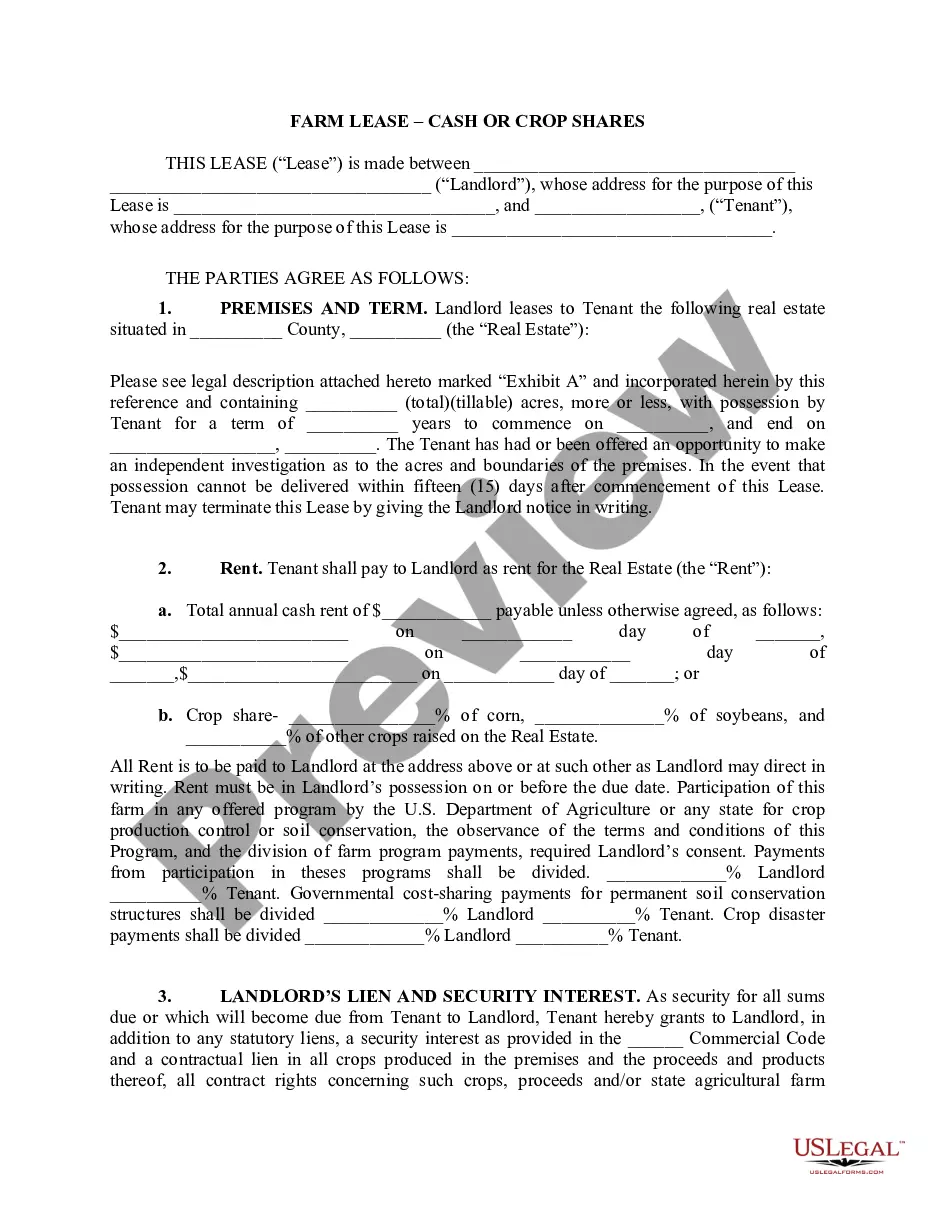

Iowa Farm Lease- Cash of Crop Shares

Description

Key Concepts & Definitions

Cash Rent: A fixed payment made by the farmer to the landlord, paid in cash rather than a share of the crop. Rental Rates: The amount charged per acre or unit of measurement for the lease of farmland. Fixed Cash: A lease agreement where rent does not change regardless of farming conditions. Flexible Cash: Rent adjusts based on yield or prices, providing potential risk and reward. Net Return: The profit from farming activities after all expenses are deducted. Crop Share: An agreement where the landlord receives a portion of the crop instead of cash. Share Lease: Similar to crop share, where rent is paid in the form of farm produce. Net Returns: A detailed assessment of profitability from a farmed land.

