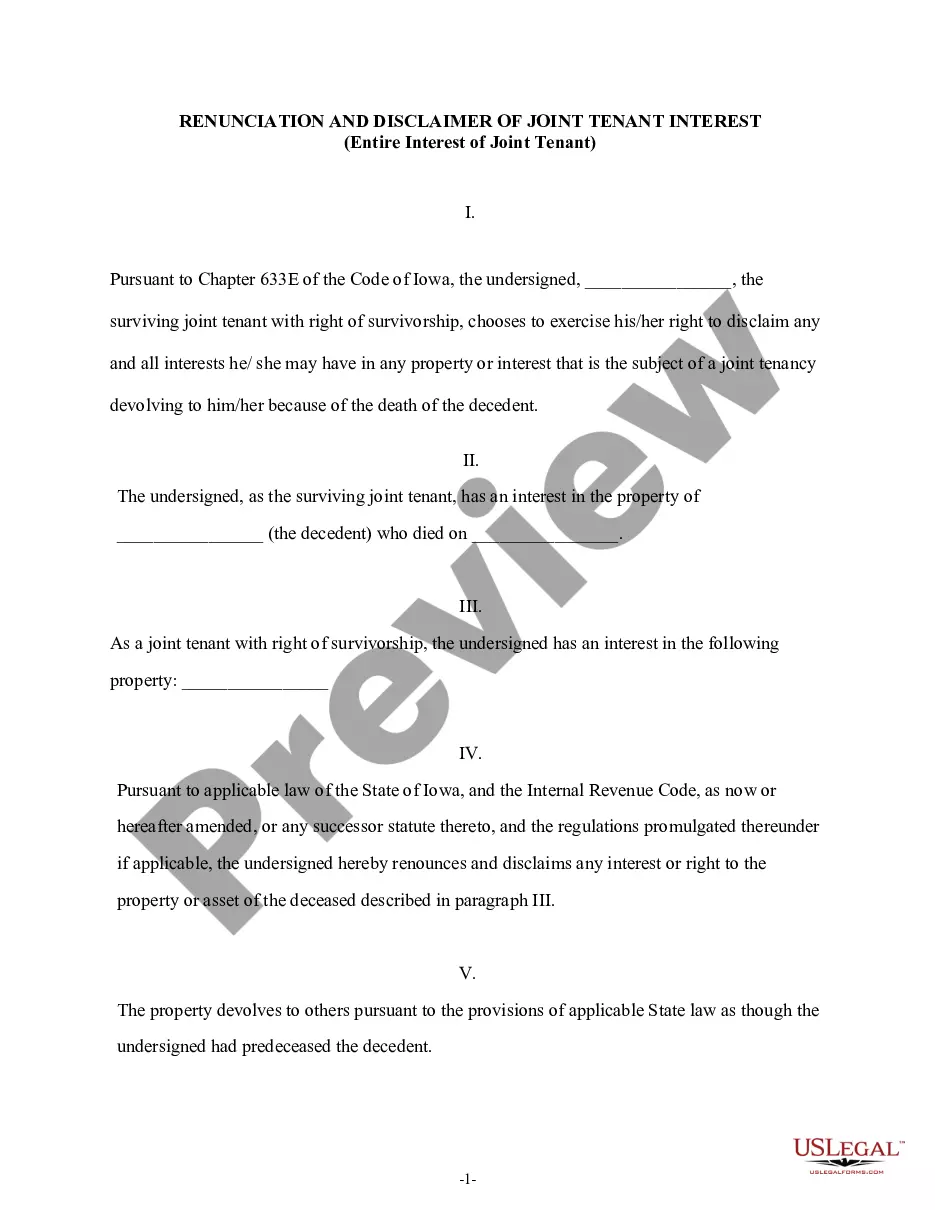

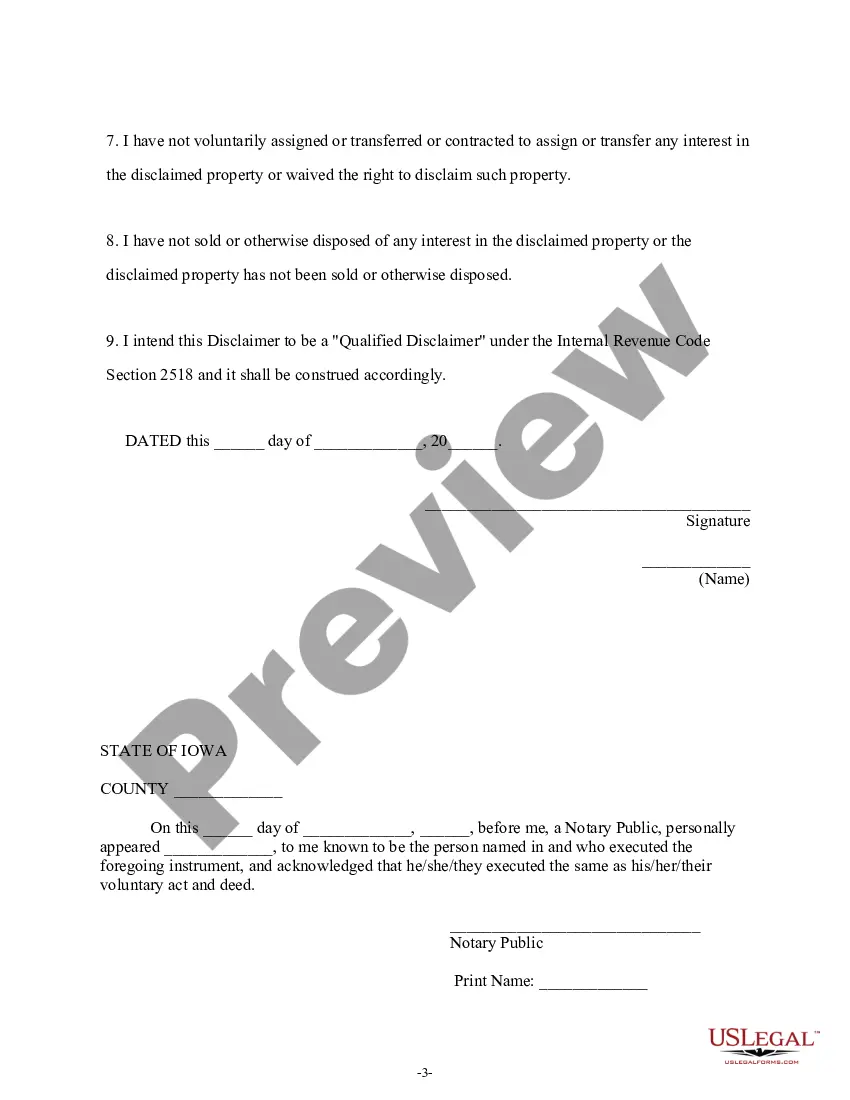

This form is a Renunciation and Disclaimer of a Joint Interest. The surviving joint tenant gained an interest in the described property upon the death of the decedent. However, the surviving joint tenant wishes to disclaim his/her entire interest in the property pursuant to the Iowa Code Chapter 633E. The disclaimer is deemed to be an irrevocable refusal of the property and relates back to the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Joint Tenant Interest - Entire Interest of Joint Tenant

Description

How to fill out Iowa Renunciation And Disclaimer Of Joint Tenant Interest - Entire Interest Of Joint Tenant?

Access the most holistic library of authorized forms. US Legal Forms is really a system to find any state-specific file in couple of clicks, even Iowa Renunciation and Disclaimer of Joint Tenant Interest - Entire Interest of Joint Tenant templates. No reason to waste hrs of the time looking for a court-admissible sample. Our accredited experts make sure that you get up-to-date samples every time.

To take advantage of the documents library, choose a subscription, and sign up your account. If you registered it, just log in and then click Download. The Iowa Renunciation and Disclaimer of Joint Tenant Interest - Entire Interest of Joint Tenant file will instantly get kept in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new profile, follow the simple recommendations below:

- If you're proceeding to utilize a state-specific example, make sure you indicate the right state.

