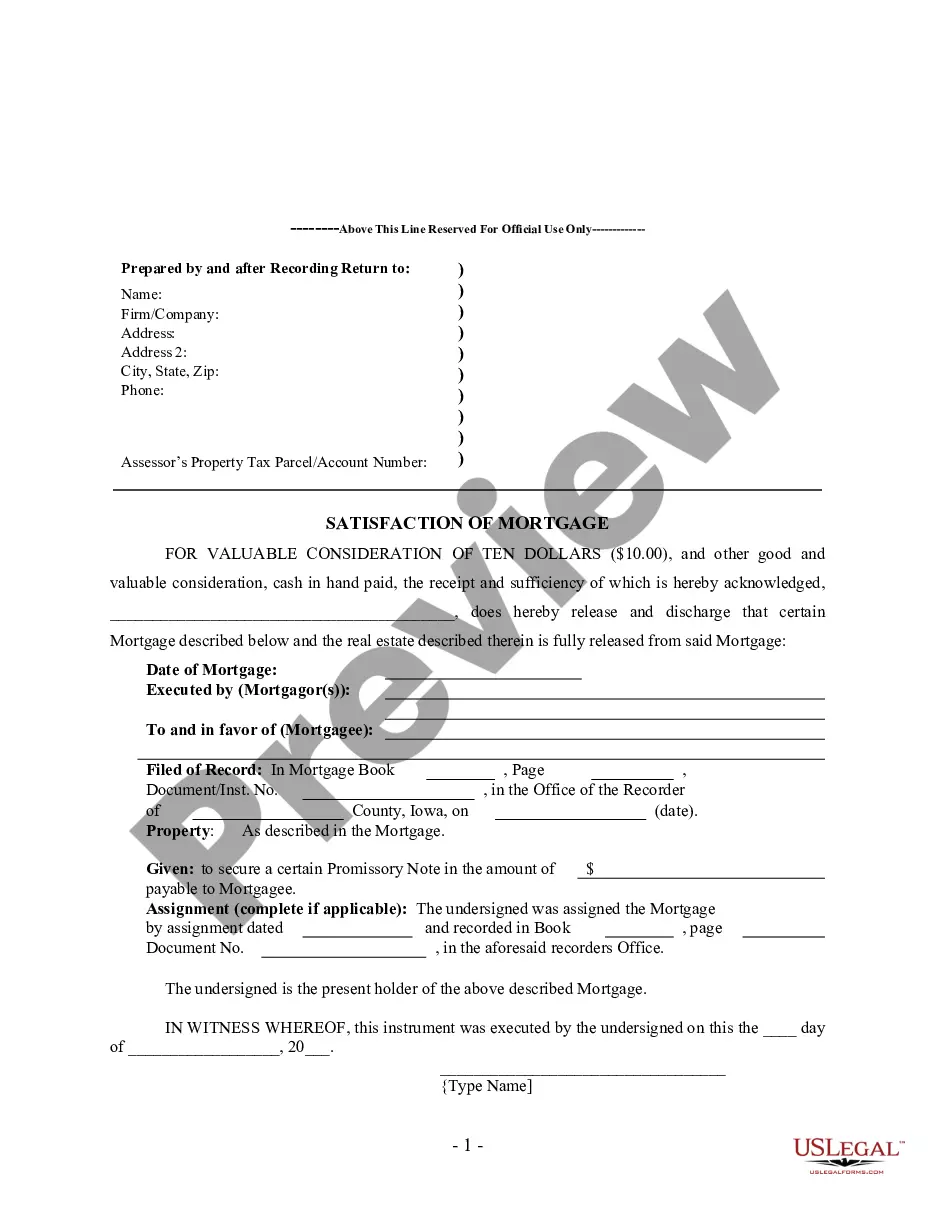

This form is for the satisfaction or release of a mortgage for the state of Iowa by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Iowa Satisfaction, Release or Cancellation of Mortgage by Individual

Description Mortgage Lien Release Form

How to fill out Iowa Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Get one of the most expansive catalogue of authorized forms. US Legal Forms is a system to find any state-specific file in couple of clicks, even Iowa Satisfaction, Release or Cancellation of Mortgage by Individual templates. No reason to waste time of the time trying to find a court-admissible sample. Our qualified specialists ensure that you get up to date examples every time.

