Iowa Debtor's Certified Motion for Discharge (IANB1328) for Ch. 13 is a legal document that the debtor files when they are ready to receive a discharge in their bankruptcy case. This motion must be filed after the debtor has completed all of their repayment obligations and other requirements set forth by the court. The Iowa Debtor's Certified Motion for Discharge (IANB1328) for Ch. 13 outlines the debtor's request for a discharge of all debts and liabilities. It also includes information on the debtor's financial condition, including their income, assets, debts, and expenses. The motion must be verified by the debtor and their attorney. Once the motion is filed, the court will review it and issue a discharge order if all the requirements are met. There are two types of Iowa Debtor's Certified Motion for Discharge (IANB1328) for Ch. 13: the Final Motion for Discharge and the Joint Motion for Discharge. The Final Motion for Discharge is filed when the debtor has completed all the repayment requirements and is ready to receive a discharge. The Joint Motion for Discharge is filed when the debtor and their spouse are filing a joint petition and both spouses are requesting a discharge.

Iowa Debtor's Certified Motion for Discharge (IANB1328) for Ch. 13

Description

How to fill out Iowa Debtor's Certified Motion For Discharge (IANB1328) For Ch. 13?

Completing formal documentation can be quite a hassle unless you have accessible fillable templates. With the US Legal Forms online resource of formal paperwork, you can trust the forms you find, as they all adhere to federal and state laws and are validated by our experts.

Acquiring your Iowa Debtor's Certified Motion for Discharge (IANB1328) for Ch. 13 from our collection is as easy as 1-2-3. Previously registered users with an active subscription simply need to Log In and click the Download button after finding the appropriate template. Later, if needed, users can retrieve the same document from the My documents section of their account. Nevertheless, even if you're new to our platform, registering with a valid subscription will only require a few minutes. Here’s a quick guide for you.

Haven’t you utilized US Legal Forms yet? Register for our service today to acquire any official document swiftly and effortlessly whenever you need to, and maintain your paperwork organized!

