Hawaii Subscription Agreement for an Equity Fund

Description

How to fill out Subscription Agreement For An Equity Fund?

Are you currently in the situation in which you will need paperwork for sometimes organization or individual purposes almost every day? There are plenty of legitimate document layouts available online, but finding types you can rely on is not effortless. US Legal Forms gives 1000s of type layouts, just like the Hawaii Subscription Agreement for an Equity Fund, which are written to fulfill state and federal needs.

Should you be already acquainted with US Legal Forms web site and have your account, basically log in. After that, it is possible to down load the Hawaii Subscription Agreement for an Equity Fund template.

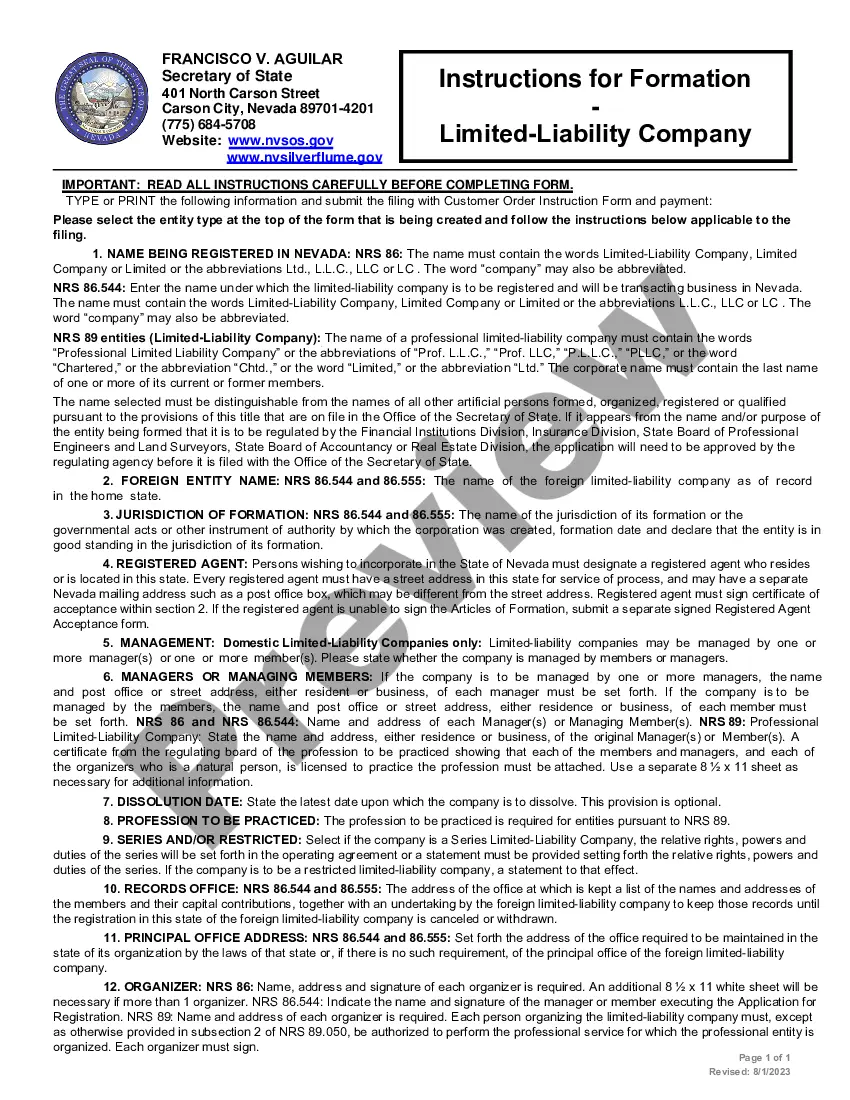

Unless you come with an profile and want to begin using US Legal Forms, adopt these measures:

- Get the type you want and ensure it is to the right city/state.

- Make use of the Preview button to check the form.

- Look at the outline to ensure that you have selected the correct type.

- If the type is not what you are searching for, utilize the Look for industry to get the type that meets your needs and needs.

- When you discover the right type, click on Get now.

- Select the prices strategy you would like, fill out the desired information and facts to create your account, and purchase an order making use of your PayPal or bank card.

- Decide on a convenient paper formatting and down load your copy.

Get every one of the document layouts you have purchased in the My Forms menu. You can get a more copy of Hawaii Subscription Agreement for an Equity Fund any time, if necessary. Just select the needed type to down load or produce the document template.

Use US Legal Forms, by far the most considerable selection of legitimate forms, to save efforts and avoid mistakes. The services gives skillfully produced legitimate document layouts that you can use for a selection of purposes. Generate your account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

Specifically, the ?Subscription Agreement for Future Equity ? Discount only? enables investors to pay in advance the subscription price for company shares/quotas (typically pre-seed and seed funding) with such shares/quotas to be issued by the company receiving the investment at a later date, so that valuation of the ...

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A simple agreement for future equity (SAFE) is a contract between an investor and a portfolio company that provides rights to the investor for future equity in the company. It does this without determining a specific price per share when the investment is made.

Subscription Documents mean any subscription agreements (or the equivalent), investor questionnaires, purchase applications, related agreements and similar materials (and any forms, correspondence and other documents ancillary thereto) relating to a Fund's investments in Portfolio Funds.

A simple agreement for future equity (SAFE) is a financing contract that may be used by a start-up company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes because a SAFE is quicker and easier to negotiate and has fewer terms.

Although it is not necessary to execute a share subscription agreement, but it is always recommended to have such an agreement as it proves to be valuable document since it will explicitly state the conditions under which a person (the subscriber) agrees to buy shares from the firm and it presents a potential ...

A simple agreement for future equity or SAFE is a financing agreement between the company and an investor which grants the investor the right to receive shares at a point in the future, based on the valuation of the company at that point (usually the next funding round, often series A).

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.