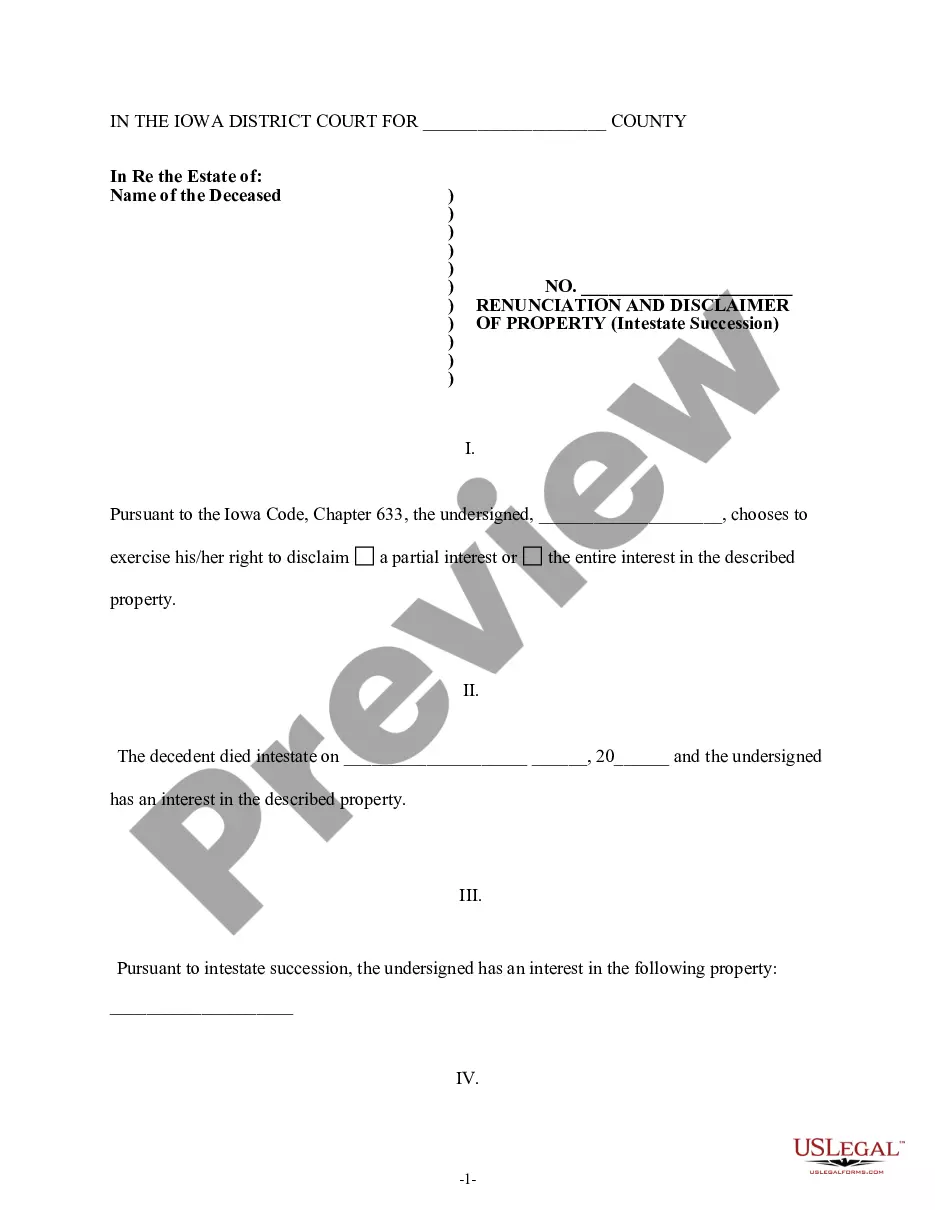

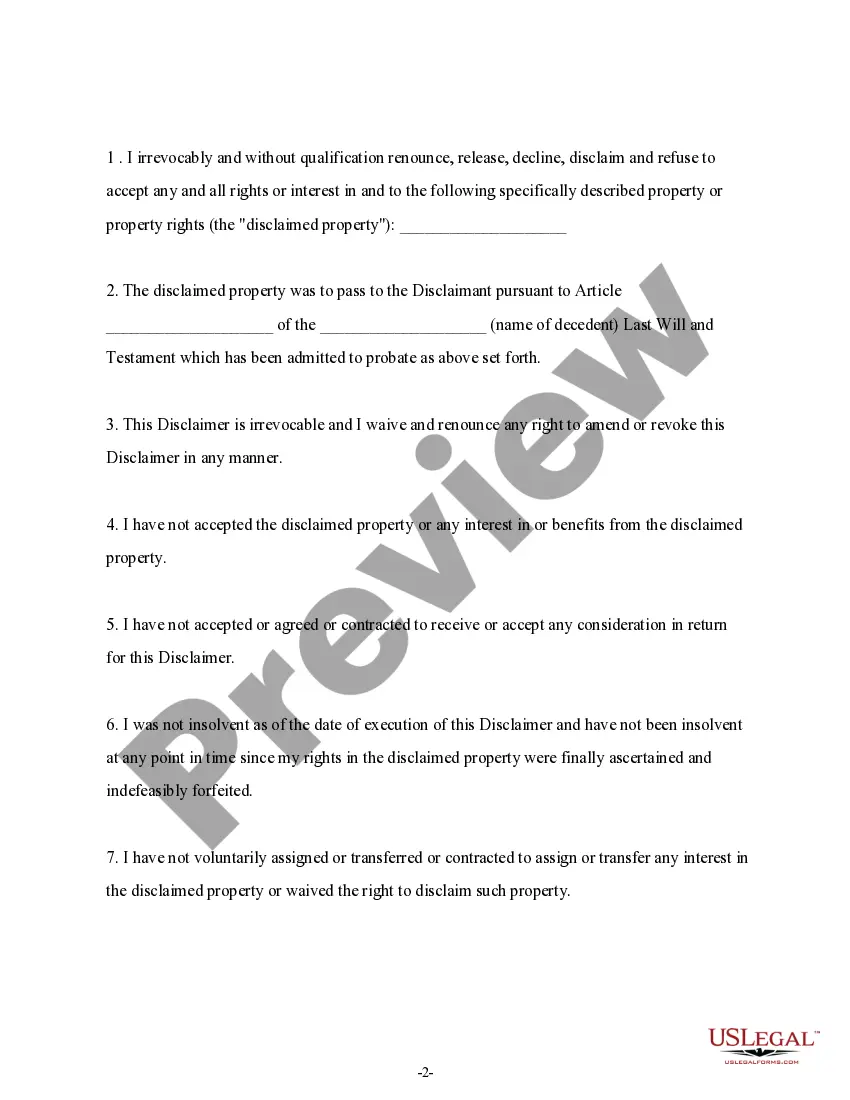

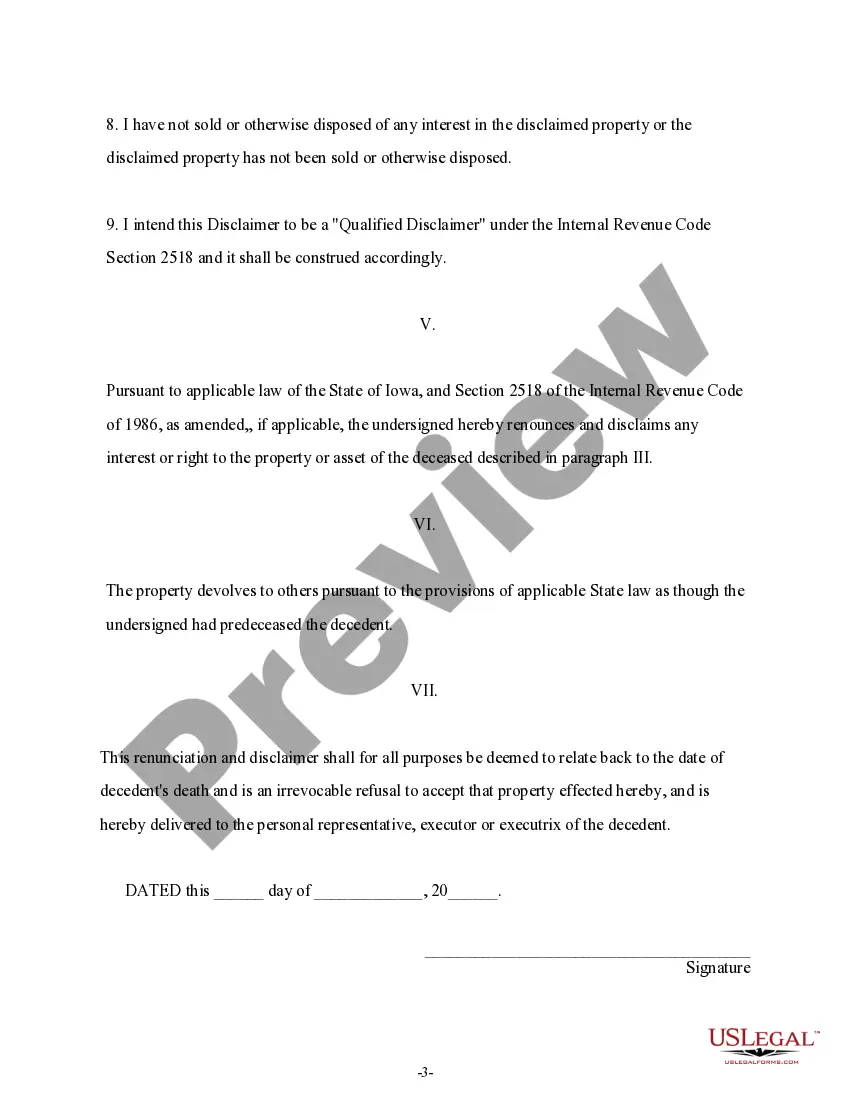

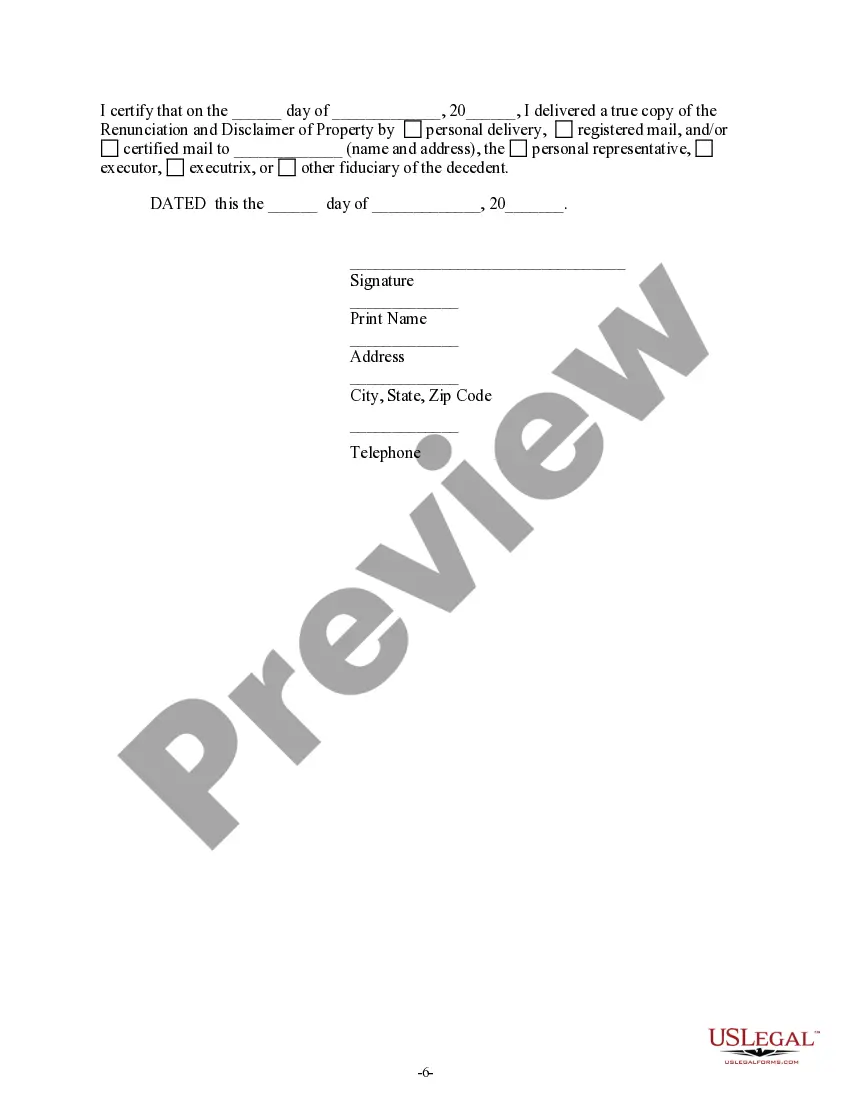

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property of the decedent. However, upon learning that he/she has an interest in the decedent's property, the beneficiary has decided to disclaim a portion of or the entire interest in the property. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Iowa Renunciation And Disclaimer Of Property Received By Intestate Succession?

Access one of the most comprehensive catalogue of authorized forms. US Legal Forms is really a solution where you can find any state-specific form in clicks, such as Iowa Renunciation and Disclaimer of Property received by Intestate Succession samples. No reason to waste time of your time searching for a court-admissible example. Our qualified specialists make sure that you get up-to-date documents all the time.