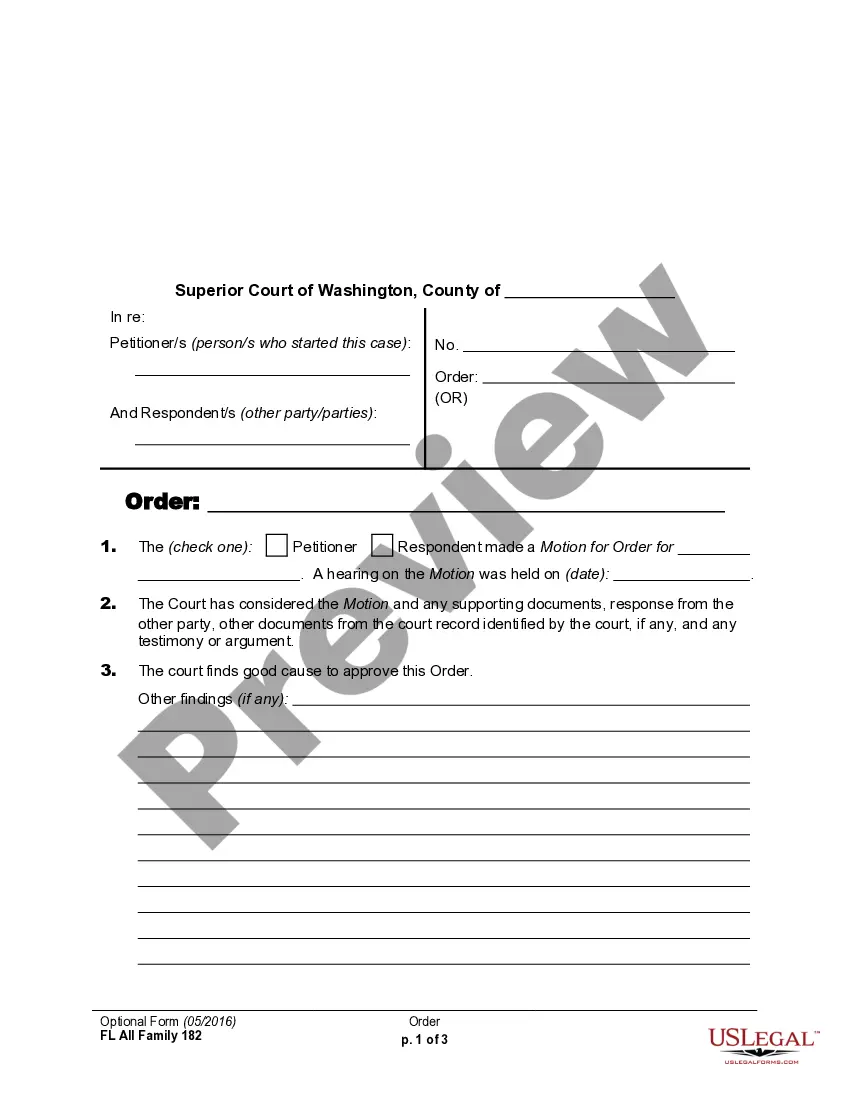

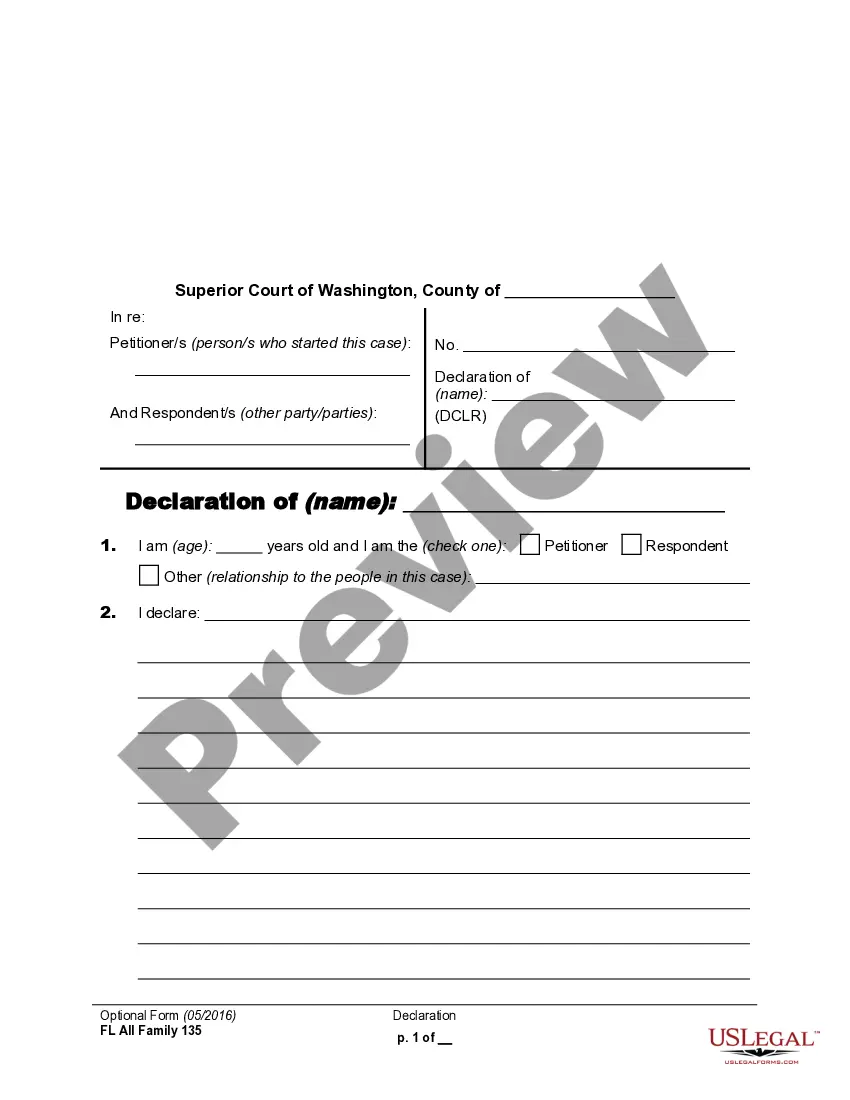

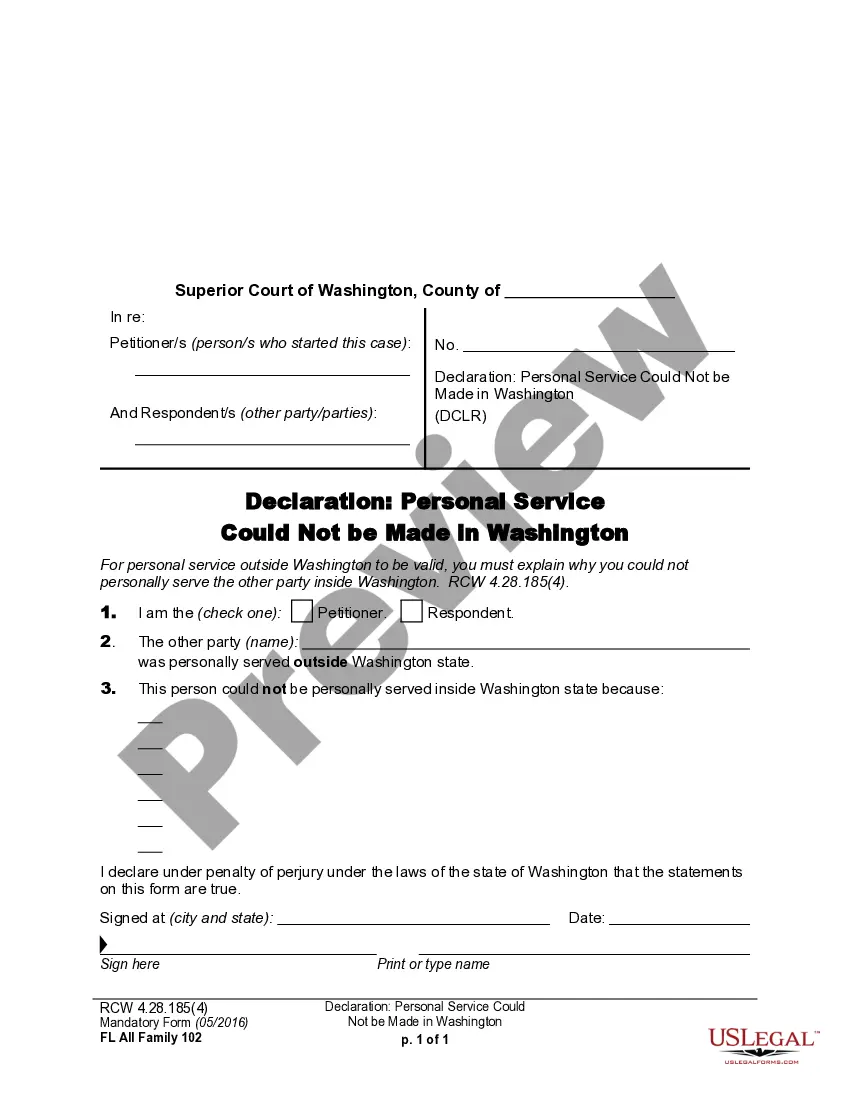

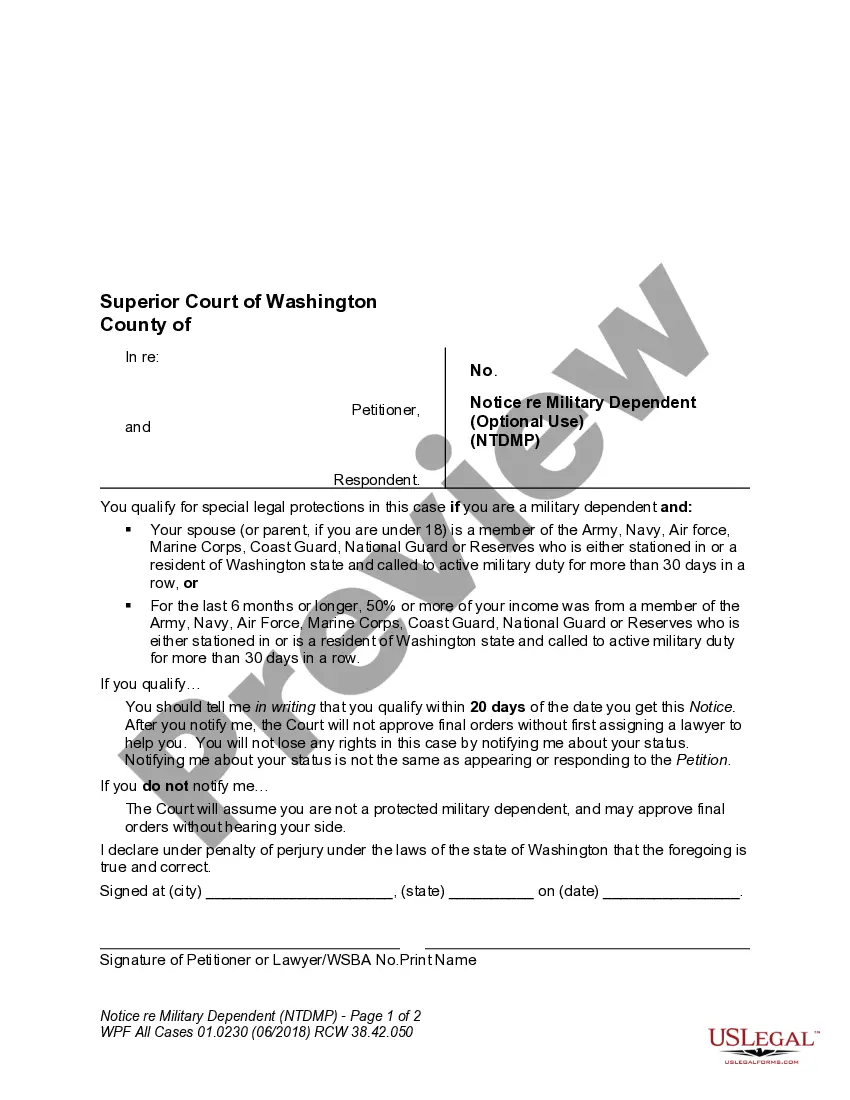

- Form compliance review. You should carefully examine the content of the form you desire and ensure that it meets your requirements and complies with your state laws. Previewing your document and assessing its overall description will assist you in doing just that.

- Alternative search (optional). If any discrepancies arise, explore the library utilizing the Search tab located at the top of the page until you discover a fitting template, and click Buy Now once you find the one you need.

- Account creation and form acquisition. Sign up for an account with US Legal Forms. After account verification, Log In and select your preferred subscription plan. Proceed with payment to continue (PayPal and credit card options are available).

