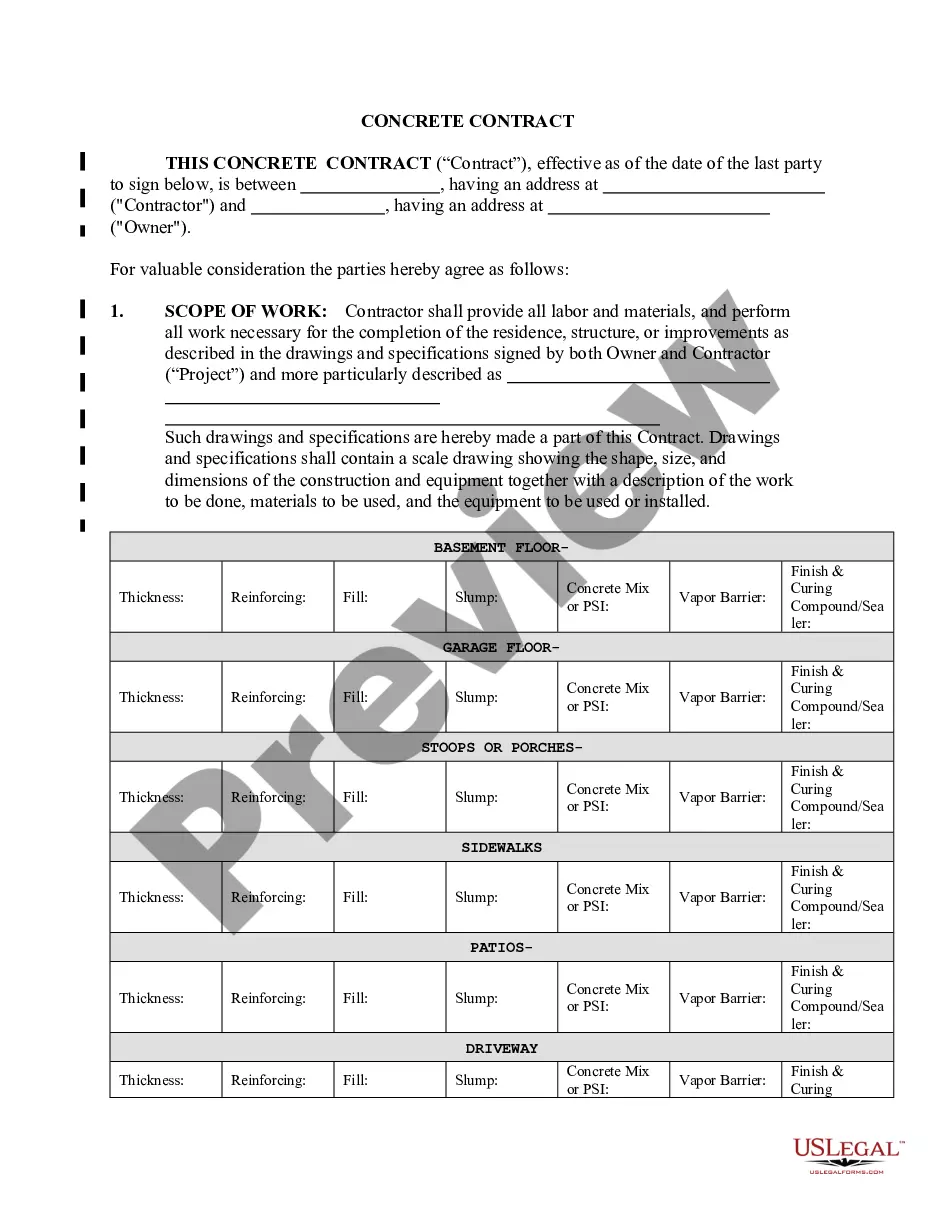

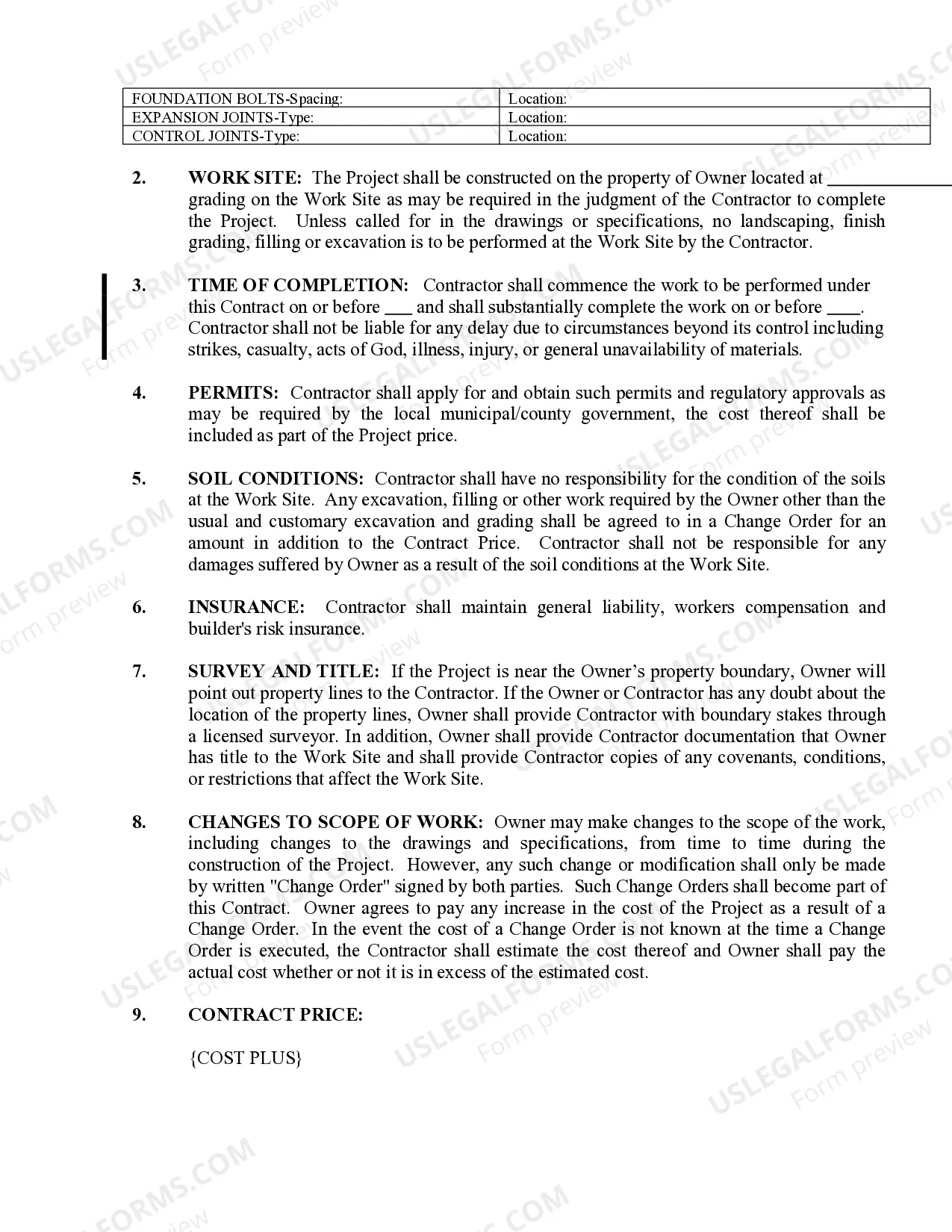

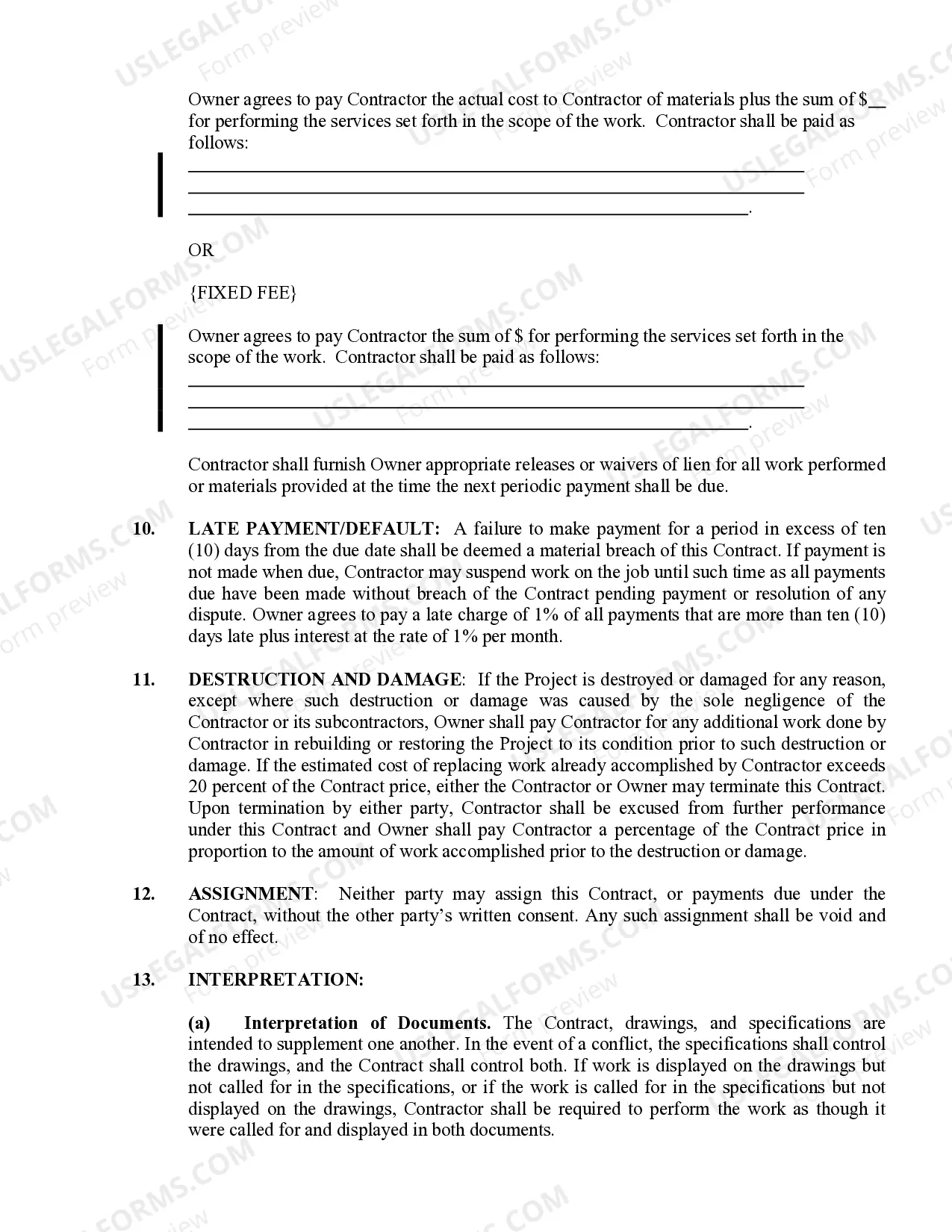

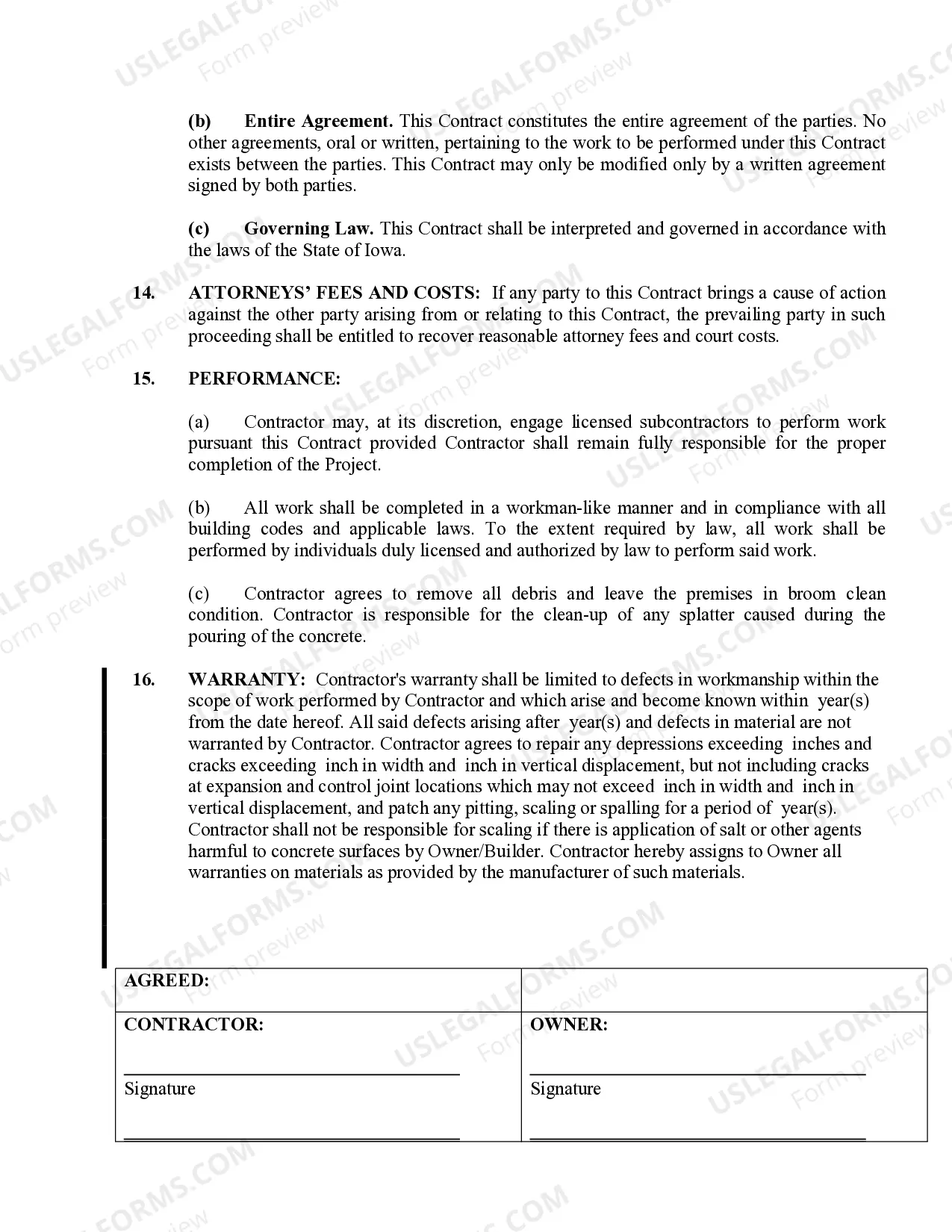

This form is designed for use between Concrete Mason Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Iowa.

Iowa Concrete Mason Contract for Contractor

Description

How to fill out Iowa Concrete Mason Contract For Contractor?

Get one of the most comprehensive catalogue of authorized forms. US Legal Forms is a solution where you can find any state-specific form in couple of clicks, such as Iowa Concrete Mason Contract for Contractor examples. No need to waste hours of the time trying to find a court-admissible sample. Our qualified pros make sure that you receive updated samples all the time.

To benefit from the forms library, pick a subscription, and sign-up an account. If you registered it, just log in and then click Download. The Iowa Concrete Mason Contract for Contractor file will quickly get saved in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new account, follow the short recommendations listed below:

