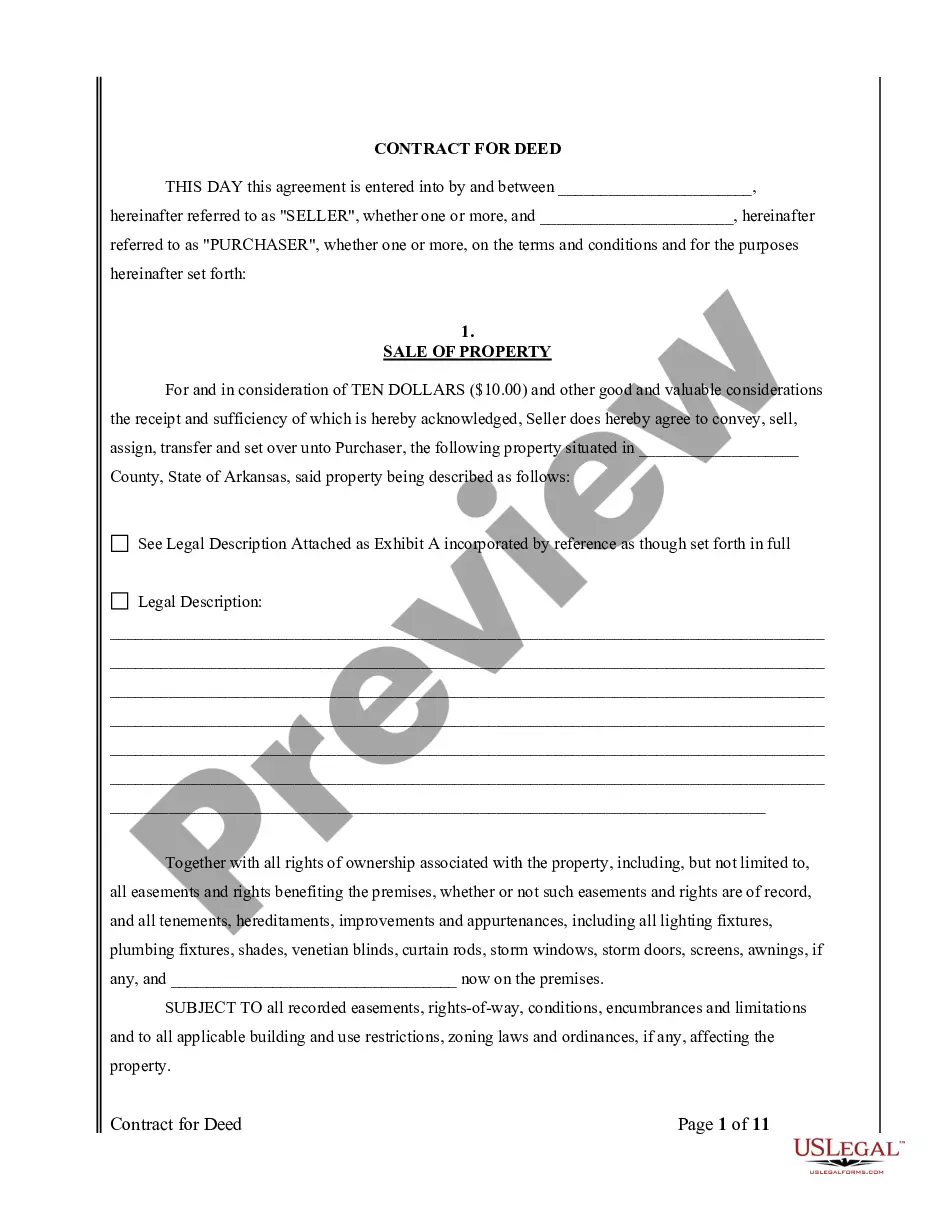

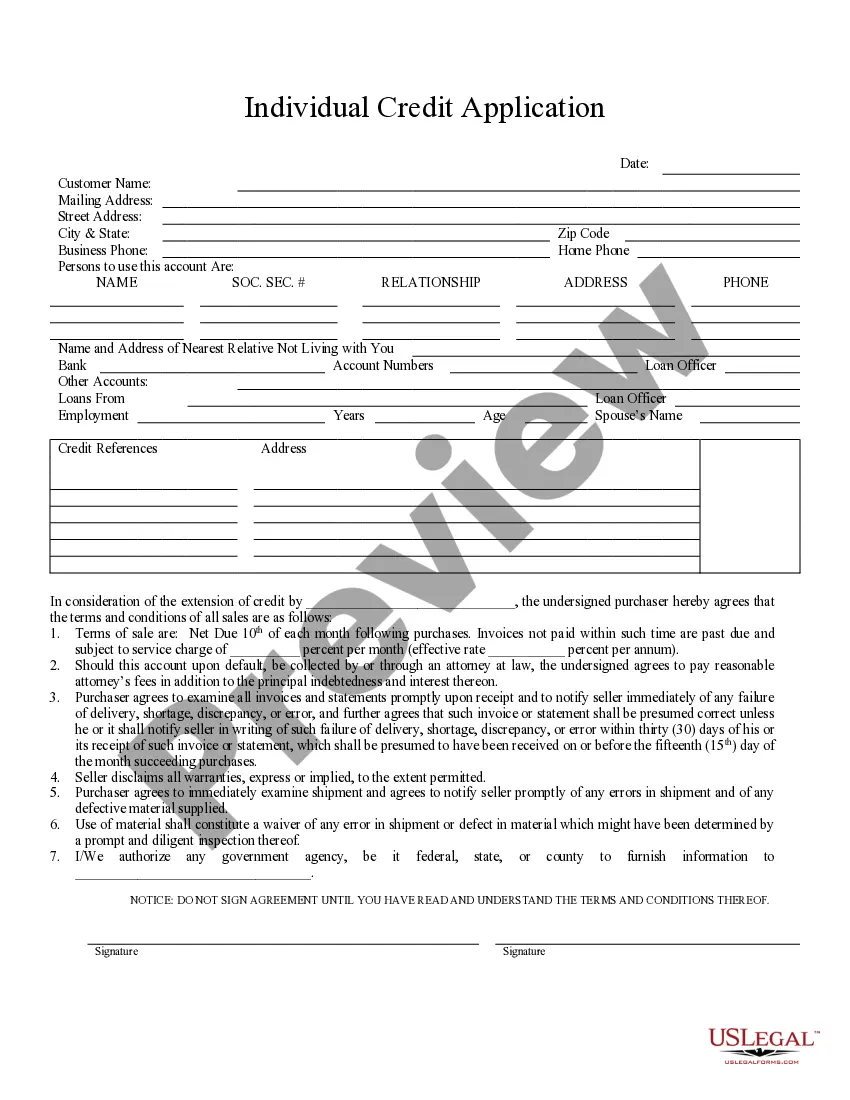

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Iowa Individual Credit Application

Description

How to fill out Iowa Individual Credit Application?

Access one of the most expansive catalogue of legal forms. US Legal Forms is a system where you can find any state-specific document in a few clicks, including Iowa Individual Credit Application templates. No need to spend hrs of the time searching for a court-admissible example. Our licensed experts make sure that you get updated examples all the time.

To make use of the forms library, choose a subscription, and sign up your account. If you did it, just log in and then click Download. The Iowa Individual Credit Application template will immediately get saved in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new account, look at simple instructions listed below:

- If you're proceeding to use a state-specific sample, make sure you indicate the right state.

- If it’s possible, review the description to learn all the ins and outs of the document.

- Use the Preview function if it’s offered to look for the document's information.

- If everything’s proper, click Buy Now.

- After choosing a pricing plan, create an account.

- Pay by card or PayPal.

- Downoad the example to your device by clicking Download.

That's all! You should complete the Iowa Individual Credit Application template and double-check it. To make sure that everything is correct, speak to your local legal counsel for help. Sign up and simply find more than 85,000 valuable samples.

Form popularity

FAQ

If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either of the following conditions: Your net income from all sources, line 26, is $9,000 or less and you are not claimed as a dependent on another person's Iowa return. ($24,000 if you are 65 or older on 12/31/14)

Declare residency in Iowa. Occupy the residence for at least six months of the year. Claim the property as their primary residence (as opposed to a second home) Apply for homestead credit by July 1.

In the state of Iowa, homestead credit is generally based on the first $4,850 of the home's Net Taxable value, and to qualify for the credit, homeowners must: Declare residency in Iowa. Occupy the residence for at least six months of the year. Claim the property as their primary residence (as opposed to a second home)

Iowa Homestead Tax Credit Eligibility: Must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Persons in the military or nursing homes who do not occupy the home are also eligible.

A valid Florida driver's license. Either a valid voter's registration or a Declaration of Domicile, reflecting the homeowner's Florida address. At least one of your automobiles must be registered in Florida.

Iowa Homestead Tax CreditEligibility: Must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Persons in the military or nursing homes who do not occupy the home are also eligible.

To be eligible, a homeowner must occupy the homestead any 6 months out of the year, but must reside there on July 1. This exemption is a reduction of the taxable value of their property amounting to a maximum $4,850 or the amount which does not allow the taxable value to be less than 0.

The basic concept is that a homestead exemption permits you to pay property taxes against all but a set amount of your home's assessed value. Put simply, there is a portion of your home's value that you do not pay property taxes on if you have applied for and been approved for the exemption.