Hawaii UCC3 Financing Statement Amendment Addendum

Description

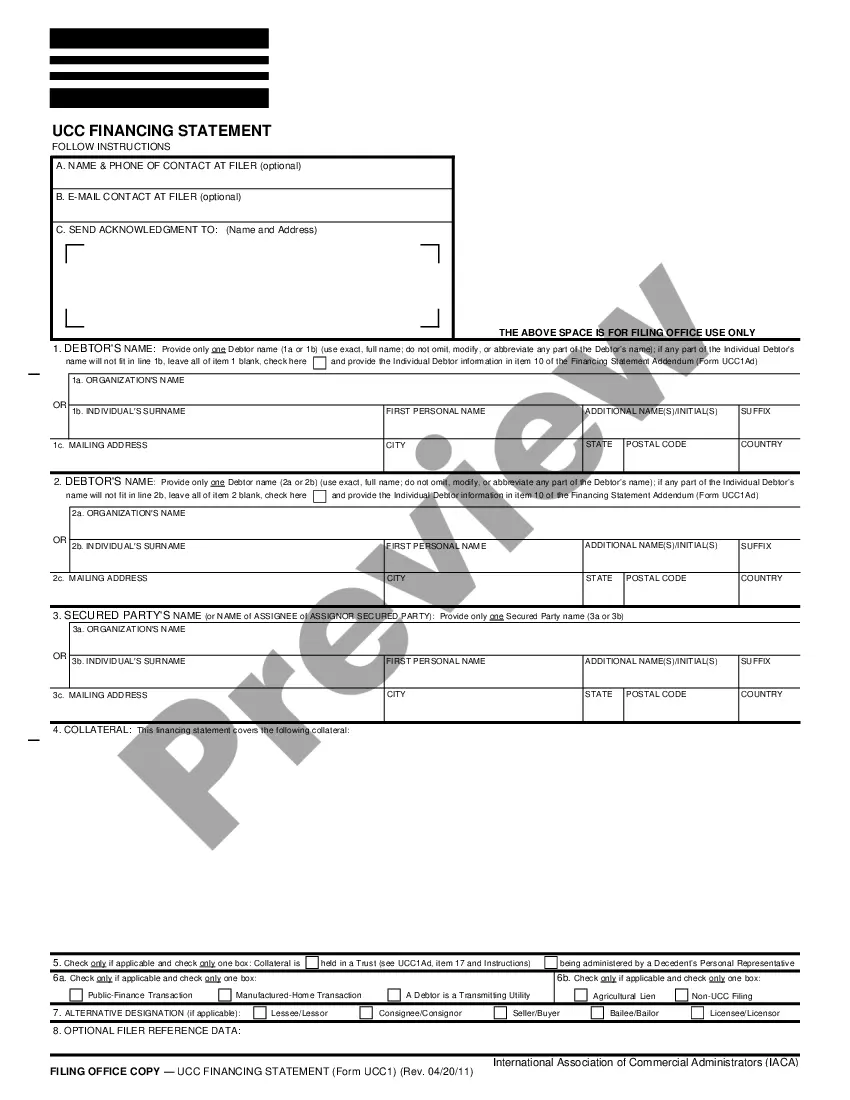

How to fill out Hawaii UCC3 Financing Statement Amendment Addendum?

Obtain entry to one of the most comprehensive collections of legal documents.

US Legal Forms is essentially a platform to discover any state-specific file in just a few clicks, including examples of the Hawaii UCC3 Financing Statement Amendment Addendum.

There's no need to squander hours searching for a court-admissible template.

If everything seems accurate, click Buy Now. After selecting a pricing option, set up an account. Make a payment via card or PayPal. Download the template to your device by clicking on the Download button. That's it! You should complete the Hawaii UCC3 Financing Statement Amendment Addendum form and verify it. To ensure everything is correct, consult with your local legal advisor for assistance. Register and explore over 85,000 beneficial forms.

- To utilize the documents library, select a subscription plan and create your account.

- If you have already registered, simply Log In and then click Download.

- The Hawaii UCC3 Financing Statement Amendment Addendum file will promptly be stored in the My documents section (a section for all forms you download from US Legal Forms).

