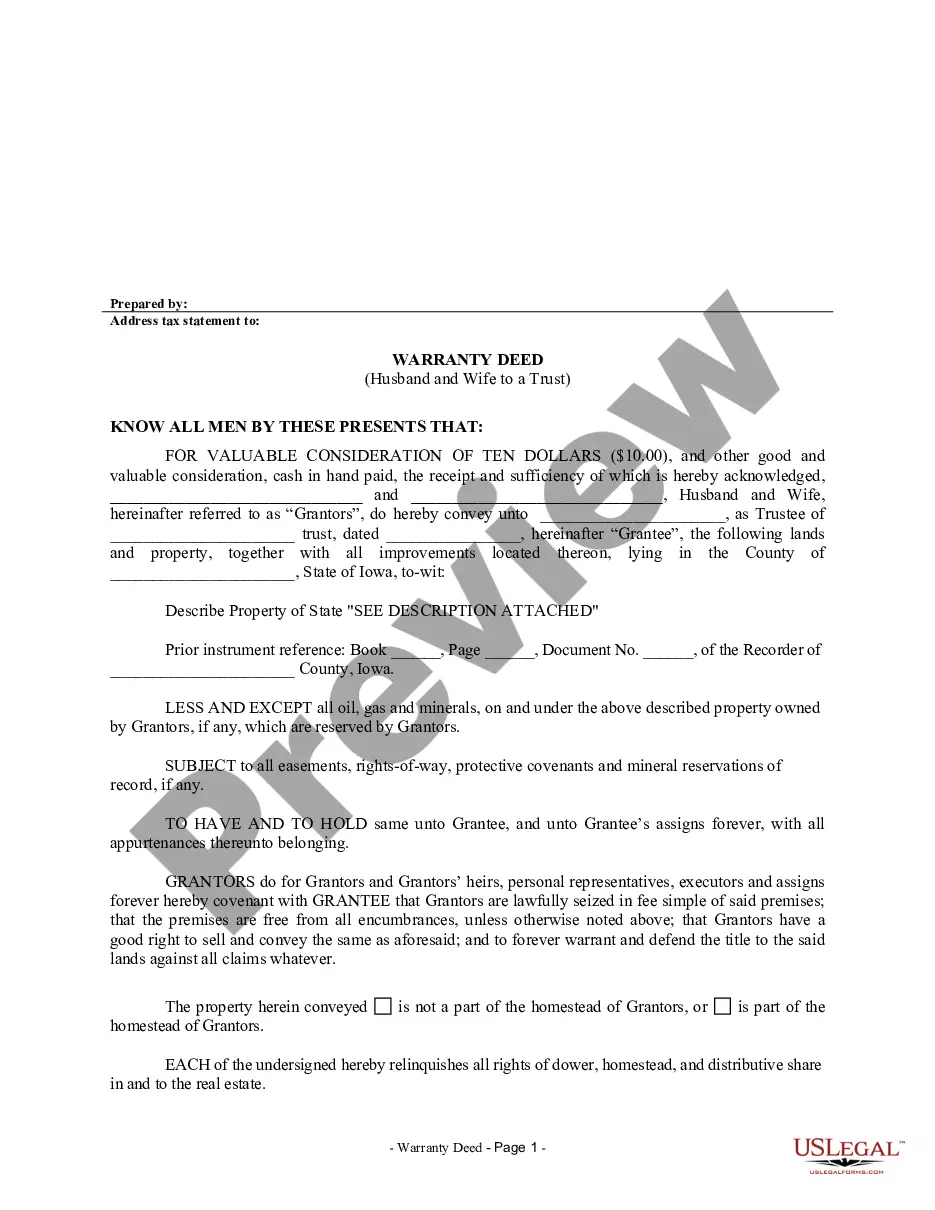

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Iowa Warranty Deed from Husband and Wife to a Trust