To take advantage of the forms library, choose a subscription, and create an account. If you created it, just log in and click on Download button. The Iowa Satisfaction, Release or Cancellation of Mortgage by Individual file will automatically get stored in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new profile, look at quick recommendations below:

- If you're proceeding to utilize a state-specific example, make sure you indicate the appropriate state.

- If it’s possible, review the description to understand all the nuances of the form.

- Use the Preview option if it’s accessible to take a look at the document's content.

- If everything’s correct, click on Buy Now button.

- Right after selecting a pricing plan, make your account.

- Pay out by card or PayPal.

- Downoad the sample to your computer by clicking Download.

That's all! You ought to fill out the Iowa Satisfaction, Release or Cancellation of Mortgage by Individual form and check out it. To be sure that everything is exact, call your local legal counsel for support. Sign up and simply find over 85,000 useful samples.

Mortgage Release Form Form popularity

Iowa Mortgage Release Form Other Form Names

Iowa State Bar Release And Satisfaction Form FAQ

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

A Satisfaction of Mortgage is used to acknowledge the same of a Mortgage agreement.In essence, the Deed of Reconveyance and Satisfaction of Mortgage both serve the same function, which is to show that the borrower has repaid the loan fully and that the lender has no further interest in the property.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.

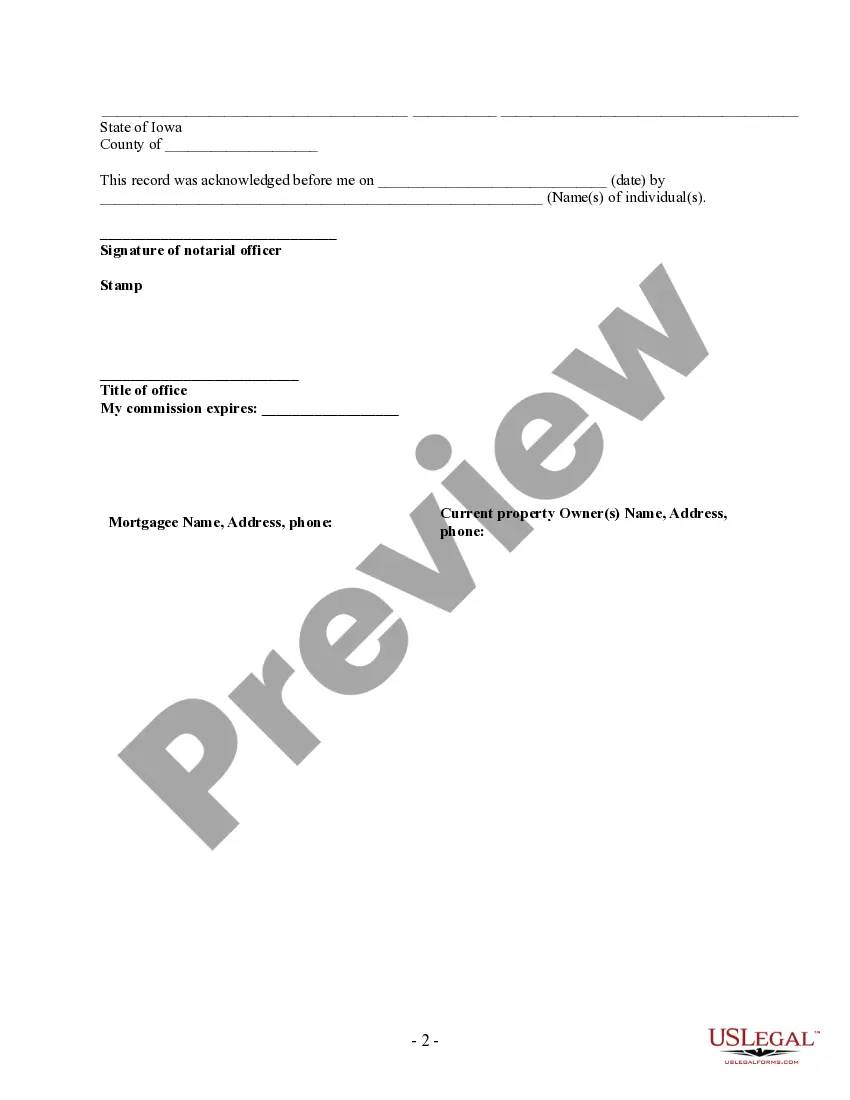

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.