Iowa Statement of Foreign Qualification Of Foreign Limited Liability Partnership

Description

How to fill out Iowa Statement Of Foreign Qualification Of Foreign Limited Liability Partnership?

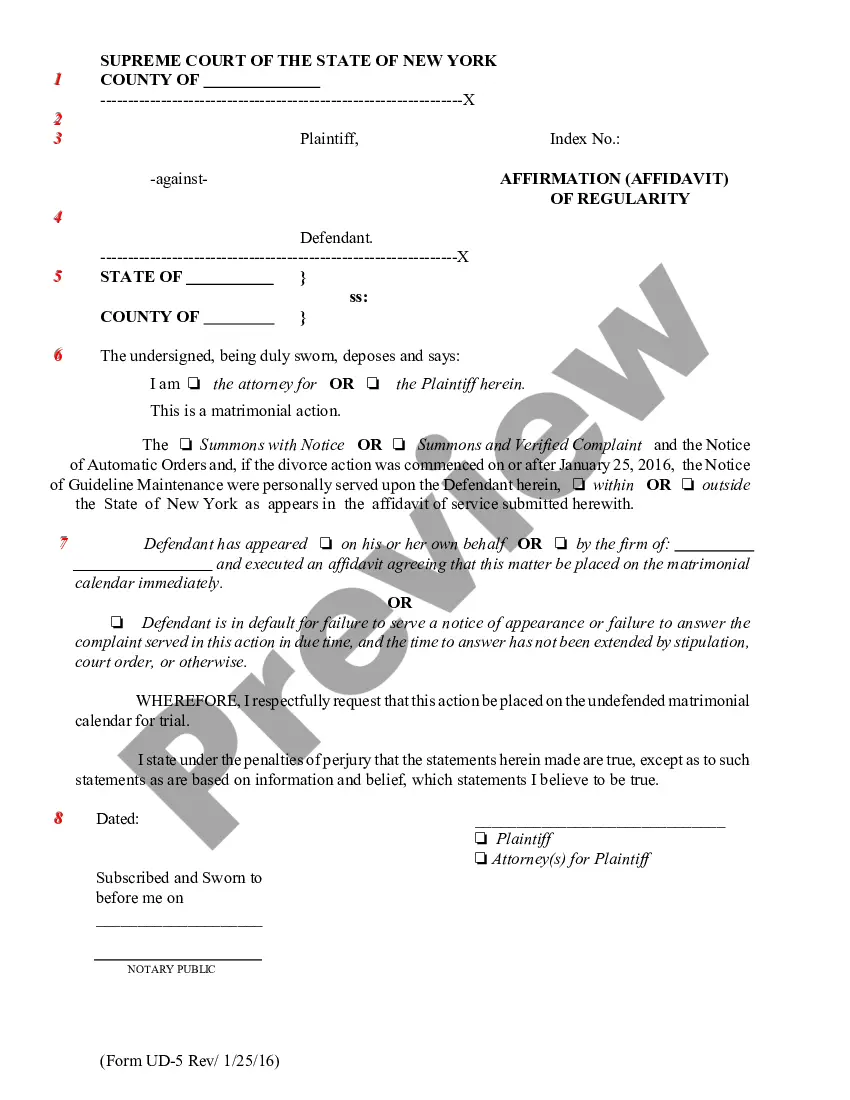

Coping with legal paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Iowa Statement of Foreign Qualification Of Foreign Limited Liability Partnership template from our library, you can be sure it meets federal and state regulations.