Description

Key Concepts & Definitions

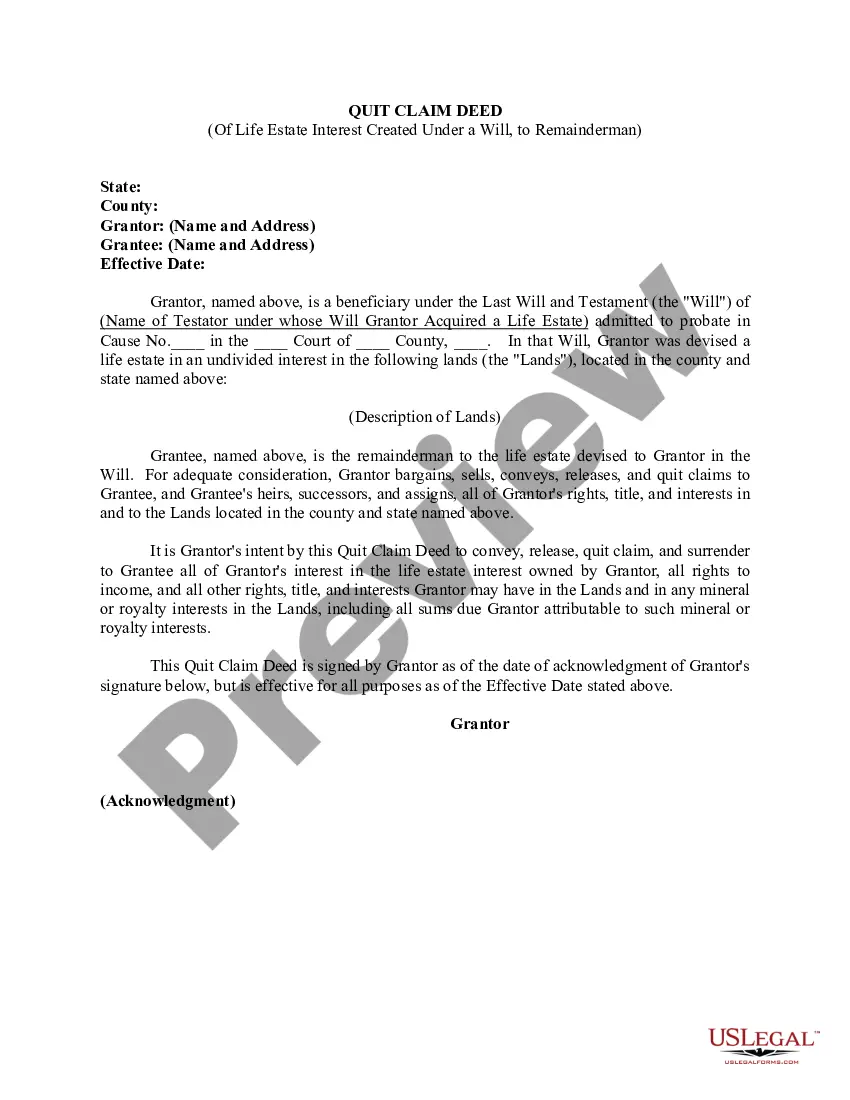

Warranty Deed from Husband and Wife to a Trust: A legal document in which a husband and wife, as joint property owners, transfer their real estate property into a trust. This deed guarantees that the property is free from any undisclosed liens or disputes. Trust: A fiduciary arrangement where a trustee holds assets on behalf of a beneficiary. Esignature: An electronic signature utilized to agree to documents digitally.

Step-by-Step Guide to Transferring Property via a Warranty Deed from Husband and Wife to a Trust

- Consult a real estate attorney to understand the specific implications in your state.

- Prepare the Warranty Deed document, ensuring accuracy in describing the property and trustee details.

- Use tools like airslate signnow for securely creating esignatures and online document checking.