- If you're having to use a state-specific documents, ensure you indicate the appropriate state.

- If it’s possible, go over the description to learn all the nuances of the document.

- Make use of the Preview option if it’s accessible to check the document's content.

- If everything’s correct, click on Buy Now button.

- Right after choosing a pricing plan, register your account.

- Pay by credit card or PayPal.

- Downoad the sample to your device by clicking Download.

That's all! You should submit the Iowa Concrete Mason Contract for Contractor form and check out it. To make sure that everything is precise, speak to your local legal counsel for support. Sign up and simply browse around 85,000 valuable samples.

Form popularity

FAQ

Payments to contractors are liable for payroll tax unless an exemption applies. To determine if an exemption applies, first check: if the contractor is an employee, even if they have an ABN or call themselves a contractor or.

Busker v. Sokoloski, 203 N.W. 2d 301, 304 (Iowa 1974). In construction cases, a non- breaching party may recover interest payments to third parties if reasonably foreseeable and caused by the defaulting parties breach.

Every subcontractor, whether domestic or foreign, entering into a contract with a service contractor engaged in petroleum operations in the Philippines shall be liable to a final income tax equivalent to eight percent (8%) of its gross income derived from such contract, such tax to be in lieu of any and all taxes,

Filters. A recovery of expenses; a reduction or withholding for legitimate reasons, of part or all of an owed amount; a defendant's right to have part of the plaintiff's claim reduced as the result of a breach of contract by same in the course of the same deal.

Iowa does not have state licensing requirements for a general contractors license. However, any construction contractor (individual or business) who makes $2,000 or more a year doing construction work, must register online with the Iowa Division of Labor or by calling 1-515-242-5871.

Must be at least 18 years old. Must provide documentation of criminal convictions related to the practice of the profession, which shall include a full explanation from the applicant. Must file an application and submit appropriate fees.

Contractors are also exempt from paying sales and use taxes on services resold to state agencies or exempt entities under a construction contract. The exemption applies only to services that will become an integral and inseparable component of the building contract (e.g., plumbing and electrical services).

Independent contractor tax rates at the federal and state level vary by income. The federal income tax rate starts at 10% and gradually increases to 37% based on a person's filing status and taxable income after deductions. The self-employment tax has two rates of 15.3% and 2.9%.

In most states, construction contractors must pay sales tax when they purchase materials used in construction. This means that any materials and supplies you purchase are taxable at the time of purchase. However, you won't have to pay sales or use tax upon the sale of the finished construction.