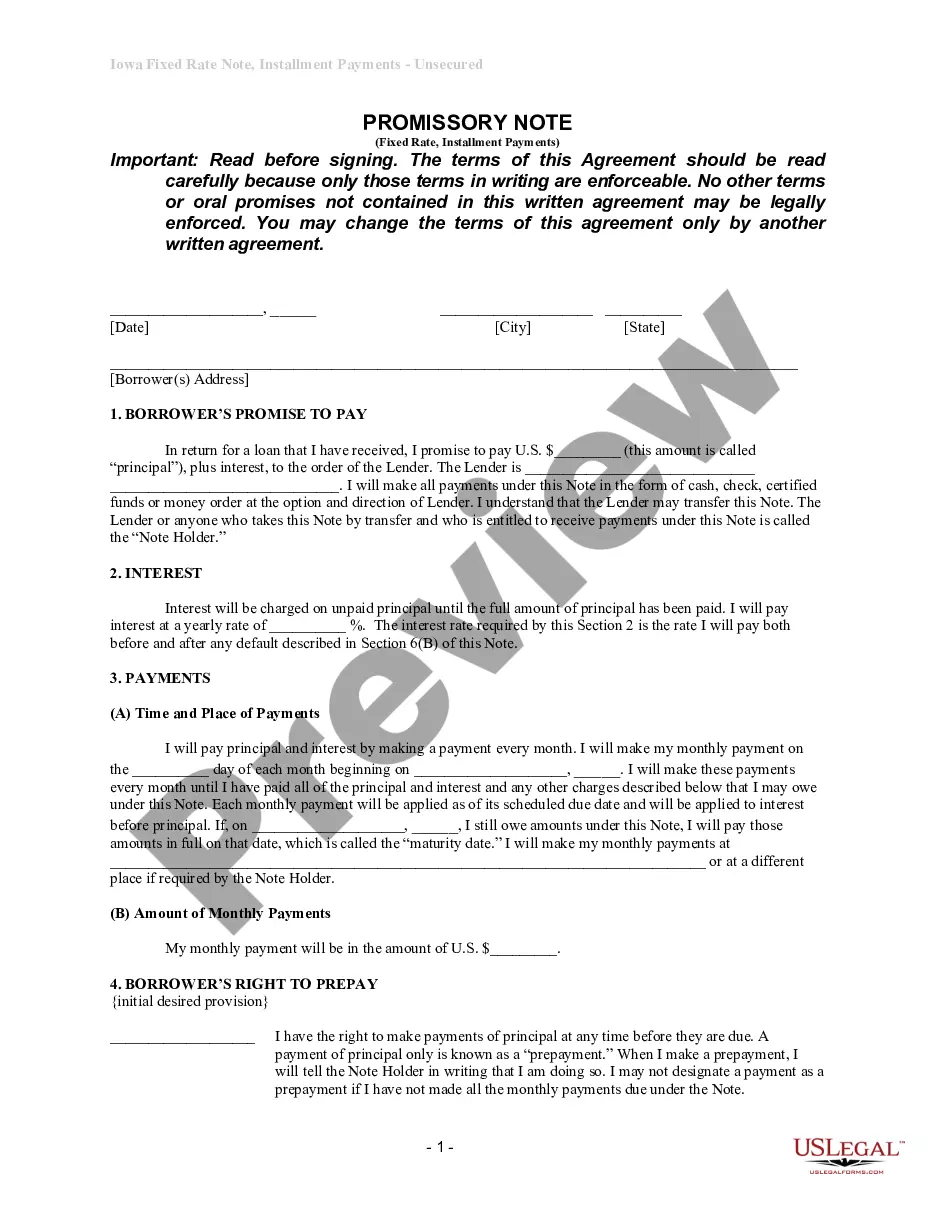

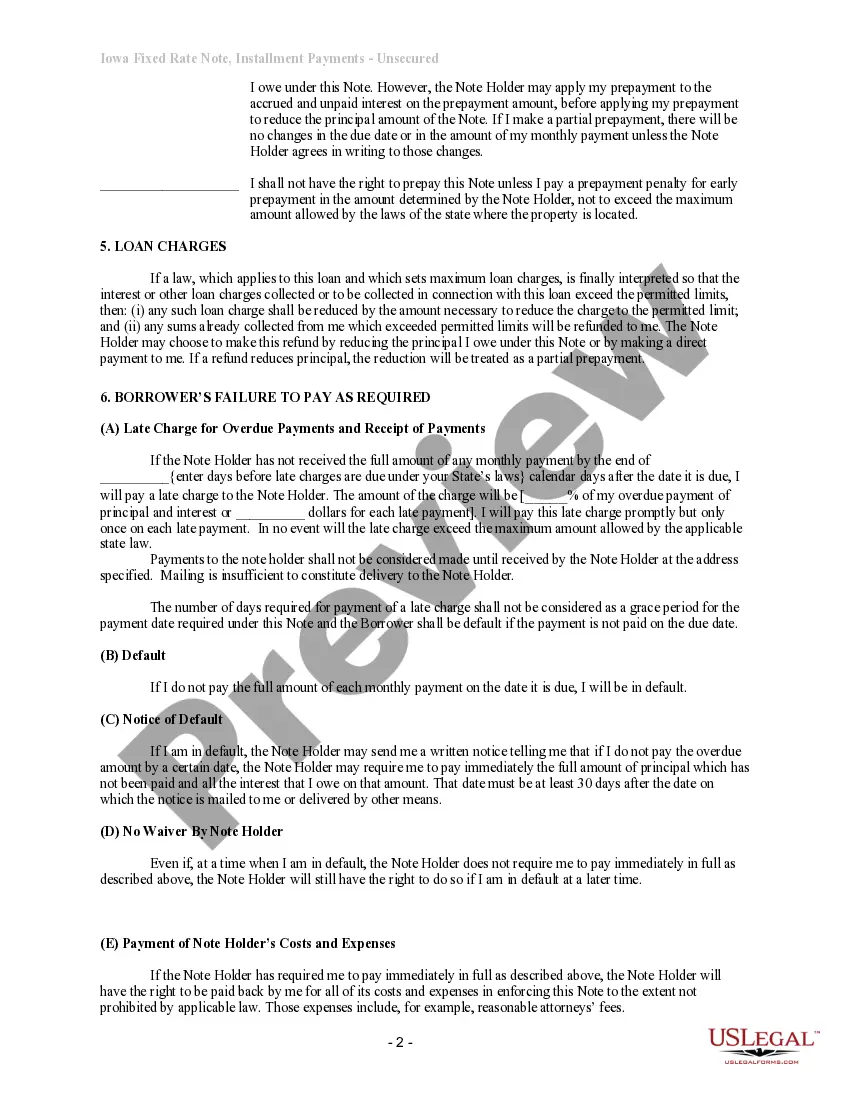

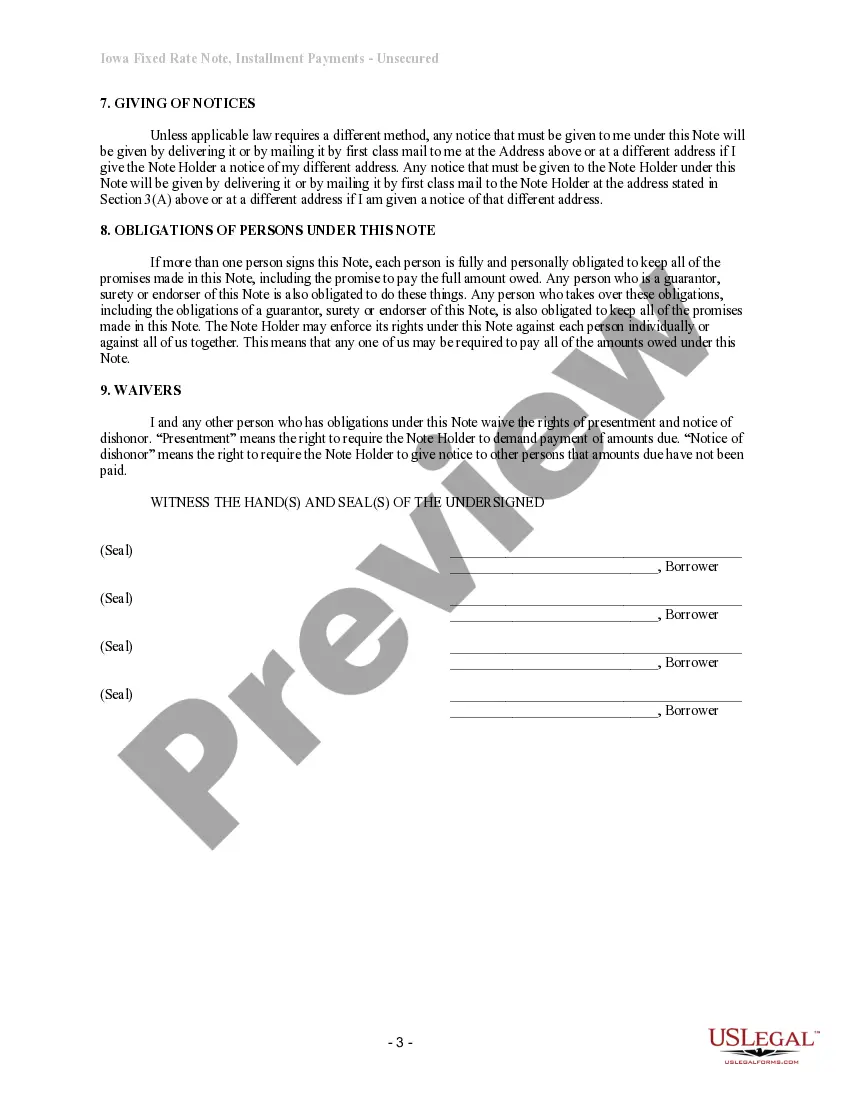

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Iowa Unsecured Installment Payment Promissory Note for Fixed Rate