- To establish a new account, follow the brief instructions outlined below.

- If you intend to use a state-specific template, ensure you specify the correct state.

- If feasible, check the description to understand all the specifics of the form.

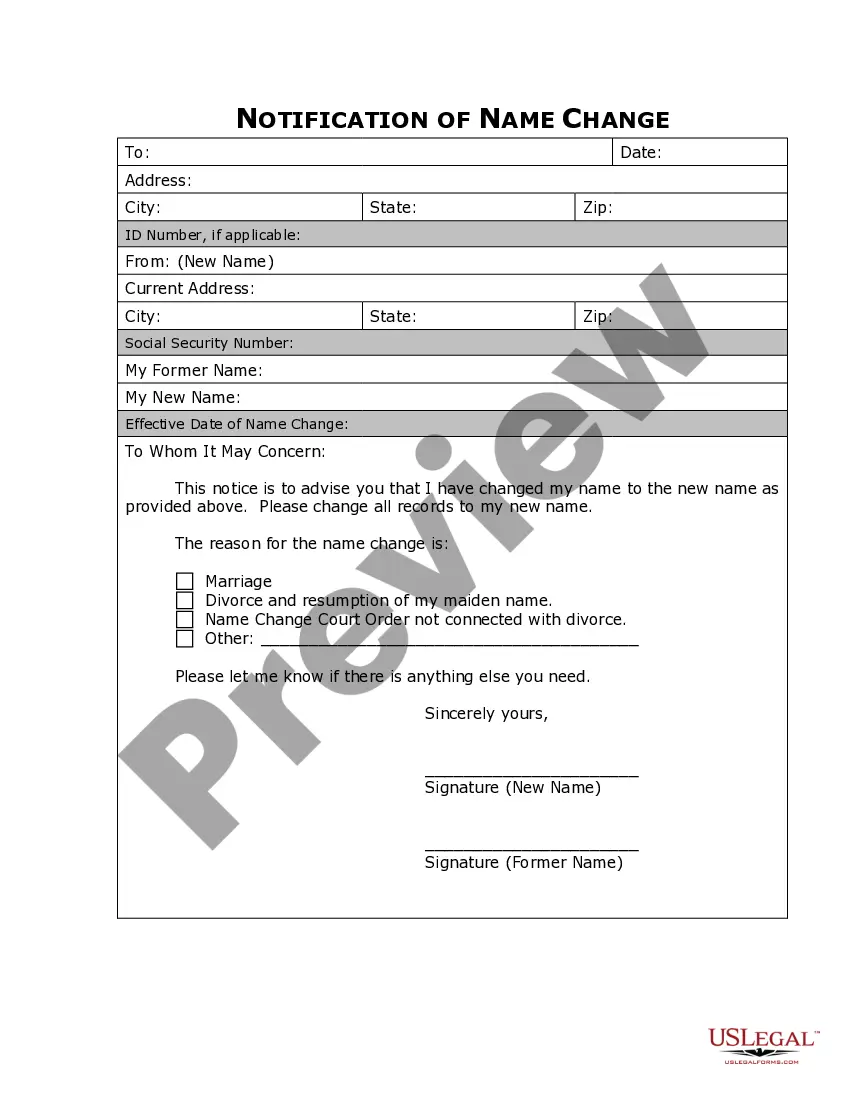

- Utilize the Preview option if it’s offered to examine the document's content.

Form popularity

FAQ

Yes, you can subordinate a UCC filing, but it typically involves creating a subordination agreement. This agreement allows a new lender to take precedence over existing secured creditors. Utilizing the Hawaii UCC3 Financing Statement Amendment Addendum can help you record this change effectively. Always consider consulting a legal expert to navigate this process to ensure compliance with state regulations.

