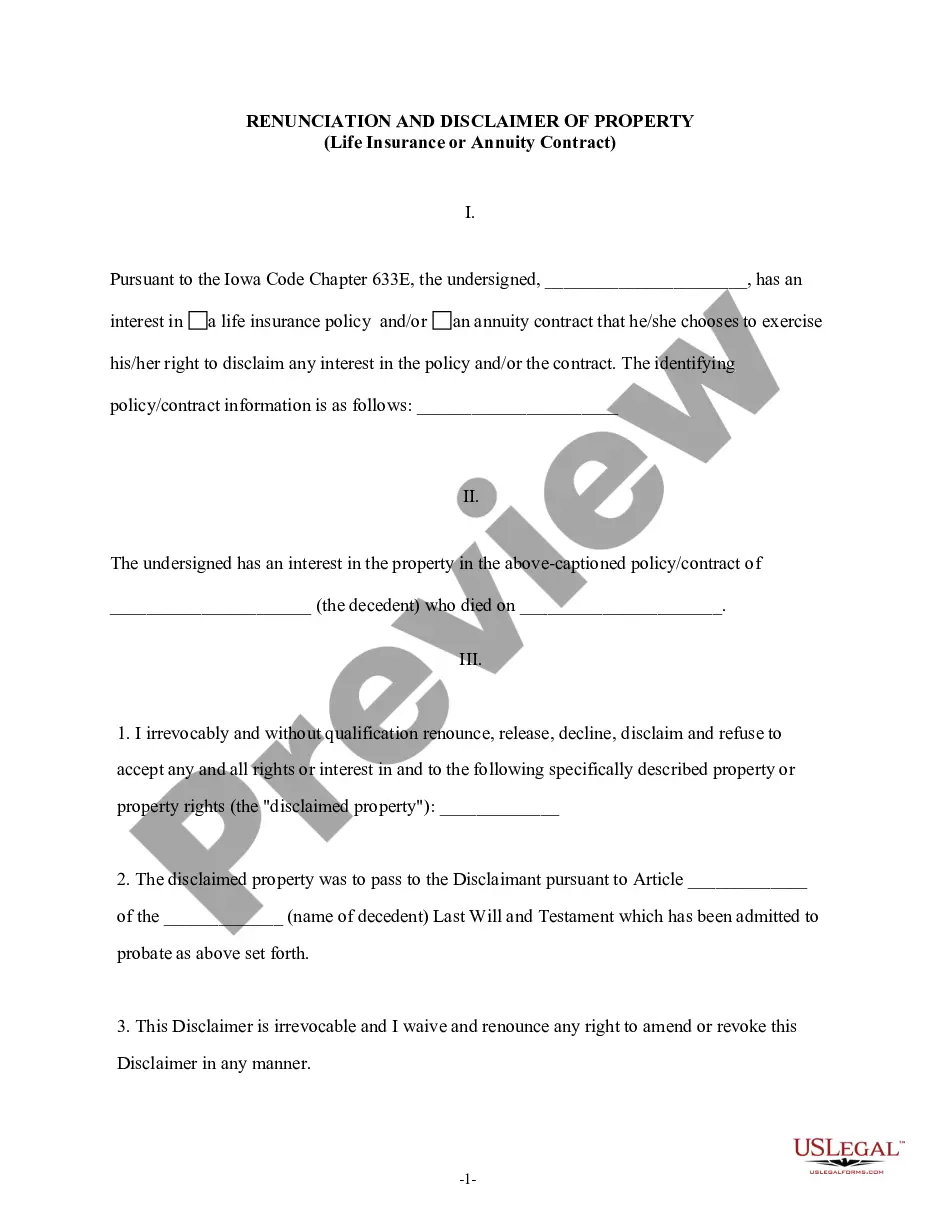

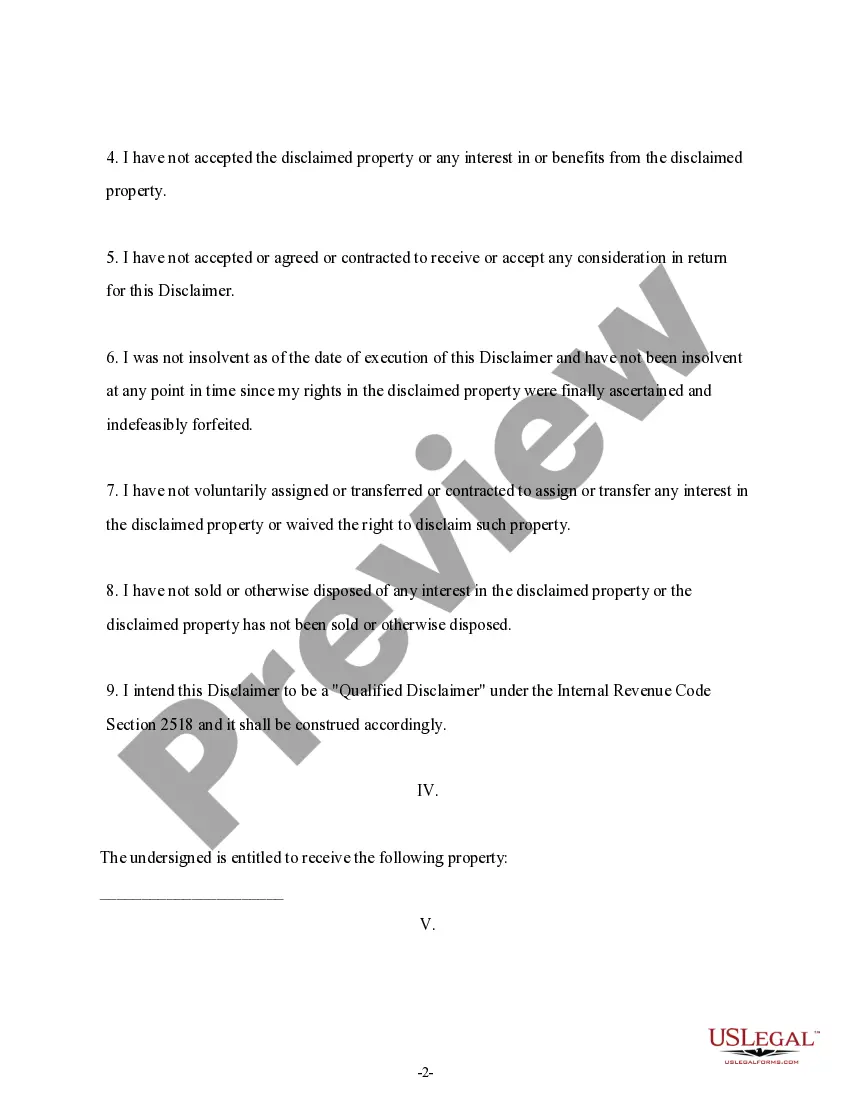

This form is a Renunciation and Disclaimer of the proceeds of a Life Insurance Policy or an Annuity Contract. The beneficiary gained an interest in the proceeds upon the death of the decedent. However, pursuant to the Iowa Code, Chapter 633E, the beneficiary wishes to disclaim his/her interest in the proceeds. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Iowa Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Get the most extensive catalogue of legal forms. US Legal Forms is really a platform to find any state-specific form in clicks, such as Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract examples. No requirement to spend time of your time seeking a court-admissible sample. Our qualified experts make sure that you get updated examples all the time.

To make use of the forms library, choose a subscription, and sign-up an account. If you already did it, just log in and click on Download button. The Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract file will immediately get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, follow the brief guidelines listed below:

