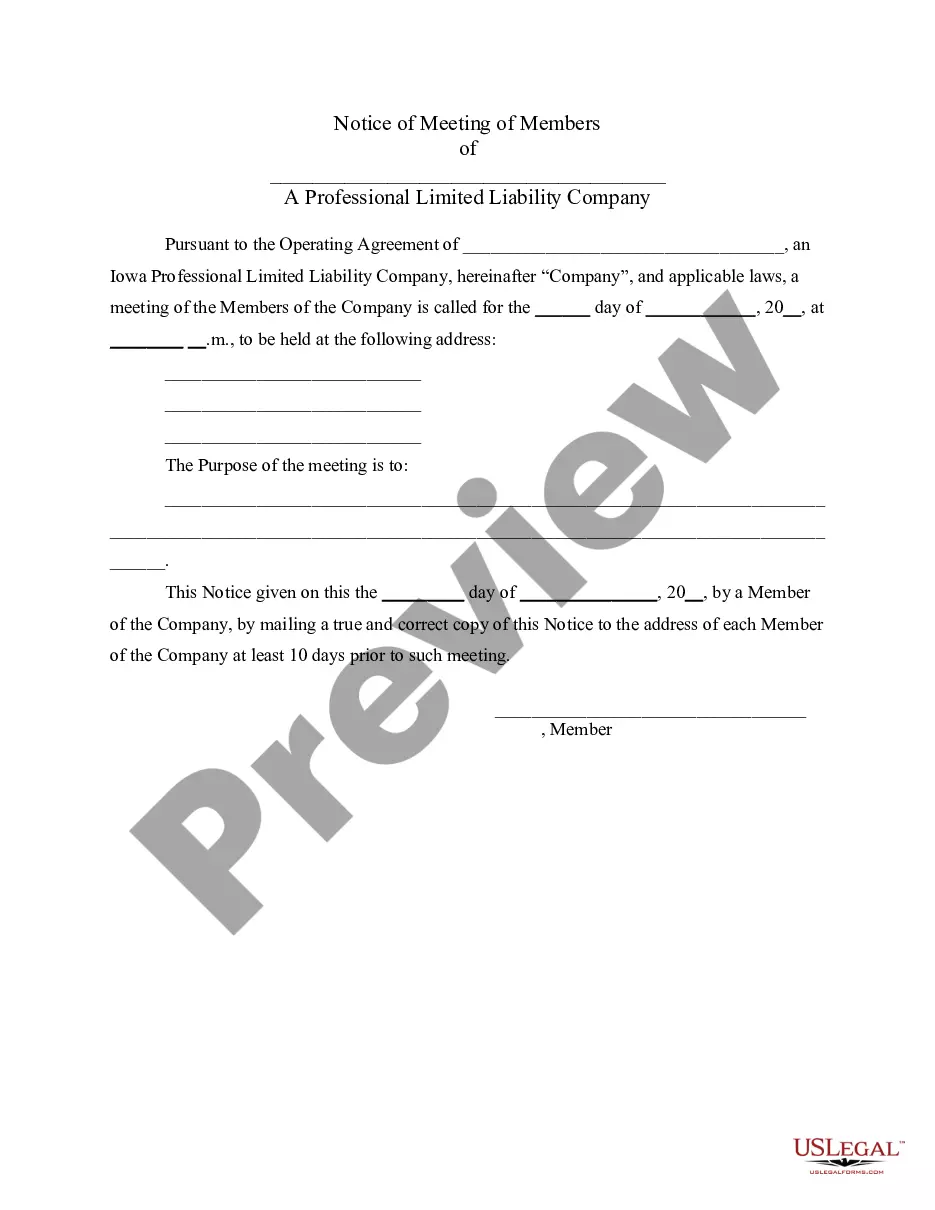

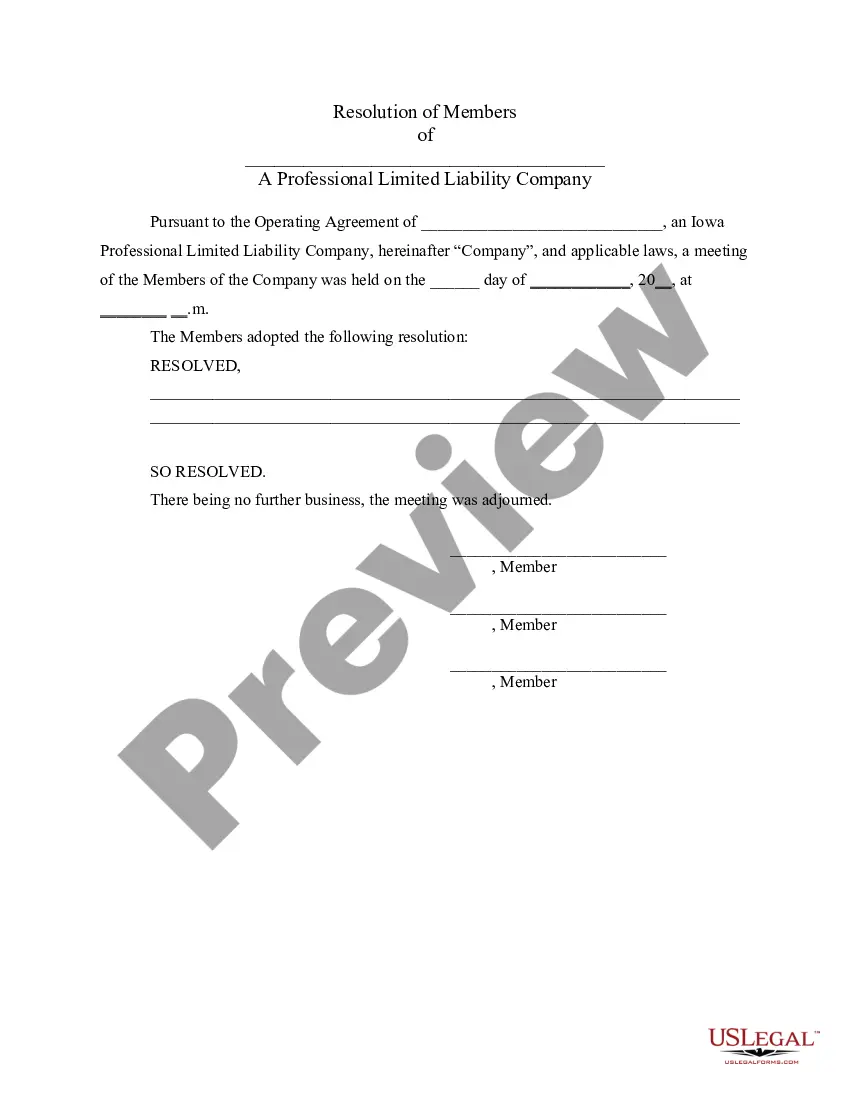

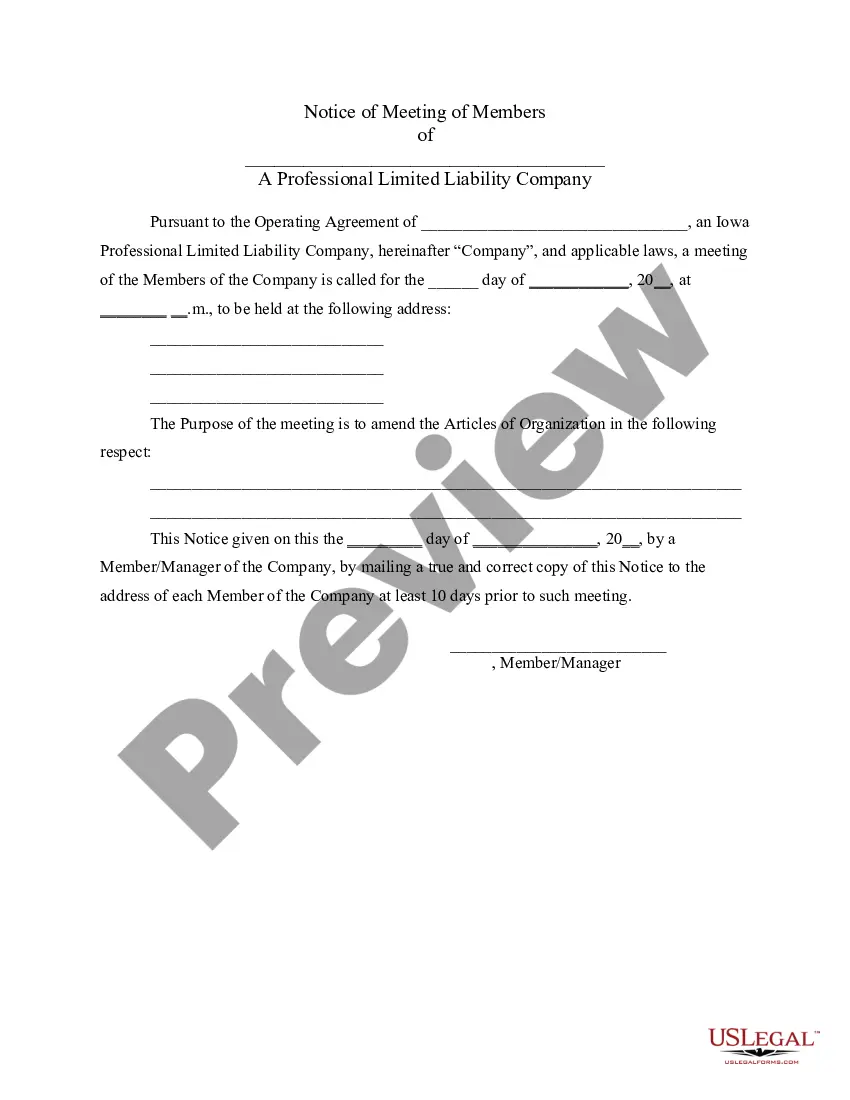

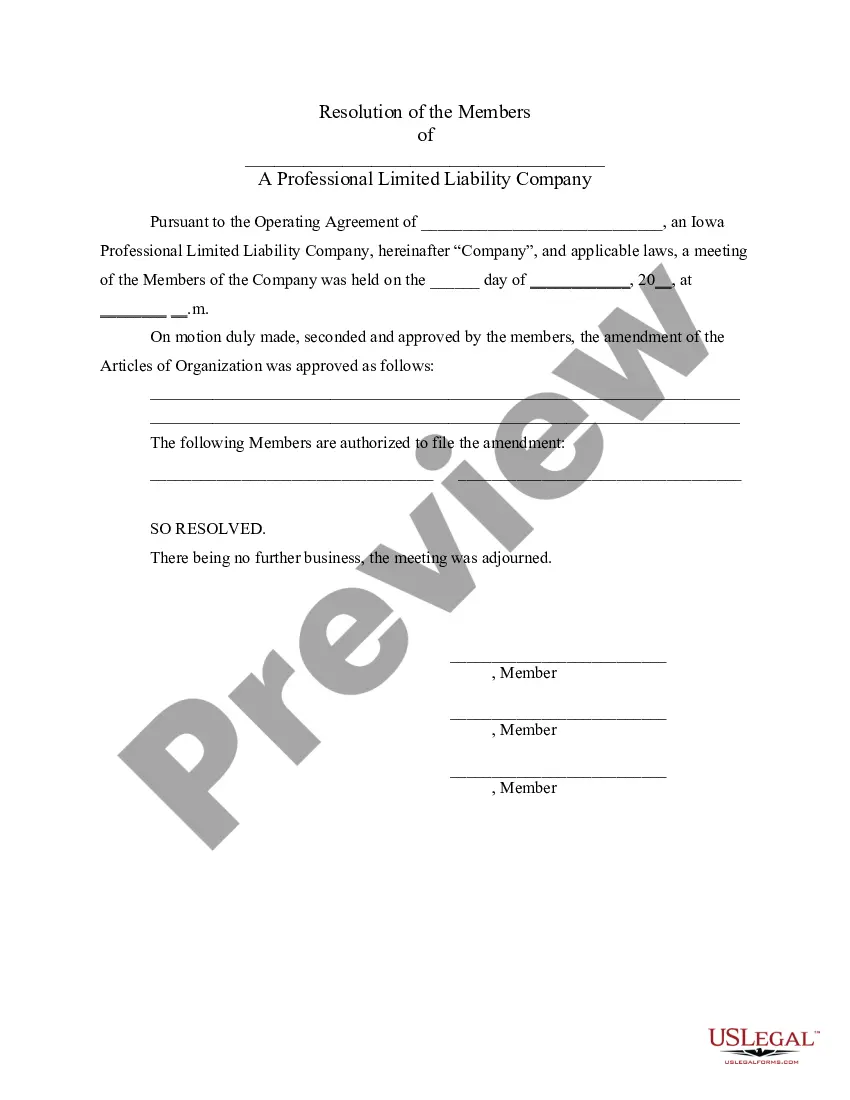

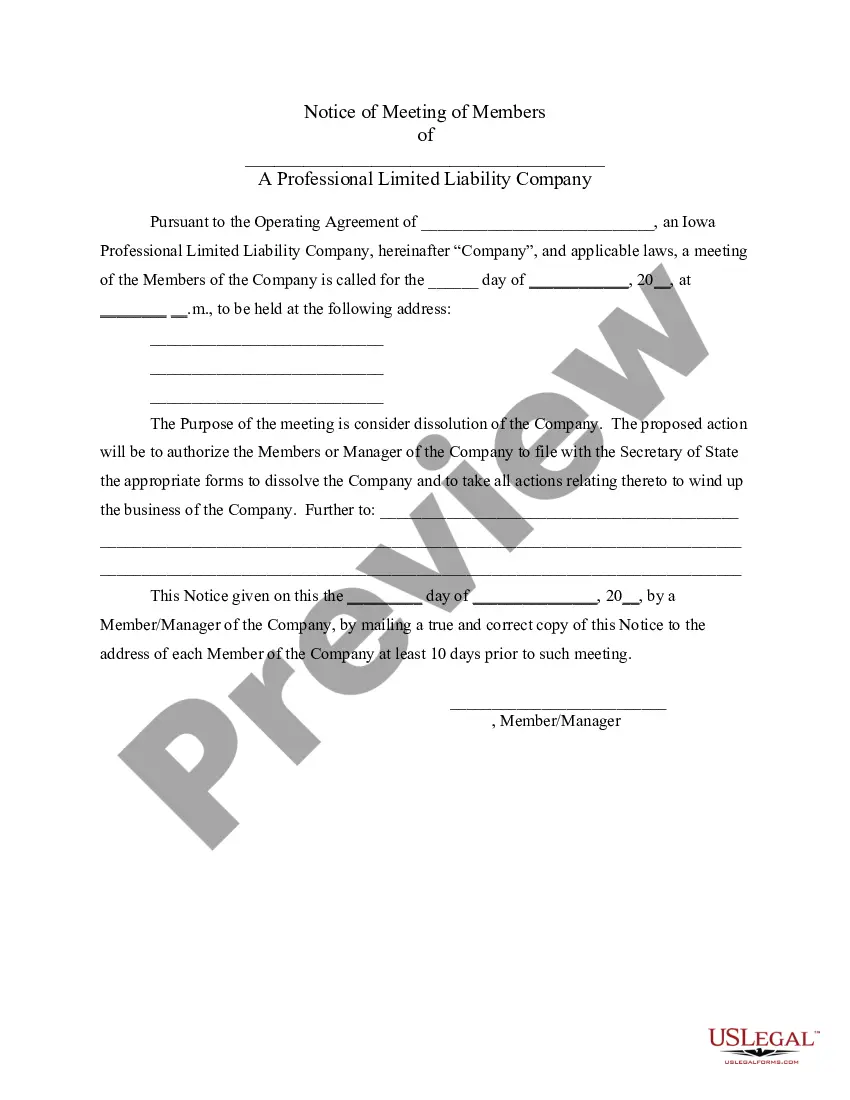

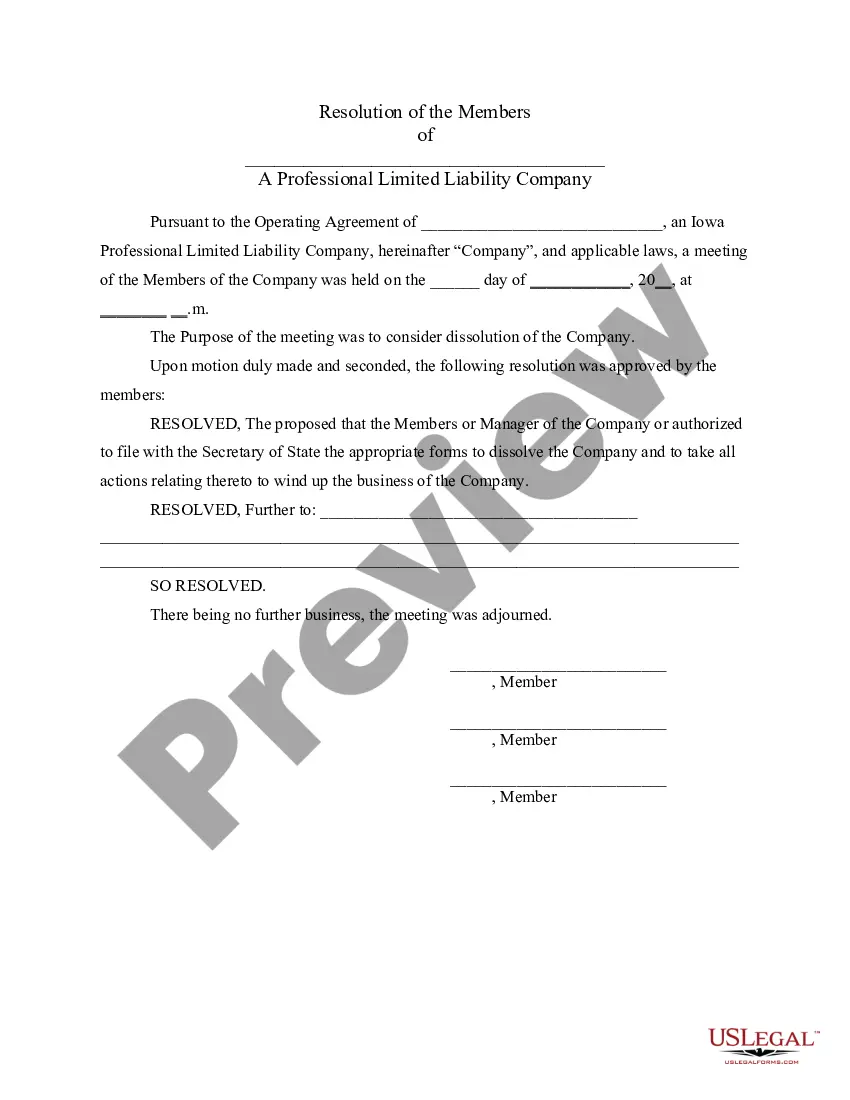

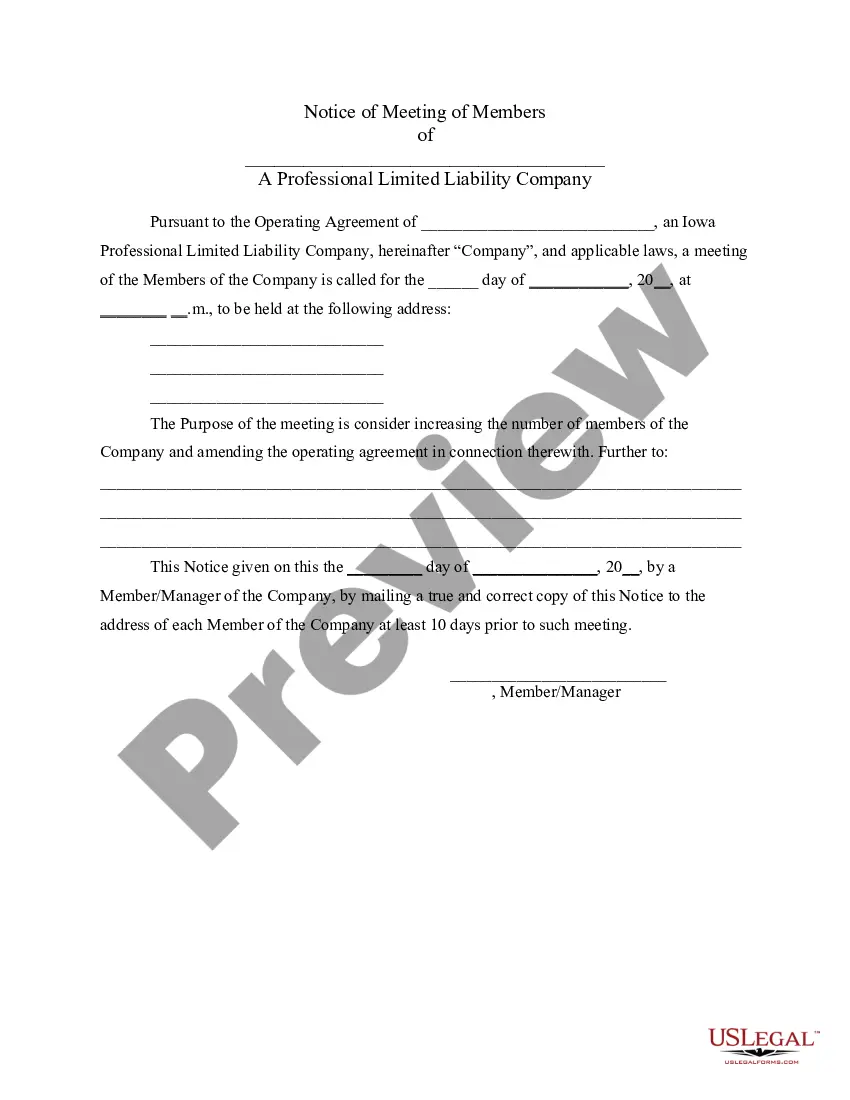

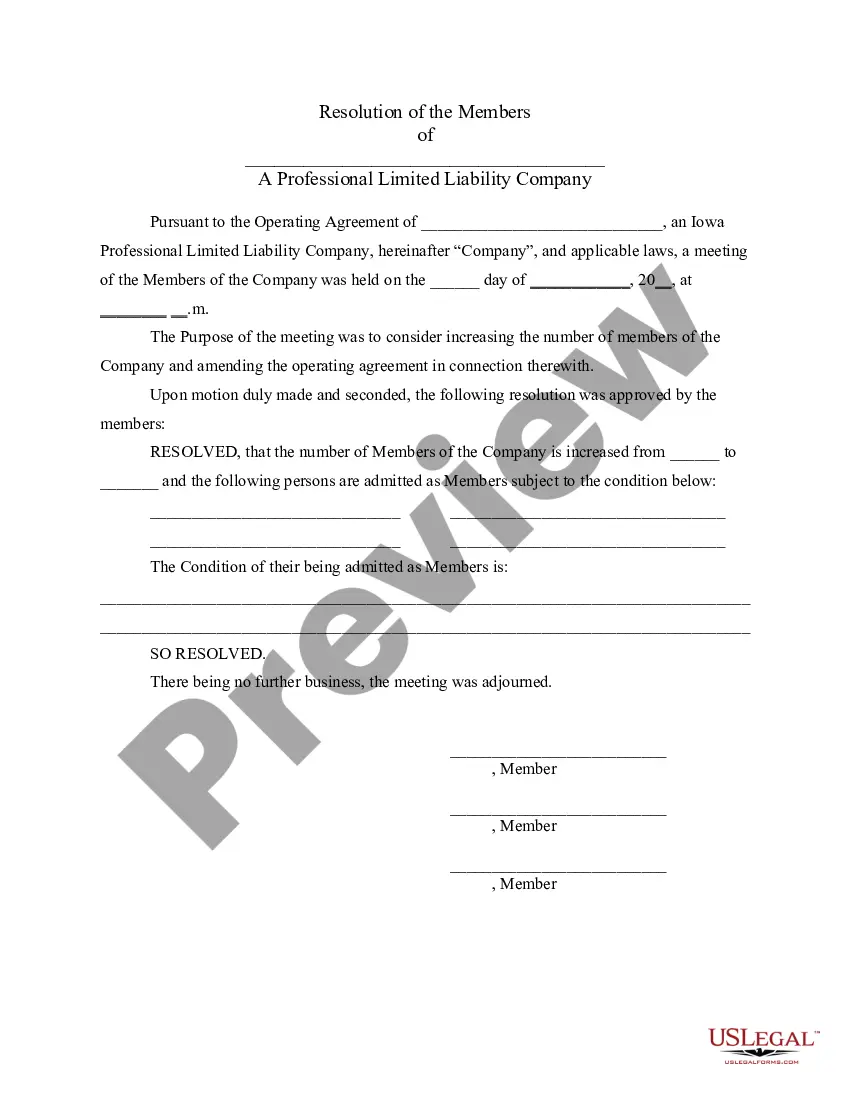

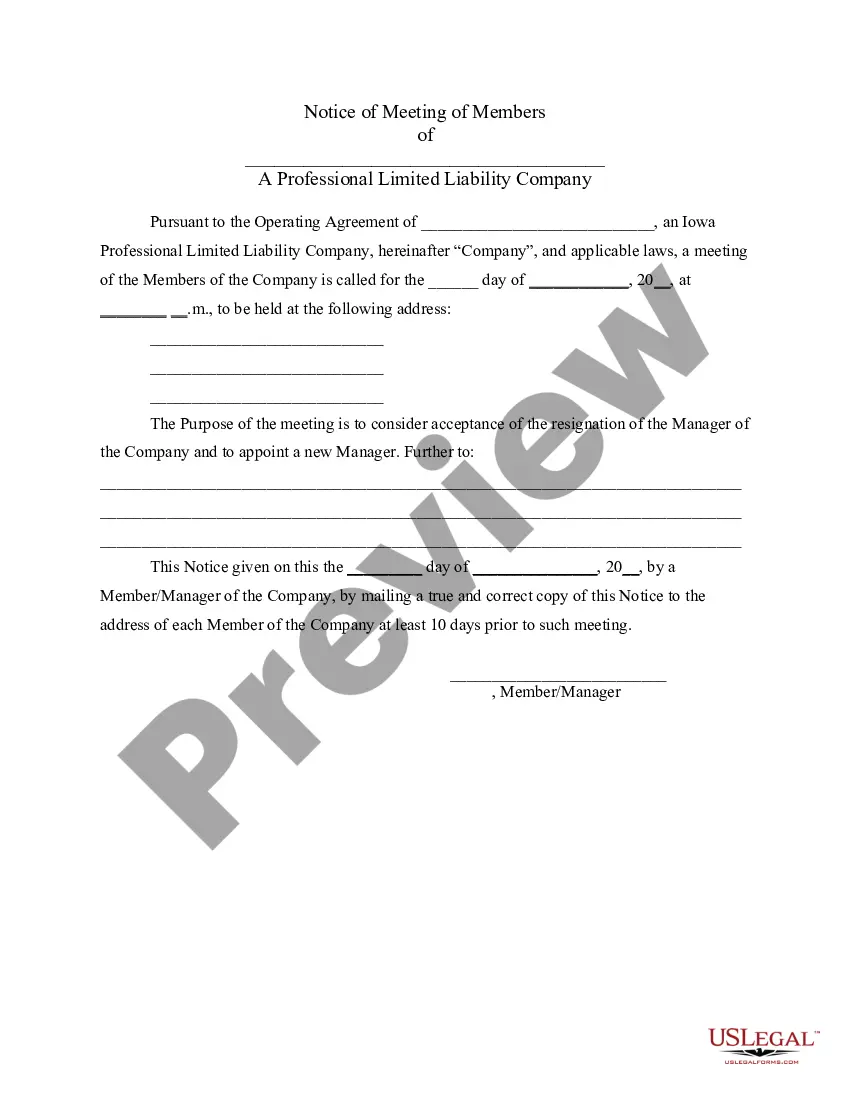

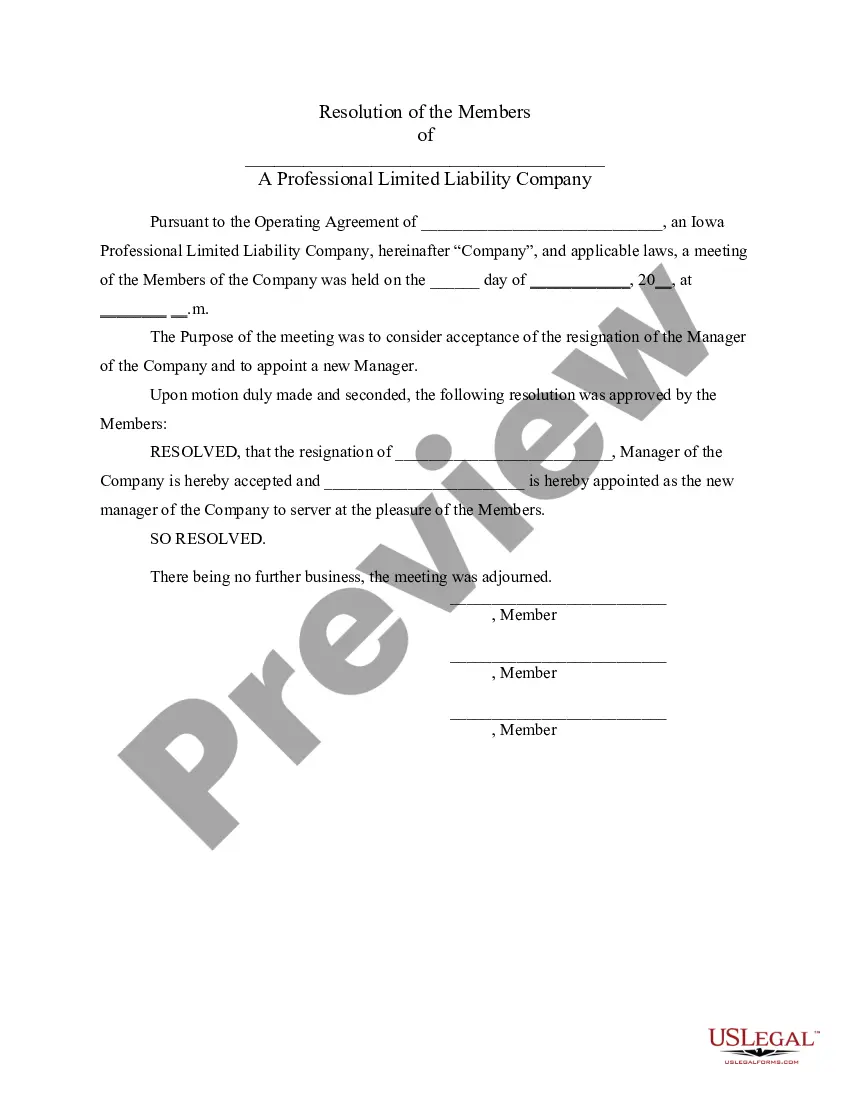