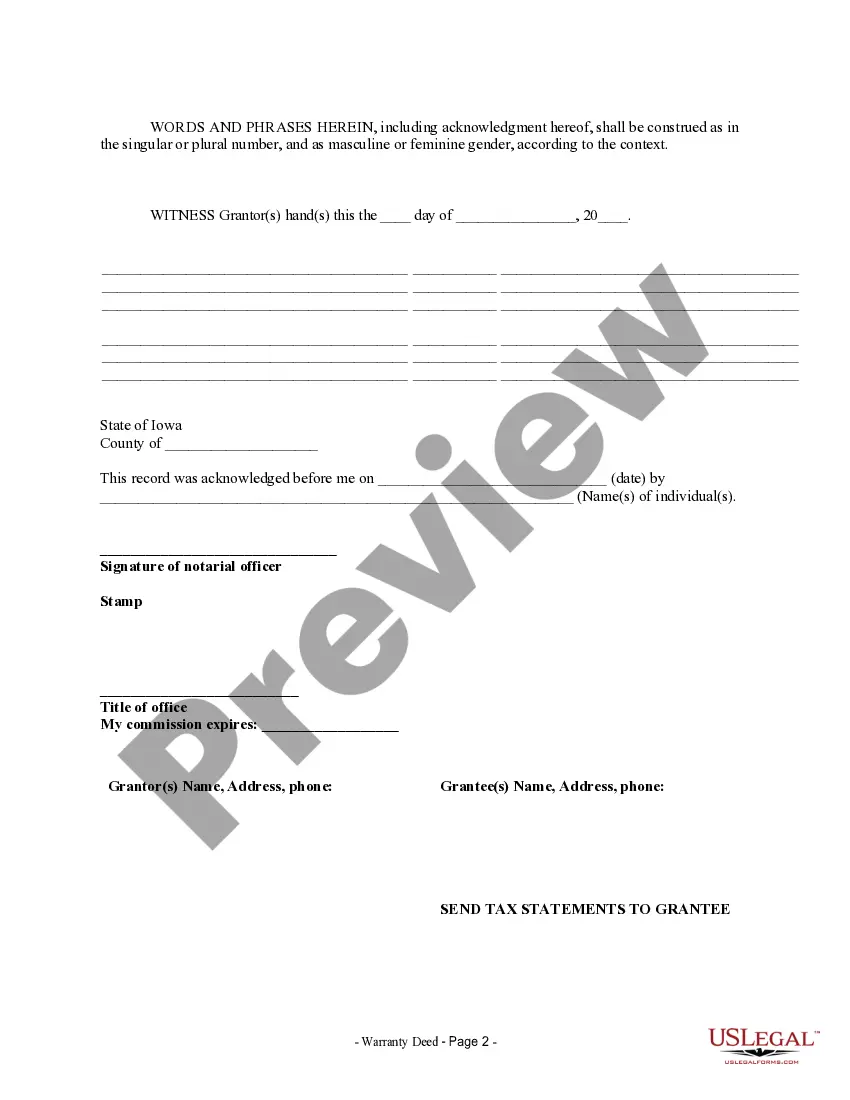

- Sign the deed in the presence of a notary to make the transfer legally binding.

- Record the deed at the local Registrar's office to formalize the transfer into the trust.

Risk Analysis of Deed Transfers to a Trust

- Credit Risks: Understanding the impact on personal credit and joint real estate loans is crucial.

- Legal Risks: Errors during the transfer can result in disputes or legal claims against the property.

- Insurance Implications: Verify how transferring assets into a trust affects existing small business or personal insurance coverage.

Common Mistakes & How to Avoid Them

- Not Using Updated Forms: Always use the latest trust Illinois form to avoid processing delays or rejections.

- Neglecting Financial Calculations: Utilize online financial calculators to understand the fiscal impact properly.

- Overlooking Library Resources: Tap into accessing library resources for additional legal and real estate templates or guidelines.

Best Practices

- Consult Professionals: Engage with legal and financial advisors to ensure compliance and correctness.

- Secure Documents: Use secure platforms for creating and storing esignatures and critical documents.

- Regularly Update Your Trust: Keep the trust document and its constitutions current to reflect any changes in the law or in your personal circumstances.

FAQ

Q1. How does a warranty deed differ from other types of deeds?

A1. A warranty deed provides the strongest protection, guaranteeing the property is free from any encumbrances apart from those stated.

Q2. Can I revert the property transfer to a trust?

A2. Reversions are typically complex and require legal proceedings. Consult a legal professional for precise guidance.

