Iowa Corrective Deed in Lieu of Foreclosure

Description

How to fill out Iowa Corrective Deed In Lieu Of Foreclosure?

Use US Legal Forms to get a printable Iowa Corrective Deed in Lieu of Foreclosure. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most comprehensive Forms library online and offers reasonably priced and accurate templates for consumers and lawyers, and SMBs. The templates are categorized into state-based categories and a number of them might be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Iowa Corrective Deed in Lieu of Foreclosure:

- Check to make sure you get the right template in relation to the state it’s needed in.

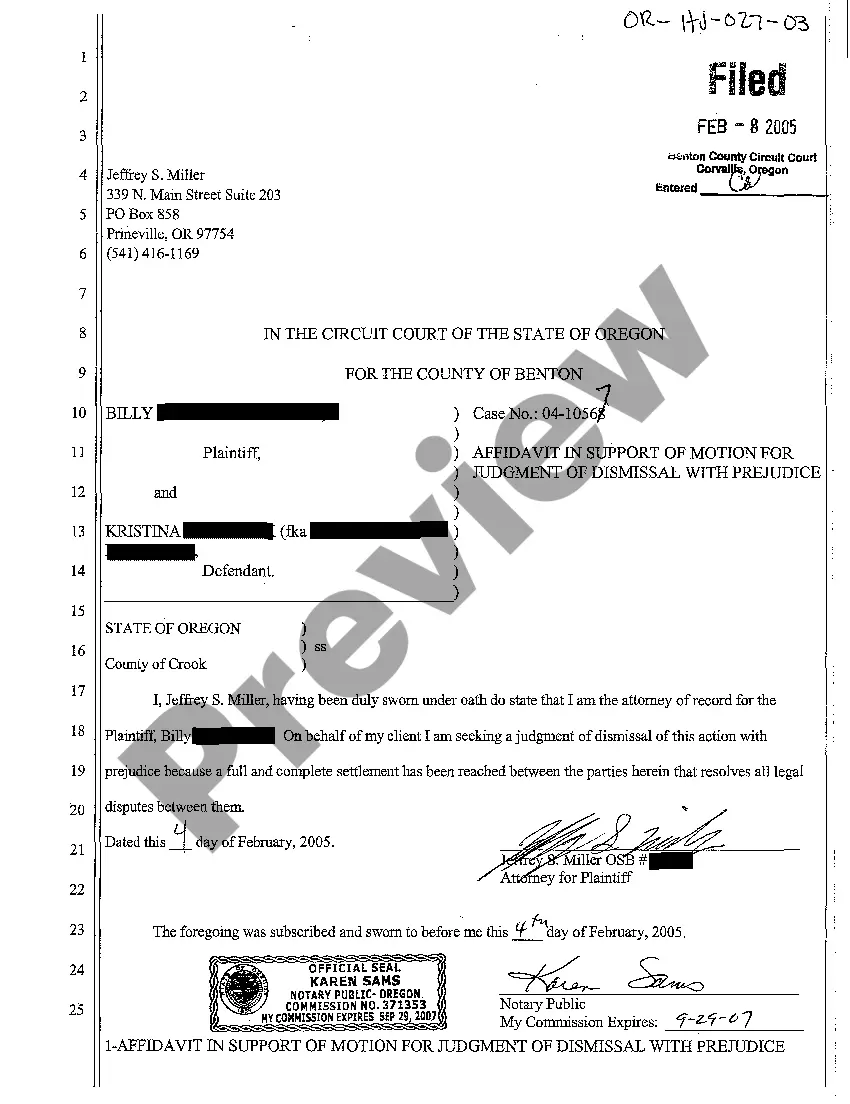

- Review the document by looking through the description and using the Preview feature.

- Hit Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to find another document template.

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Iowa Corrective Deed in Lieu of Foreclosure. Over three million users have used our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

Form popularity

FAQ

When the entire deed in lieu of foreclosure process with the lender is over, the homeowner may transfer title by use of a quitclaim deed. A quitclaim deed is a simple document used to transfer title from a seller to a purchaser without making any specific claims or offering any protections, such as title warranties.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

Both short sales and deeds in lieu can help homeowners avoid foreclosure.One benefit to these options is that that you won't have a foreclosure on your credit history. But your credit score will still take a major hit. A short sale or deed in lieu is almost as bad as a foreclosure when it comes to credit scores.

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for being relieved of the mortgage debt.

A deed in lieu of foreclosure (lieu deed) is a conveyance, by the owner of property encumbered by a mortgage, to the mortgagee, in full satisfaction of the obligation secured by the mortgage.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

A deed in lieu is different from a foreclosure. A deed in lieu means you and your lender reach a mutual understanding that you cannot make your loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably.

A deed in lieu arrangement offers several advantages to the homeowner: It allows you to avoid or minimize any deficiency on your mortgage. That's the loss the lender takes on the difference between the current, fair market value for your home and the balance of your home loan.