Hawaii Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Hawaii Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

If you wish to full, obtain, or print authorized file themes, use US Legal Forms, the greatest variety of authorized kinds, which can be found online. Make use of the site`s simple and hassle-free lookup to get the paperwork you want. Various themes for business and personal purposes are categorized by types and claims, or keywords and phrases. Use US Legal Forms to get the Hawaii Irrevocable Power of Attorney for Transfer of Stock by Executor with a handful of mouse clicks.

In case you are presently a US Legal Forms buyer, log in to your profile and then click the Acquire switch to have the Hawaii Irrevocable Power of Attorney for Transfer of Stock by Executor. You may also access kinds you earlier saved in the My Forms tab of the profile.

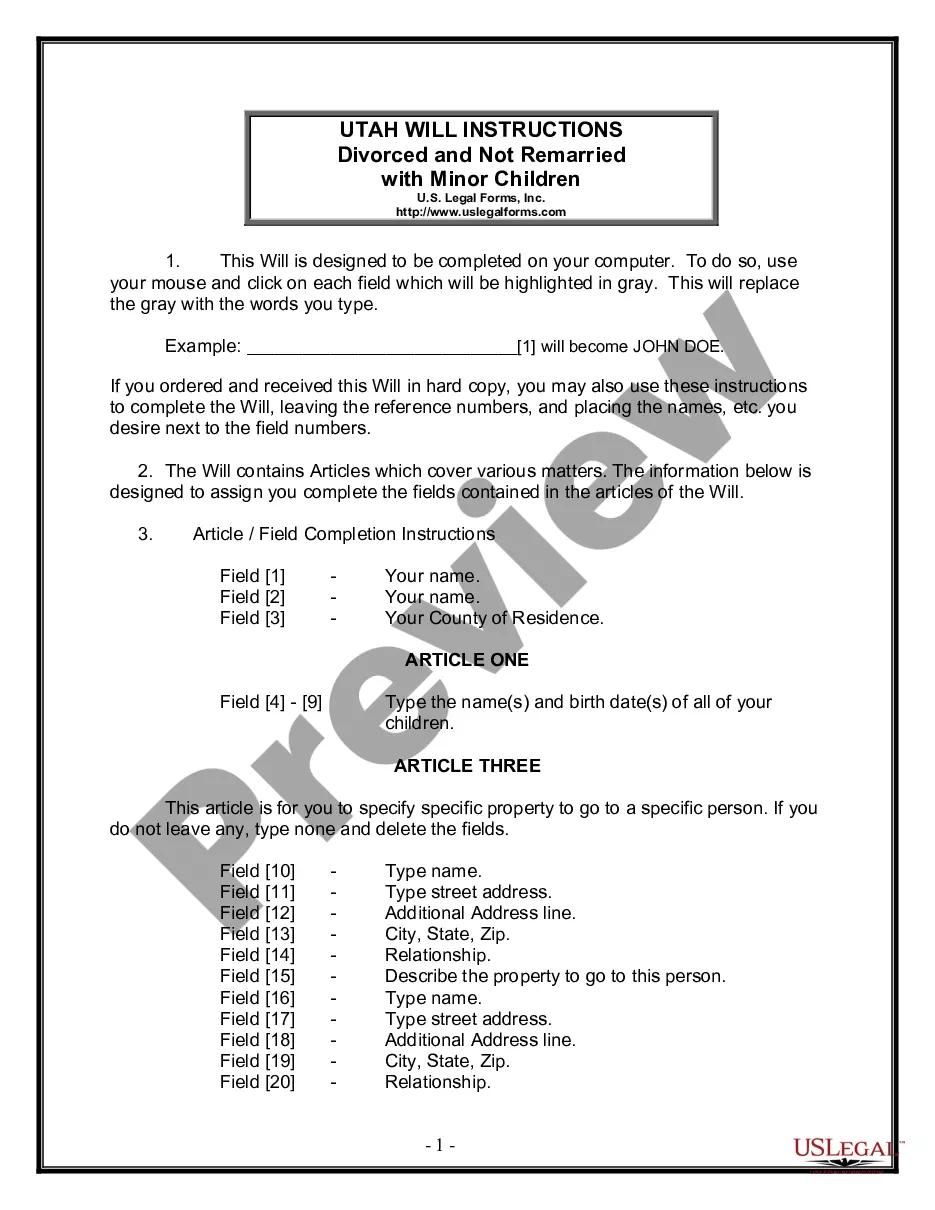

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the shape for your proper metropolis/land.

- Step 2. Make use of the Preview solution to look over the form`s content material. Don`t forget to read through the outline.

- Step 3. In case you are unsatisfied with all the type, utilize the Research field at the top of the display to find other variations of your authorized type template.

- Step 4. After you have located the shape you want, click on the Buy now switch. Opt for the rates program you prefer and add your qualifications to register for an profile.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal profile to finish the financial transaction.

- Step 6. Choose the file format of your authorized type and obtain it in your device.

- Step 7. Total, revise and print or sign the Hawaii Irrevocable Power of Attorney for Transfer of Stock by Executor.

Every single authorized file template you acquire is your own permanently. You possess acces to each type you saved inside your acccount. Click the My Forms segment and decide on a type to print or obtain once again.

Remain competitive and obtain, and print the Hawaii Irrevocable Power of Attorney for Transfer of Stock by Executor with US Legal Forms. There are many professional and status-particular kinds you can utilize for your business or personal requires.

Form popularity

FAQ

To transfer any stock certificate which you hold, you are generally required to submit the stock certificates, along with an executed assignment (either on the reverse of the certificate or an Assignment Separate From Security) with your signatures guaranteed by your stockbroker or bank, to the transfer agent with

Generally speaking, a Trustee (who is not also the Grantor) cannot appoint a Power of Attorney to take over the Trustee's duties or responsibilities, unless this is something that is directly permitted by the Trust Deed or a court order.

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them.

A swap power is also called a power to substitute. It is a special right reserved to you (or someone else) in a trust you create while you are alive. This right gives you the power to swap an asset of yours, say cash, for an asset held in the trust you created.

To put stocks or bonds that you hold into a trust, you typically use a document called a securities assignment (sometimes called a "stock power"). This document asks the securities' transfer agent for permission to transfer the securities to your trust.

How do you dissolve an irrevocable trust after death? While, in general, irrevocable trusts cannot be changed, they can be modified or dissolved after the grantor dies in certain situations as authorized by the California Probate Code.

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Normally, you can transfer your shares in a closely held corporation to your living trust by following corporate bylaws and having the stock certificates reissued in the living trust's name.