Description

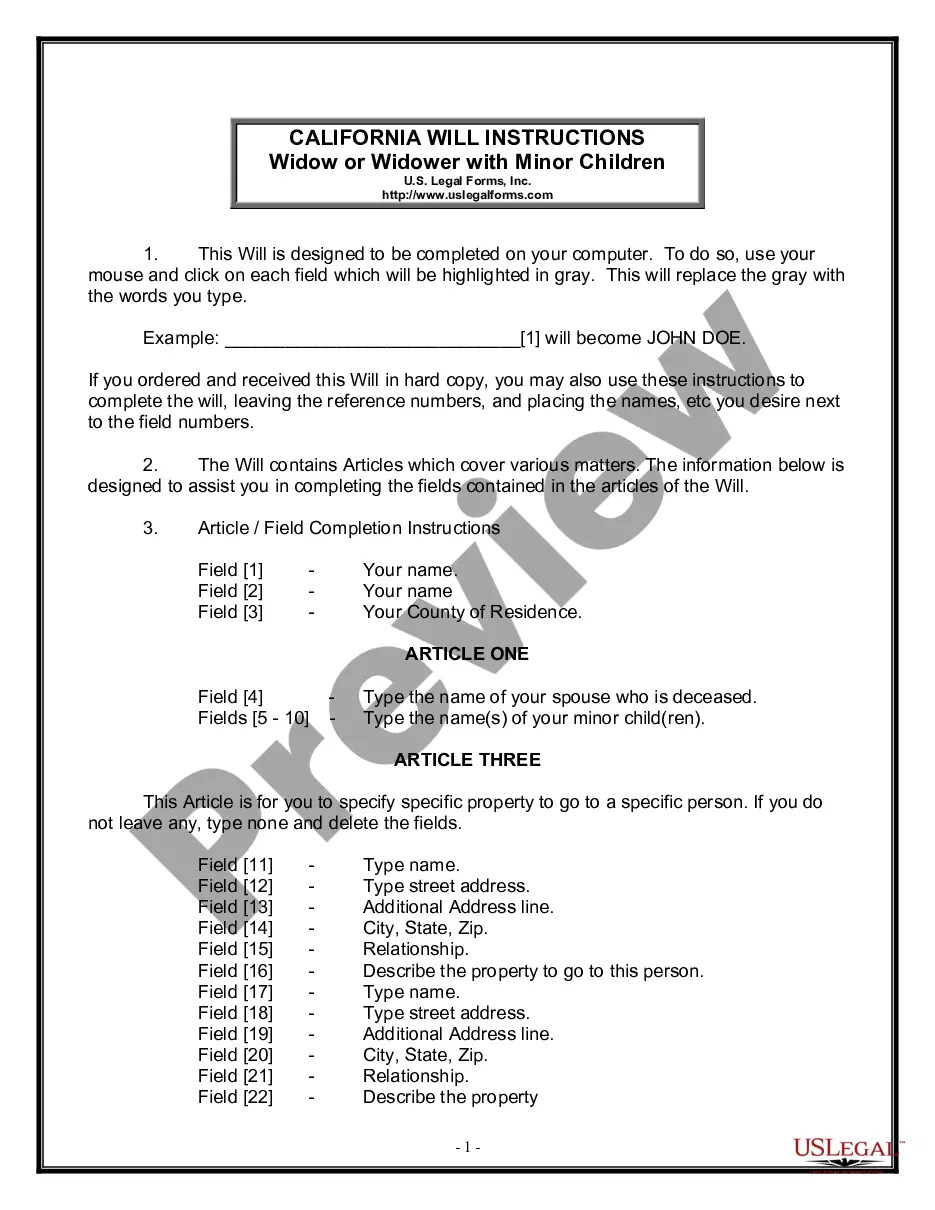

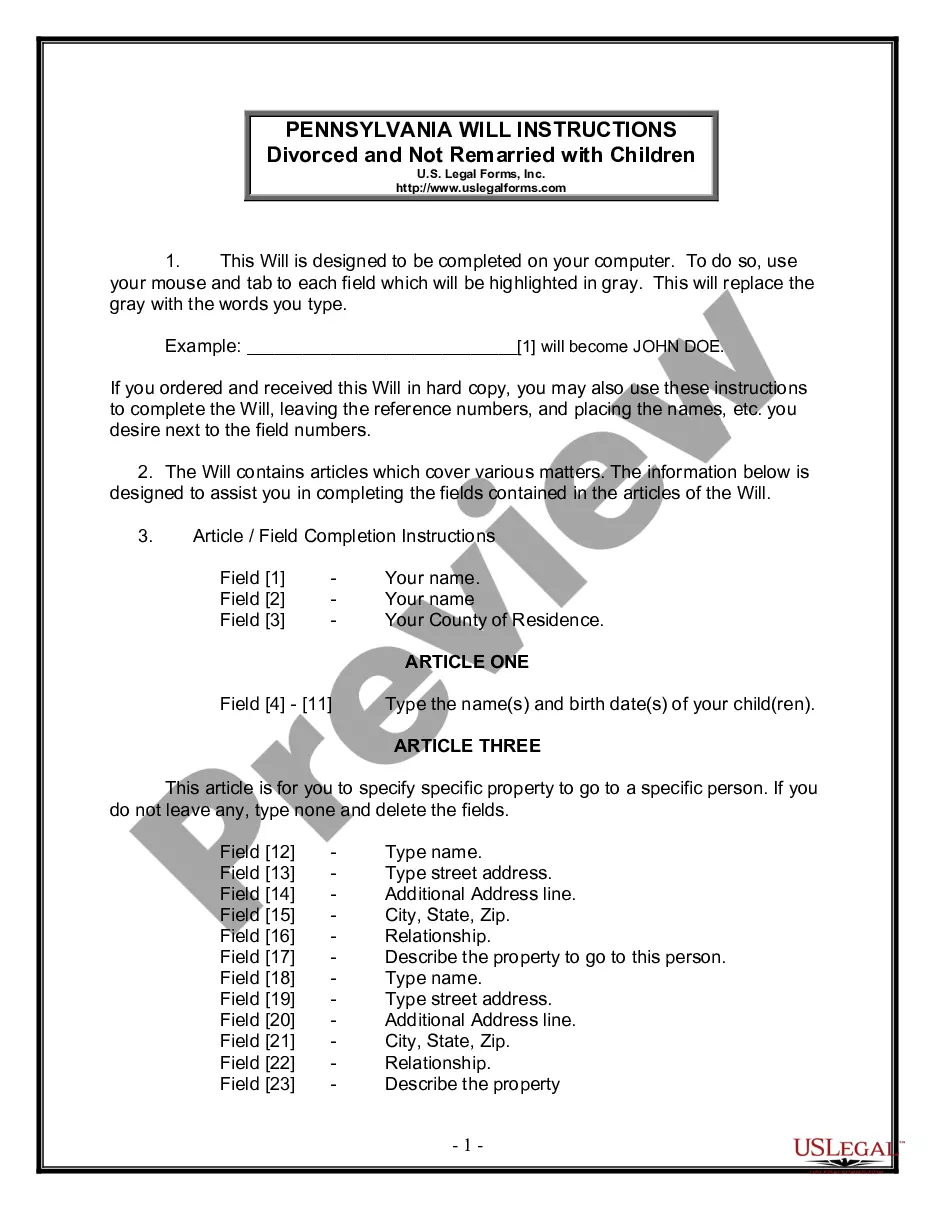

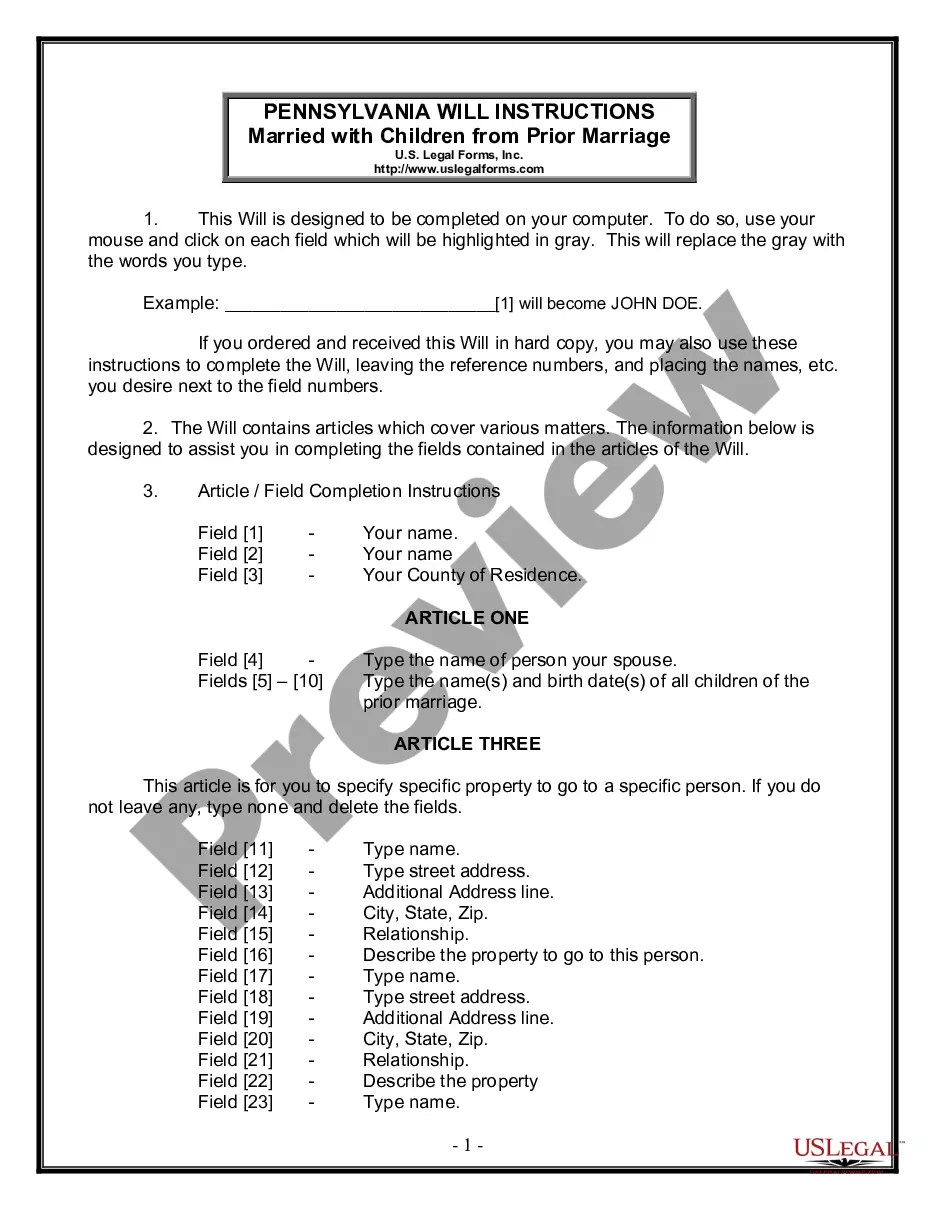

How to fill out Iowa Unsecured Installment Payment Promissory Note For Fixed Rate?

Get access to one of the most expansive catalogue of authorized forms. US Legal Forms is a platform where you can find any state-specific file in couple of clicks, such as Iowa Unsecured Installment Payment Promissory Note for Fixed Rate examples. No reason to spend hours of your time seeking a court-admissible form. Our licensed experts ensure you receive up to date samples all the time.

To leverage the documents library, select a subscription, and sign-up an account. If you did it, just log in and click Download. The Iowa Unsecured Installment Payment Promissory Note for Fixed Rate file will instantly get kept in the My Forms tab (a tab for all forms you download on US Legal Forms).