- If you're having to use a state-specific sample, make sure you indicate the proper state.

- If it’s possible, review the description to understand all of the nuances of the form.

- Use the Preview function if it’s accessible to check the document's information.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, register an account.

- Pay out by card or PayPal.

- Save the document to your computer by clicking Download.

That's all! You need to fill out the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract template and double-check it. To ensure that all things are precise, speak to your local legal counsel for assist. Sign up and easily look through above 85,000 useful samples.

Form popularity

FAQ

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

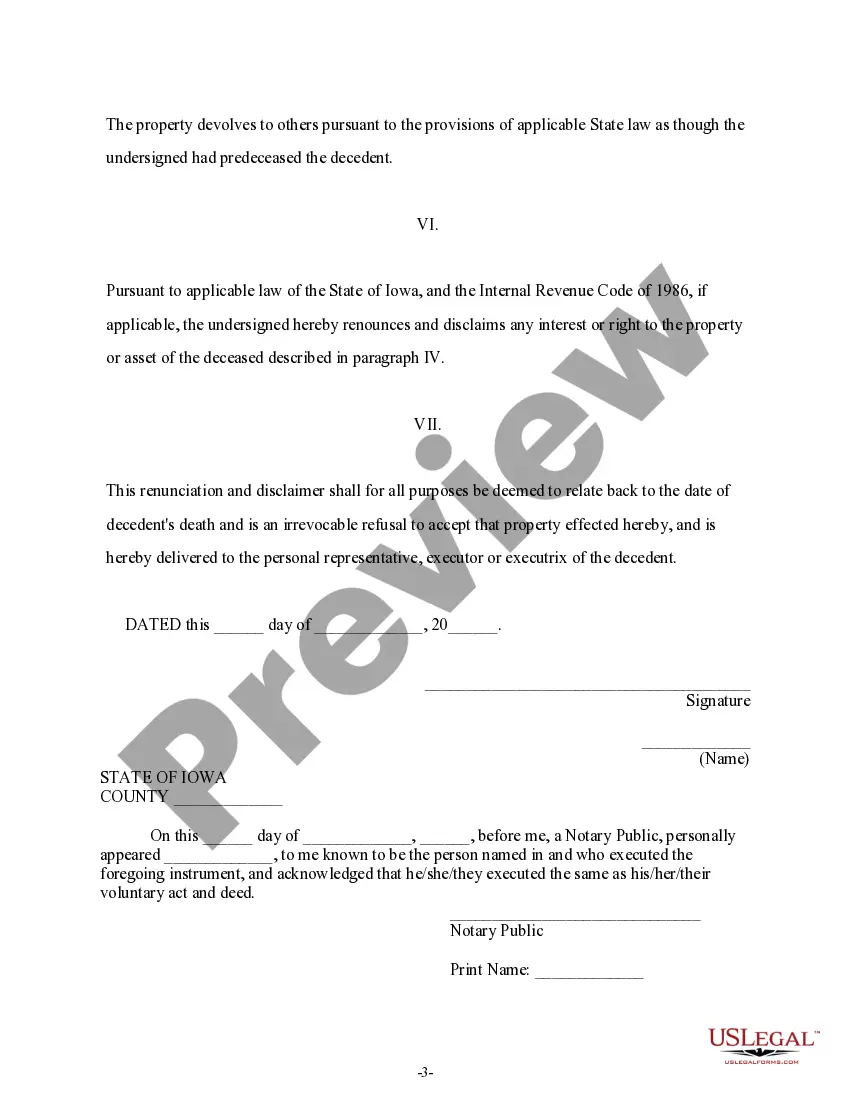

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

In law, a disclaimer is a statement denying responsibility intended to prevent civil liability arising for particular acts or omissions. Disclaimers are frequently made to escape the effects of the torts of negligence and of occupiers' liability towards visitors.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.