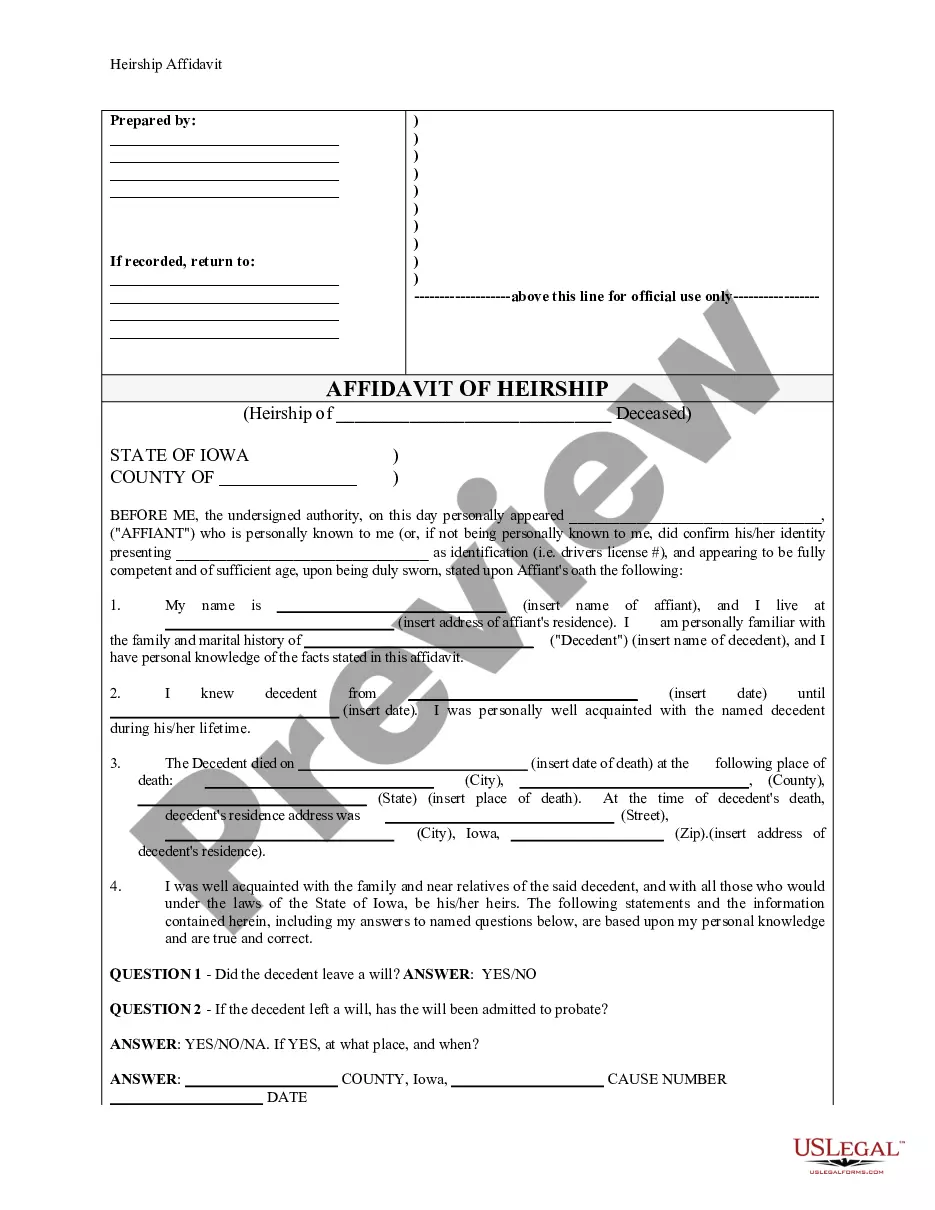

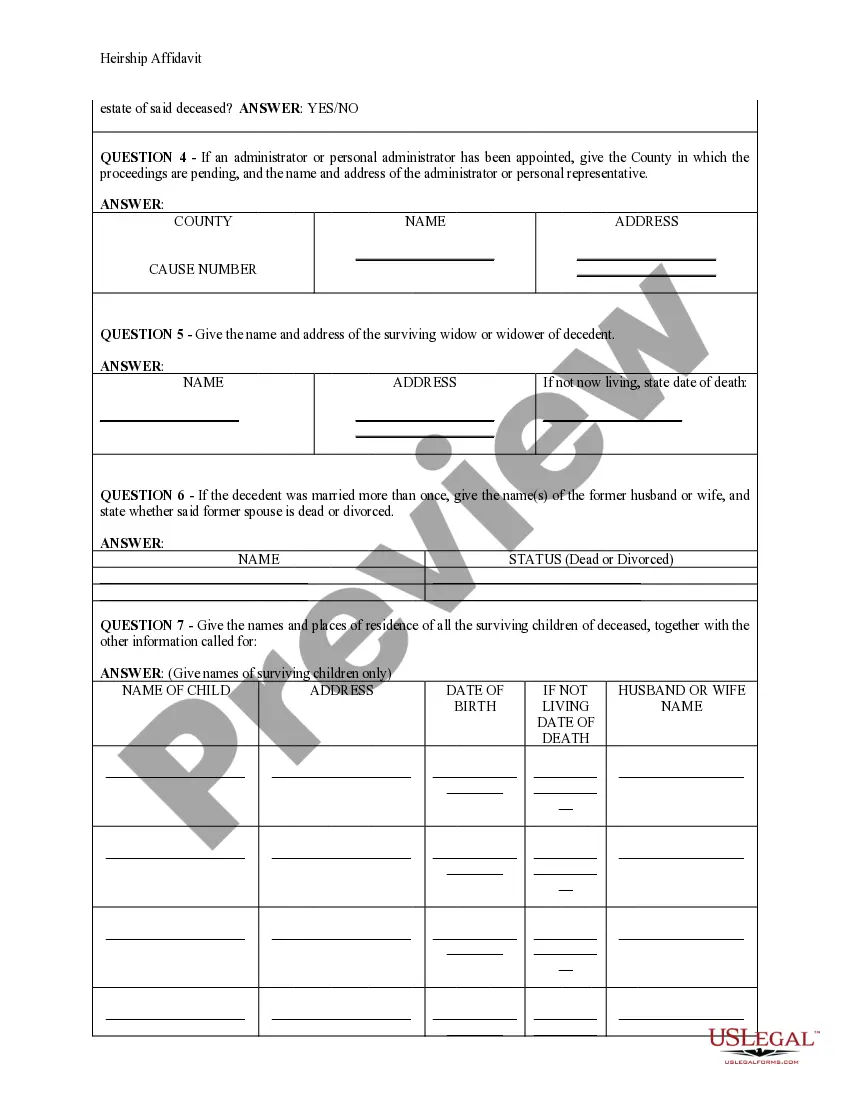

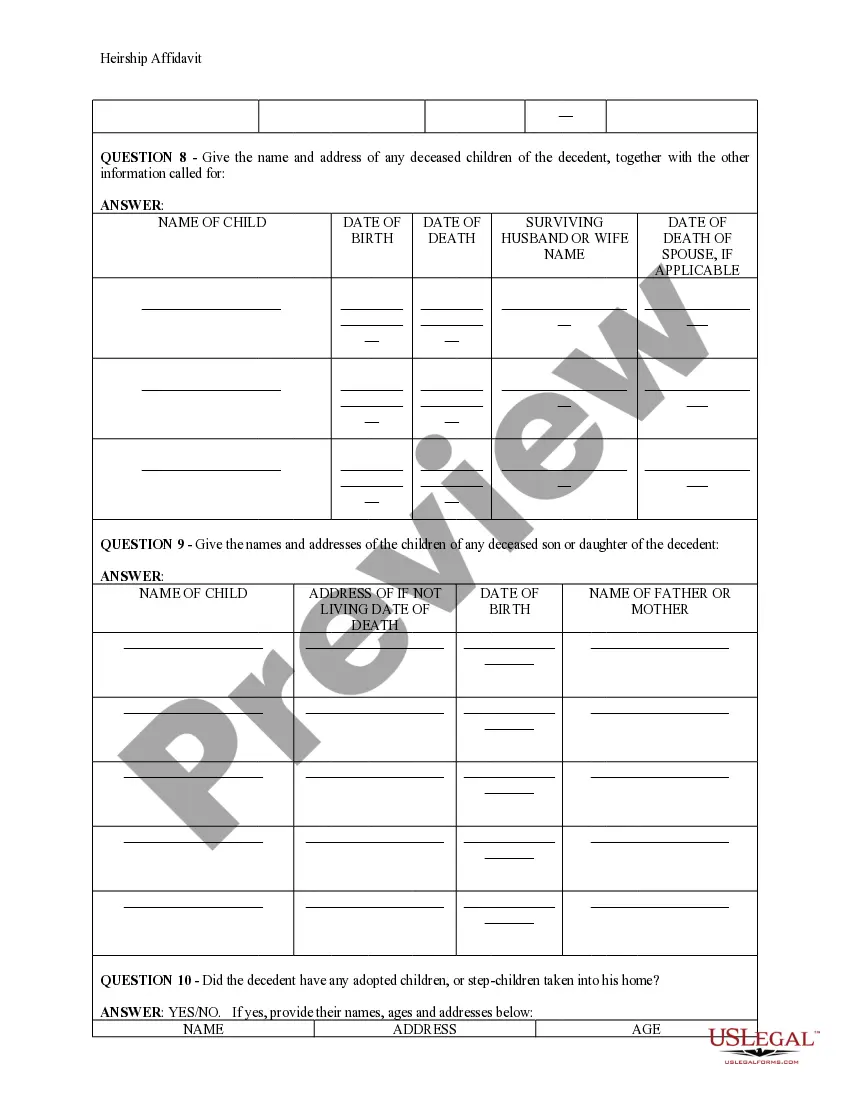

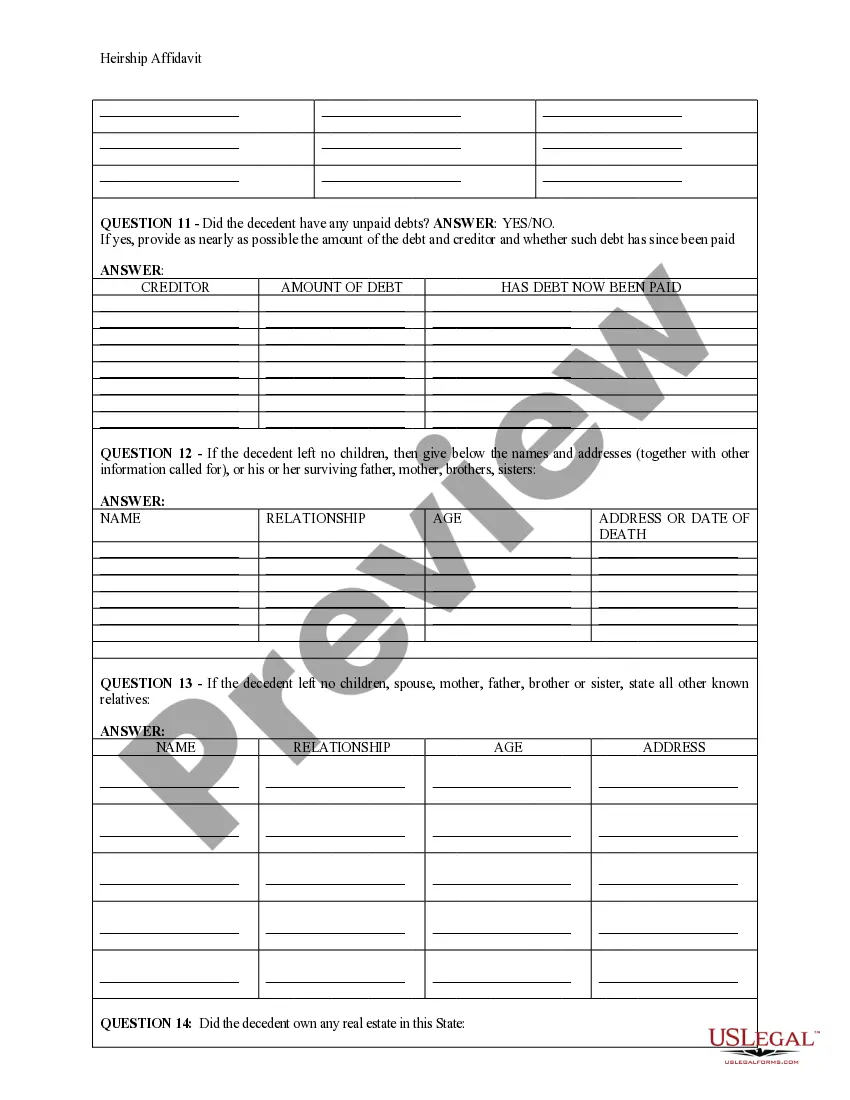

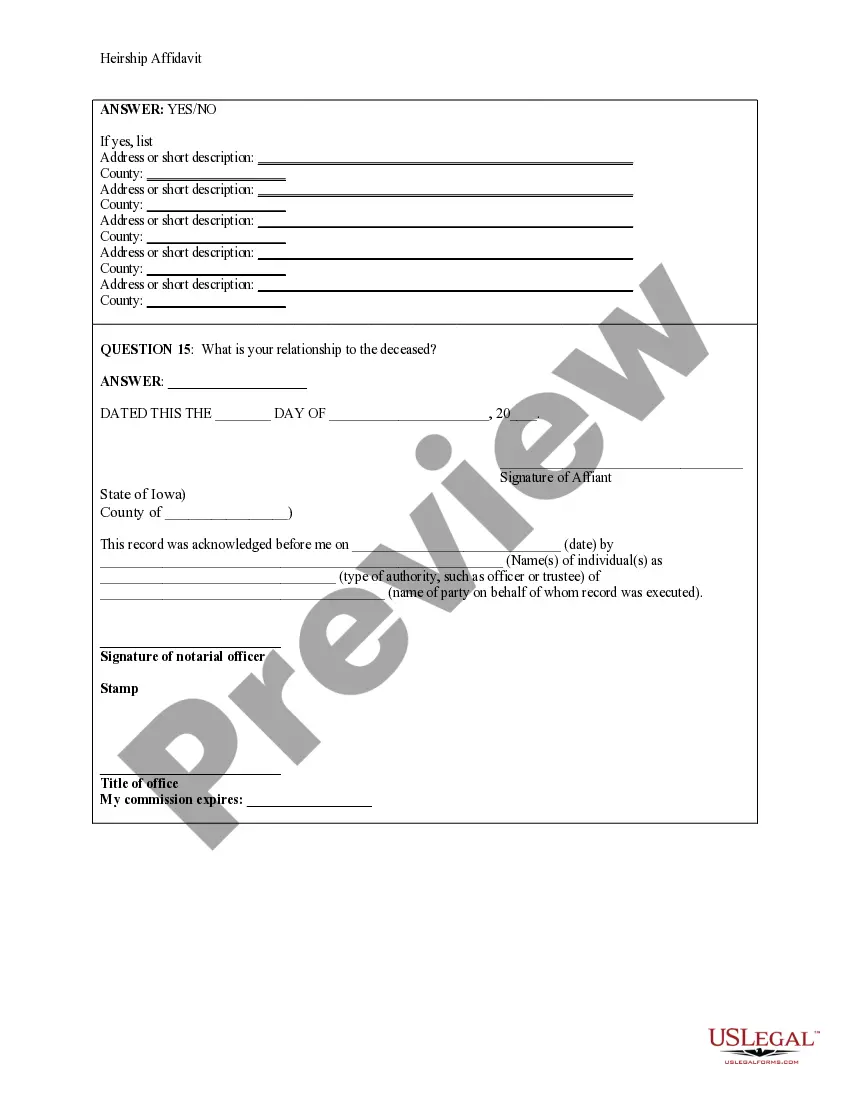

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Iowa Heirship Affidavit - Descent

Description Small Estate Affidavit Iowa

How to fill out Iowa Heirship Affidavit - Descent?

Get access to one of the most expansive library of authorized forms. US Legal Forms is a system to find any state-specific form in clicks, such as Iowa Heirship Affidavit - Descent templates. No requirement to waste hrs of the time trying to find a court-admissible form. Our qualified specialists make sure that you get updated documents every time.

