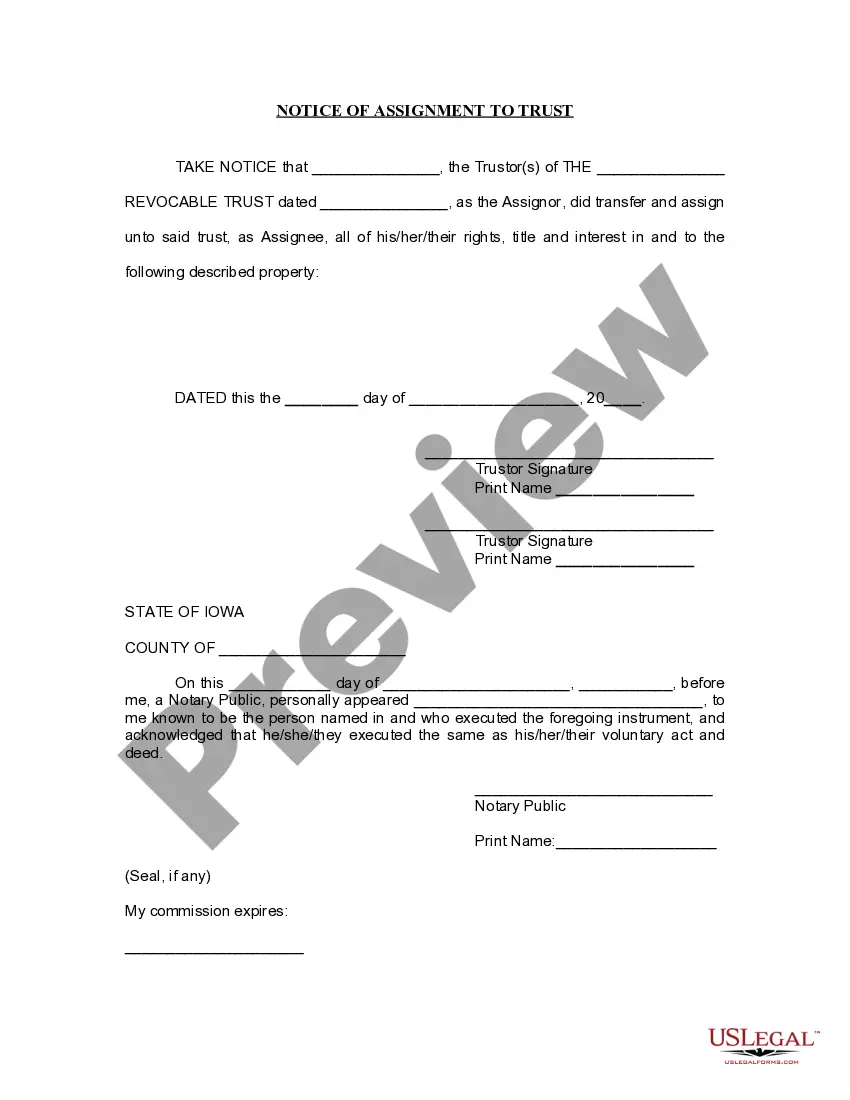

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Iowa Notice of Assignment to Living Trust

Description

How to fill out Iowa Notice Of Assignment To Living Trust?

Obtain the most extensive directory of legal documents.

US Legal Forms is fundamentally a platform where you can discover any state-specific document in moments, including Iowa Notice of Assignment to Living Trust forms.

No need to waste your time searching for a court-acceptable example.

After selecting a pricing option, create your account. Make payment through credit card or PayPal. Download the document to your computer by clicking Download. That's it! You should submit the Iowa Notice of Assignment to Living Trust form and review it. To ensure everything is correct, consult your local legal advisor for assistance. Register and easily browse more than 85,000 useful templates.

- Select a subscription to access the forms library and create an account.

- If you have already registered, simply Log In and then click Download.

- The Iowa Notice of Assignment to Living Trust form will automatically be saved in the My documents section (a section for all forms you download on US Legal Forms).

- To establish a new profile, review the brief instructions below.

- If you require state-specific documents, be sure to specify the appropriate state.

- If possible, examine the description to grasp all of the details of the document.

- Utilize the Preview feature if it’s available to assess the content of the document.

- If everything appears accurate, click Buy Now.

Form popularity

FAQ

UDT is an abbreviation for under declaration of trust, which is the legal language used in some trust instruments to indicate that the grantor is both creating the trust and controlling its assets.Most personal trusts are trusts under agreement, or "UA," in which the grantor and the trustee are different parties.

Bypass Trusts Couples can set up a living trust, including ownership of an LLC, as a "bypass." In this type of trust, the surviving spouse is guaranteed support from the trust and its assets, including an LLC, for his or her lifetime, but all assets and income go to the trust on the death of the second spouse.

Ownership in a business can also be transferred through a living trust. To do this, the business owner must first transfer the business to the trust, then name the intended successor as successor trustee to the trust. The business owner, while living, would serve as both trustee and beneficiary of the trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

A trust can be used to run a business. But because it is not a legal entity, the trustee undertakes the business activities on behalf of the trust. A trustee can be an individual or a company we recommend a corporate trustee.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.