Step-by-Step Guide to Setting Up a Farm Lease

- Determine Lease Type: Decide between fixed cash, flexible cash, or crop share based on your financial stability and risk appetite.

- Assess the Land: Evaluate soil quality, access to water, and history of the land to anticipate production capabilities.

- Negotiate Terms: Clearly define rental rates, lease duration, and terms of payment (cash or crop share).

- Prepare a Lease Agreement: Draft a formal contract that includes all agreed upon details. This may require legal assistance to ensure all terms are clear and enforceable.

- Sign and Execute the Lease: Both parties should sign the lease, and any legal formalities required by local regulations should be completed.

Risk Analysis of Different Lease Types

- Fixed Cash Leases: Less risk for the farmer in terms of variable costs, but potentially less profit during high-yield years.

- Flexible Cash Leases: Higher risk and reward, adapting to price fluctuations and yields but requiring careful management.

- Crop Share Leases: Risks and rewards are shared between the landlord and farmer, aligning interests but introducing variability in income.

Pros & Cons

- Pros:

- Fixed cash lease simplifies budgeting and financial planning.

- Flexible leases allow benefits from higher market prices or yields.

- Crop share leases align landlord and farmer interests, potentially leading to better land management.

- Cons:

- Fixed leases can lead to missed opportunities during peak market conditions.

- Flexible and crop share leases require more complex management and have higher financial variability.

Best Practices

Regularly review and possibly renegotiate the lease terms every few years to adapt to market changes and farming conditions. Maintain open communication with the landlord to address any issues or opportunities related to the lease or farmed land.

Common Mistakes & How to Avoid Them

- Not thoroughly assessing the land before forming a lease agreement. Solution: Conduct detailed land health evaluations beforehand.

- Failing to define flexible terms clearly in the lease can lead to disputes. Solution: Specify all potential scenarios and how they should be handled legally within the agreement.

How to fill out Iowa Farm Lease- Cash Of Crop Shares?

Use US Legal Forms to get a printable Iowa Farm Lease- Cash of Crop Shares. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms catalogue online and provides cost-effective and accurate templates for customers and lawyers, and SMBs. The templates are grouped into state-based categories and a number of them can be previewed before being downloaded.

To download templates, users need to have a subscription and to log in to their account. Press Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the following guidelines to quickly find and download Iowa Farm Lease- Cash of Crop Shares:

- Check to ensure that you have the right form in relation to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Hit Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including Iowa Farm Lease- Cash of Crop Shares. More than three million users have already utilized our platform successfully. Select your subscription plan and have high-quality forms in a few clicks.

Form popularity

FAQ

Iowa's cash rents declined from a high of $260 per acre in 2014 to $235 per acre in 2016. The 2020 average state rent is $230 per acre.

Agricultural communities developed approximately 10,000 years ago when humans began to domesticate plants and animals. By establishing domesticity, families and larger groups were able to build communities and transition from a nomadic hunter-gatherer lifestyle dependent on foraging and hunting for survival.

Tenant farming is a system of agriculture whereby farmers cultivate crops or raise livestock on rented lands.A tenant farmer typically could buy or owned all that he needed to cultivate crops; he lacked the land to farm. The farmer rented the land, paying the landlord in cash or crops.

