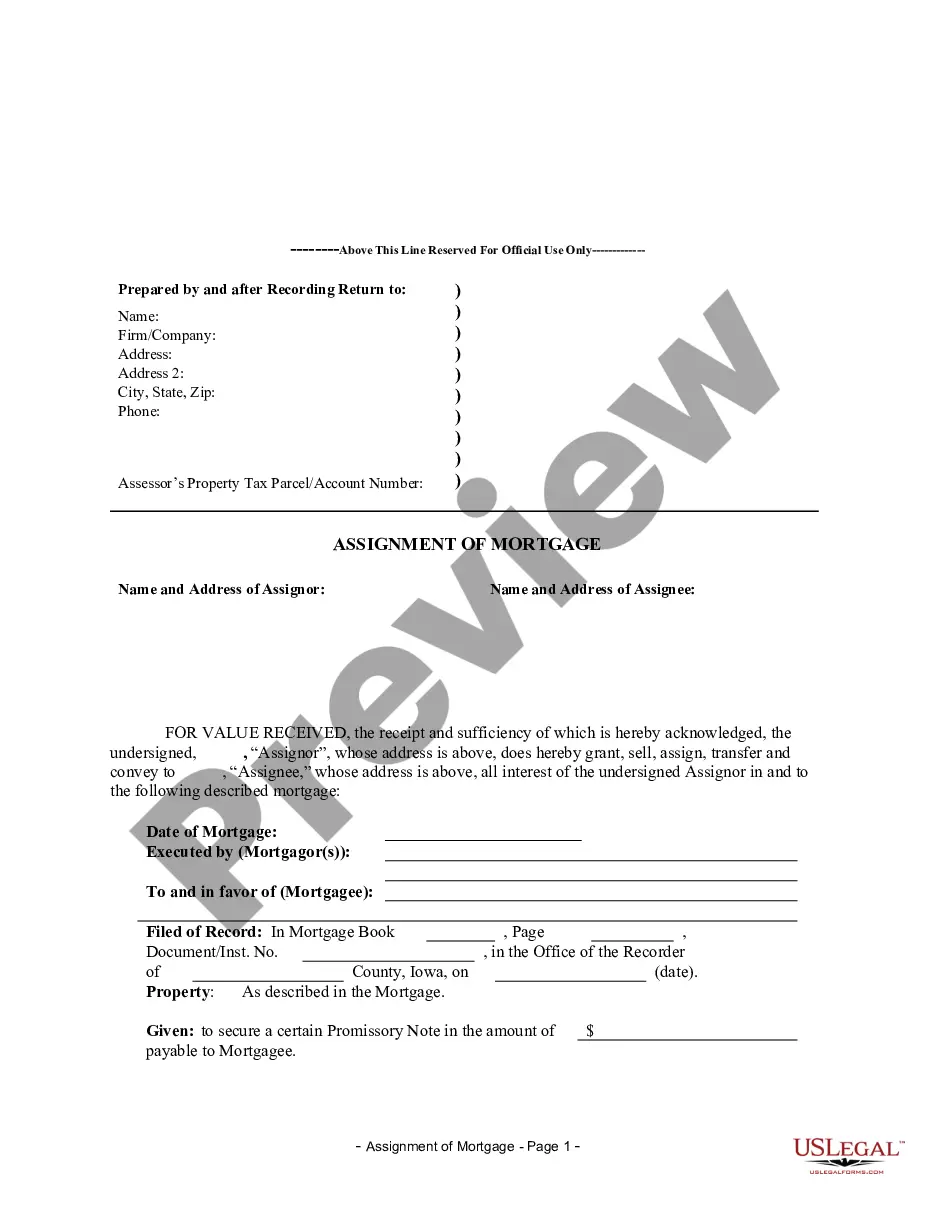

Assignment of Mortgage by Individual Mortgage Holder

Assignments Generally: Lenders, or

holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rules is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Iowa Law

Assignment: It is recommended that an assignment

be in writing and recorded immediately.

Demand to Satisfy: Upon full payoff, mortgagor

may request recordation of satisfaction by mortgagee, who must comply within

30 days or face liablity.

Recording Satisfaction: When the amount

due on a mortgage is paid off, the mortgagee must acknowledge satisfaction

thereof by execution of an instrument in writing, referring to the mortgage,

and duly acknowledged and recorded.

Marginal Satisfaction: Not allowed. Separate

instrument required.

Penalty: If mortgagee fails to discharge

a satisfied mortgage within thirty days after a request for discharge,

the mortgagee is liable to the mortgagor and the mortgagor's heirs or assigns,

for all actual damages caused by such failure, including reasonable attorney

fees.

