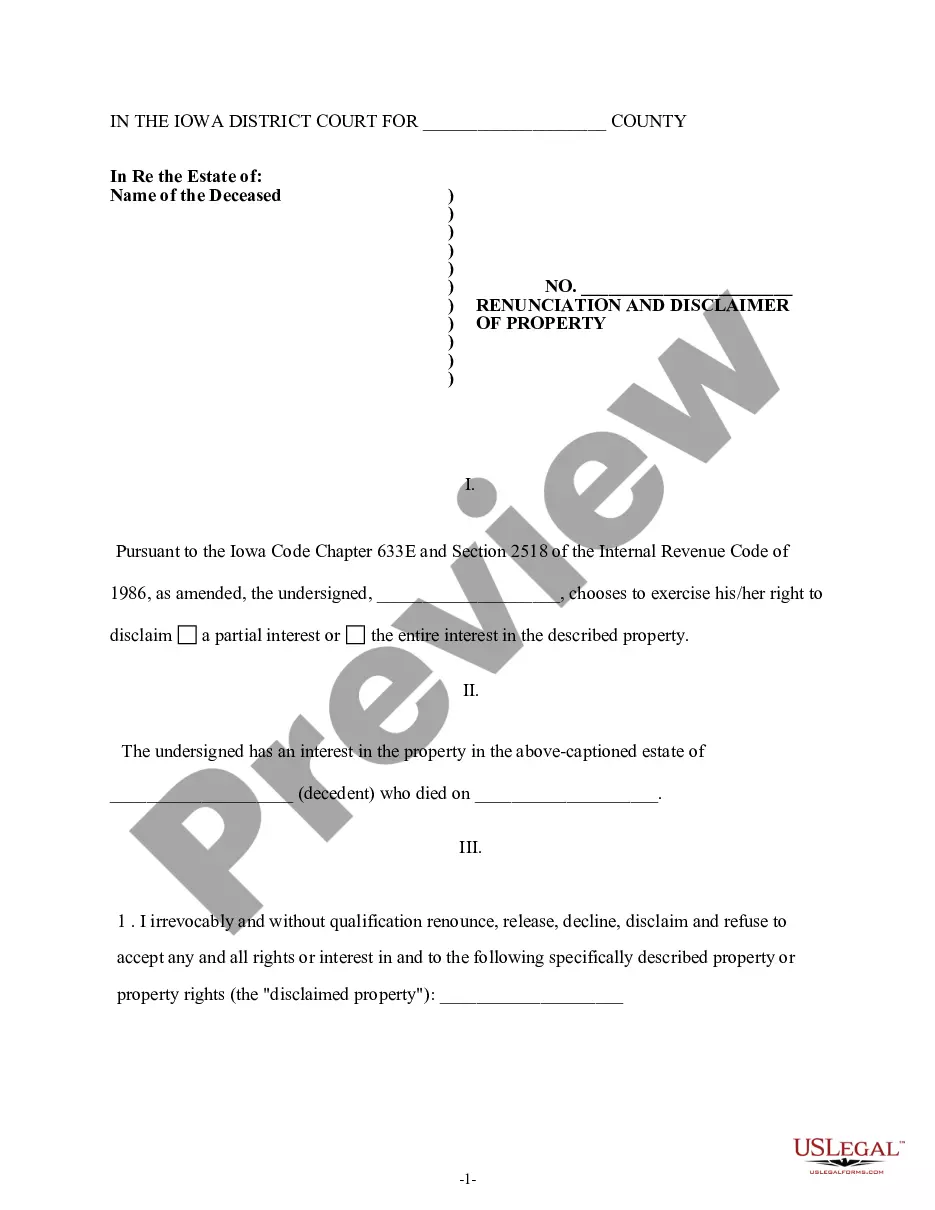

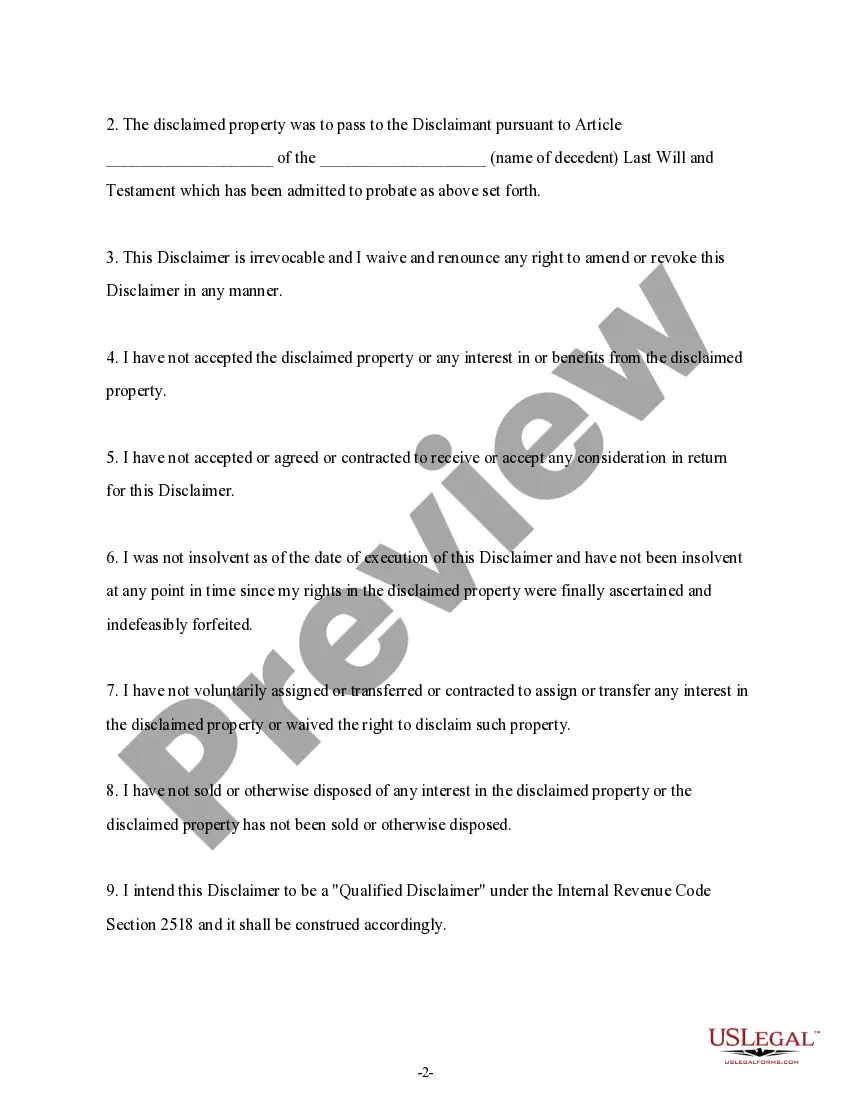

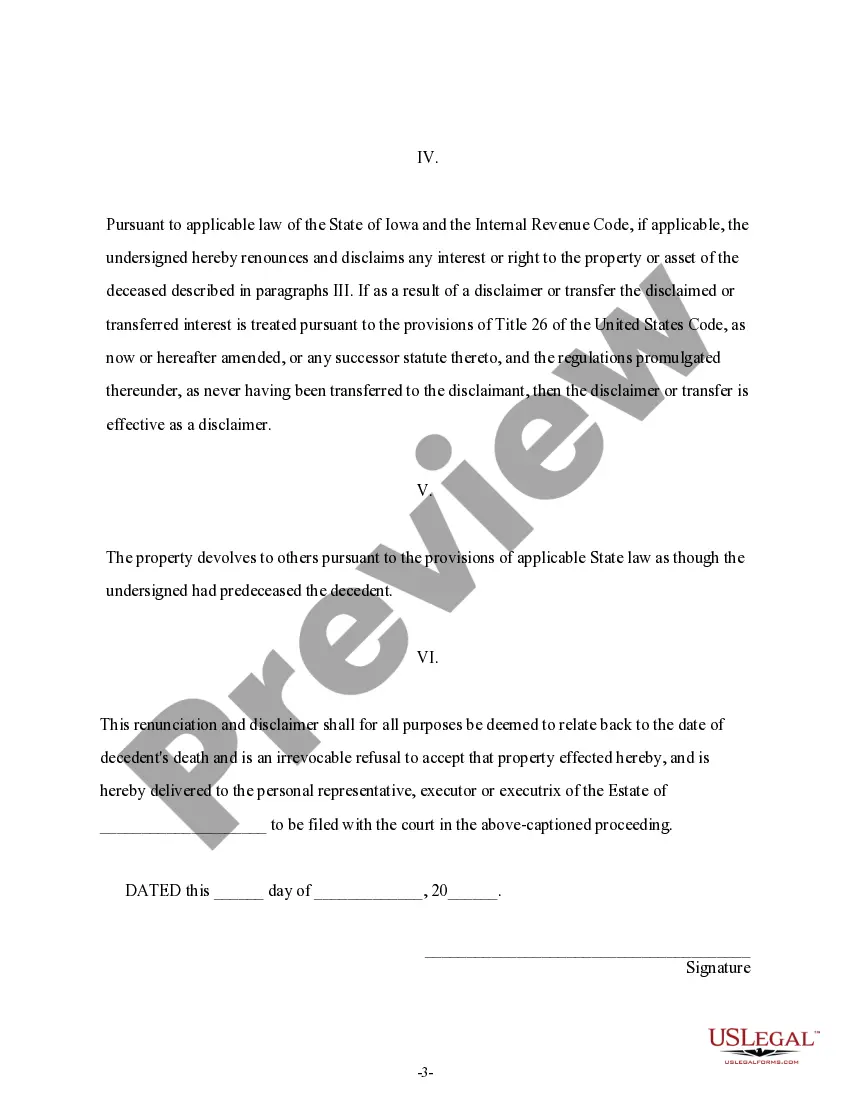

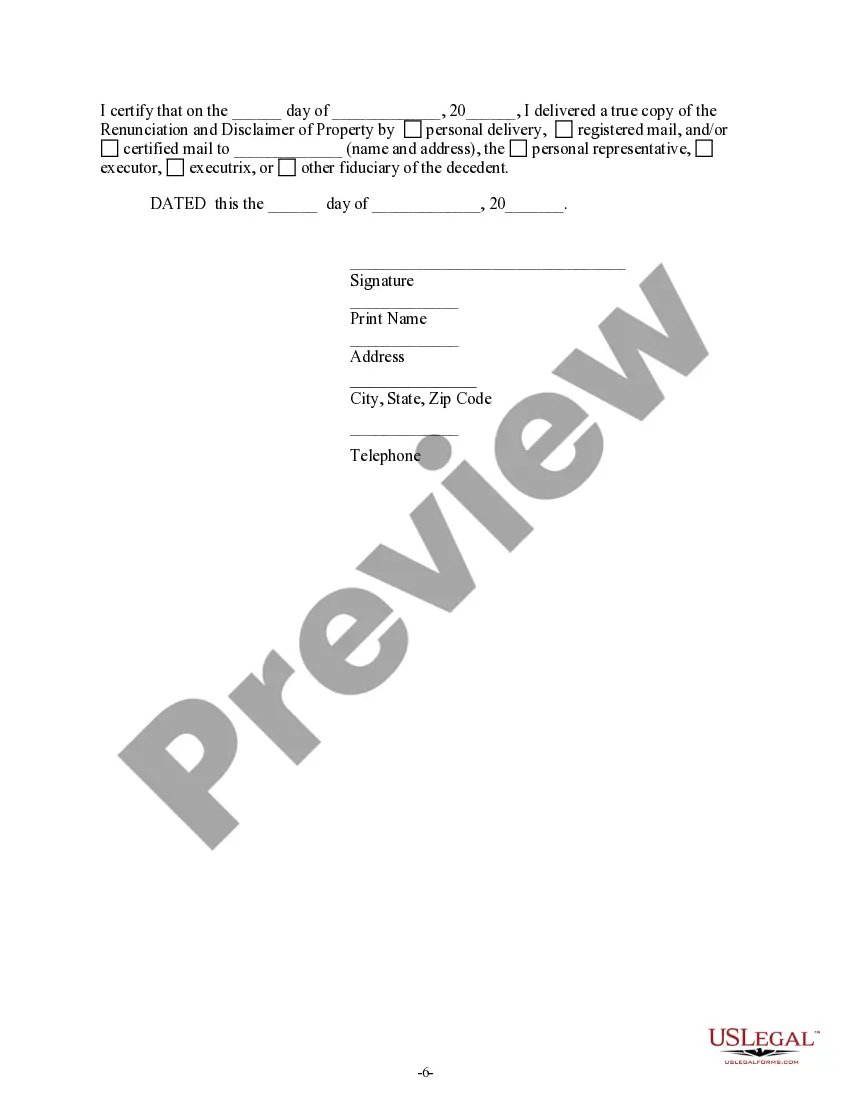

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. Pursuant to the Iowa Code Chapter 633E, the beneficiary will disclaim a portion of or the entire interest in the described property. The renunciation will relate back to the date of the decedent's death and will serve as a refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Property from Will by Testate

Description Property Testate Ia

How to fill out Disclaimer Property?

Access one of the most comprehensive library of legal forms. US Legal Forms is a system where you can find any state-specific document in a few clicks, even Iowa Renunciation and Disclaimer of Property from Will by Testate templates. No reason to spend several hours of the time seeking a court-admissible sample. Our certified specialists ensure that you receive up to date samples all the time.