These Professional Limited Liability Company Notices & Resolutions collection contains over 15 forms for use in connection with the operation of a PLLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, and (16) Demand for Indemnity by Member/Manager.

Iowa Professional Limited Liability Company PLLC Notices and Resolutions

Description

How to fill out Iowa Professional Limited Liability Company PLLC Notices And Resolutions?

Get the most comprehensive catalogue of legal forms. US Legal Forms is really a system to find any state-specific form in a few clicks, including Iowa Professional Limited Liability Company PLLC Notices and Resolutions samples. No reason to spend hrs of your time looking for a court-admissible form. Our licensed professionals ensure that you receive up-to-date examples every time.

To benefit from the forms library, pick a subscription, and create an account. If you already did it, just log in and then click Download. The Iowa Professional Limited Liability Company PLLC Notices and Resolutions file will instantly get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new account, look at quick instructions listed below:

- If you're proceeding to use a state-specific example, be sure you indicate the appropriate state.

- If it’s possible, look at the description to know all of the nuances of the document.

- Make use of the Preview function if it’s available to check the document's information.

- If everything’s proper, click on Buy Now button.

- Right after picking a pricing plan, create your account.

- Pay out by credit card or PayPal.

- Save the sample to your computer by clicking Download.

That's all! You should submit the Iowa Professional Limited Liability Company PLLC Notices and Resolutions form and check out it. To make sure that everything is accurate, call your local legal counsel for support. Register and easily look through above 85,000 beneficial templates.

Form popularity

FAQ

Choose your management structure. There are two forms of management for LLCs: member-managed and manager-managed. Choose your title. In a single-member LLC, you have the freedom to choose whatever title best reflects your role. Create an Operating Agreement.

A limited liability company (LLC) structure is the simplest form of legal business structure for business operations.In this LLC setup, the owner would designate persons as officers and directors of the firm. An LLC acts in a way that offers advantages to a company for taxes, profits and losses for its owners.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

A professional limited liability company (PLLC) is a business entity that offers tax benefits and limited liability for professionals, such as lawyers, accountants, and doctors.

The PLLC files a standard Form 1120, Corporate Income Tax Return, and pays taxes at the regular corporate tax rate. It retains earnings as a corporation, however, and doesn't distribute them to members for personal taxation.

Choose a Name for Your LLC. Appoint a Registered Agent. File Certificate of Organization. Prepare an Operating Agreement. Obtain an EIN. File Biennial Reports.

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

The owners of a PLLC are called members, and they have an operating agreement that governs how they work together and divide profits and losses. Many professionals start a PLLC because they want to separate their individual liability from their liability as a member of the business or practice.