How to fill out Iowa Warranty Deed From Husband And Wife To A Trust?

Obtain one of the most comprehensive collections of sanctioned forms.

US Legal Forms serves as a tool to locate any state-specific document in just a few clicks, including Iowa Warranty Deed from Spouse to a Trust templates.

There’s no need to squander hours searching for a court-acceptable template.

After choosing a payment plan, create an account. Pay using a credit card or PayPal. Download the document to your device by clicking on the Download button. That’s it! You should fill out the Iowa Warranty Deed from Spouse to a Trust template and verify it. To ensure that everything is correct, consult your local legal advisor for assistance. Sign up and easily access over 85,000 useful templates.

- To utilize the forms library, select a subscription plan and set up an account.

- If you’re already registered, simply Log In and click Download.

- The Iowa Warranty Deed from Spouse to a Trust example will be promptly saved in the My documents section (a section for all documents you download on US Legal Forms).

- To create a new account, follow the quick suggestions below.

- If you need to use a state-specific document, be sure to specify the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if it’s offered to check the document's content.

- If everything is accurate, select the Buy Now button.

Form popularity

FAQ

An example of a trust deed might include a document where a husband and wife jointly transfer their property into a trust for their children. This document will clearly outline the assets, the roles of all parties involved, and the intended use of the property. For your needs regarding an Iowa Warranty Deed from Husband and Wife to a Trust, exploring examples on uslegalforms can offer clarity and inspiration.

A trust deed needs essential components such as the names of the grantor, trustee, and beneficiaries, as well as the property being transferred. Additionally, it should state the terms of the trust and any specific powers allocated to the trustee. For an Iowa Warranty Deed from Husband and Wife to a Trust, ensure you accurately detail all legal descriptors to avoid issues.

Creating a trust deed starts by organizing the necessary information about the trust's assets and beneficiaries. Draft the document while ensuring you comply with Iowa regulations for an Iowa Warranty Deed from Husband and Wife to a Trust. Uslegalforms offers templates and resources that simplify the process, making it easier for you.

Writing a trust deed involves defining the grantor, trustee, and beneficiaries. Clearly outline duties and powers of each party to avoid confusion. If you’re dealing with an Iowa Warranty Deed from Husband and Wife to a Trust, ensure your language reflects local legal requirements, potentially using resources from uslegalforms for guidance.

To write a trust document, start by clearly stating your intentions for the trust. Include details about the trust's purpose, the assets it will hold, and the beneficiaries. It is essential to follow Iowa laws to ensure your Iowa Warranty Deed from Husband and Wife to a Trust is valid, so consider using a template or consulting an expert.

While warranty deeds provide solid protection for buyers, they also come with some disadvantages. The grantors are responsible for any title issues that arise, which could lead to financial liability. Additionally, if you plan to transfer your property using an Iowa Warranty Deed from Husband and Wife to a Trust, understanding these risks is vital for protecting your interests.

The main purpose of a warranty deed is to assure the buyer that the property title is clear of any claims or encumbrances. By using an Iowa Warranty Deed from Husband and Wife to a Trust, the grantors provide a warranty that protects the buyer’s investment. This peace of mind is invaluable when transferring real estate assets.

Yes, a warranty deed serves as proof of ownership. When you execute an Iowa Warranty Deed from Husband and Wife to a Trust, it indicates that the grantors guarantee legitimate ownership of the property. This document is vital when conveying property, as it assures the buyer of clear title and protects against future claims.

While you can transfer a deed without an attorney, consulting one can provide clarity and prevent potential errors. An attorney specializes in real estate law and can help prepare the Iowa Warranty Deed from Husband and Wife to a Trust accurately. Their guidance can ensure you meet all legal requirements and protect your ownership rights.

To put your house in a trust in Iowa, you start by drafting a trust document. This legal document outlines the terms of the trust and names the beneficiaries. Next, execute a deed, commonly an Iowa Warranty Deed from Husband and Wife to a Trust, to transfer your property into the trust. This process can simplify estate management and ensure your wishes are honored.