- If it’s possible, go over the description to know all of the nuances of the document.

- Take advantage of the Preview option if it’s accessible to look for the document's information.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, make an account.

- Pay out by credit card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You ought to submit the Iowa Renunciation and Disclaimer of Joint Tenant Interest - Entire Interest of Joint Tenant template and check out it. To make sure that all things are precise, call your local legal counsel for assist. Register and simply look through over 85,000 helpful forms.

Form popularity

FAQ

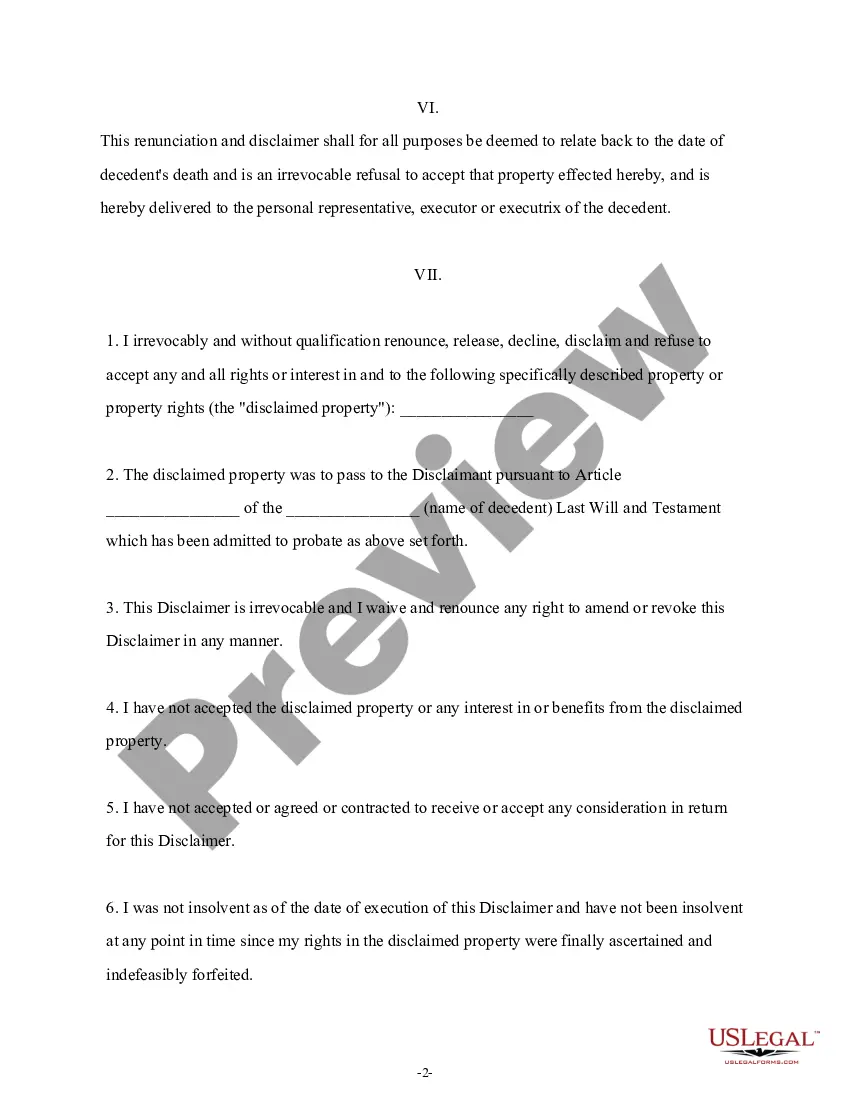

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

In New South Wales, the Registrar General is able record the State of New South Wales as the proprietor of disclaimed land. The land will remain subject to any charges and mortgages despite the change in proprietor.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The deadline can be anywhere from three to nine months, depending on state law, but it can run simultaneously with the inventory period in some states. The executor is then granted another period of time to decide whether claims are valid and whether they should or should not be paid.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.