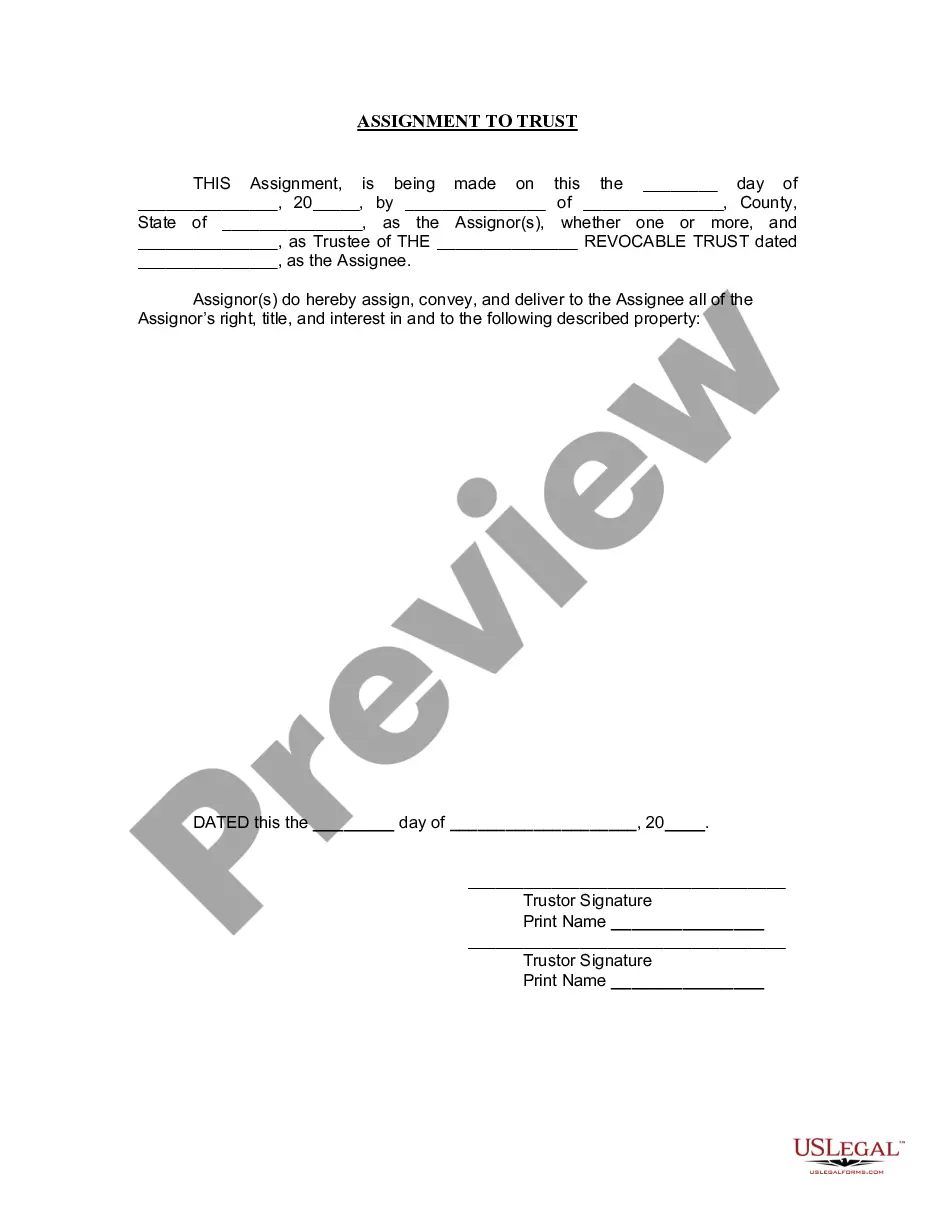

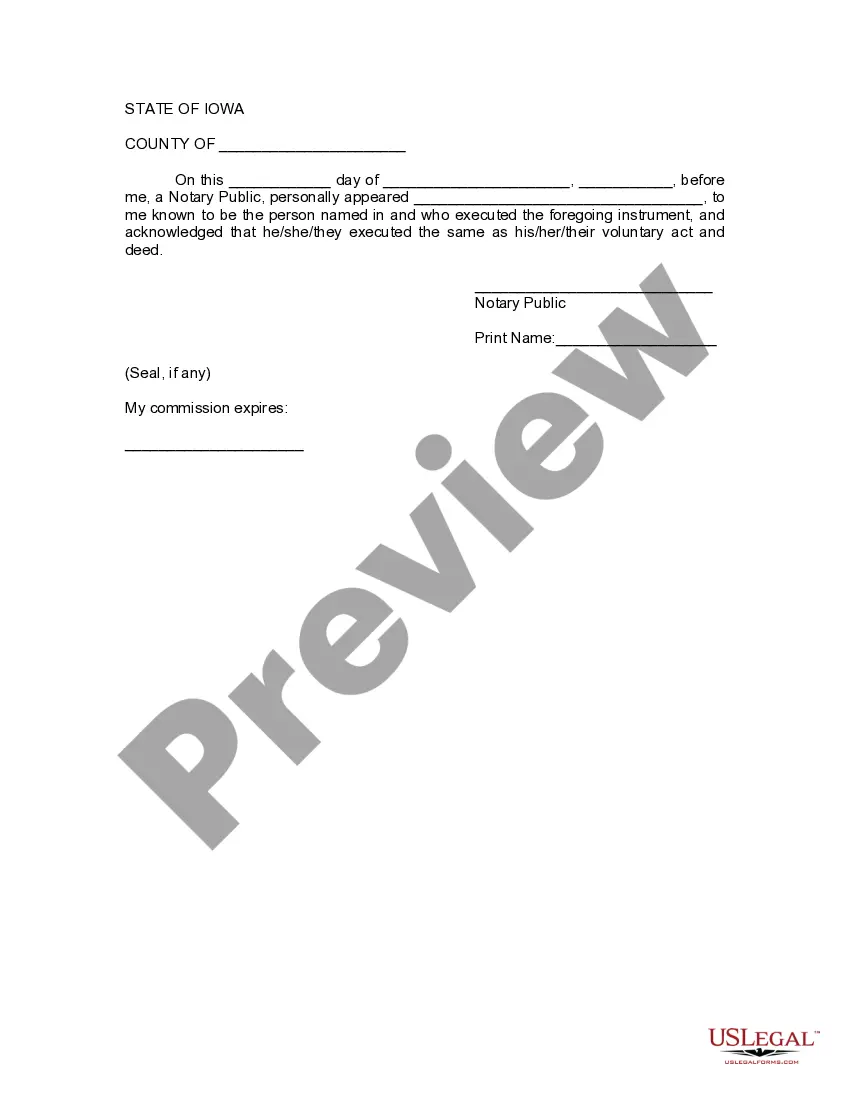

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Iowa Assignment to Living Trust

Description

How to fill out Iowa Assignment To Living Trust?

Access the most expansive catalogue of authorized forms. US Legal Forms is actually a system where you can find any state-specific form in a few clicks, including Iowa Assignment to Living Trust examples. No reason to spend several hours of the time searching for a court-admissible example. Our licensed professionals ensure you receive up-to-date examples every time.

To benefit from the documents library, choose a subscription, and sign-up an account. If you did it, just log in and then click Download. The Iowa Assignment to Living Trust sample will instantly get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To create a new profile, look at brief recommendations listed below:

- If you're having to utilize a state-specific documents, make sure you indicate the right state.

- If it’s possible, go over the description to understand all the ins and outs of the document.

- Make use of the Preview option if it’s accessible to look for the document's information.

- If everything’s right, click Buy Now.

- After picking a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Downoad the example to your computer by clicking on Download button.

That's all! You need to fill out the Iowa Assignment to Living Trust form and double-check it. To ensure that all things are precise, speak to your local legal counsel for assist. Join and easily browse over 85,000 valuable templates.

Form popularity

FAQ

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

You don't need a lawyer to complete most of your tasks during the first few months of a trust administration.If you'll be distributing all the trust property to beneficiaries quickly, you'll probably get most of your work done in about six months.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

The average cost for an attorney to create your trust ranges from $1,000 to $1,500 for an individual and $1,200 to $1,500 for a couple. Legal fees vary by location, so your costs could be much higher or slightly lower.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.