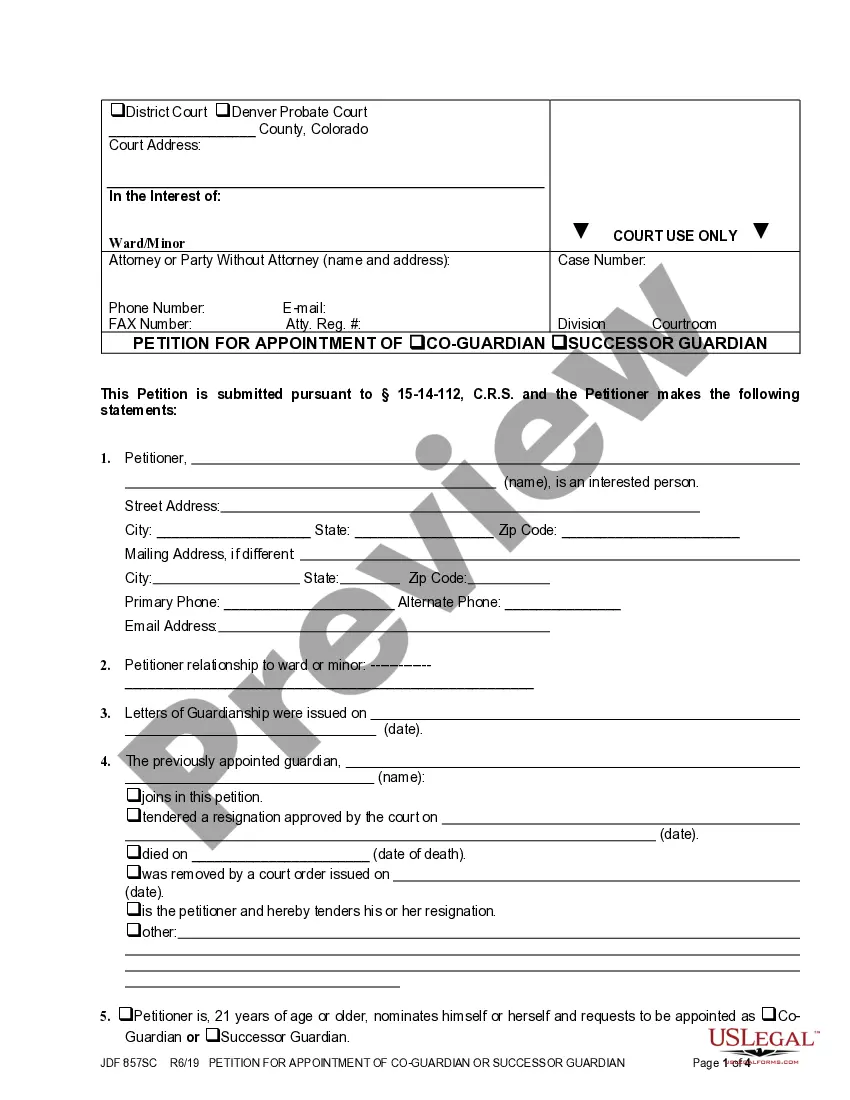

How to fill out Hawaii Clauses Relating To Dividends, Distributions?

Are you presently in the position where you need papers for both organization or specific uses just about every day time? There are tons of lawful file themes available online, but locating kinds you can rely on is not easy. US Legal Forms delivers a huge number of develop themes, just like the Hawaii Clauses Relating to Dividends, Distributions, which are created to fulfill state and federal demands.

If you are previously knowledgeable about US Legal Forms internet site and also have a free account, simply log in. Following that, you are able to obtain the Hawaii Clauses Relating to Dividends, Distributions web template.

Unless you come with an bank account and need to start using US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is for your proper city/county.

- Utilize the Preview option to examine the form.

- Read the information to ensure that you have selected the proper develop.

- When the develop is not what you are looking for, make use of the Search field to find the develop that suits you and demands.

- When you obtain the proper develop, just click Buy now.

- Pick the rates prepare you would like, complete the necessary details to create your account, and pay for an order utilizing your PayPal or charge card.

- Decide on a practical paper format and obtain your copy.

Discover all of the file themes you might have purchased in the My Forms food list. You can obtain a more copy of Hawaii Clauses Relating to Dividends, Distributions at any time, if necessary. Just select the necessary develop to obtain or printing the file web template.

Use US Legal Forms, one of the most substantial selection of lawful kinds, to save time and steer clear of faults. The service delivers skillfully made lawful file themes that can be used for a variety of uses. Generate a free account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

Dividends are taxable at the hands of the investor while a TDS of 10% is applicable on dividend payouts exceeding INR 5,000 in a financial year. If an individual's total income including the dividend income is below the personal income tax exemption limit, they can submit the 15G/15H, as applicable, to avoid TDS.

AMT starts when the dividends reach $55,002 (2022 $54,403). Federal AMT is applicable for dividends above this amount, until the amount of the dividends reaches $175,218 (2022 $161,215), when the regular federal tax equals or exceeds the minimum amount.

In lieu of the federal dividend received deduction, Hawaii provides corporations with a 100% deduction for dividends received from a national banking association, or dividends received by members of an affiliated group as defined by IRC § 243(b) or a small business investment company; and a 70% deduction for dividends ...

The federal dividend tax credit as a percentage of taxable dividends is 15.0198% for eligible dividends and 9.0301% for non-eligible dividends.

Dividend Distribution Tax is levied at the rate of 15% on dividends distributed by a domestic company and mutual fund. The tax is payable by the company or mutual fund and is not borne by the shareholders.

If your total dividend income is less than Rs. 5,000 in a financial year, then TDS will not apply to your interest income received. 2. You can submit Form 15G/15H to the company or mutual fund declaring that your total income for the financial year is below the taxable limit.

Dividend exclusion allows corporate entities to deduct dividends received from their investments. This ensures that the dividends of the receiving entity are only taxed once, meaning they don't incur double taxation. Before the rule was put into effect, corporations could be taxed twice.

Form N-35 is used to report the income, de- ductions, gains, losses, etc., of an S corporation doing business in Hawaii.