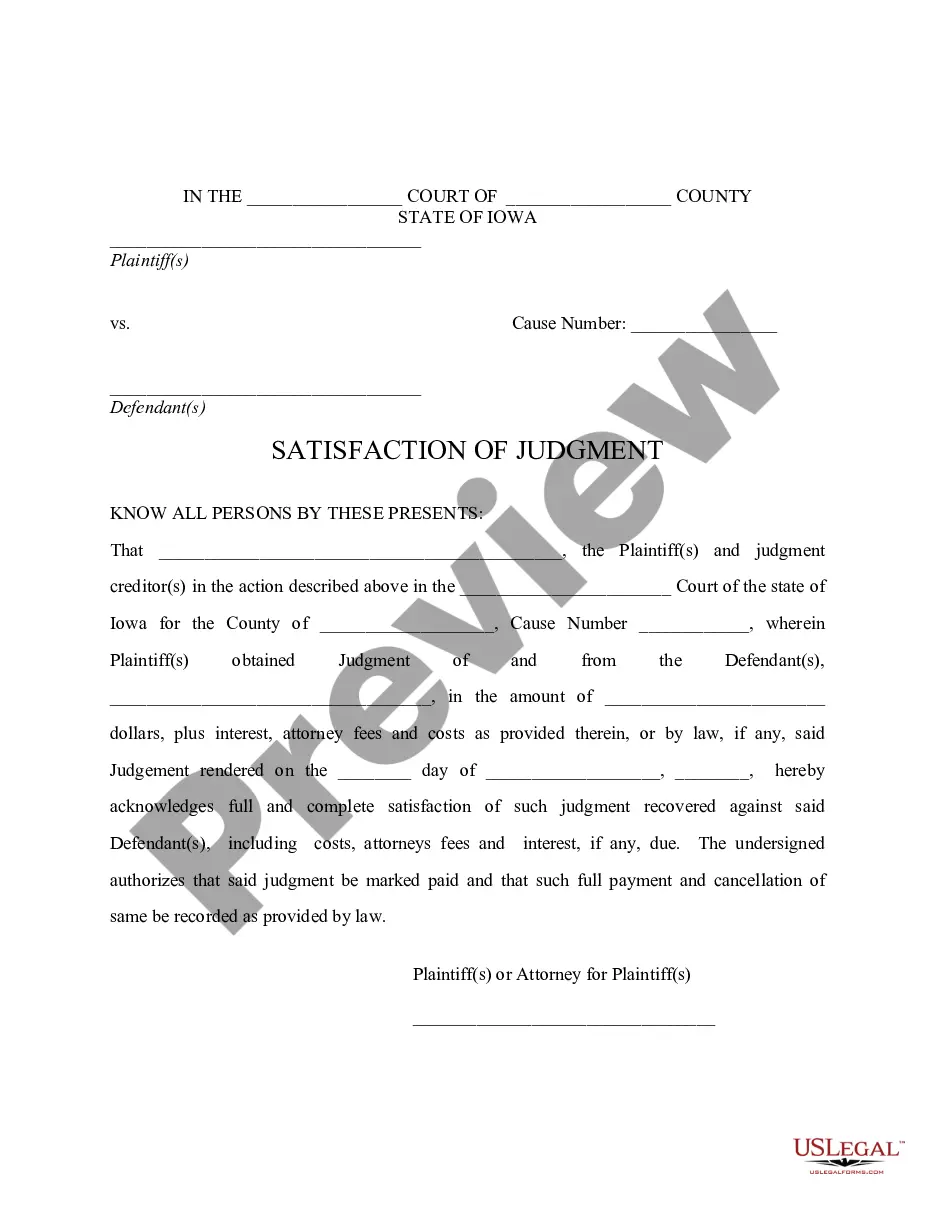

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Iowa Satisfaction of Judgment

Description

How to fill out Iowa Satisfaction Of Judgment?

Access the most extensive collection of legal documents.

US Legal Forms serves as a platform to locate any state-specific form in just a few clicks, including Iowa Satisfaction of Judgment forms.

There's no need to invest several hours searching for a court-acceptable sample.

After selecting a pricing plan, create an account. Pay using a card or PayPal. Download the document to your device by clicking the Download button. That's it! You should complete the Iowa Satisfaction of Judgment form and verify its accuracy by consulting your local legal advisor for assistance. Sign up and easily access over 85,000 valuable samples.

- To utilize the forms library, select a subscription and create an account.

- If you have already created it, just Log In and hit Download.

- The Iowa Satisfaction of Judgment form will be automatically saved in the My documents section (a section for every form you download from US Legal Forms).

- To establish a new account, follow the straightforward instructions below.

- If you intend to use state-specific documents, make sure to designate the correct state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview feature if available to examine the document's information.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

Obtaining a deferred judgment in Iowa requires you to request the court for this option during your sentencing hearing. You must show that you can meet certain conditions set by the court, like probation or community service. If successful, the court delays the judgment, allowing you a chance to prove your rehabilitation. Using the services provided by platforms such as USLegalForms can help you understand these requirements and navigate the application process for Iowa Satisfaction of Judgment.

After a default judgment is issued in Iowa, the creditor may take steps to collect the judgment amount from you. This can include garnishing wages, placing liens on property, or seizing bank accounts. It’s crucial to respond promptly to avoid these consequences. If you find yourself in this predicament, seeking help from resources like USLegalForms can guide you through filing for Iowa Satisfaction of Judgment.

