The Iowa Application for Business Property Tax Credit is a tax incentive program administered by the Iowa Department of Revenue that allows businesses to receive a credit on their Iowa income tax return for a portion of their property taxes paid on Iowa business property. The program is designed to help businesses offset the cost of property taxes and encourage economic development in the state. There are two types of Iowa Application for Business Property Tax Credits: the High Quality Jobs Program and the Small Business Property Tax Credit. The High Quality Jobs Program provides a tax credit of up to 50% of the total property taxes paid on Iowa business property for businesses that meet certain criteria, including creating new jobs and investing in capital improvements. The Small Business Property Tax Credit provides a tax credit of up to 15% of the total property taxes paid on Iowa business property for businesses with fewer than 50 employees and total property tax payments of less than $25,000.

Iowa Application for Business Property Tax Credit

Description

How to fill out Iowa Application For Business Property Tax Credit?

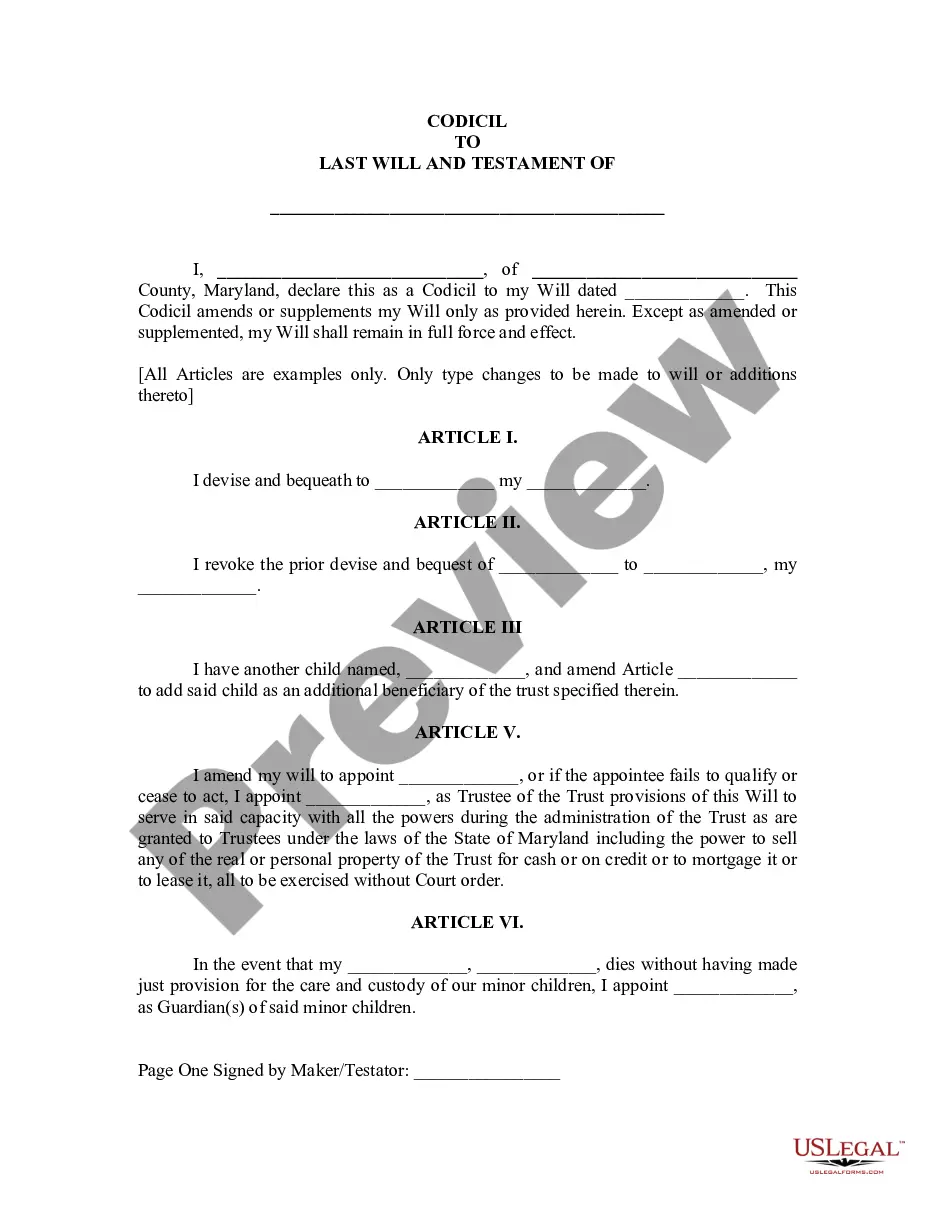

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are examined by our specialists. So if you need to complete Iowa Application for Business Property Tax Credit, our service is the perfect place to download it.

Getting your Iowa Application for Business Property Tax Credit from our library is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button after they find the proper template. Afterwards, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance check. You should carefully review the content of the form you want and check whether it satisfies your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Iowa Application for Business Property Tax Credit and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Iowa offers a personal tax credit equal to 50% of the federal solar tax credit of 26%. So, for an average 6-kW solar energy system installed for $18,000, you are eligible for $4,680 from the Federal government (26% $18,000), and an additional $2,340 (50% of the Federal credit).

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

Iowa Homestead Tax Credit Eligibility: Must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Persons in the military or nursing homes who do not occupy the home are also eligible.

The Business Property Tax Credit (BPTC) is a credit issued against the tax statements of business property (Commercial/Industrial classes), similar to Homestead Credits which can be applied to residential property. For business landowners who apply for this credit, the property taxes for the year are reduced.

Workforce Housing Investment Tax Credit This credit is limited to 10% of $150,000 for each home or individual unit. Any credit in excess of the tax liability is not refundable but may be carried forward to the tax liability for the following five years or until depleted, whichever is earlier.

IDR Announces: Homestead Tax Exemption for Claimants 65 Years of Age or Older. Iowa Department Of Revenue.

Iowa Homestead Tax Credit The current credit is equal to the actual tax levy on the first $4,850 of actual value. Eligibility: Must own and occupy the property as a homestead on July 1 of each year, declare residency in Iowa for income tax purposes and occupy the property for at least six months each year.

In 2023, Iowa will no longer have the standard deduction and state deduction for federal taxes paid. The state's exempting retirement income and some farm rental income from taxes.