Working with our service is simple and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Iowa Statement of Foreign Qualification Of Foreign Limited Liability Partnership within minutes:

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Iowa Statement of Foreign Qualification Of Foreign Limited Liability Partnership in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Iowa Statement of Foreign Qualification Of Foreign Limited Liability Partnership you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

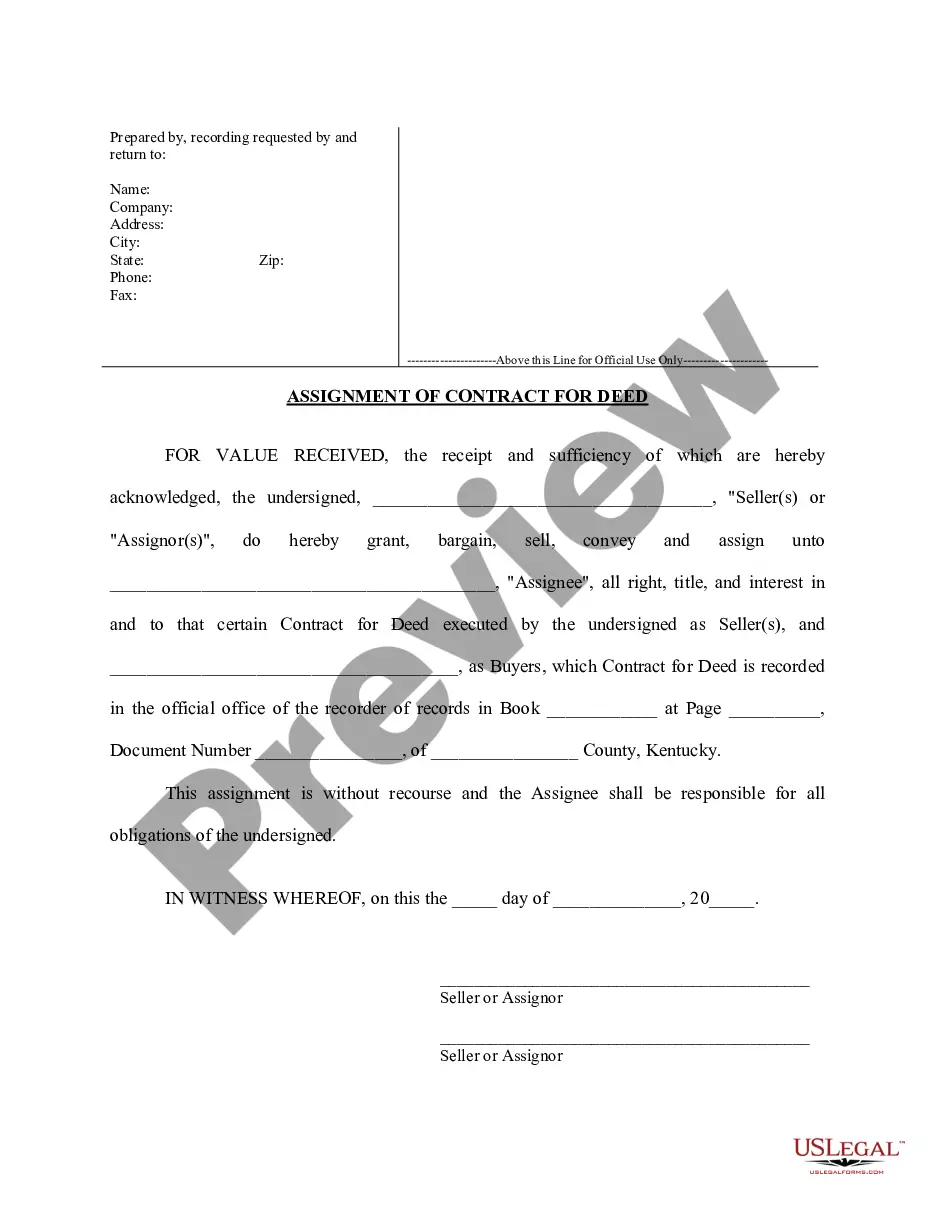

A certificate of organization form, sometimes referred to as the articles of organization, is the document that one must complete and submit to the state to establish the creation of an LLC within Iowa. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

Iowa allows LLC domestication under IA Code § 489.1010, part of the Revised Uniform Limited Liability Company Act.