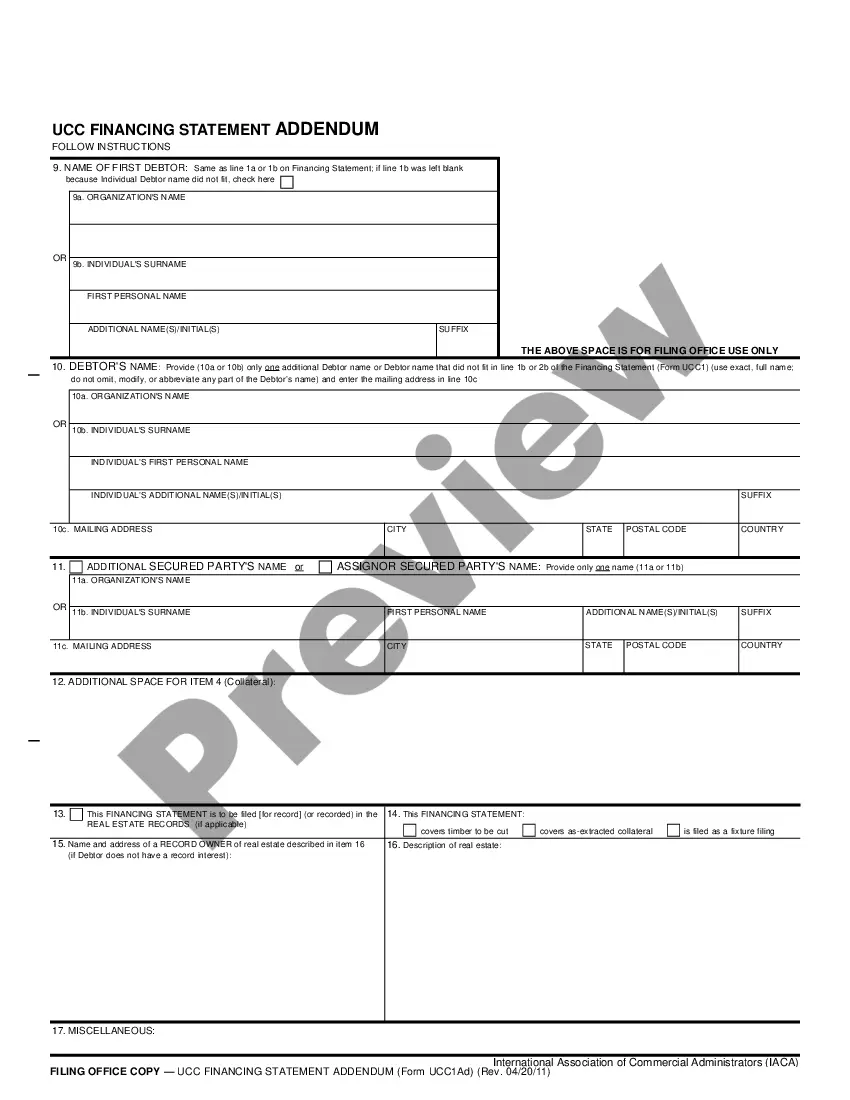

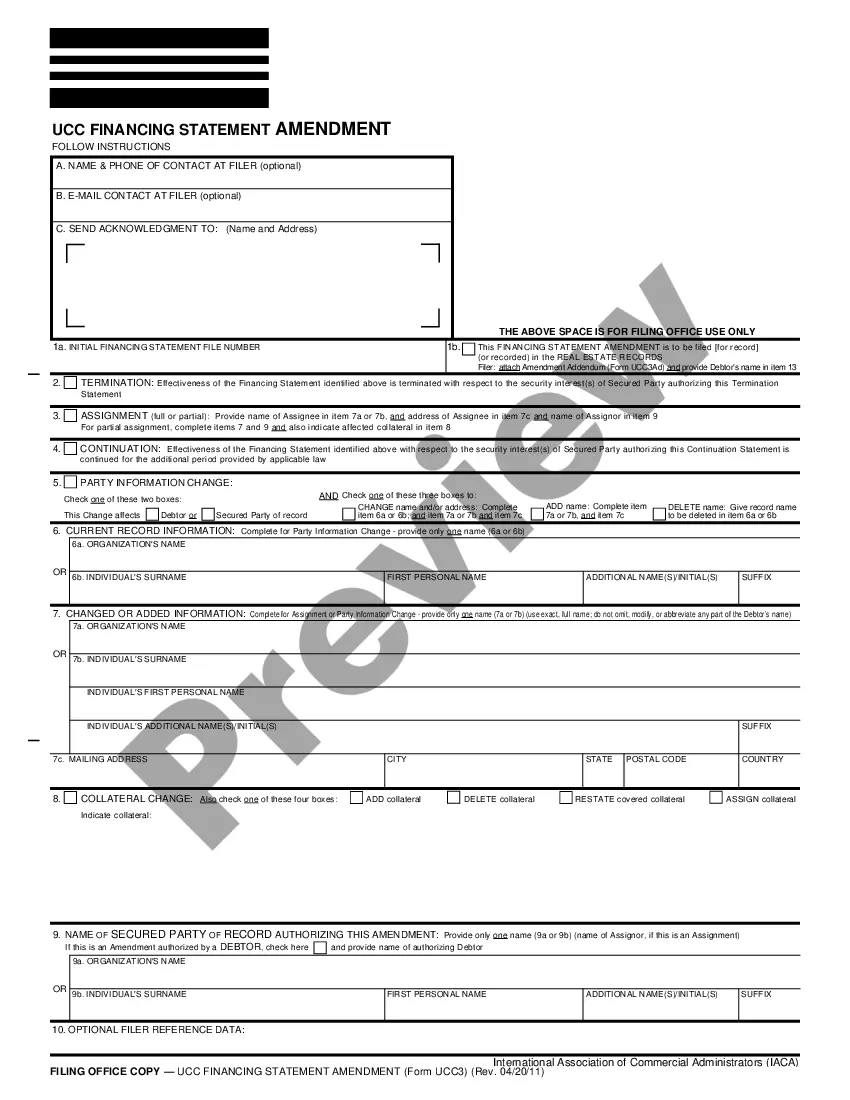

To amend a UCC filing, you will need to complete the Hawaii UCC3 Financing Statement Amendment Addendum. Start by obtaining the necessary form from the official state website or the uslegalforms platform. Next, fill out the required sections with the updated information pertinent to your filing. Finally, submit the completed form to the relevant state office, and ensure you keep a copy for your records.

The UCC-3 amendment statement refers to the document used to amend an existing UCC financing statement. In the context of the Hawaii UCC3 Financing Statement Amendment Addendum, it serves as an official way to revise or clarify the existing information on file. This amendment is essential for securing your interests and ensures that all parties have access to the most current information. By submitting the UCC-3, you keep your filing up-to-date and protect your rights.

Yes, you can amend a UCC filing using the Hawaii UCC3 Financing Statement Amendment Addendum. This addendum allows you to update information related to your original UCC filing, such as the secured party or collateral descriptions. By filing this amendment, you ensure that your information remains accurate and relevant, which is crucial for maintaining your legal protections. To proceed, gather the necessary details and follow the proper submission guidelines.

