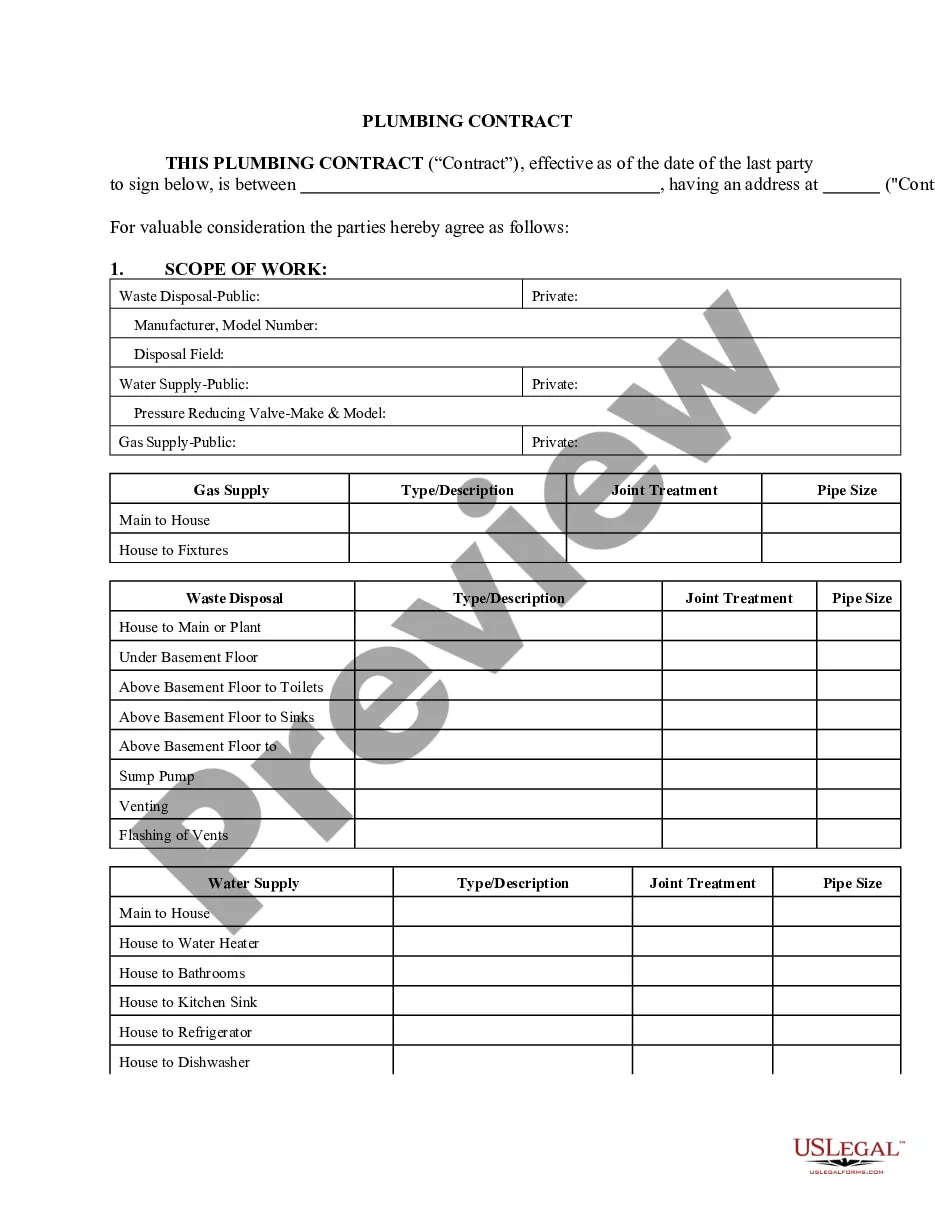

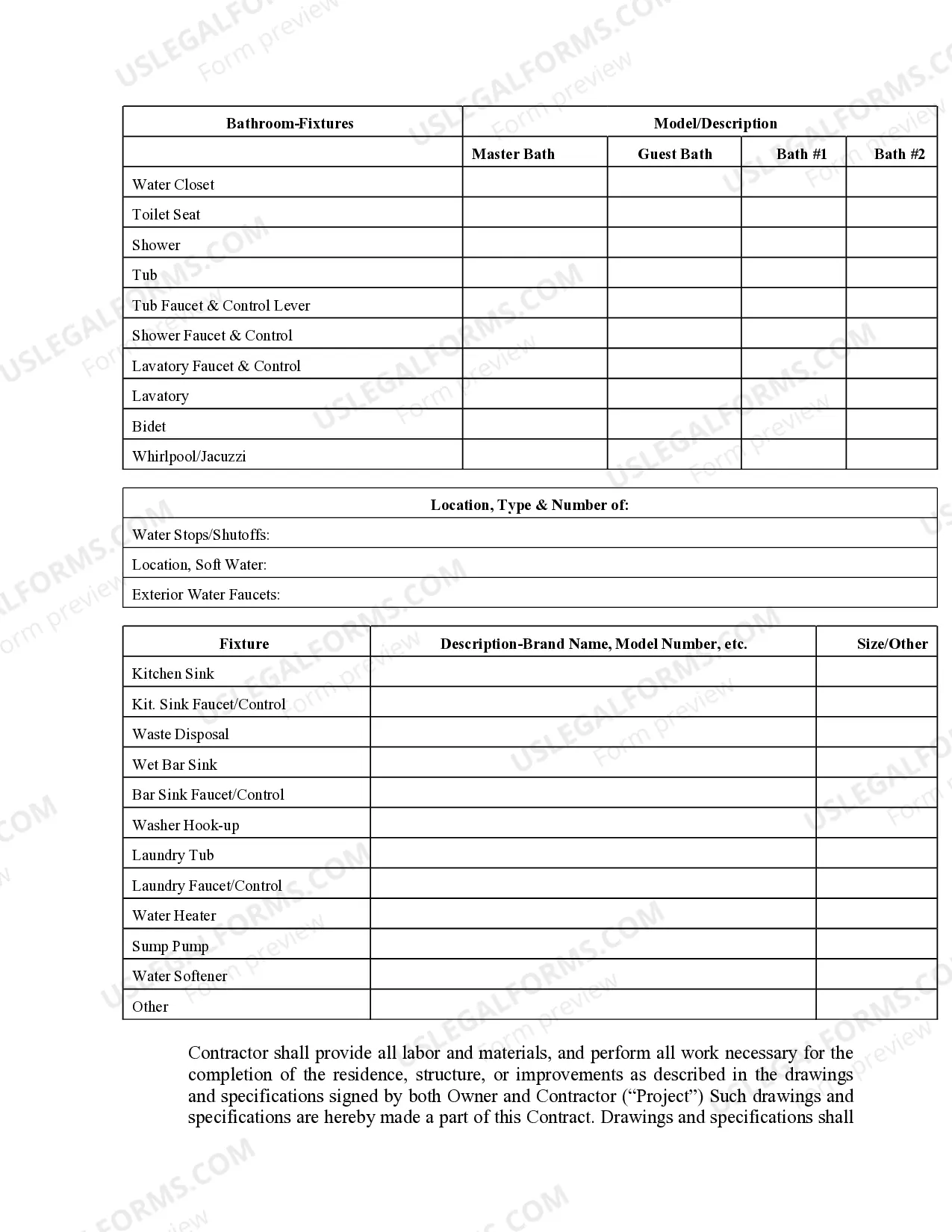

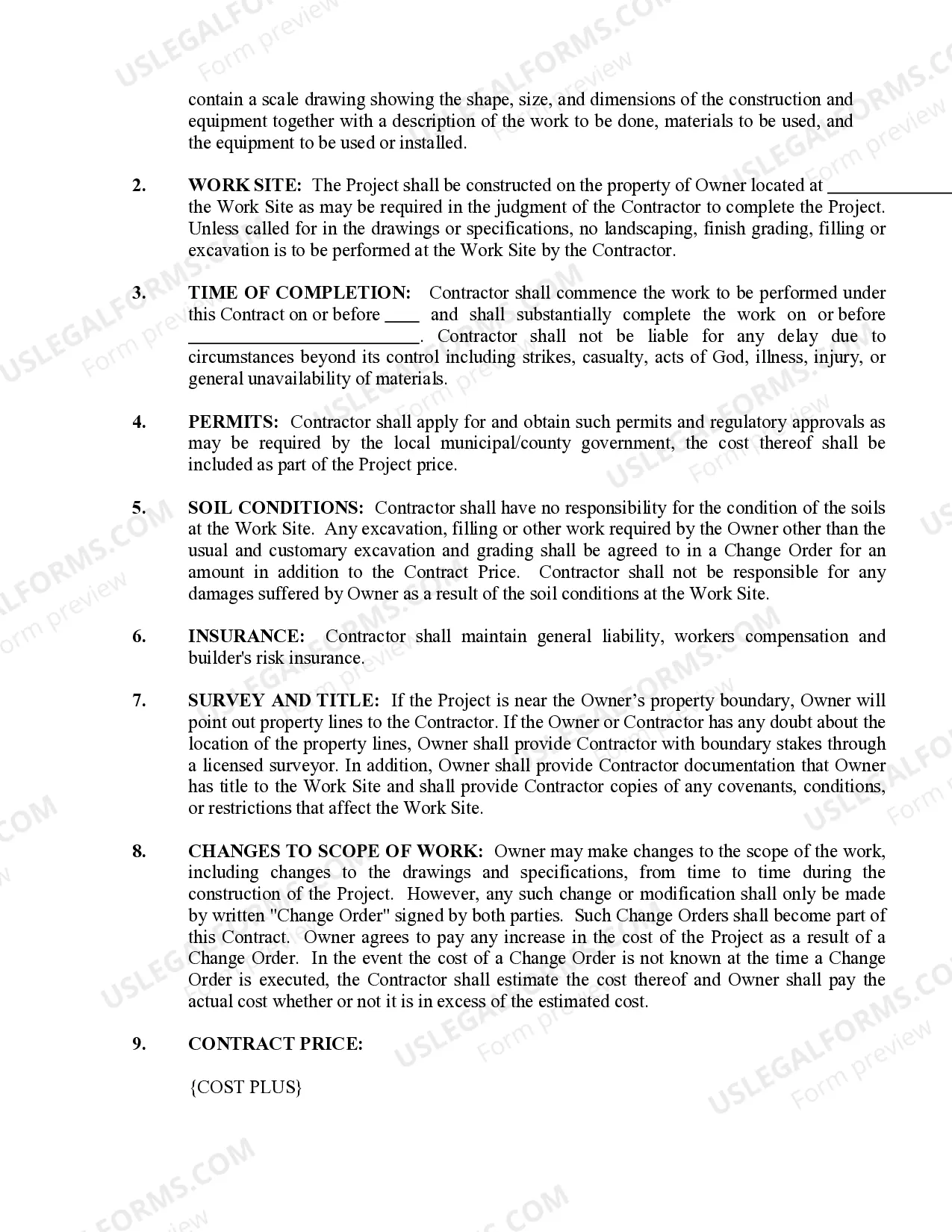

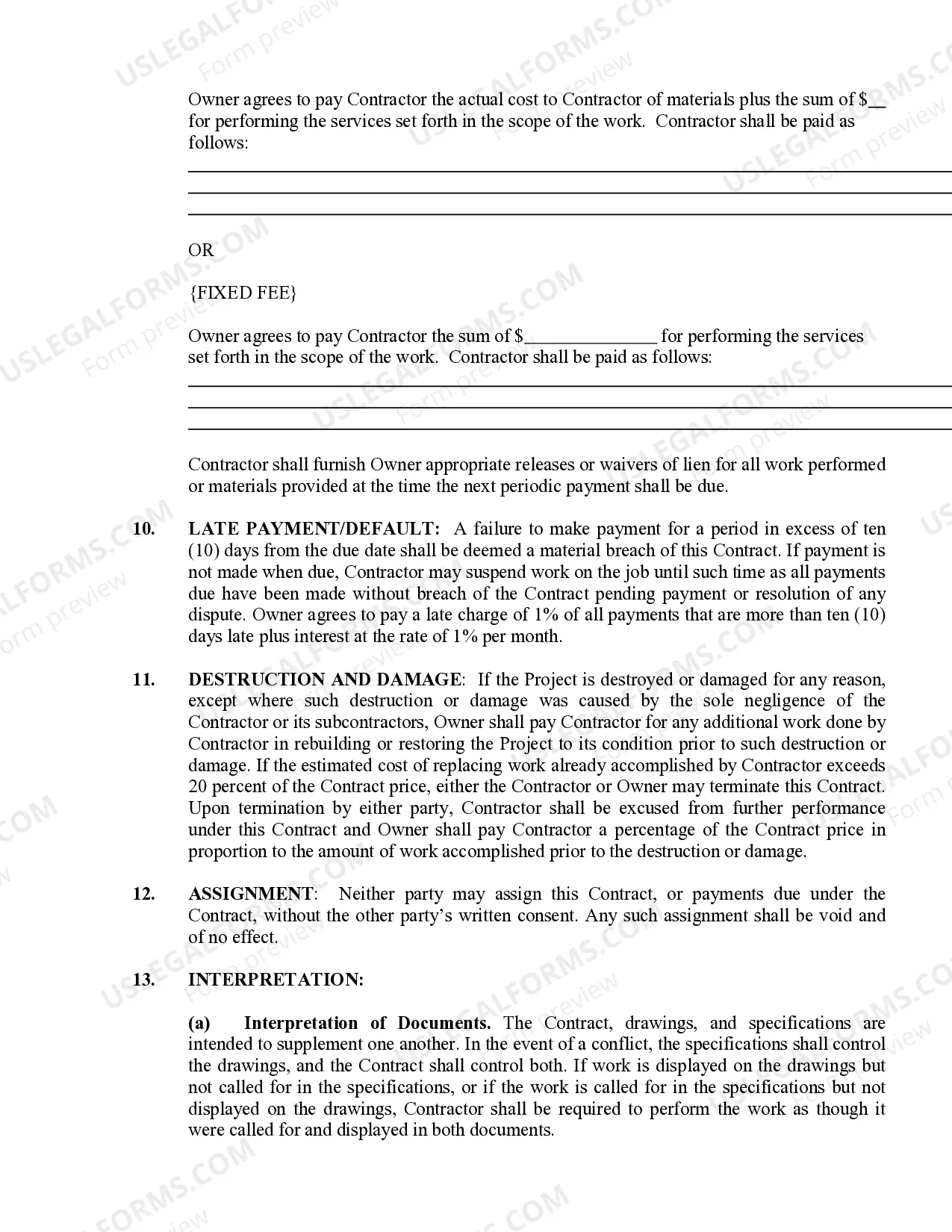

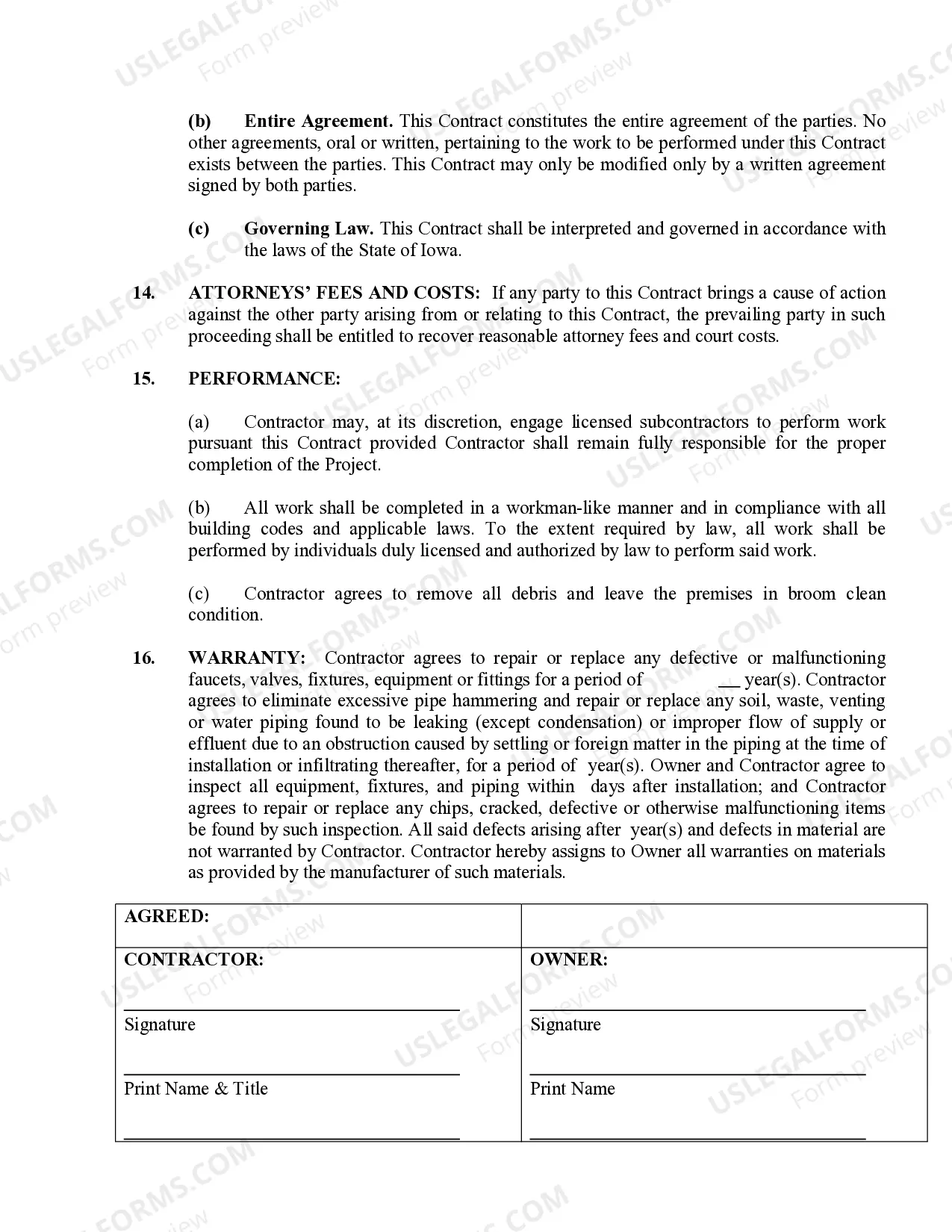

This form is designed for use between Plumbing Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Iowa.

Iowa Plumbing Contract for Contractor

Description

How to fill out Iowa Plumbing Contract For Contractor?

Access one of the most extensive catalogue of authorized forms. US Legal Forms is really a solution where you can find any state-specific form in a few clicks, even Iowa Plumbing Contract for Contractor samples. No reason to waste several hours of the time searching for a court-admissible form. Our qualified specialists make sure that you get up-to-date documents all the time.

