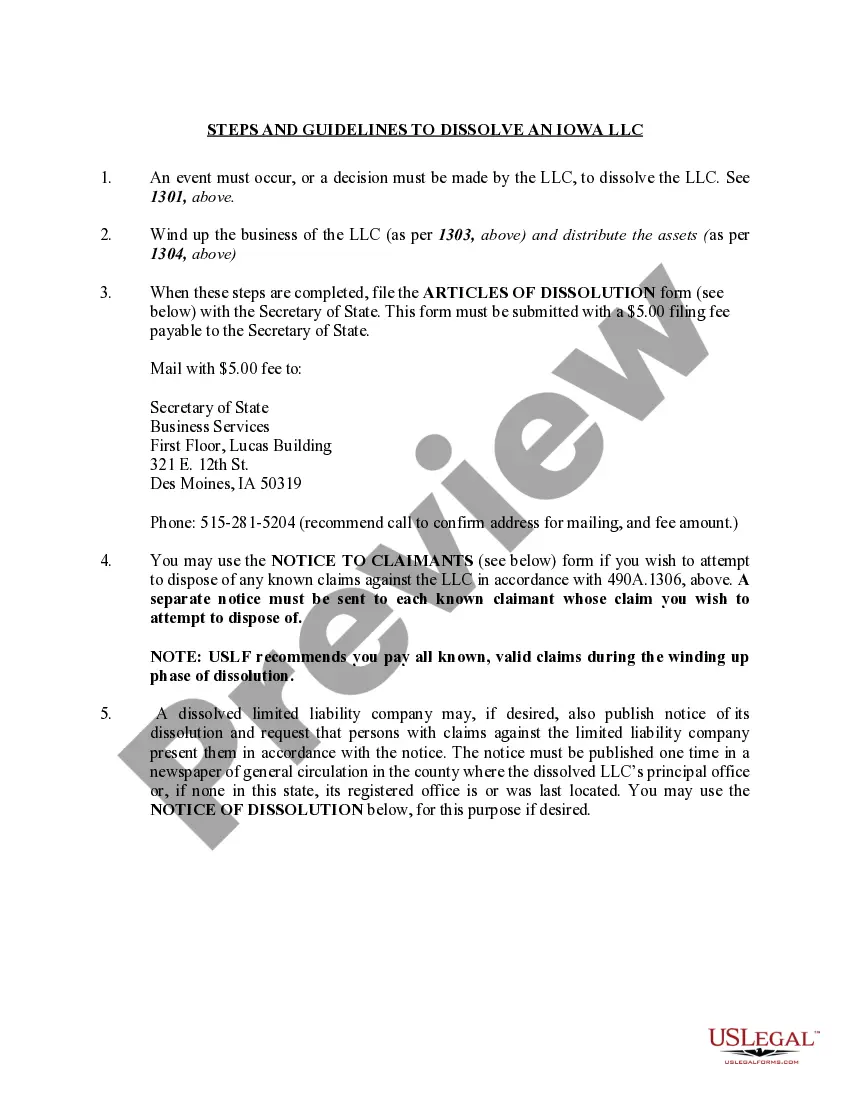

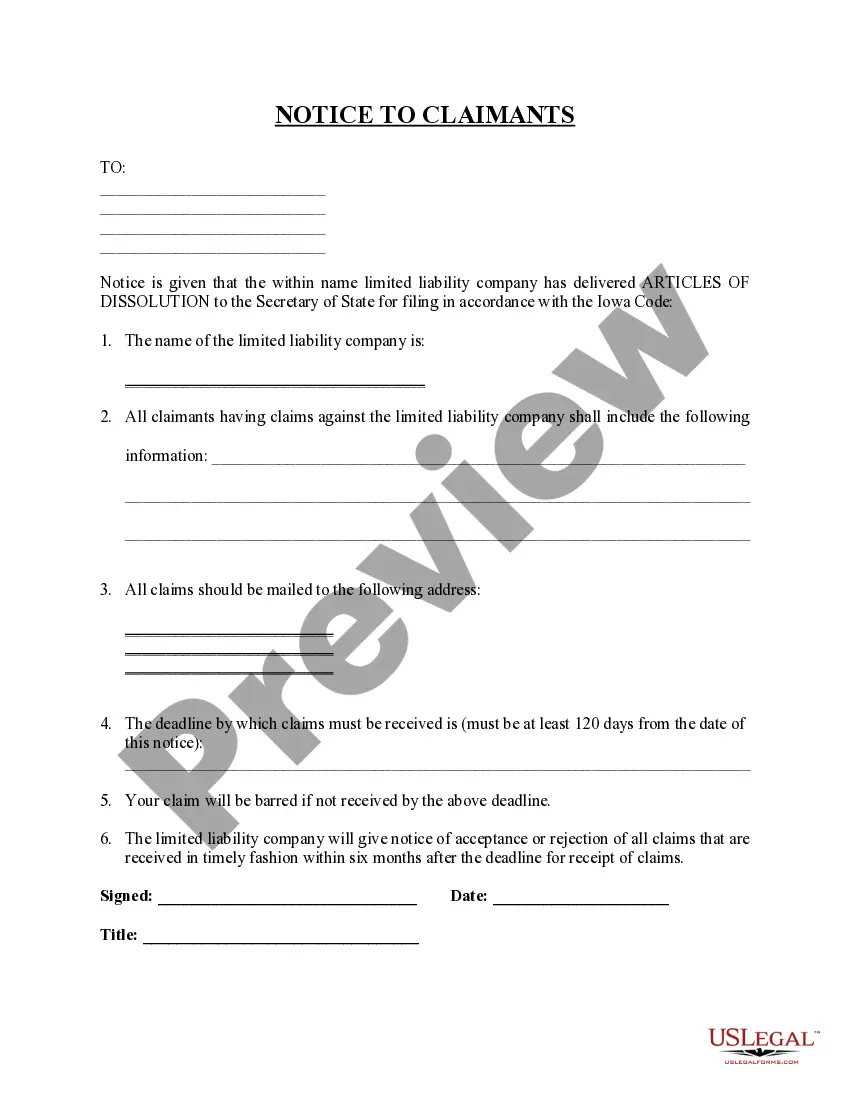