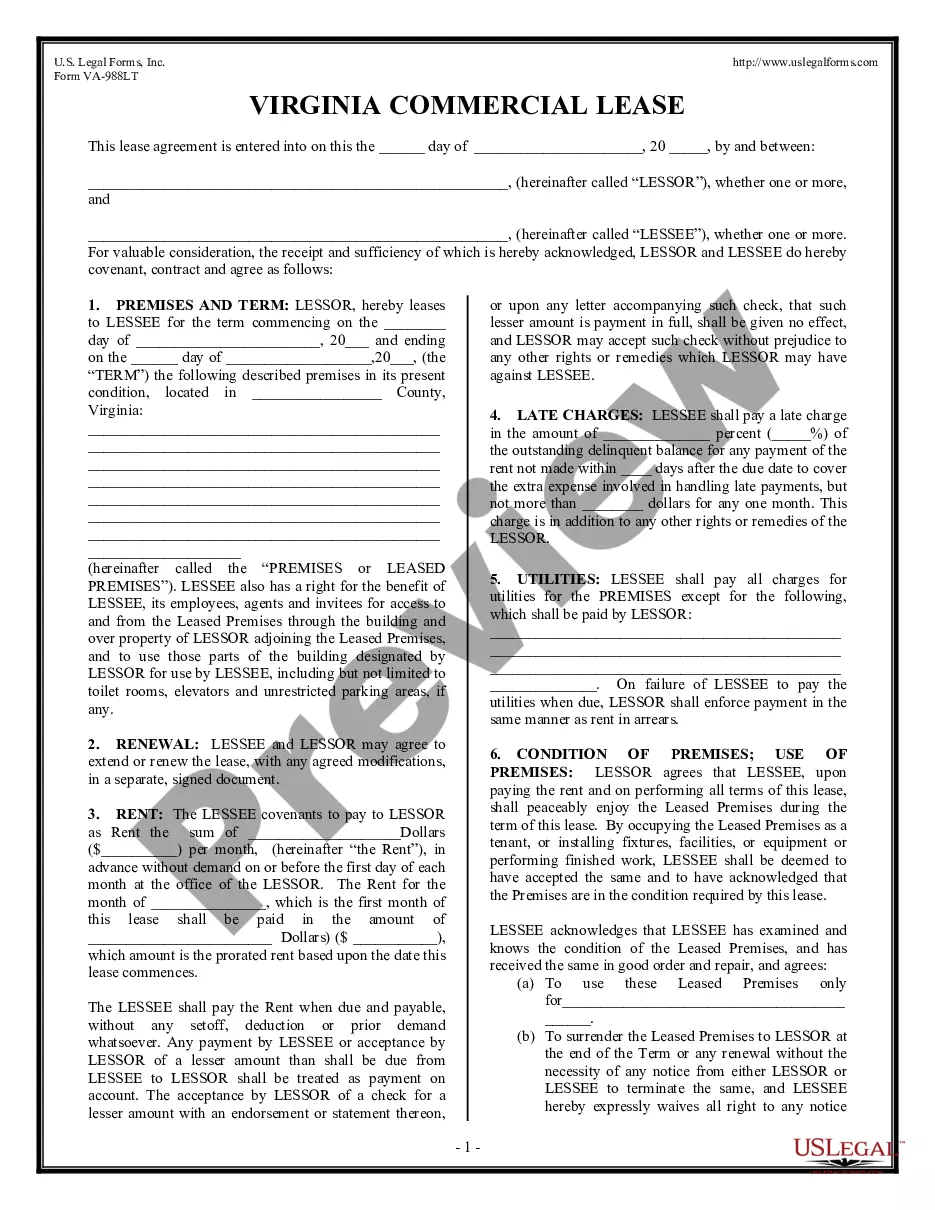

To file a UCC financing statement in Hawaii, you should go to the Office of Elections or the Department of Commerce and Consumer Affairs. This office handles all UCC filings, including the Hawaii UCC3 Financing Statement Amendment Addendum. It is crucial to ensure you file with the correct agency to maintain your financial interests. Using the ulegalforms platform simplifies this process, guiding you through the necessary steps for accurate and timely filing.

You can file a UCC financing statement amendment with the appropriate state agency, usually the Secretary of State's office, where the original statement was filed. For those in Hawaii, this means using the state-specific procedures to submit your Hawaii UCC3 Financing Statement Amendment Addendum. Utilizing platforms like uslegalforms can simplify this process and ensure your amendment is filed correctly. This saves you time and helps you maintain compliance.