To take advantage of the documents library, choose a subscription, and sign-up an account. If you already created it, just log in and then click Download. The Iowa Renunciation and Disclaimer of Property received by Intestate Succession sample will automatically get saved in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new account, look at brief instructions below:

- If you're going to use a state-specific sample, make sure you indicate the proper state.

- If it’s possible, go over the description to learn all of the ins and outs of the form.

- Use the Preview function if it’s offered to look for the document's information.

- If everything’s proper, click Buy Now.

- After selecting a pricing plan, register your account.

- Pay out by card or PayPal.

- Downoad the document to your device by clicking on Download button.

That's all! You should complete the Iowa Renunciation and Disclaimer of Property received by Intestate Succession template and double-check it. To ensure that things are accurate, speak to your local legal counsel for assist. Register and simply browse more than 85,000 valuable forms.

Form popularity

FAQ

If one dies, the other partner will automatically inherit the whole of the money. Property and money that the surviving partner inherits does not count as part of the estate of the person who has died when it is being valued for the intestacy rules.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

If the decedent died without a valid will they are said to have died intestate. When a person dies without a will, Iowa Code provides a surviving spouse with an exclusive right for 20 days to file with the court a petition to initiate administration of the estate.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

4. Siblings If the person who died had no living spouse, civil partner, children or parents, then their siblings are their next of kin.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

The laws are different in every state, but if you're married and die without a will, your estate will probably go to your spouse if you both own it.If he passes away without a will, the law says his surviving spouse will inherit the first $50,000 of his personal assets (not any shared assets) plus half the balance.