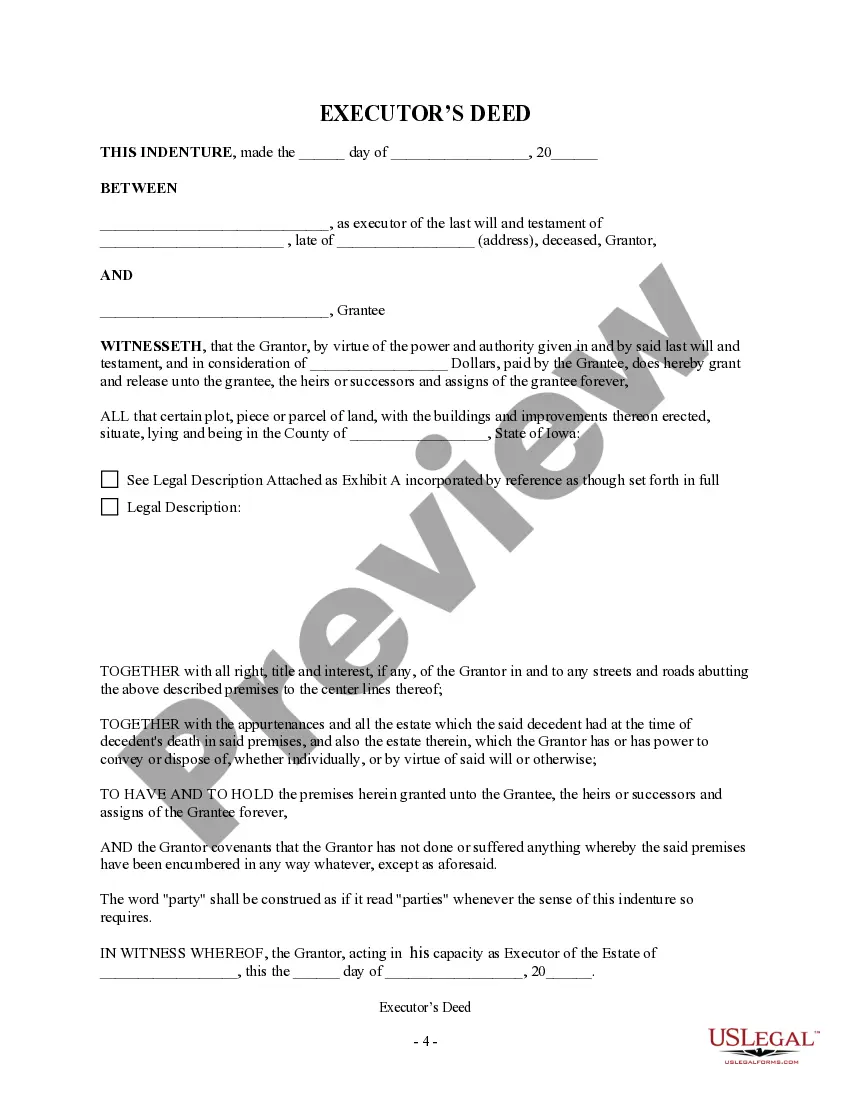

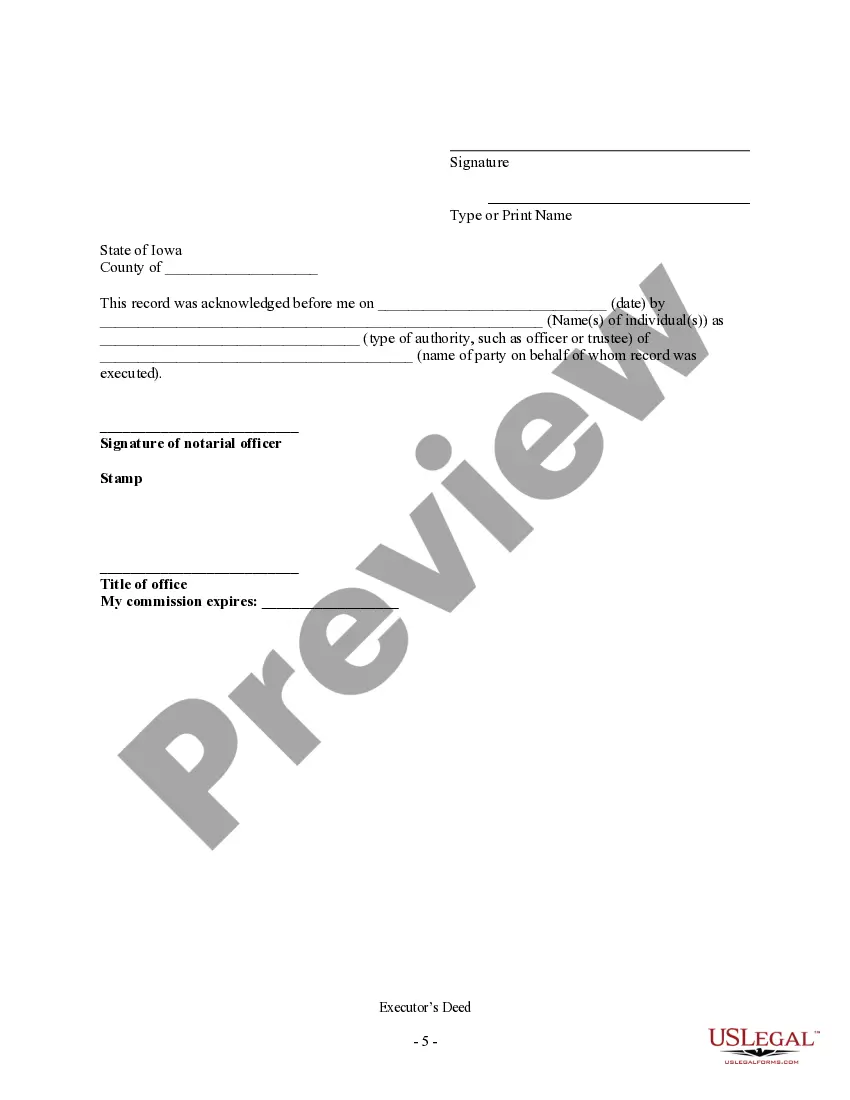

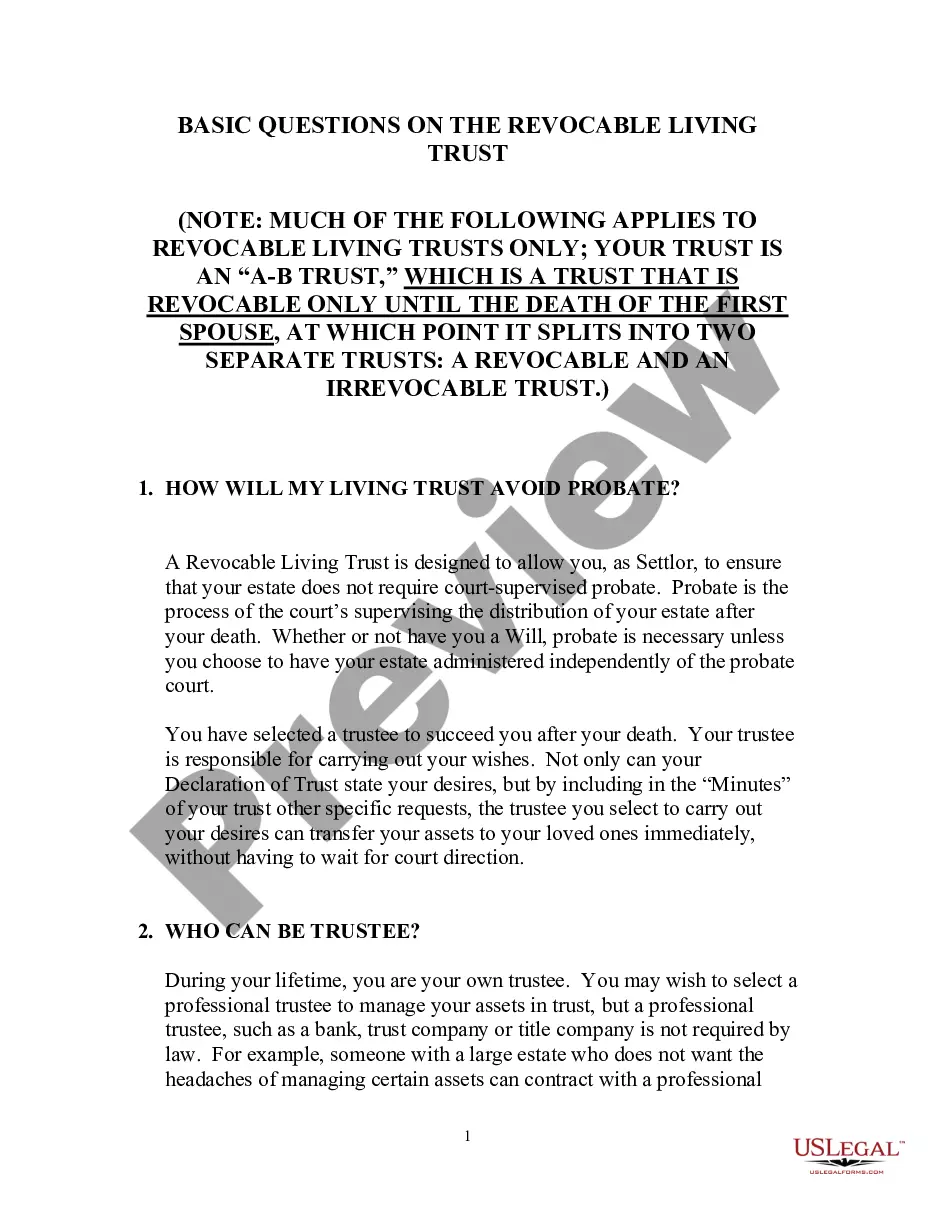

This form is an Executor's Deed where the grantor is the executor of an estate and the Grantee is an individual. Grantor conveys the described property to the grantee. \This deed complies with all state statutory laws.