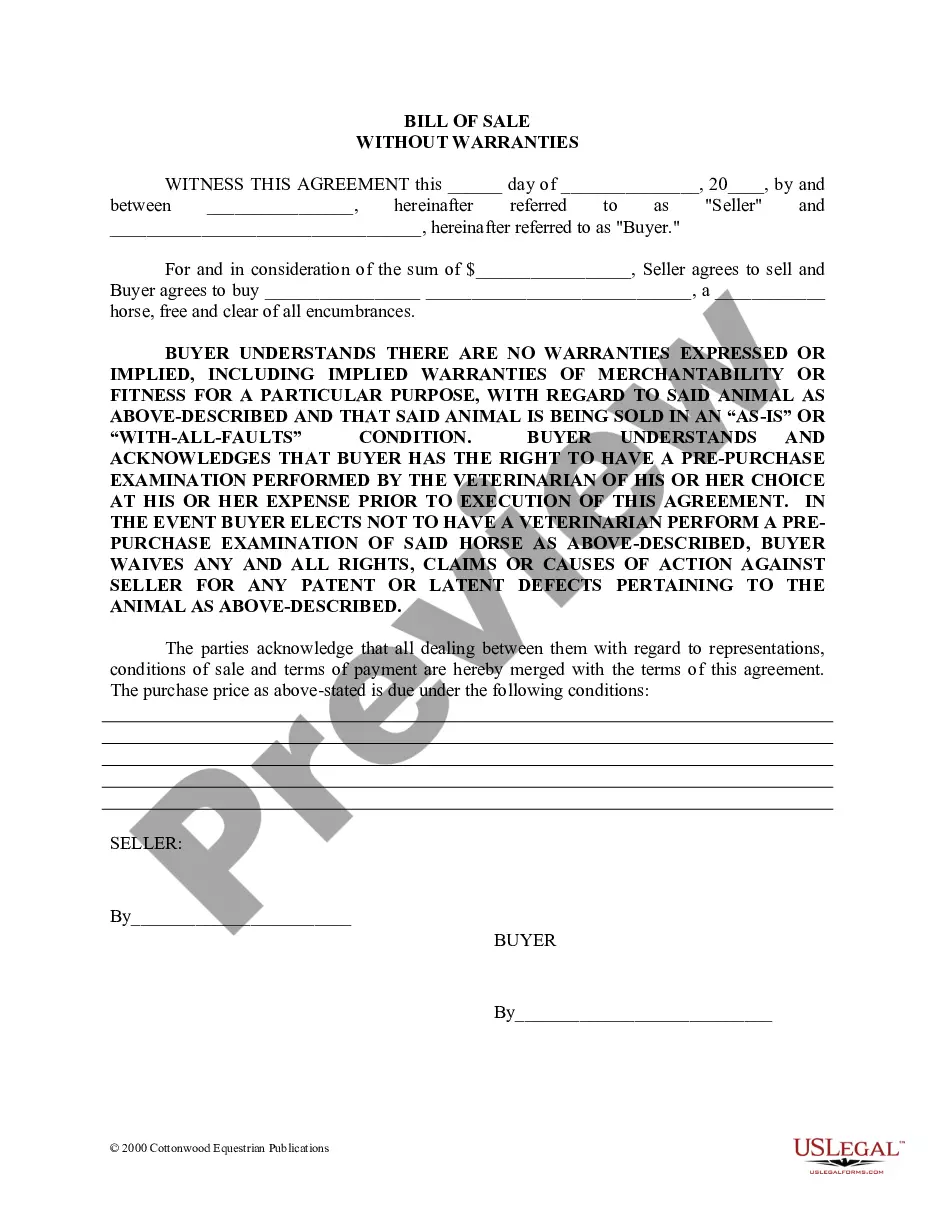

If a financing statement is seriously misleading, it can create confusion about the secured party's rights to the collateral. In such cases, the effectiveness of the financing statement may be compromised, making it harder to enforce security interests. A Hawaii UCC3 Financing Statement Amendment Addendum can rectify misleading details, ensuring clarity and legal integrity. Correcting errors promptly can save you from complications down the line.

3 amendment is a legal document used to change information on an existing UCC financing statement. With a Hawaii UCC3 Financing Statement Amendment Addendum, you can update details such as the debtor's name, the creditor's name, or the collateral description. This amendment ensures that all parties have correct and current information. Such accuracy is crucial for protecting your interests and avoiding potential disputes.

A UCC financing statement amendment termination refers to the process of formally ending a secured party's interest in a debtor's collateral. When you file a Hawaii UCC3 Financing Statement Amendment Addendum to terminate a statement, you release the lien on the property. This legally protects the debtor and ensures transparency in public records. Understanding this process can help you maintain accurate financing records.

Filing an UCC-3 termination requires you to complete the UCC-3 form, identifying the specific lien you want to terminate. Submit the form to your Secretary of State's office, along with any necessary fees. The Hawaii UCC3 Financing Statement Amendment Addendum provides a straightforward guide for completing this task efficiently. Properly handling this filing is essential for maintaining your financial standing.