The dissolution of a corporation package contains all forms to dissolve a corporation in Iowa, step by step instructions, addresses, transmittal letters, and other information.

Iowa Dissolution Package to Dissolve Corporation

Description

Key Concepts & Definitions

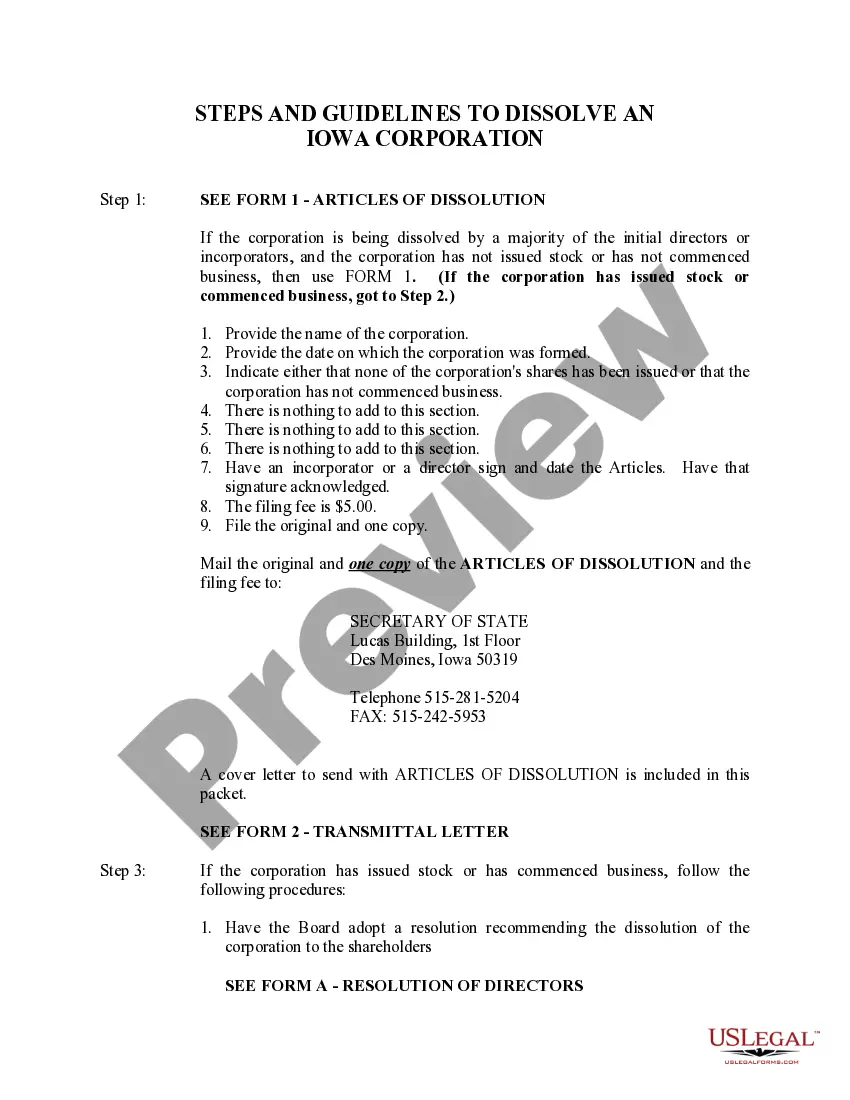

Iowa dissolution package to dissolve corporation refers to a set of documents and procedural steps required for formally terminating the existence of a corporation registered in Iowa. This process is also known as corporate dissolution. The primary components often include a formal resolution to dissolve, filing the required forms with the Iowa Secretary of State, and settling any corporate debts or obligations.

Step-by-Step Guide

- Board Resolution: Hold a board meeting and pass a resolution to dissolve the corporation.

- Shareholder Approval: Obtain approval from the shareholders as required by Iowa law.

