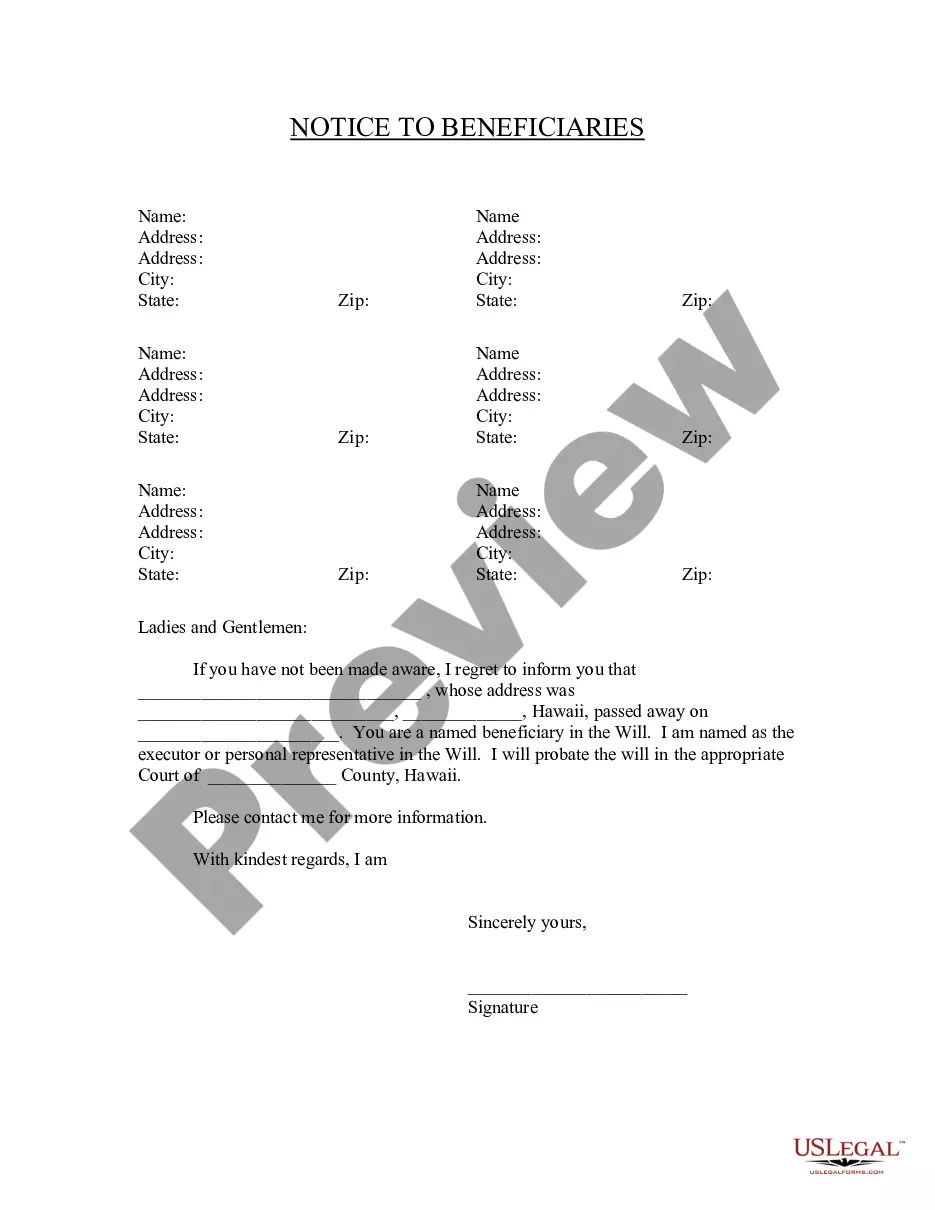

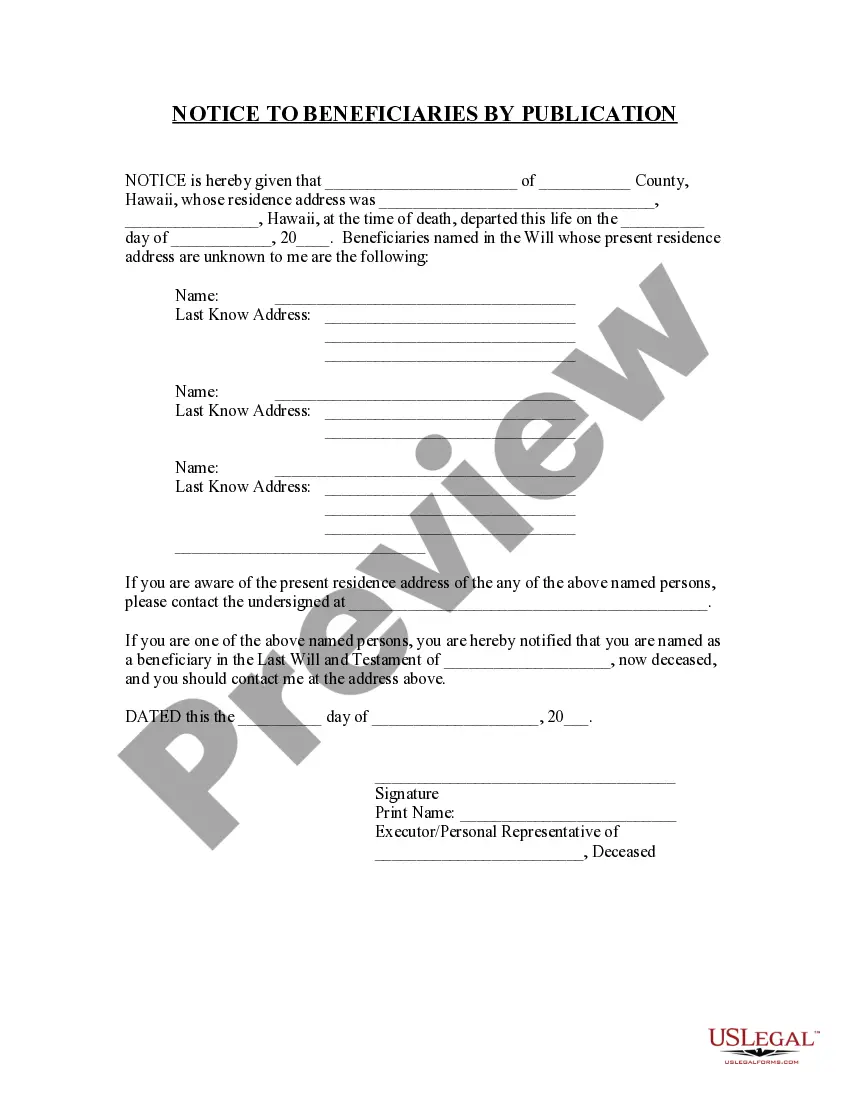

Hawaii Notice to Beneficiaries of being Named in Will

Description

How to fill out Hawaii Notice To Beneficiaries Of Being Named In Will?

Access the most holistic library of legal forms. US Legal Forms is a solution to find any state-specific form in a few clicks, including Hawaii Notice to Beneficiaries of being Named in Will examples. No requirement to spend hrs of the time searching for a court-admissible example. Our qualified professionals ensure you get up-to-date documents all the time.

To leverage the forms library, select a subscription, and register an account. If you did it, just log in and click Download. The Hawaii Notice to Beneficiaries of being Named in Will file will instantly get stored in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, look at short instructions below:

- If you're proceeding to use a state-specific example, be sure to indicate the correct state.

- If it’s possible, look at the description to know all the nuances of the document.

- Use the Preview option if it’s offered to look for the document's information.

- If everything’s correct, click on Buy Now button.

- Right after picking a pricing plan, register your account.

- Pay out by card or PayPal.

- Downoad the sample to your computer by clicking Download.

That's all! You should fill out the Hawaii Notice to Beneficiaries of being Named in Will form and double-check it. To ensure that all things are precise, call your local legal counsel for assist. Join and simply find over 85,000 helpful forms.

Form popularity

FAQ

Beneficiaries RightsBeneficiaries under a will have important rights including the right to receive what was left to them, to receive information about the estate, to request a different executor, and for the executor to act in their best interests.

In Hawaii, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

There are no federal probate laws. Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all personal property owned in his or her name alone is worth more than $100,000.

Under California law (Probate Code section 16061.7) every Trust beneficiary, and every heir-at-law of the decedent, is entitled to receive a copy of the Trust document.

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

Under California law (Probate Code section 16061.7) every Trust beneficiary, and every heir-at-law of the decedent, is entitled to receive a copy of the Trust document.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

Who Notifies Me That I Am a Beneficiary of a Trust? A trustee is required by law to notify beneficiaries of a trust upon the settlor's death. The settlor is the person who created the trust. The trustee has 60 days from the settlor's death to provide the notification to the beneficiaries.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.