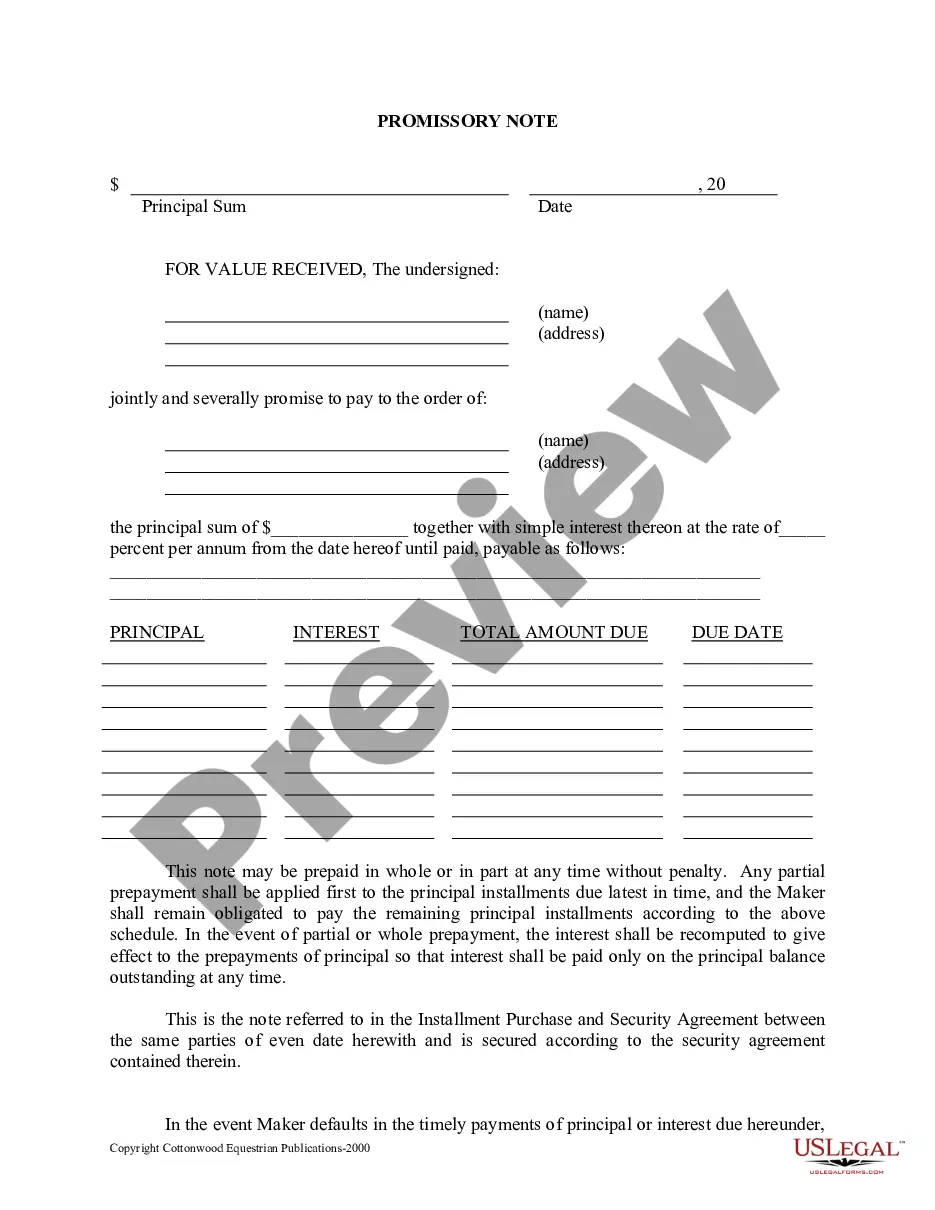

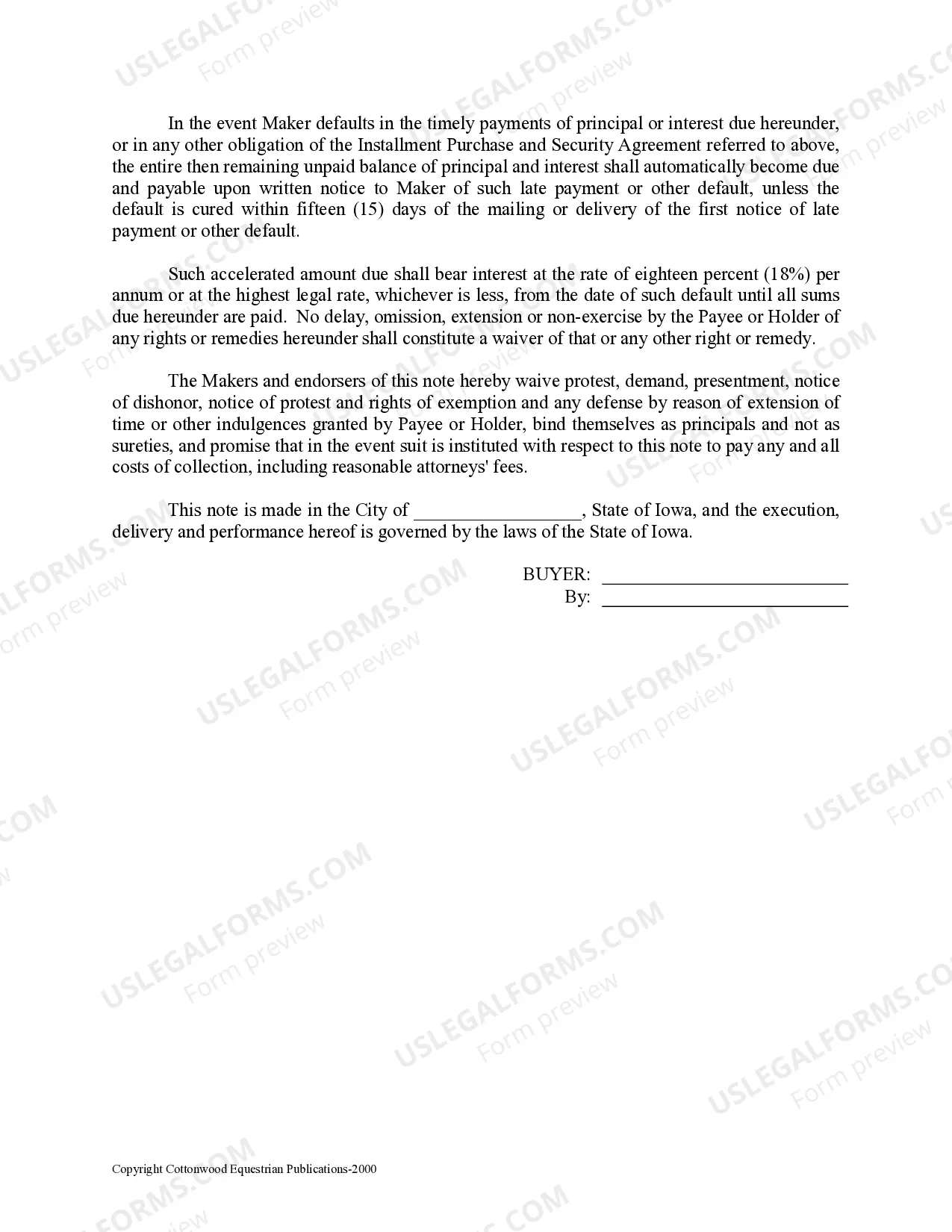

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Iowa Promissory Note - Horse Equine Forms

Description

How to fill out Iowa Promissory Note - Horse Equine Forms?

Get the most expansive library of authorized forms. US Legal Forms is really a solution where you can find any state-specific file in a few clicks, including Iowa Promissory Note - Horse Equine Forms templates. No reason to waste hrs of the time searching for a court-admissible form. Our licensed experts make sure that you get up-to-date examples all the time.

To benefit from the documents library, pick a subscription, and sign up your account. If you registered it, just log in and click on Download button. The Iowa Promissory Note - Horse Equine Forms template will instantly get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, follow the quick recommendations below:

- If you're going to use a state-specific example, make sure you indicate the right state.

- If it’s possible, review the description to understand all of the ins and outs of the form.

- Take advantage of the Preview option if it’s available to check the document's content.

- If everything’s appropriate, click Buy Now.

- Right after selecting a pricing plan, register an account.

- Pay out by card or PayPal.

- Save the document to your computer by clicking Download.

That's all! You ought to submit the Iowa Promissory Note - Horse Equine Forms form and double-check it. To ensure that all things are precise, speak to your local legal counsel for support. Join and simply find around 85,000 beneficial templates.

Form popularity

FAQ

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.Final Amount After Addition of Interest - In case interest is being charged, the note must clearly mention the final amount which is to be repaid after the interest is applied.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid.The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

A simple promissory note is a legal document that evidences a loan. The individual or entity executing the note is promising to repay the debt to the lender. The terms of the promissory note include: Parties to the contract.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

If you are owed money under a promissory note that has not been repaid in full, it may be necessary to file a breach of contract lawsuit.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The lender can then take the promissory note to a financial institution (usually a bank, albeit this could also be a private person, or another company), that will exchange the promissory note for cash; usually, the promissory note is cashed in for the amount established in the promissory note, less a small discount.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.