- Template download and subsequent use. Choose the file format for your Iowa Debtor's Certified Motion for Discharge (IANB1328) for Ch. 13 and click Download to save it on your device. Print it to complete your documentation manually, or utilize a comprehensive online editor to prepare an electronic version more quickly and effectively.

Form popularity

FAQ

If you had a Chapter 13 filing that ended with a discharge and you need to refile Chapter 13 again, you cannot file any sooner than two years from when your previous case was filed.

If the Chapter 13 plan is dismissed, creditors may immediately initiate or continue with state court litigation pursuant to applicable state law to foreclose on the petitioner's property or garnish their income. If a bankruptcy case is dismissed, the legal affect is that the bankruptcy is deemed void.

Final Step: Final Decree (Case Closed) and Freedom! About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.

Closing of a Bankruptcy Case ? Closing means that all activity in the main bankruptcy case is completed. This means that all motions have already been ruled upon, and if a trustee was appointed, the trustee has filed a statement that all trustee duties have been completed. See related FAQs below.

After receiving all required payments under the plan (including any tax refunds owed) and completing an audit to determine that all amounts owed were received, the Chapter 13 Trustee will file a Certificate of Final Payment with the Bankruptcy Court.

If a debtor fails to keep up with payments under their repayment plan in a Chapter 13 bankruptcy, the bankruptcy trustee may file a motion to dismiss their case. This means that their debts would not be discharged because the case would be considered unsuccessful.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.