To benefit from the documents library, pick a subscription, and sign up your account. If you created it, just log in and click Download. The Iowa Heirship Affidavit - Descent sample will instantly get kept in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new profile, follow the simple guidelines below:

- If you're going to use a state-specific sample, be sure to indicate the proper state.

- If it’s possible, go over the description to learn all the nuances of the document.

- Use the Preview option if it’s available to take a look at the document's content.

- If everything’s right, click on Buy Now button.

- Right after selecting a pricing plan, make an account.

- Pay by credit card or PayPal.

- Save the document to your device by clicking Download.

That's all! You should submit the Iowa Heirship Affidavit - Descent form and check out it. To make certain that all things are exact, speak to your local legal counsel for assist. Join and easily browse over 85,000 helpful samples.

Form popularity

FAQ

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000. For estates over $5,000, they can each receive $220 plus 2% of the amount over $5000. If the estate is complicated, a judge can order higher fees. You can also negotiate the fees to pay an attorney.

If the decedent died without a valid will they are said to have died intestate. When a person dies without a will, Iowa Code provides a surviving spouse with an exclusive right for 20 days to file with the court a petition to initiate administration of the estate.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

In Iowa, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

In most cases, probate is required in Iowa.If the assets have a named beneficiary, you can also avoid probate. There are different types of probate with some being less complicated and designed for small estates.

You can use the simplified small estate process in Iowa if the gross value of property subject to probate does not exceed $100,000. Iowa Code § 635.1.That the gross value of the estate is $100,000 or less.