Iowa Executor's Deed - Executor to Individual

Description Legal Executor Information

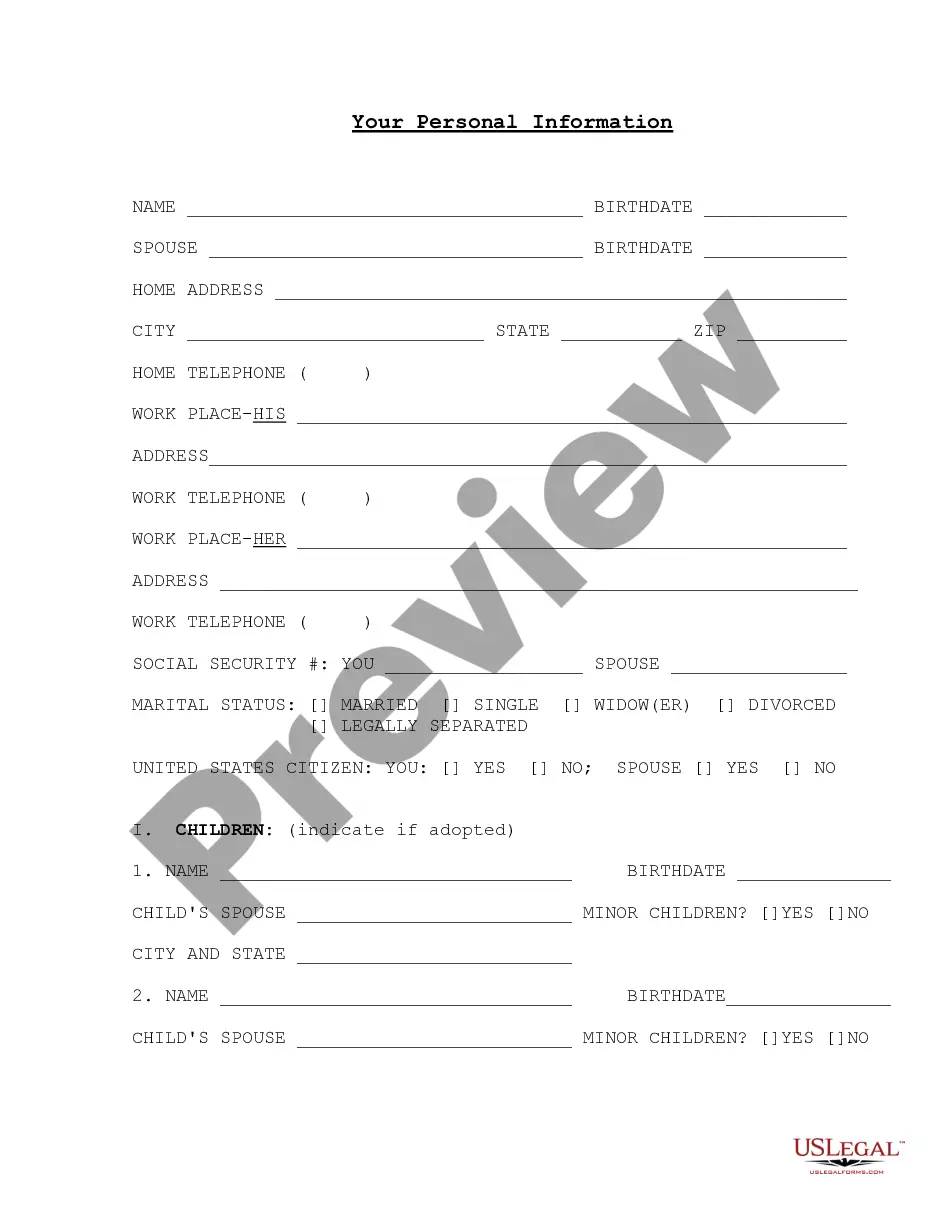

How to fill out Iowa Executor Template?

Access the most extensive catalogue of legal forms. US Legal Forms is a solution where you can find any state-specific form in clicks, including Iowa Executor's Deed - Executor to Individual templates. No reason to waste several hours of the time trying to find a court-admissible sample. Our licensed experts ensure you receive up-to-date examples every time.

To take advantage of the forms library, pick a subscription, and register your account. If you created it, just log in and click Download. The Iowa Executor's Deed - Executor to Individual sample will instantly get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new account, look at simple instructions below:

- If you're going to use a state-specific example, make sure you indicate the right state.

- If it’s possible, review the description to know all the nuances of the form.

- Utilize the Preview function if it’s accessible to take a look at the document's information.

- If everything’s right, click on Buy Now button.

- After selecting a pricing plan, create your account.

- Pay by card or PayPal.

- Downoad the document to your device by clicking on Download button.

That's all! You ought to submit the Iowa Executor's Deed - Executor to Individual template and check out it. To ensure that things are precise, call your local legal counsel for assist. Register and easily find around 85,000 valuable forms.

Iowa Executor Document Form popularity

Ia Executor Pdf Other Form Names

Ia Deed Uslegal FAQ

In order to qualify for the simplified probate process, the gross value of the estate must be $100,000 or less. In order to use the procedure, the executor files a written request with the local probate court asking to use the simplified process.

Given the amount of work and risk involved in being an executor, it's no wonder that an executor is entitled to compensation for her work.An executor is entitled to a 6% commission on any income that the estate earns. So, for instance, assume that the entire estate is worth $400,000.

Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000. For estates over $5,000, they can each receive $220 plus 2% of the amount over $5000. If the estate is complicated, a judge can order higher fees. You can also negotiate the fees to pay an attorney.

Iowa does not allow real estate to be transferred with transfer-on-death deeds.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

Executor's remuneration: 3.5% calculated on the gross value of assets as at death. income collection fee: 6% calculated on all post-death revenue.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

The guidelines set out four categories of executor fees: Fees charged on the gross capital value of the estate. 3% to 5% is charged on the first $250,000; 2% to 4% on the next $250,000; and 0.5% to 3% on the balance. According to the Fee Guidelines, compensation on revenue receipts is 4% to 6%.