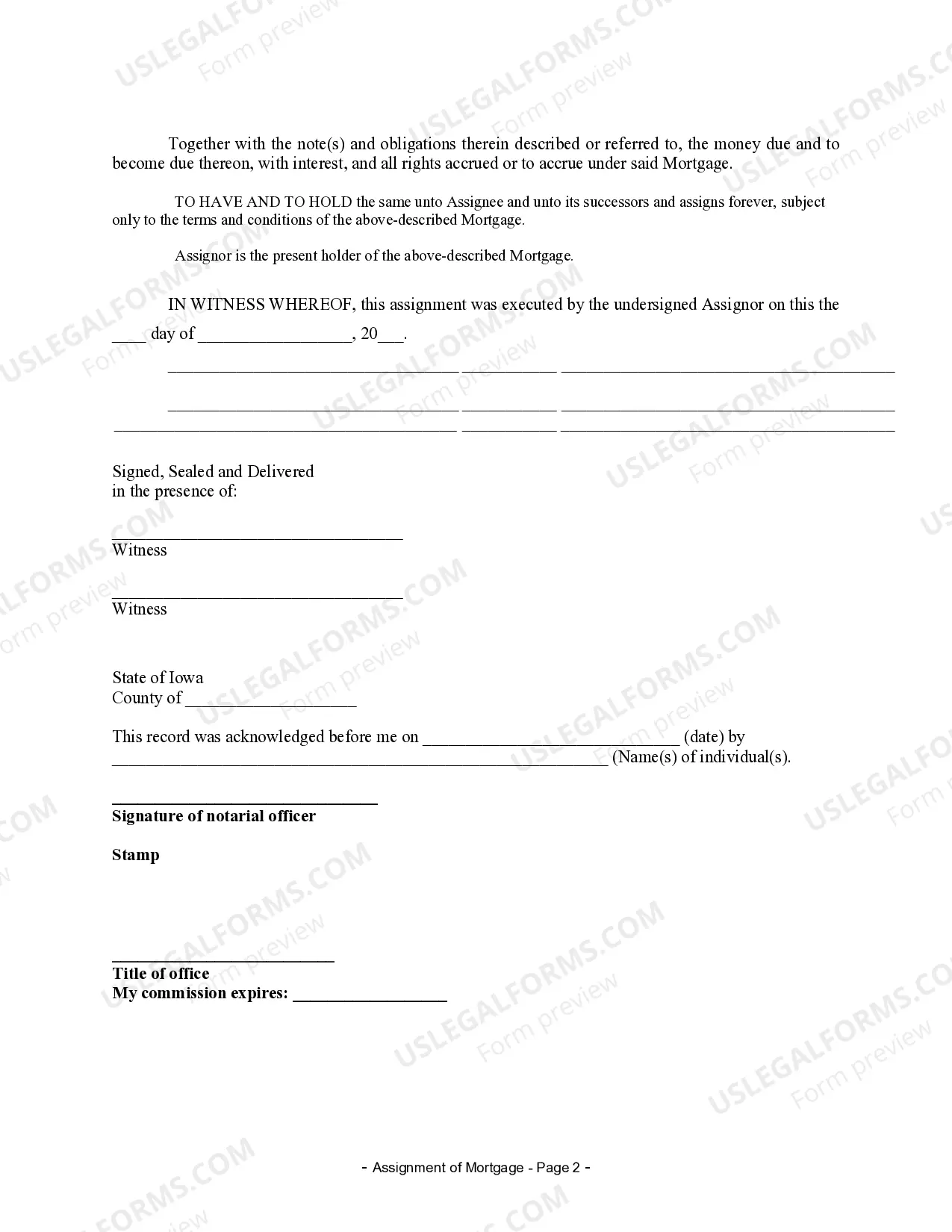

Acknowledgment: An assignment or satisfaction

must contain a proper Iowa acknowledgment, or other acknowledgment approved

by Statute.

Iowa Statutes

655.1 Written instrument acknowledging satisfaction.

When the amount due on a mortgage is paid off, the mortgagee, the

mortgagee's personal representative or assignee, or those legally acting

for the mortgagee, and in case of payment of a school fund mortgage the

county auditor, must acknowledge satisfaction thereof by execution of

an instrument in writing, referring to the mortgage, and duly acknowledged

and recorded.

655.3 Penalty for failure to discharge.

If a mortgagee, or a mortgagee's personal representative or assignee,

upon full performance of the conditions of the mortgage, fails to discharge

such mortgage within thirty days after a request for discharge, the

mortgagee is liable to the mortgagor and the mortgagor's heirs or assigns,

for all actual damages caused by such failure, including reasonable attorney

fees. A claim for such damages may be asserted in an action for discharge

of the mortgage. If the defendant is not a resident of this state, such

action may be maintained upon the expiration of thirty days after the conditions

of the mortgage have been performed, without such previous request or tender.

655.4 Entry of foreclosure.

When a judgment of foreclosure is entered in any court, the clerk

shall record with the recorder an instrument in writing referring to the

mortgage and duly acknowledging that the mortgage was foreclosed and giving

the date of the decree. The fee for recording and indexing an instrument

shall be as provided in section 331.604.

655.5 Instrument of satisfaction.

When the judgment is fully paid and satisfied upon the judgment

docket of the court, the clerk shall record with the recorder an instrument

in writing, referring to the mortgage and duly acknowledging a satisfaction

of the mortgage. The fee for recording and indexing an instrument shall

be as provided in section 331.604.