To take advantage of the documents library, choose a subscription, and register your account. If you already registered it, just log in and then click Download. The Iowa Renunciation and Disclaimer of Property from Will by Testate template will immediately get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new account, look at short recommendations below:

- If you're proceeding to utilize a state-specific sample, ensure you indicate the proper state.

- If it’s possible, review the description to learn all of the ins and outs of the document.

- Make use of the Preview function if it’s accessible to take a look at the document's information.

- If everything’s correct, click Buy Now.

- After picking a pricing plan, create your account.

- Pay out by credit card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You need to fill out the Iowa Renunciation and Disclaimer of Property from Will by Testate form and check out it. To make certain that all things are correct, contact your local legal counsel for assist. Sign up and simply look through around 85,000 useful forms.

Ia Property Testate Form popularity

Property Will Paper Other Form Names

Disclaimer Will Editable FAQ

For a beneficiary to effectively monitor the administration of estate property it goes without saying the beneficiary needs information regarding the performance of the executor's duties and powers. To this end the law has imposed on executors and trustees a duty to account beneficiaries.

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.

While an executor is obligated to notify beneficiaries and then move things along at a reasonable pace, he or she isn't required to distribute inheritances at the time of notification. In fact, beneficiaries might not receive anything until several months after they've been notified of their place in the will.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Probate can take two years or more depending upon the complexity. Federal and State tax returns need to be filed within nine months after the date of death. Iowa law requires that an estate be closed within three years of publishing the second notice to creditors, unless the court grants an extension.

Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000. For estates over $5,000, they can each receive $220 plus 2% of the amount over $5000. If the estate is complicated, a judge can order higher fees. You can also negotiate the fees to pay an attorney.

A beneficiary is entitled to be told if they are named in a person's will. They are also entitled to be told what, if any, property/possessions have been left to them, and the full amount of inheritance they will receive.

In most cases, beneficiaries can't go to the court and contest an executor simply because they disagree with one or more of the executor's decisions. In order for the court to remove an executor, someone (usually a beneficiary) must prove that the executor has engaged in misconduct or is otherwise incompetent.