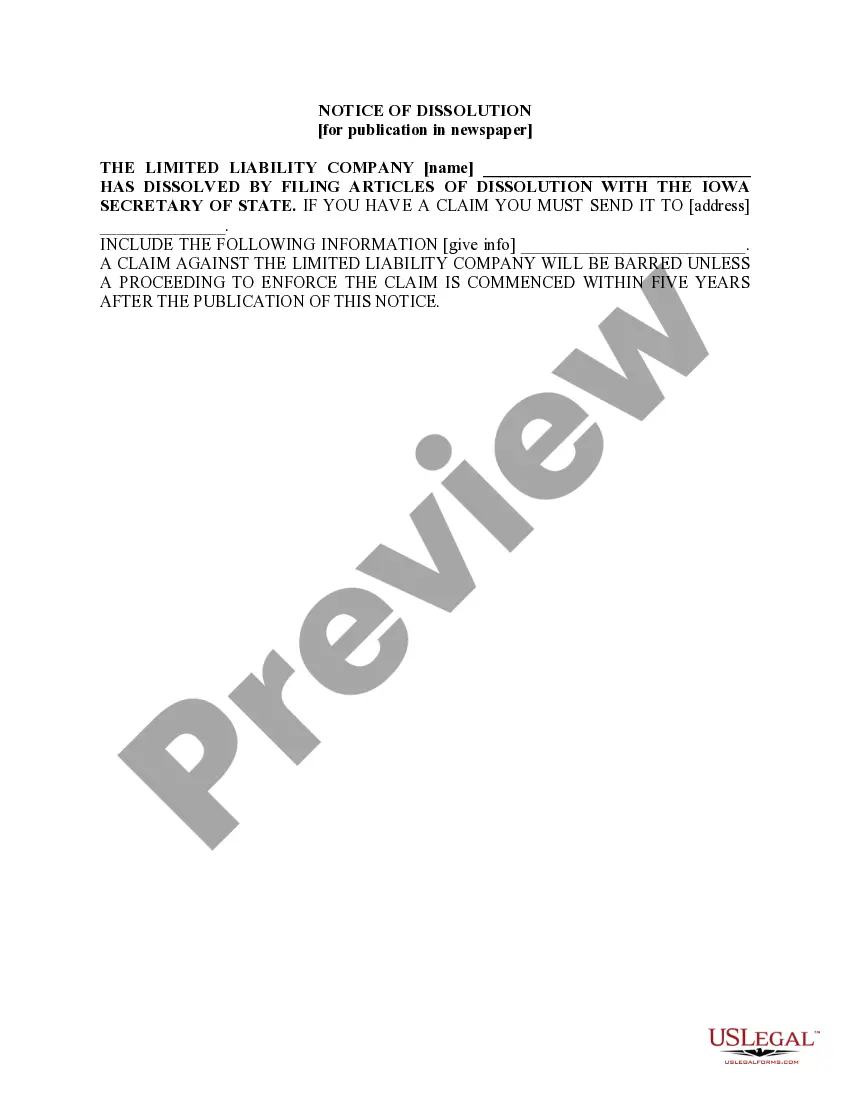

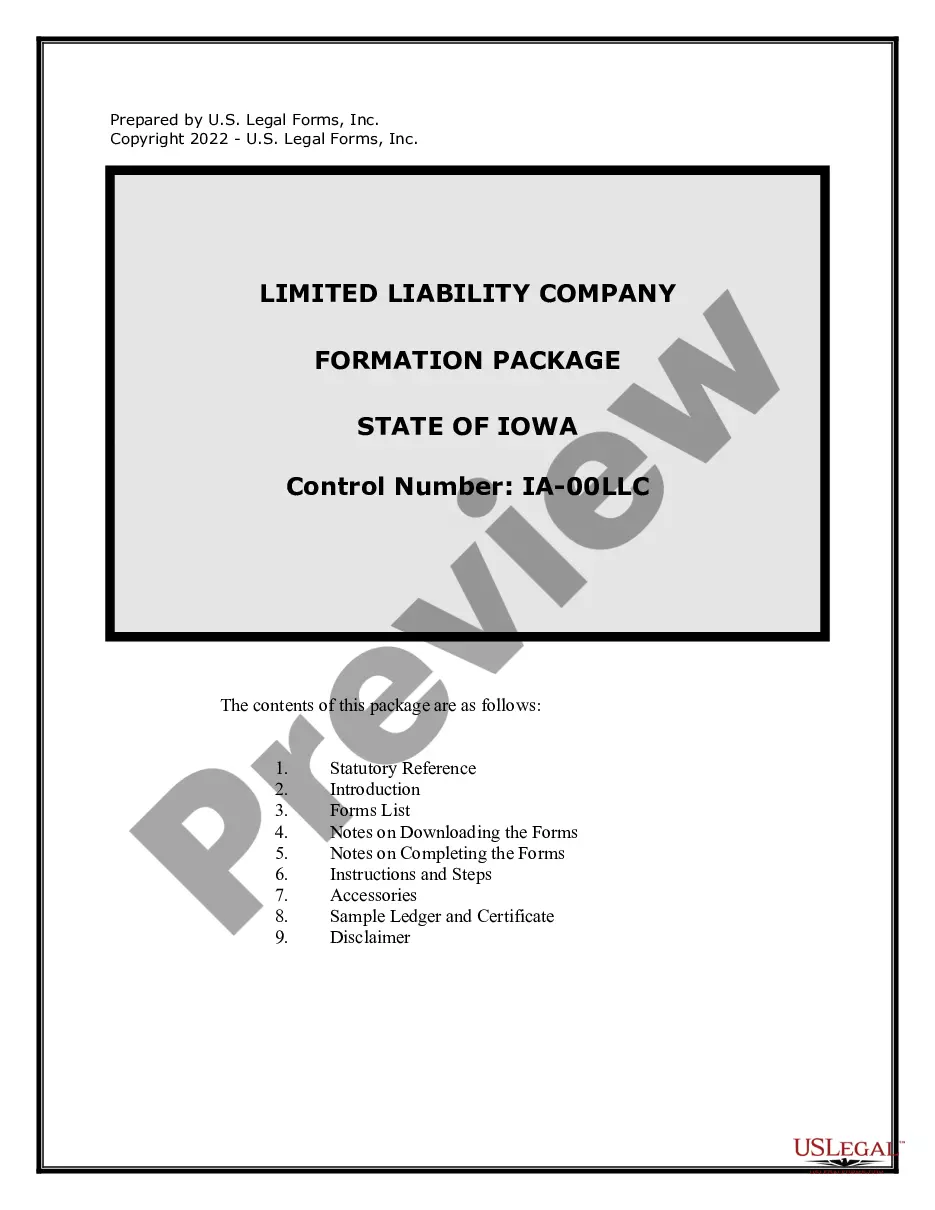