Yes, you can be your own registered agent in Iowa. However, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

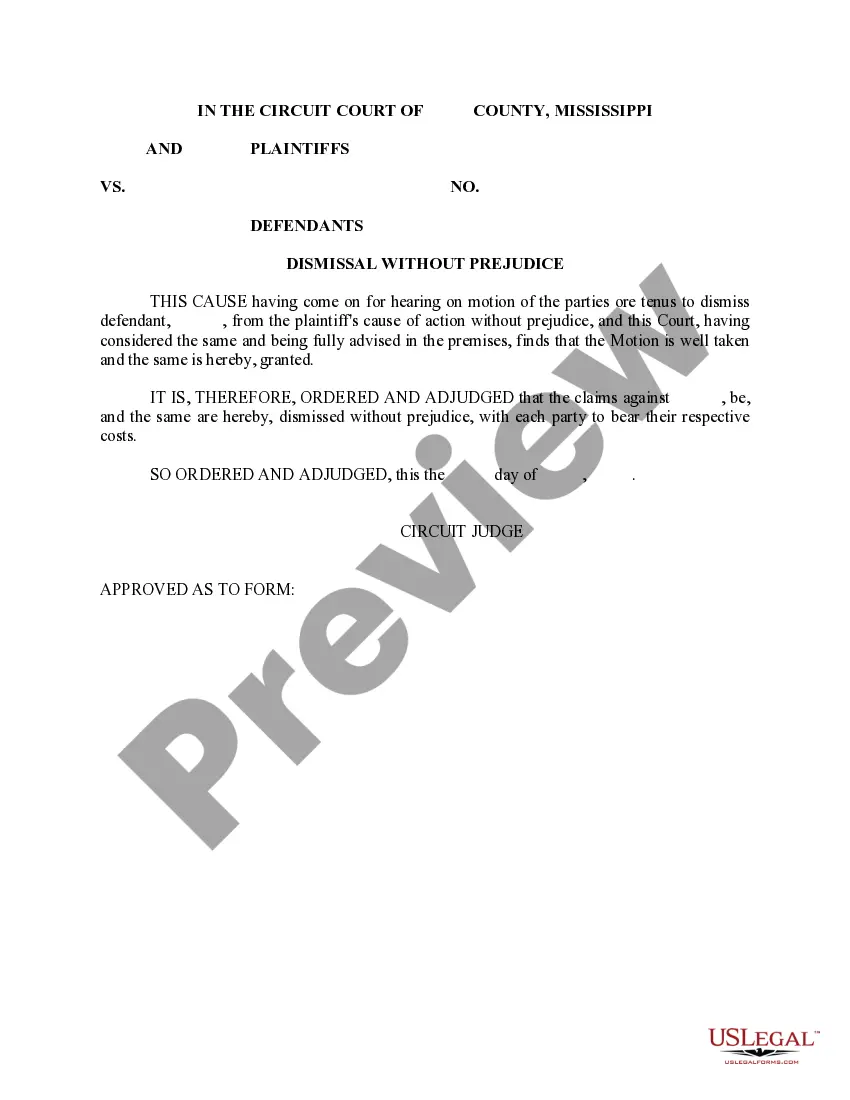

A foreign business entity can be registered with the State by submitting a Certificate of Authority. You may submit this file through the Fast Track Filing website. The version submitted depends on the type of entity being registered (LLC, Profit, Nonprofit).

What is an Iowa certificate of authority? Companies are required to register with the Iowa Secretary of State before doing business in Iowa. Businesses that are incorporated in another state will typically apply for an Iowa certificate of authority.

An Iowa Certificate of Standing (COS) is proof that your registered business is a valid legal entity under the state's laws. Signed by the Secretary of State (SOS), the certificate can help your business conduct its operations smoothly beyond state borders.

The term ?transacting business? is murky and isn't defined in the statute. Iowa law does, however, govern when foreign LLC's have to collect sales tax, which offers some guidance. Under Iowa law, a business must have a physical presence or nexus in the Iowa in order to be required to collect sales tax from residents.

This certificate is proof that your LLC is now an official legal business in your state. If you operate your business from several different states, you will need to have a certificate of organization from each state in which the business operates.