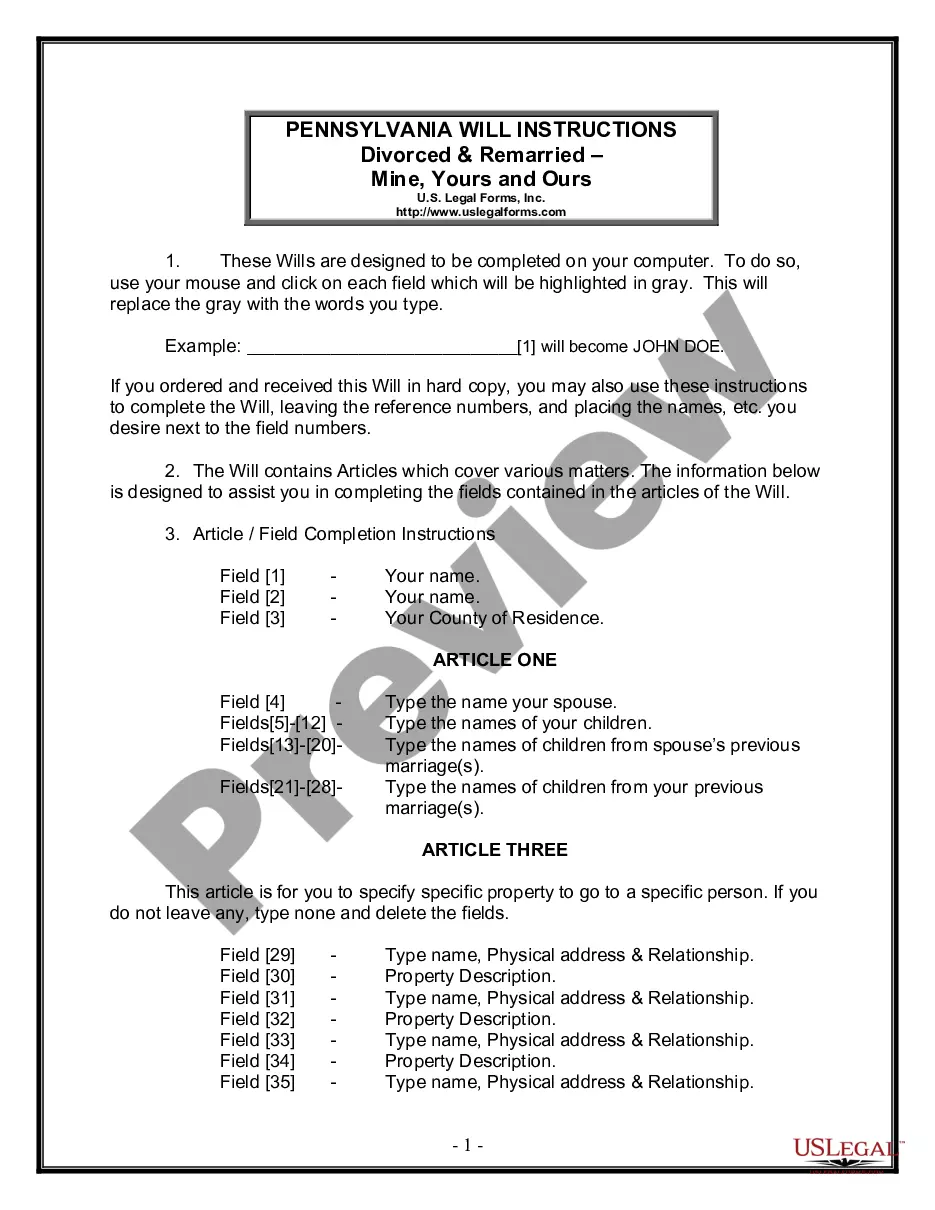

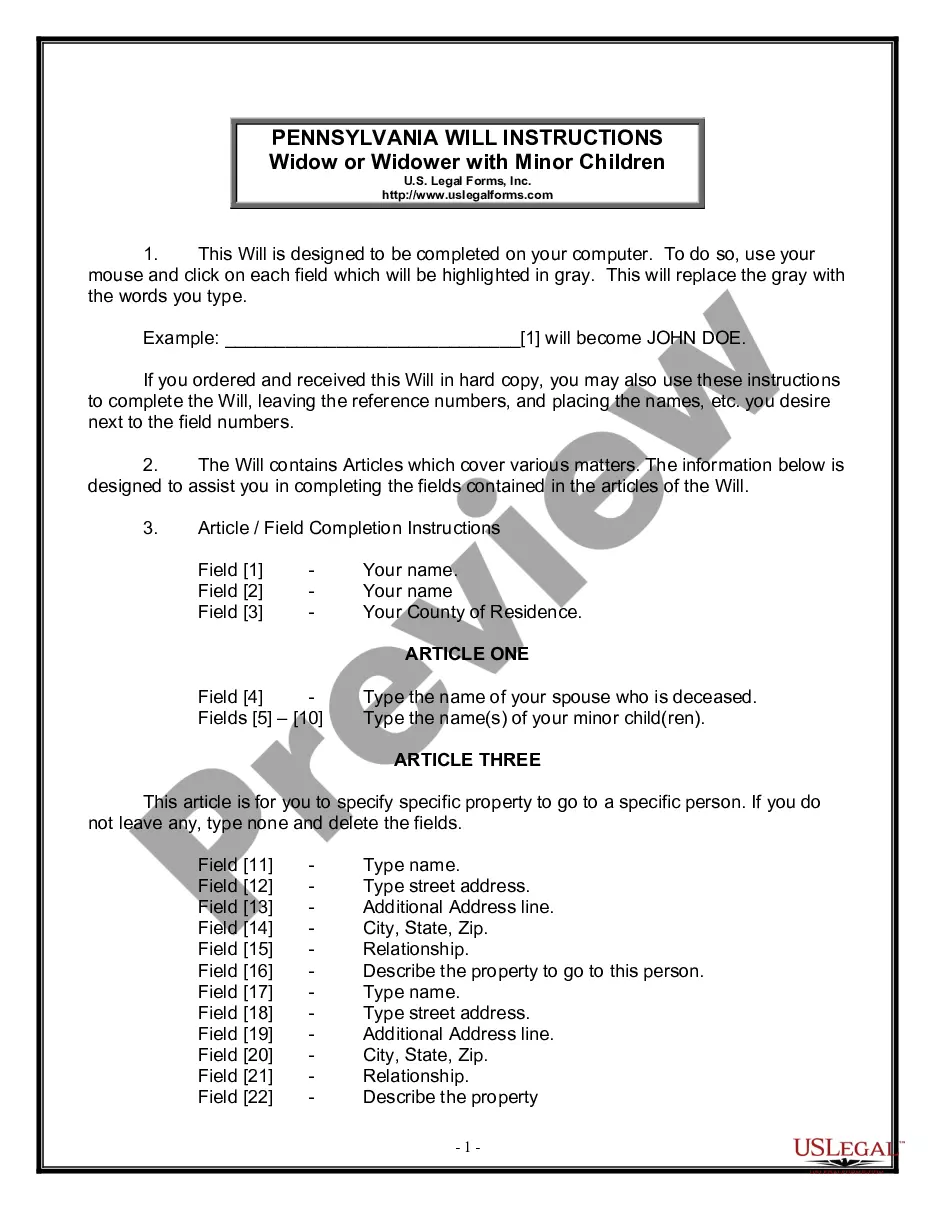

To register a new profile, look at quick instructions below:

- If you're going to utilize a state-specific sample, be sure you indicate the appropriate state.

- If it’s possible, go over the description to understand all of the ins and outs of the document.