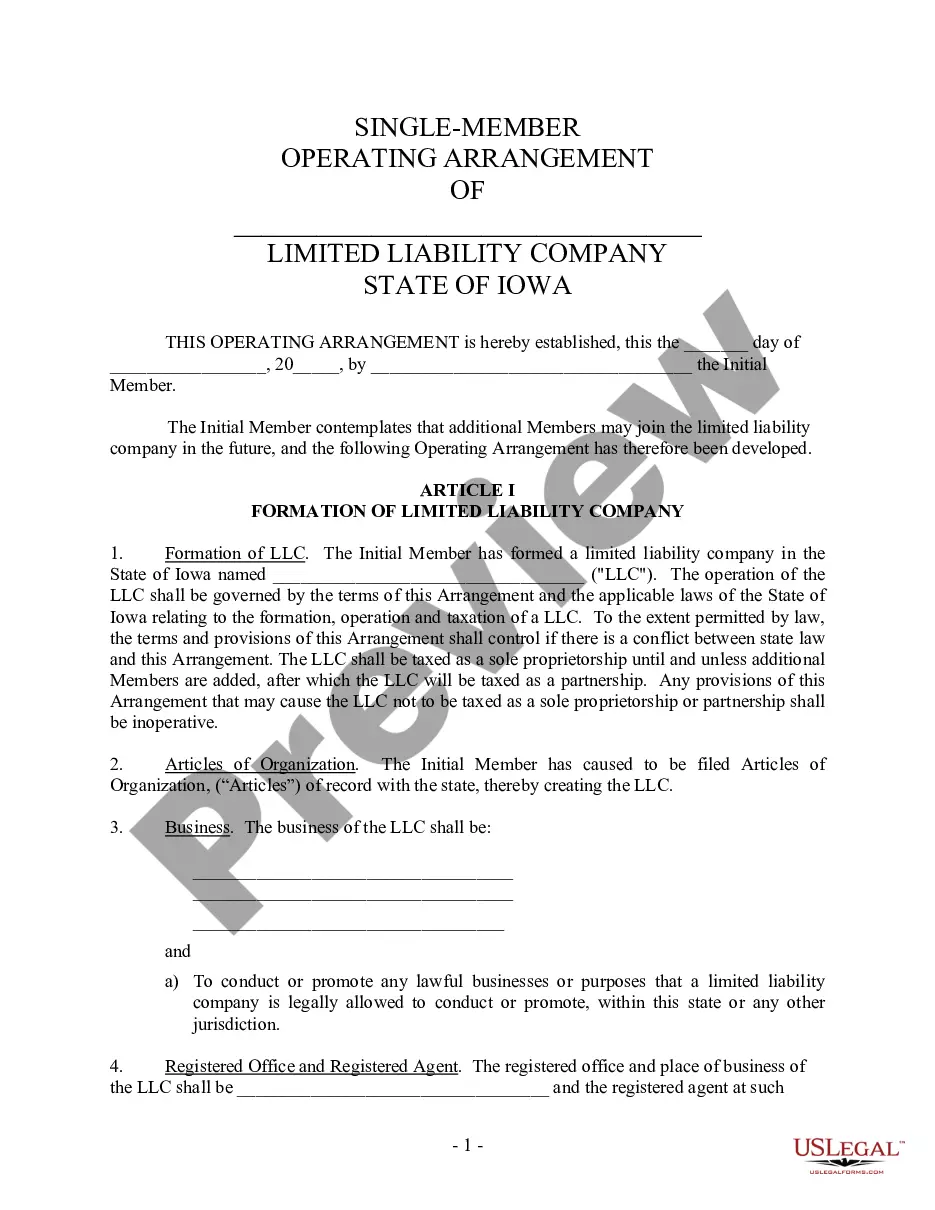

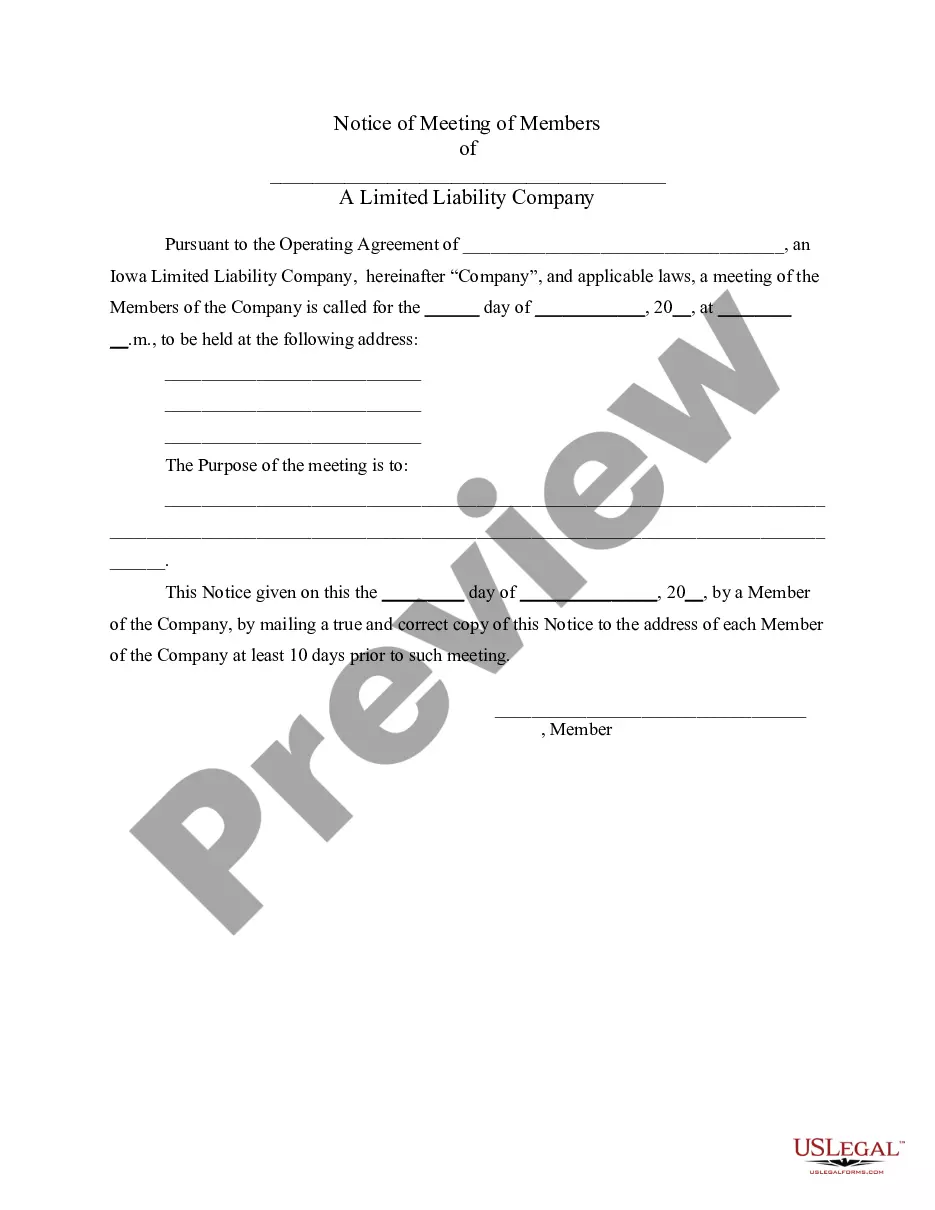

The dissolution package contains all forms to dissolve a LLC or PLLC in Iowa, step by step instructions, addresses, transmittal letters, and other information.

