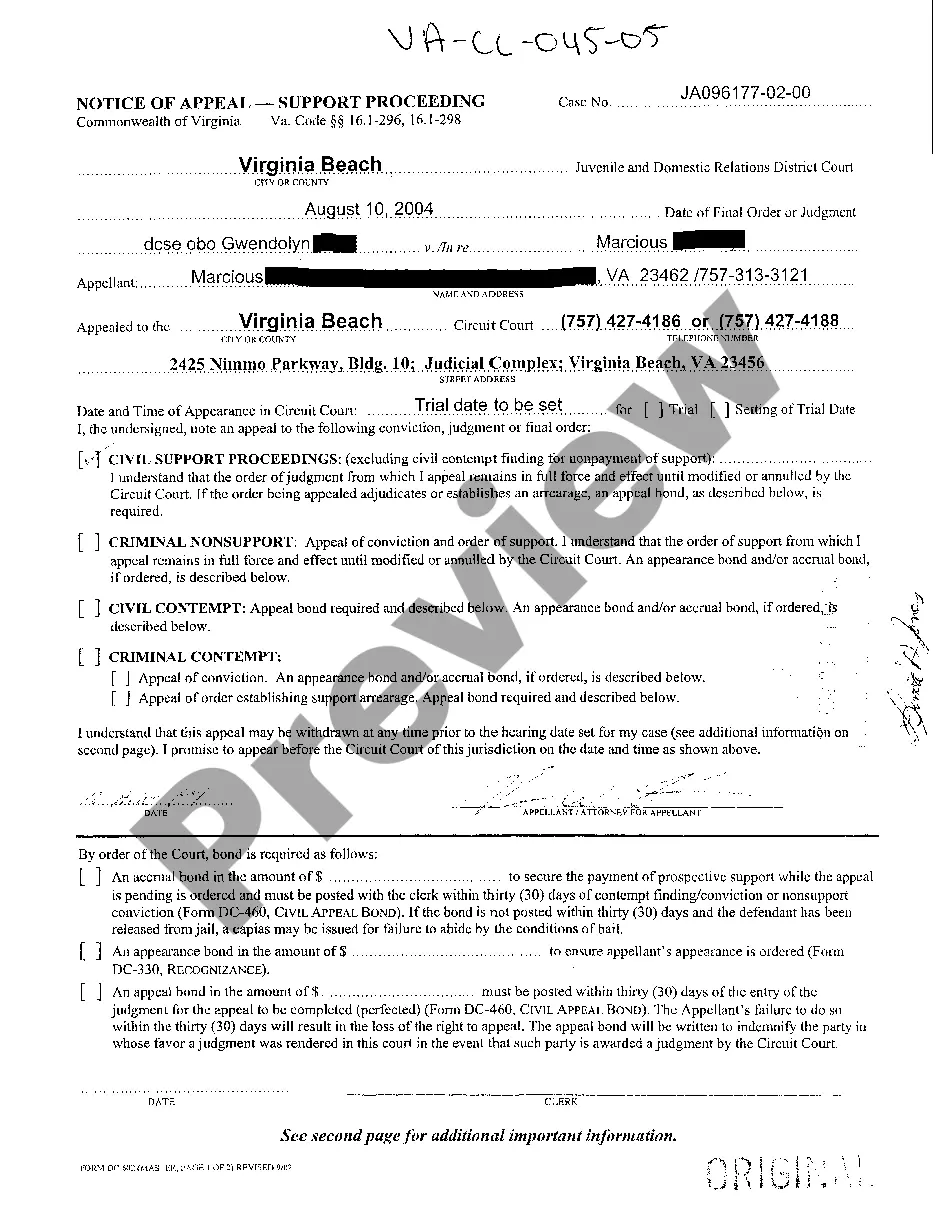

Iowa Trust Deed

Description

How to fill out Iowa Trust Deed?

Use US Legal Forms to obtain a printable Iowa Trust Deed. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most extensive Forms catalogue online and offers affordable and accurate templates for consumers and legal professionals, and SMBs. The documents are categorized into state-based categories and many of them can be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For individuals who don’t have a subscription, follow the following guidelines to quickly find and download Iowa Trust Deed:

- Check out to ensure that you get the proper form in relation to the state it’s needed in.

- Review the form by looking through the description and using the Preview feature.

- Click Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Use the Search engine if you want to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Iowa Trust Deed. Over three million users have used our service successfully. Select your subscription plan and obtain high-quality documents in just a few clicks.

Form popularity

FAQ

A trust deedalso known as a deed of trustis a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.The trustee, however, holds the legal title to the property.

Trust deeds can be a valuable aid to financial stability, but they are not right for everybody. They are best suited to people who have a regular income and can commit to regular payments. You can owe any amount to set up a trust deed but the typical minimum is about £7,000 or A£8,000.

A trust deedalso known as a deed of trustis a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

The deed of trust is currently used in Alabama, Alaska, Arkansas, Arizona, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Iowa, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Hampshire, North Carolina, Oklahoma, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia,

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.