In Iowa, not paying a judgment can lead to serious consequences, but jail is not typically one of them. Instead, creditors may pursue wage garnishments or bank levies as ways to collect the owed amount. However, if you willfully ignore a judgment and refuse to comply with the court's orders, you could face additional legal penalties. Understanding your rights regarding Iowa Satisfaction of Judgment can help you navigate this situation more effectively.

In Iowa, judgments typically remain valid for a period of ten years. However, if you have not taken action towards collecting the judgment within this timeframe, it may become unenforceable. To maintain your rights, it is essential to understand the implications of the judgment period. For help with the process or to ensure compliance, you can explore resources available on the US Legal Forms platform.

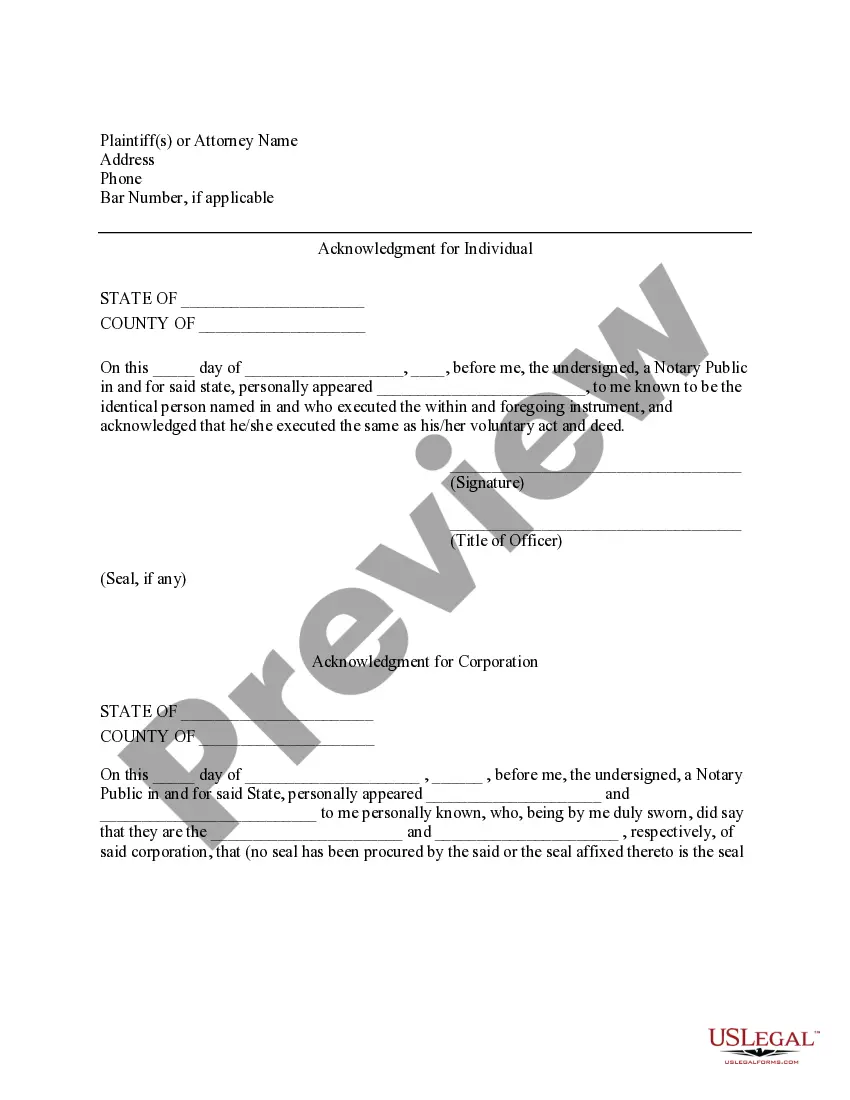

To satisfy a judgment in Iowa, you need to fulfill the terms set by the court, typically by paying the owed amount. Once you have completed this payment, you should obtain a satisfaction of judgment document from the creditor. Filing this document with the court updates the public record, confirming that the judgment has been satisfied. Using uslegalforms can simplify this process by providing the required forms and guidance to ensure you meet all legal requirements for Iowa Satisfaction of Judgment.

To file a contempt in Iowa, you must first gather the necessary documentation that shows the other party has failed to comply with a court order. Then, you will need to file a motion for contempt with the court that issued the original judgment. It is essential to include clear evidence and specific instances of non-compliance to strengthen your case. If you need assistance, uslegalforms offers resources to help you navigate the legal process effectively.

Release and satisfaction of judgment refer to the process by which a judgment creditor acknowledges that the debtor has fulfilled the terms of the judgment. This means that the creditor releases all claims against the debtor concerning that judgment. Understanding this process is crucial for ensuring your records reflect your Iowa Satisfaction of Judgment accurately.

To remove a satisfied judgment from your credit report, first, obtain a copy of the satisfaction of judgment document from the court. Then, send this document to the credit reporting agencies along with a request to update your credit report. It's important to follow up to ensure they process the request, as this helps improve your credit score and reflects your Iowa Satisfaction of Judgment.

To determine if a judgment has been satisfied, you can contact the court that issued the judgment. They typically maintain records of case statuses, including whether a judgment is active or satisfied. Additionally, you can check with the creditor who may have filed the judgment to confirm its status. It's essential to ensure that your records are up to date concerning your Iowa Satisfaction of Judgment.