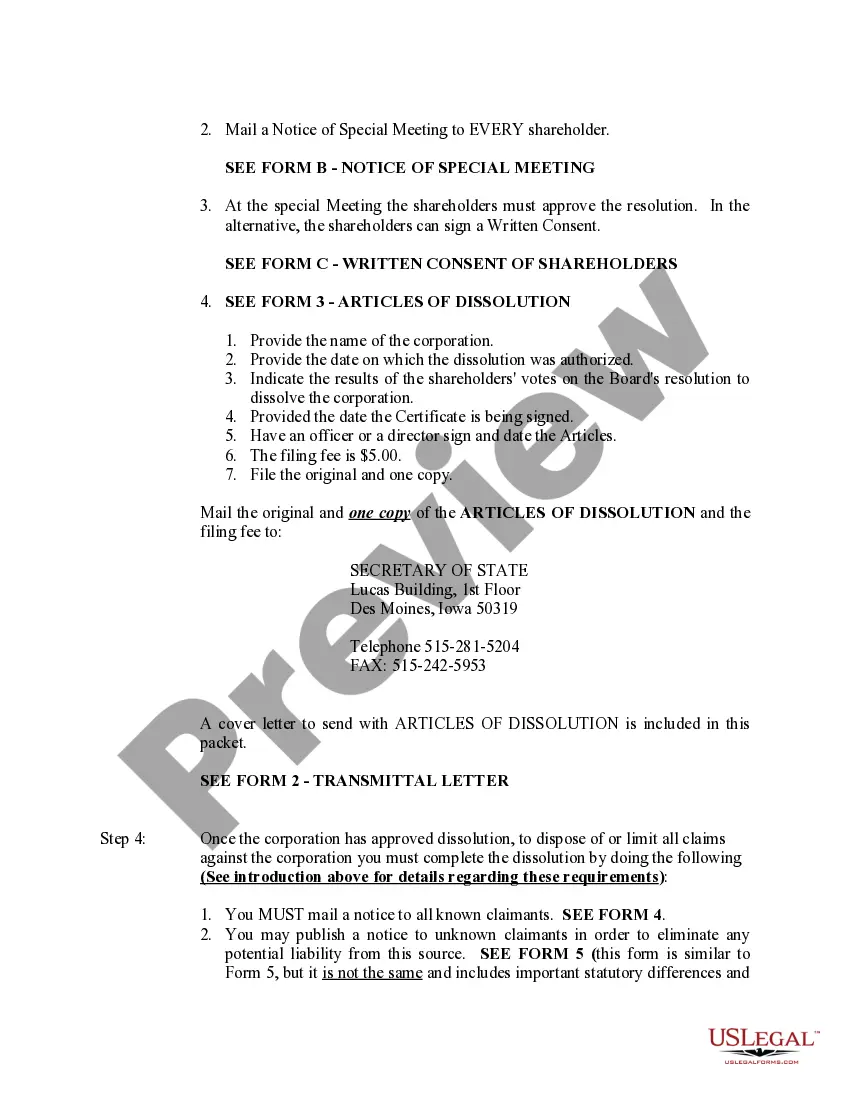

- Filing Articles of Dissolution: Complete and file the Articles of Dissolution with the Iowa Secretary of State's office along with the required fee.

- Notice to Creditors: Notify creditors of the dissolution, allowing them to make claims against the corporation.

- Settle Claims: Address and settle any claims from creditors.

- Distribution of Assets: Distribute remaining assets among shareholders.

- Final Tax Returns: File final federal and state tax returns and close out any business tax accounts.

Risk Analysis

- Legal Risks: Failing to properly notify creditors or settle claims can lead to legal consequences.

- Financial Risks: Incorrect handling of final tax submissions or asset distribution could result in financial liabilities for former directors or shareholders.

- Reputational Risks: Inadequate dissolution process might affect stakeholders' trust and future business endeavors of the directors.

How to fill out Iowa Dissolution Package To Dissolve Corporation?

Obtain the most extensive collection of legal forms.

US Legal Forms is fundamentally a platform to locate any specific state document in just a few clicks, including the Iowa Dissolution Package to Terminate Corporation templates.

No need to squander hours of your time searching for an example that is admissible in court.

That's it! You need to fill out the Iowa Dissolution Package to Terminate Corporation form and check out. To confirm that everything is correct, consult your local legal advisor for assistance. Register and effortlessly discover over 85,000 valuable templates.

- Our certified professionals guarantee that you receive current documents every time.