Iowa Dissolution Package to Dissolve Limited Liability Company LLC

Description Iowa Dissolution Dissolve

How to fill out Form An Iowa Llc?

Access the most extensive catalogue of legal forms. US Legal Forms is a platform to find any state-specific form in couple of clicks, even Iowa Dissolution Package to Dissolve Limited Liability Company LLC examples. No reason to waste hrs of the time looking for a court-admissible sample. Our licensed experts make sure that you get up-to-date examples all the time.

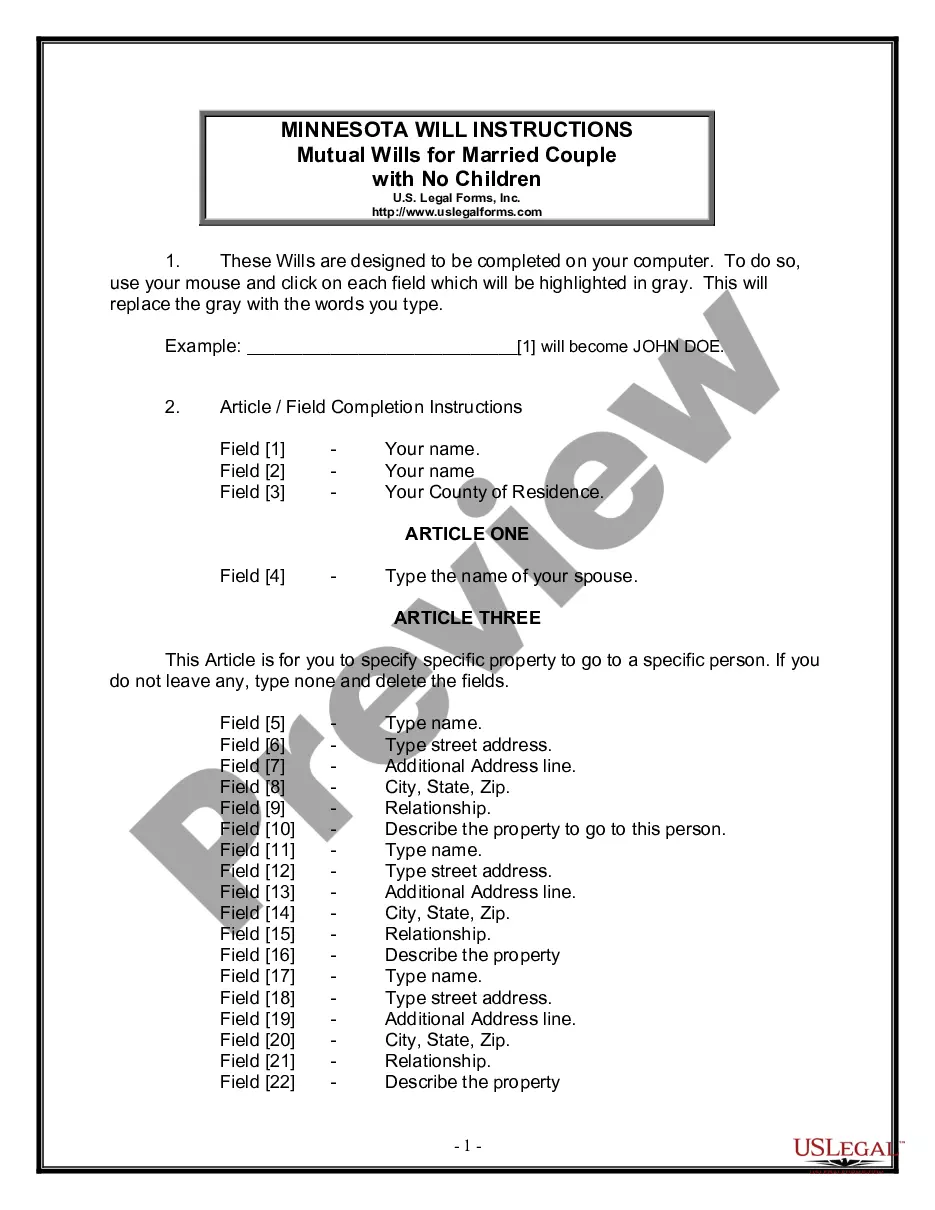

To take advantage of the documents library, select a subscription, and sign-up your account. If you did it, just log in and click on Download button. The Iowa Dissolution Package to Dissolve Limited Liability Company LLC template will quickly get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, look at short guidelines below:

- If you're proceeding to use a state-specific documents, be sure you indicate the right state.

