Have you been in the place in which you require files for either business or individual purposes virtually every day time? There are tons of legitimate document themes available on the Internet, but getting versions you can depend on is not simple. US Legal Forms delivers thousands of kind themes, like the Hawaii HAMP Loan Modification Package, that are created to fulfill state and federal requirements.

When you are already knowledgeable about US Legal Forms website and get your account, just log in. Next, you are able to download the Hawaii HAMP Loan Modification Package format.

Unless you have an account and would like to begin to use US Legal Forms, follow these steps:

- Get the kind you will need and ensure it is for your right town/state.

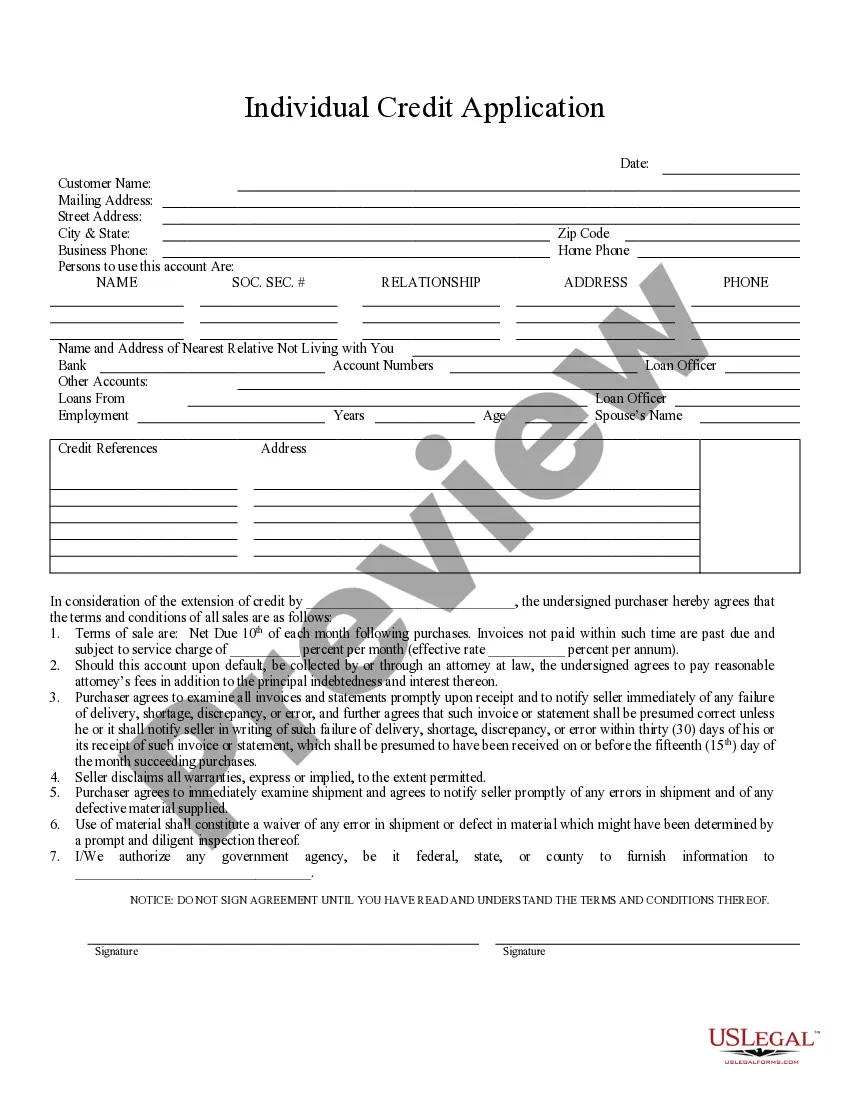

- Use the Preview option to analyze the shape.

- Read the explanation to ensure that you have chosen the right kind.

- In the event the kind is not what you`re searching for, utilize the Search field to get the kind that meets your needs and requirements.

- Once you discover the right kind, just click Buy now.

- Pick the prices strategy you need, complete the desired info to make your account, and pay money for the transaction with your PayPal or charge card.

- Pick a hassle-free data file formatting and download your copy.

Get each of the document themes you possess bought in the My Forms menu. You may get a extra copy of Hawaii HAMP Loan Modification Package at any time, if required. Just click the needed kind to download or printing the document format.

Use US Legal Forms, probably the most comprehensive variety of legitimate forms, to conserve time as well as avoid blunders. The support delivers professionally manufactured legitimate document themes that can be used for a selection of purposes. Generate your account on US Legal Forms and commence producing your way of life easier.