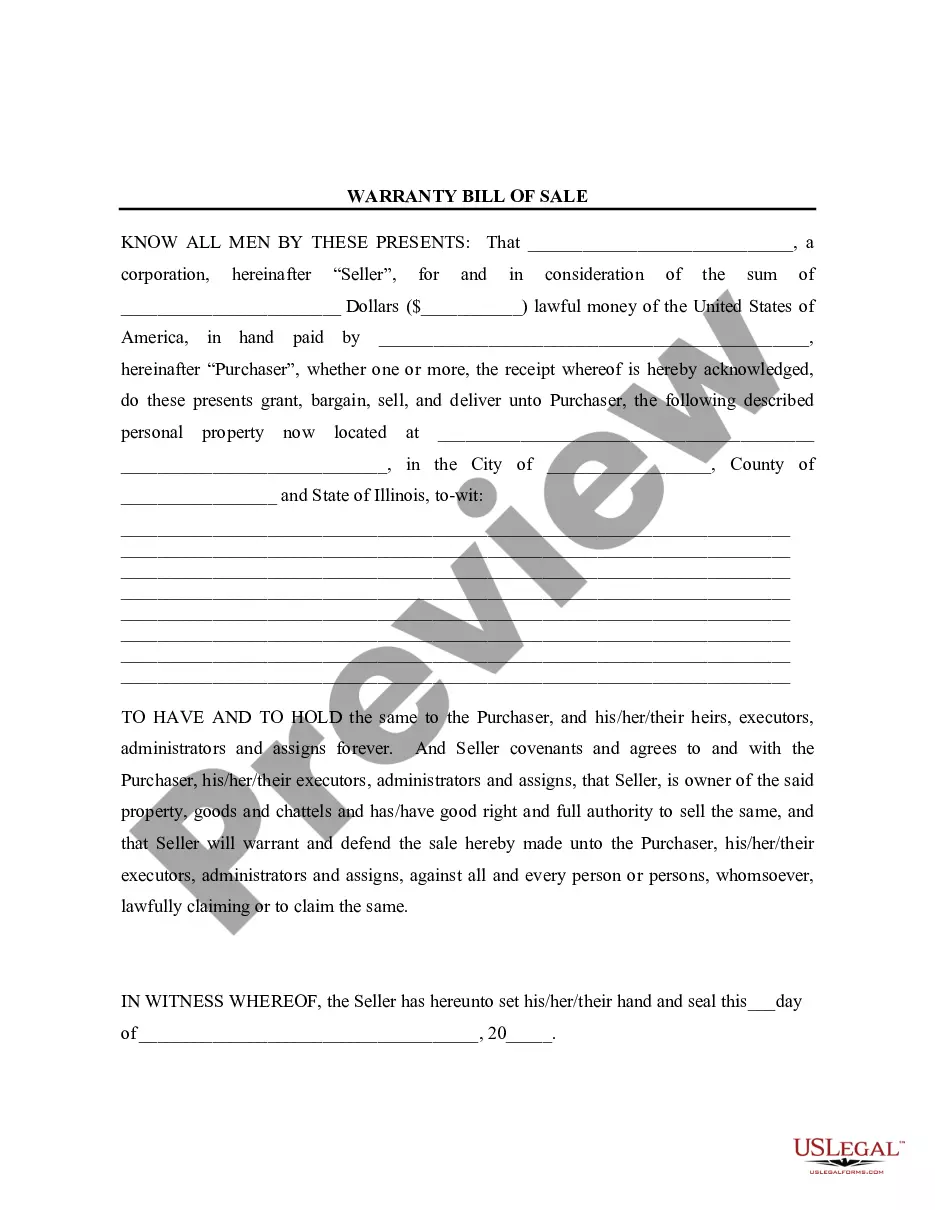

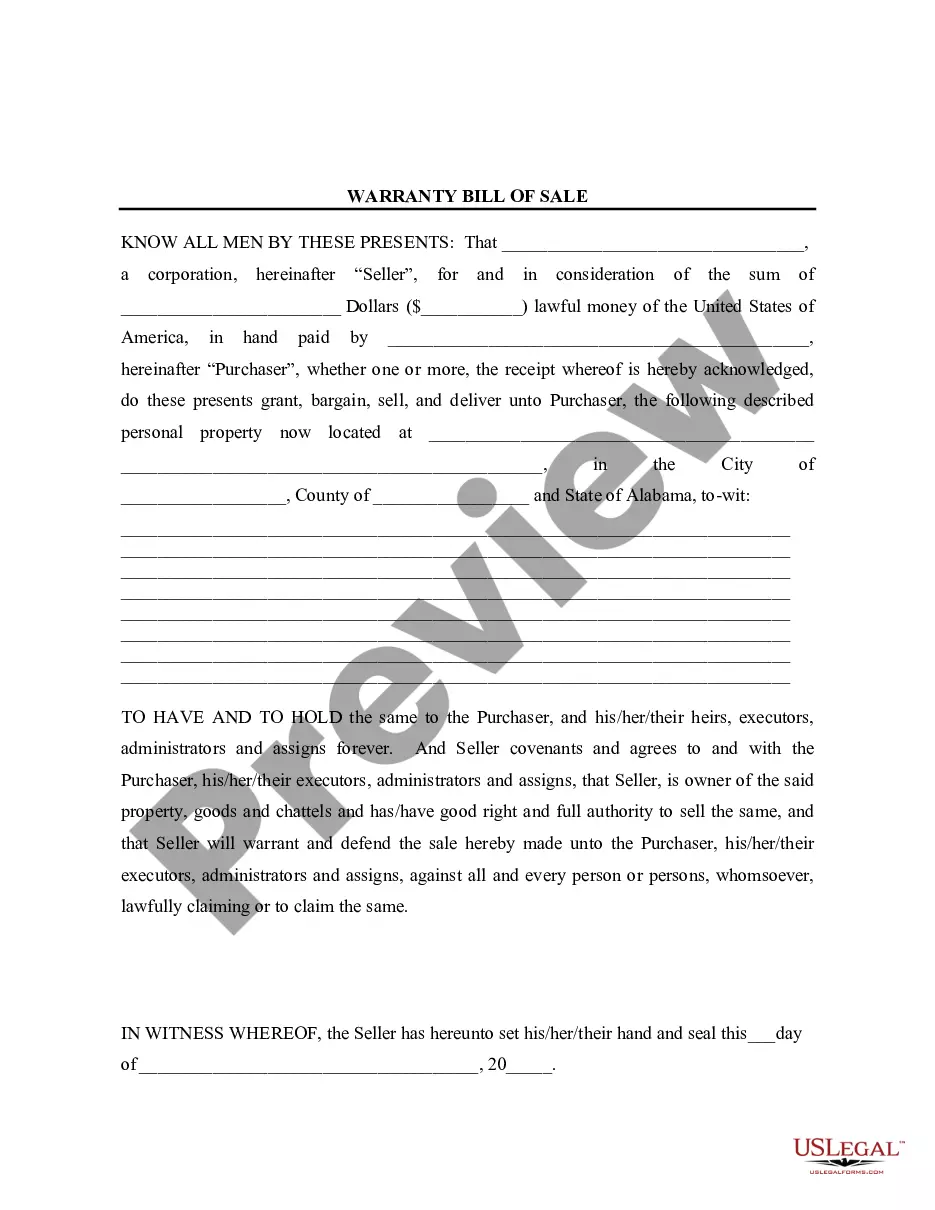

- Use the Preview option if it’s offered to check the document's information.

- If everything’s right, click Buy Now.

- Right after picking a pricing plan, create an account.

- Pay out by card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You ought to complete the Iowa Unsecured Installment Payment Promissory Note for Fixed Rate form and double-check it. To be sure that all things are correct, speak to your local legal counsel for assist. Register and easily find more than 85,000 useful forms.

Form popularity

FAQ

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

A commercial note is the type of promissory note that is signed between a borrower and a financial institution. A real estate note is when a borrower uses an immovable asset as collateral for the credit. Investment note is used by firms and businesses when procuring funds for the enterprise.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Commercial Promissory note A commercial promissory note is used when borrowing money from a commercial lender such as a bank or loan agency. In the event the borrower is unable to make required payments, the lender may demand full payment of the loan including interest.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).