- To utilize the document library, select a subscription and create your account.

- If you have already registered, simply Log In and click on the Download button.

- The Iowa Dissolution Package to Terminate Corporation sample will automatically be saved in the My documents tab (a tab for all forms you save on US Legal Forms).

- To establish a new account, follow the straightforward instructions provided below.

- When you intend to use a state-specific document, ensure you indicate the correct state.

- If feasible, review the description to understand all the details of the form.

- Utilize the Preview option if it’s accessible to verify the document's information.

- If everything is accurate, click on the Buy Now button.

- After selecting a pricing plan, register an account.

- Pay using credit card or PayPal.

- Download the document to your computer by clicking Download.

Form popularity

FAQ

Dissolving a corporation does not automatically trigger an audit, but it can prompt state and federal agencies to review your financial records. It is essential to ensure all financial obligations are settled prior to dissolution to minimize any potential scrutiny. Using an Iowa Dissolution Package to Dissolve Corporation will help you address any outstanding financial matters correctly before proceeding with the dissolution.

To dissolve a corporation in Iowa, start by holding a meeting with shareholders to approve the dissolution. Next, file the Articles of Dissolution with the state, and settle any outstanding debts. Once you have completed these steps, an Iowa Dissolution Package to Dissolve Corporation can help you manage the necessary notifications and final filings with the state, making compliance easier.

The process of dissolving a corporation involves formally ending its legal existence. You will need to file specific documents with the state of Iowa, which detail your intention to dissolve the company. Utilizing an Iowa Dissolution Package to Dissolve Corporation can streamline this process, ensuring you meet all state requirements and submit the correct paperwork efficiently.

Dissolving as a corporation involves following specific procedures defined by your state. You will typically need to hold a vote among shareholders to agree on the dissolution and file necessary documents with the state. Additionally, it is crucial to notify creditors and settle any outstanding obligations. Utilizing the Iowa Dissolution Package to Dissolve Corporation simplifies this complex process by providing you with the required forms and guidance.

Failing to dissolve a corporation can lead to ongoing legal responsibilities and liabilities. If you do not formally dissolve your corporation, you may remain liable for taxes, debts, and obligations. Additionally, this oversight can hinder your ability to start new ventures or affect your personal credit. The Iowa Dissolution Package to Dissolve Corporation helps protect you from these consequences by ensuring your corporation is dissolved properly.

Dissolving a company is not the same as simply closing your doors. When you dissolve a corporation, you are officially terminating its existence and settling all debts, which ensures proper legal closure. On the other hand, closing may imply shutting down operations without fulfilling formal legal requirements. The Iowa Dissolution Package to Dissolve Corporation provides clarity by guiding you through the necessary steps for a legal dissolution.

The process of dissolving a corporation involves several steps to ensure all legal obligations are met. First, the corporation must hold a meeting and vote to approve the dissolution. Next, you will need to file the appropriate paperwork, such as the Articles of Dissolution, with the state. Using the Iowa Dissolution Package to Dissolve Corporation can simplify this process, helping you navigate each requirement smoothly.

To write a business dissolution letter, start by stating your intention to dissolve the corporation clearly. Include essential details such as the name of the corporation, the address, and the date of the dissolution. You should also mention the reason for dissolving the business, and if applicable, notify any stakeholders or partners involved. If you need assistance in drafting this letter, the Iowa Dissolution Package to Dissolve Corporation from US Legal Forms provides a convenient and professional solution, ensuring you have all the necessary documentation to finalize your corporation's dissolution.

Dissolving your LLC in Iowa involves a few essential steps. Begin by voting to dissolve the LLC in accordance with your operating agreement. Afterward, you must file the Articles of Dissolution with the Iowa Secretary of State. To ensure a smooth and compliant dissolution process, consider using an Iowa Dissolution Package to Dissolve Corporation, which provides all necessary tools and guidance.

To dissolve a corporation in Iowa, you must first obtain approval from your board of directors and shareholders. Next, complete and file the appropriate forms with the Iowa Secretary of State. Additionally, ensure that all debts and obligations are settled before you proceed. Utilizing an Iowa Dissolution Package to Dissolve Corporation can simplify this process and ensure you meet all legal requirements.