- If it’s possible, go over the description to understand all the ins and outs of the document.

- Take advantage of the Preview option if it’s available to check the document's information.

- If everything’s proper, click Buy Now.

- After picking a pricing plan, register an account.

- Pay by card or PayPal.

- Save the example to your device by clicking Download.

That's all! You ought to submit the Iowa Dissolution Package to Dissolve Limited Liability Company LLC form and double-check it. To make certain that everything is exact, contact your local legal counsel for support. Register and easily find around 85,000 valuable samples.

Articles Of Organization Iowa Form popularity

Dissolve Llc Package Other Form Names

Dissolution Letter Sample FAQ

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

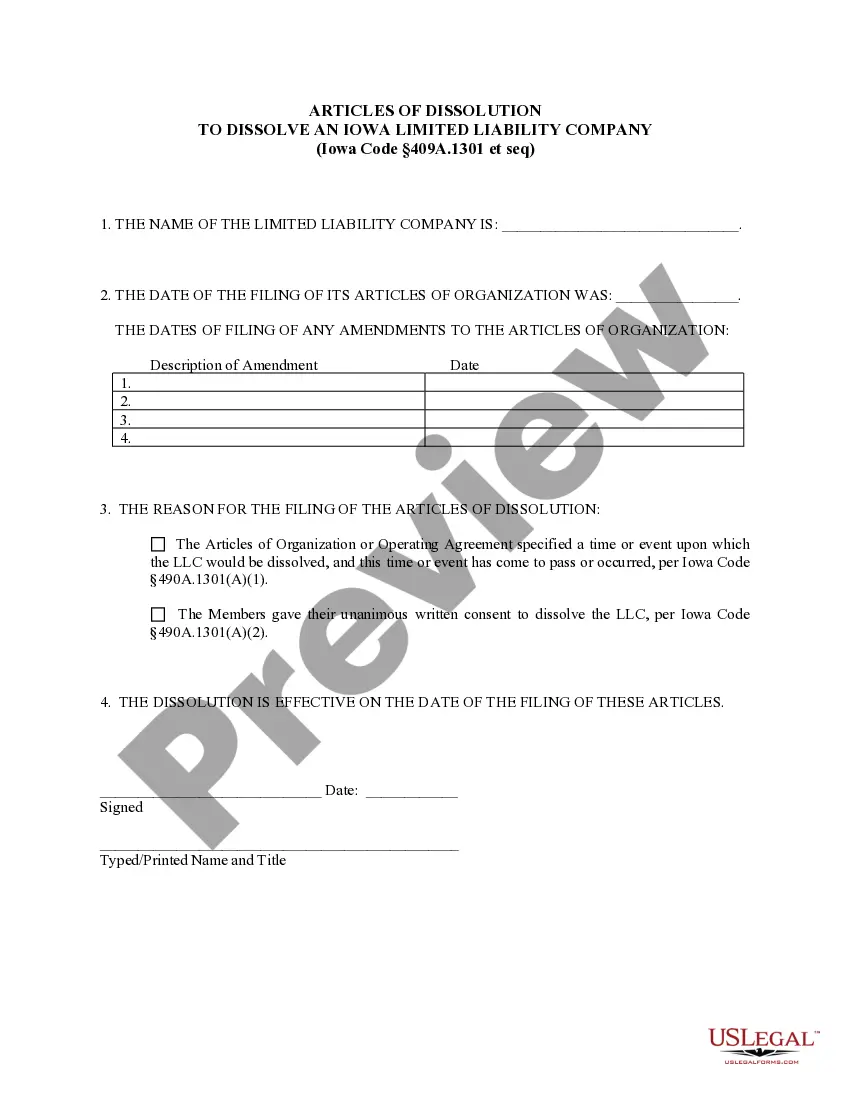

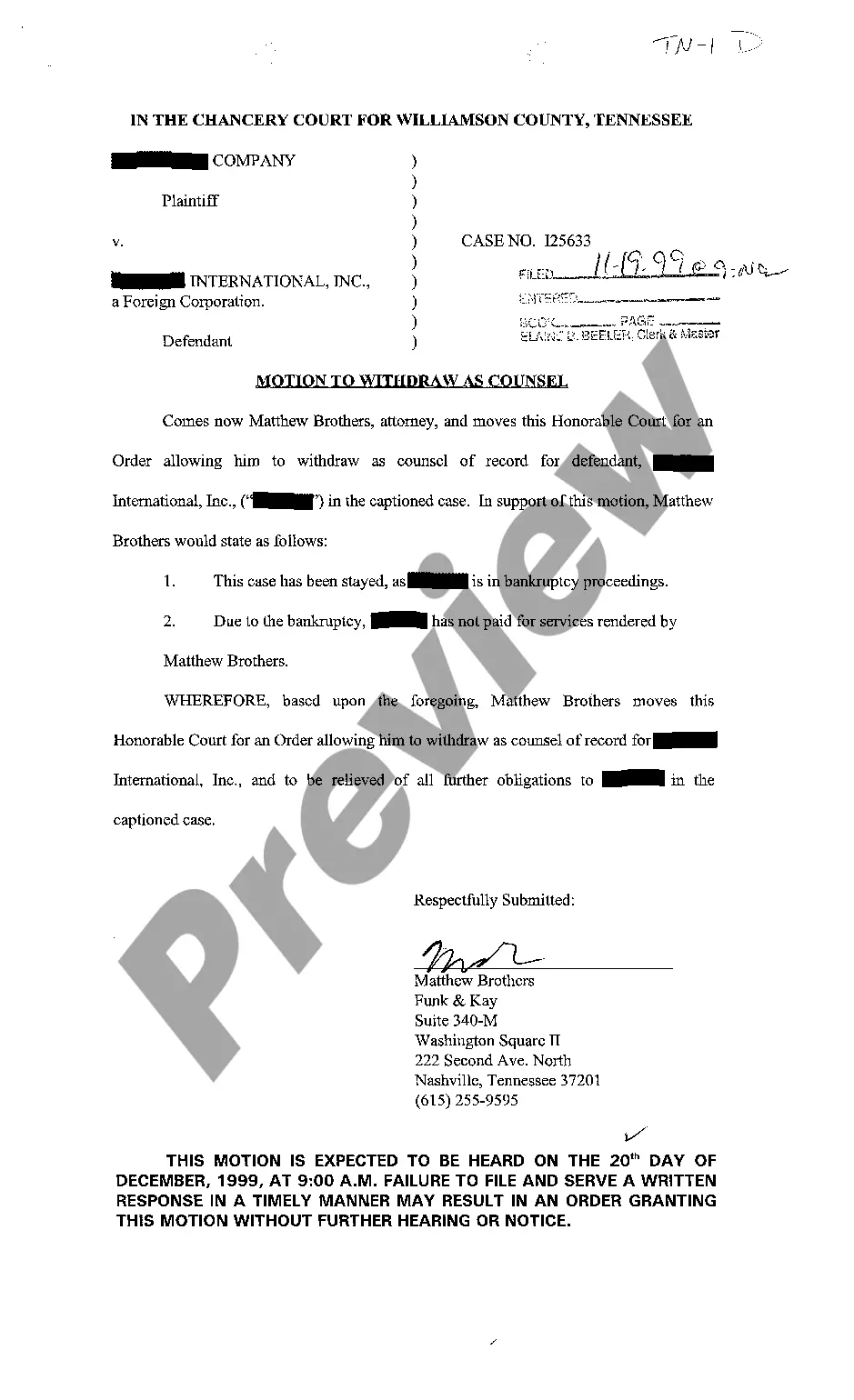

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.