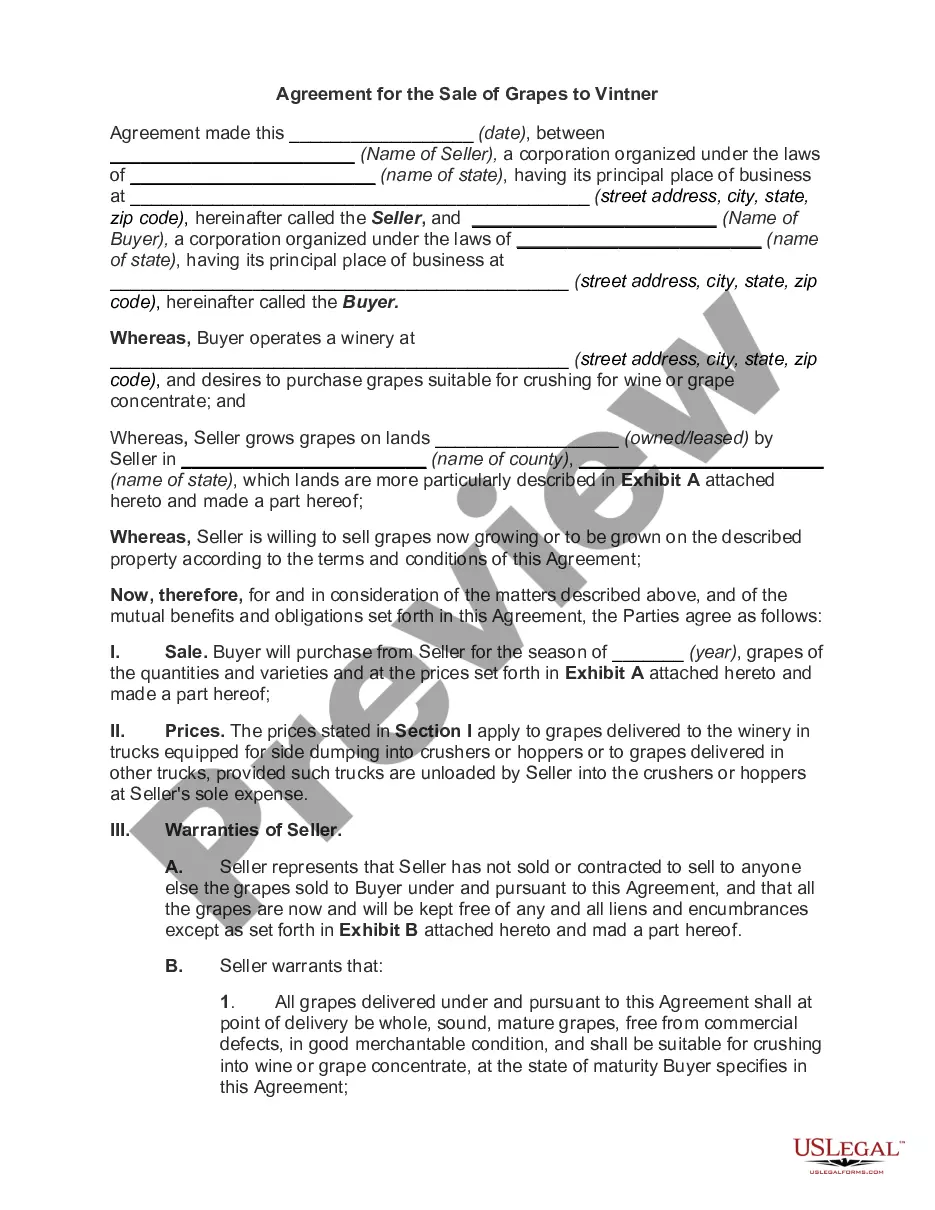

Crop-share arrangements refer to a method of leasing crop land where the production (crop) is shared between the landowner and the operator. Other income items, such as government payments and crop residue, are also often shared as are some of the production expenses.

In a share farming arrangement, a landowner will extend their land to another farmer. From there, they will share the expenses and profits all while still operating as separate businesses. This could be a really great way to scale your farming activities, but it's important to make sure you're doing it right.

Under a crop share agreement, the landlord and tenant agree that rent will be paid in the form of a percentage of income derived from the subject property. For example, parties may agree that the land owner will receive 25% of the income from the land as rent payment.

Farm Land Leases In a typical cash rent lease, the tenant is obligated to pay a set price per acre or a set rate for the leased land. With this form of lease, the tenant bears certain economic risks, and the landlord is guaranteed a predictable return, regardless of commodity prices.