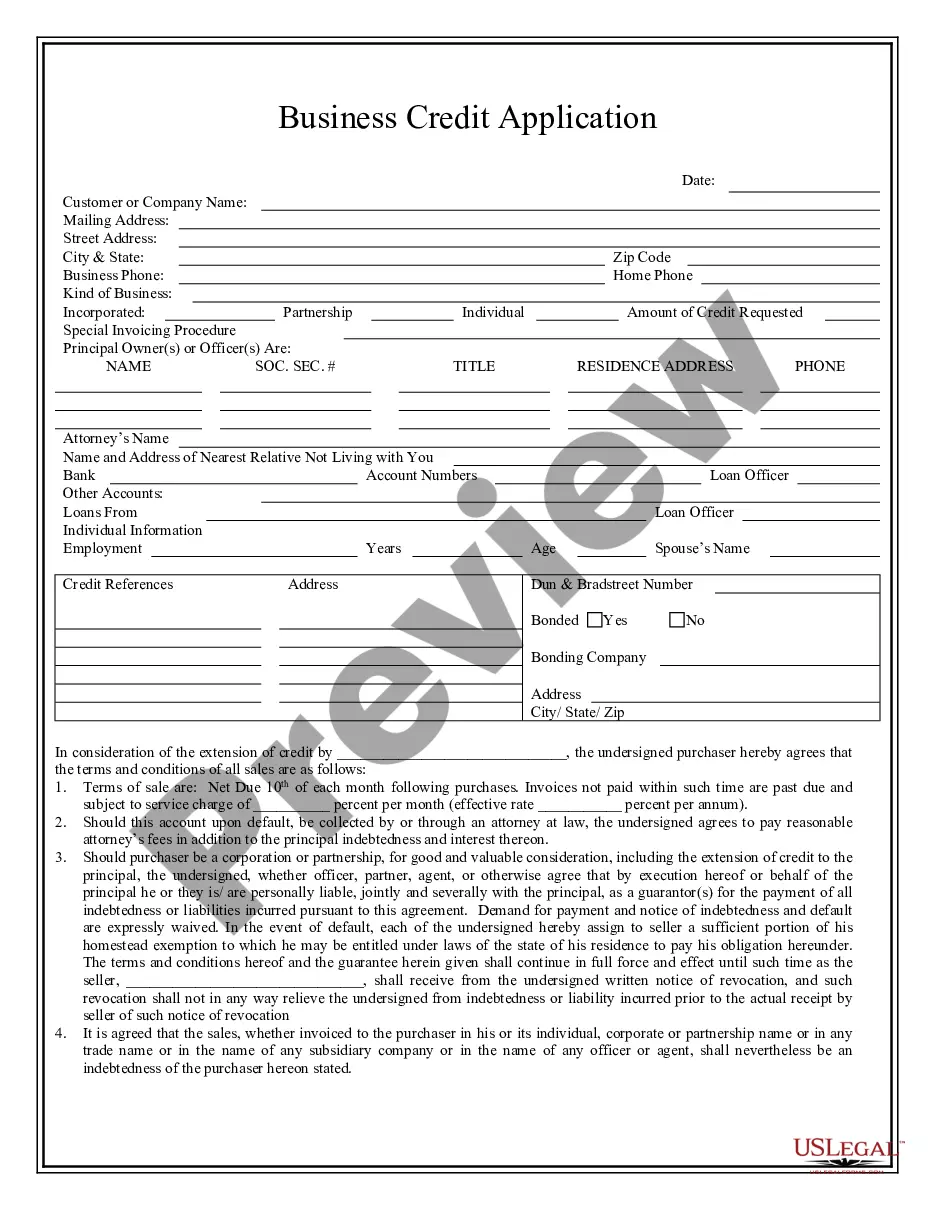

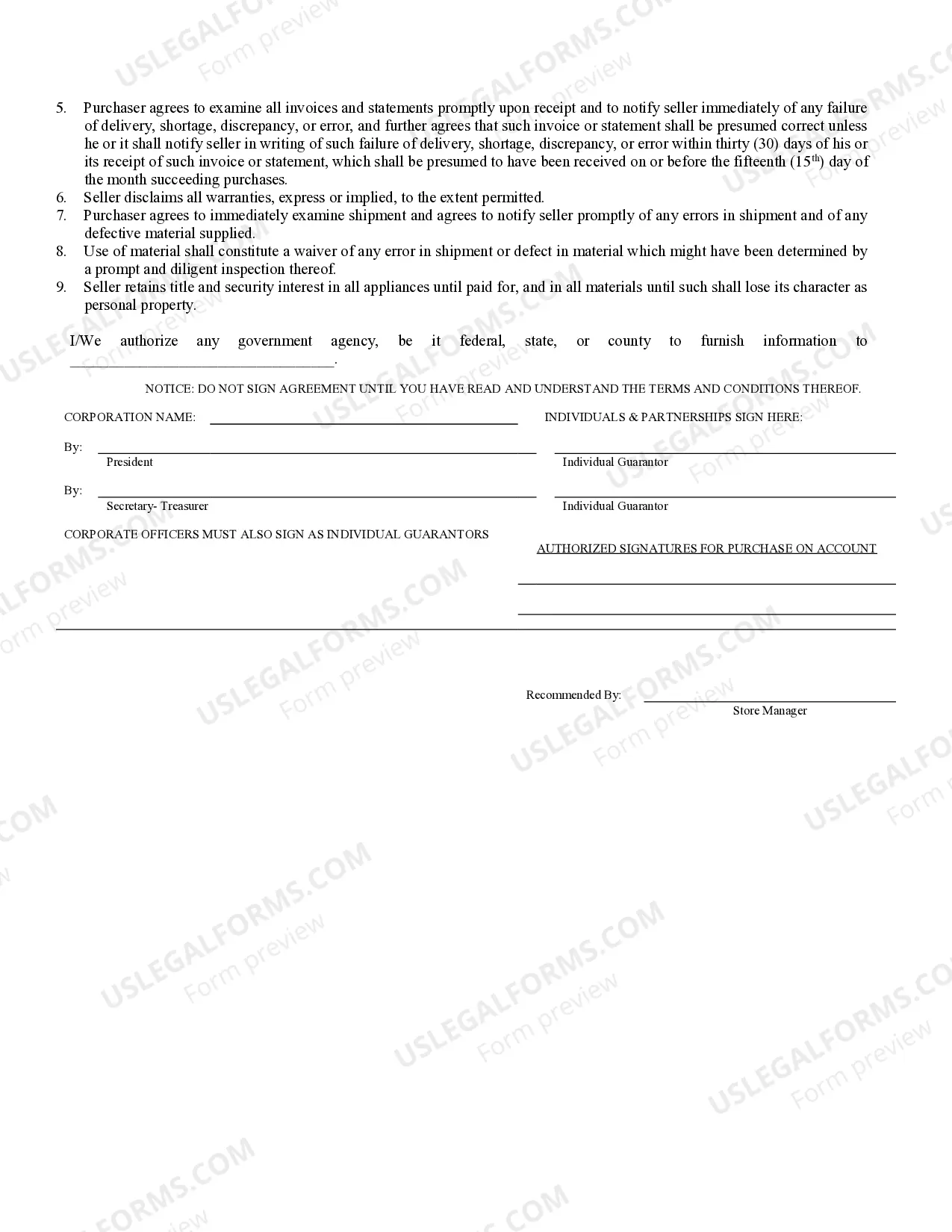

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Iowa Business Credit Application

Description

How to fill out Iowa Business Credit Application?

Get access to one of the most holistic library of authorized forms. US Legal Forms is a solution where you can find any state-specific form in couple of clicks, including Iowa Business Credit Application examples. No reason to waste hrs of the time trying to find a court-admissible example. Our licensed professionals make sure that you receive up to date examples every time.

To leverage the forms library, select a subscription, and sign up your account. If you already registered it, just log in and click on Download button. The Iowa Business Credit Application sample will instantly get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at short recommendations listed below:

- If you're going to utilize a state-specific documents, be sure you indicate the right state.

- If it’s possible, look at the description to understand all of the ins and outs of the form.

- Use the Preview option if it’s offered to look for the document's content.

- If everything’s right, click Buy Now.

- Right after selecting a pricing plan, register an account.

- Pay by card or PayPal.

- Save the sample to your device by clicking Download.

That's all! You need to complete the Iowa Business Credit Application template and check out it. To make sure that all things are precise, speak to your local legal counsel for support. Register and easily look through around 85,000 useful templates.

Form popularity

FAQ

This information is reported to Equifax by your lenders and creditors and includes the types of accounts (for example, a credit card, mortgage, student loan, or vehicle loan), the date those accounts were opened, your credit limit or loan amount, account balances, and your payment history.

A credit application serves two purposes: It is a data gathering tool and it is a contract. As a contract, it specifies the rights and obligations of both the customer and creditor.If the signer is not authorized to accept the terms and conditions of the credit application, they can't sign the application.

The present Unit on 'Process of Credit Application' covers various aspects like features and conditions for credit sales, identifying credit checks and getting authorisation, describing the process of credit requisitions, demonstrate the techniques for determining creditworthiness.

Identification and Contact Info. This one is a no-brainer as it is a requisite for pretty much any financial transaction or agreement. Social Security Number. Proof of Age. Income or Salary Totals. Employer Contact Information. Healthy FICO Credit Score.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.