To benefit from the forms library, choose a subscription, and sign-up your account. If you already created it, just log in and click Download. The Iowa Plumbing Contract for Contractor sample will immediately get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, follow the quick instructions below:

- If you're going to utilize a state-specific documents, make sure you indicate the right state.

- If it’s possible, look at the description to understand all of the nuances of the form.

- Use the Preview function if it’s available to check the document's information.

- If everything’s appropriate, click on Buy Now button.

- After picking a pricing plan, make an account.

- Pay by card or PayPal.

- Save the sample to your device by clicking on Download button.

That's all! You ought to complete the Iowa Plumbing Contract for Contractor form and double-check it. To make sure that things are exact, contact your local legal counsel for assist. Sign up and simply browse over 85,000 beneficial templates.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

A certified contractor passed the state licensing examination. Certified contractors can work anywhere within the state in which they are licensed. A registered contractor is registered by a local county or municipality and receives a certificate of competency from the Electrical Contractors' Licensing Board.

Must be at least 18 years old. Must provide documentation of criminal convictions related to the practice of the profession, which shall include a full explanation from the applicant. Must file an application and submit appropriate fees.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Iowa does not have state licensing requirements for a general contractors license. However, any construction contractor (individual or business) who makes $2,000 or more a year doing construction work, must register online with the Iowa Division of Labor or by calling 1-515-242-5871.

Must be at least 18 years old. Must provide documentation of criminal convictions related to the practice of the profession, which shall include a full explanation from the applicant. Must file an application and submit appropriate fees.

Iowa. All construction contractors who earn more than $2,000 per year are required to be registered with the Iowa Division of Labor if they work in the state. There is no exam, but you must show proof of unemployment insurance. Roofing contractors do not require a state license, unless you're working with asbestos.

In California, anyone who contracts to perform work on a project that is valued at $500 or more for combined labor and materials costs must hold a current, valid license from CSLB.The quality of their work usually doesn't compare to that of a licensed contractor. Don't take the chance in order to save a few dollars.

Must be at least 18 years old; Must provide legal documents of any past criminal offenses; Must have completed at least four years of practical experience from an apprenticeship training program registered by the U.S. Department of Labor; Must pass the licensing exam.