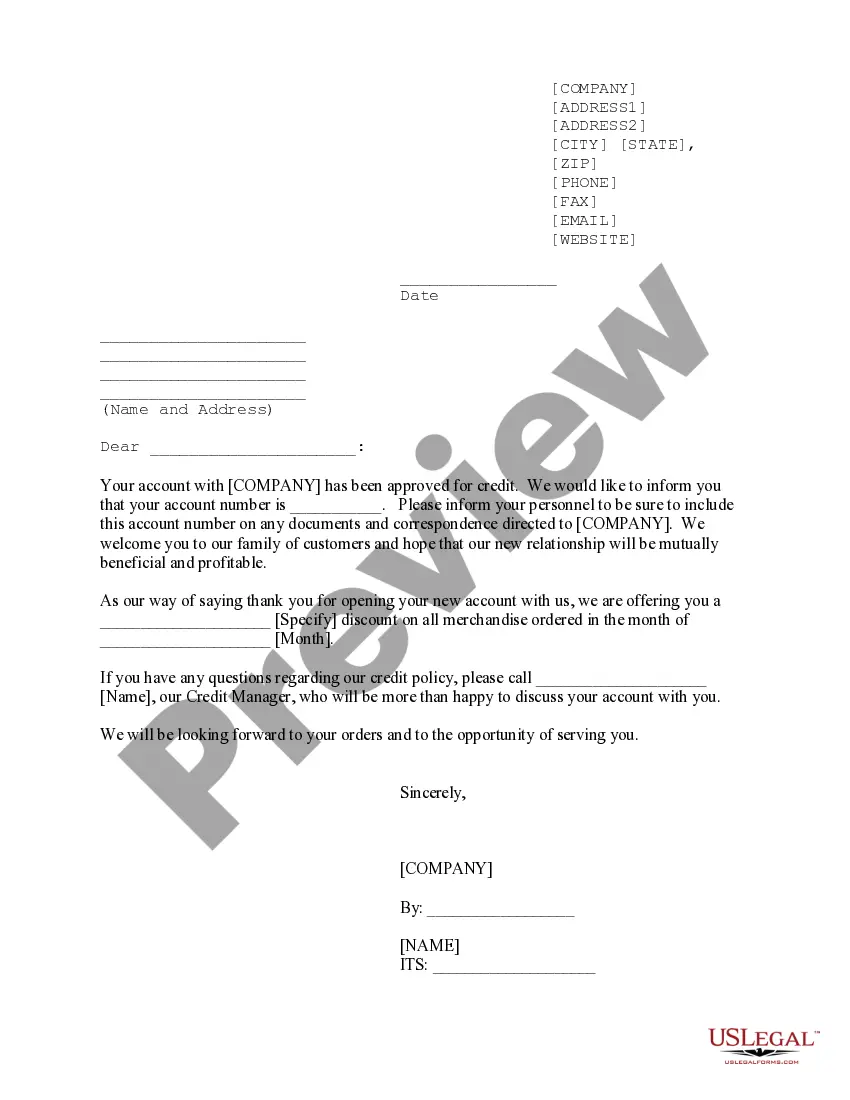

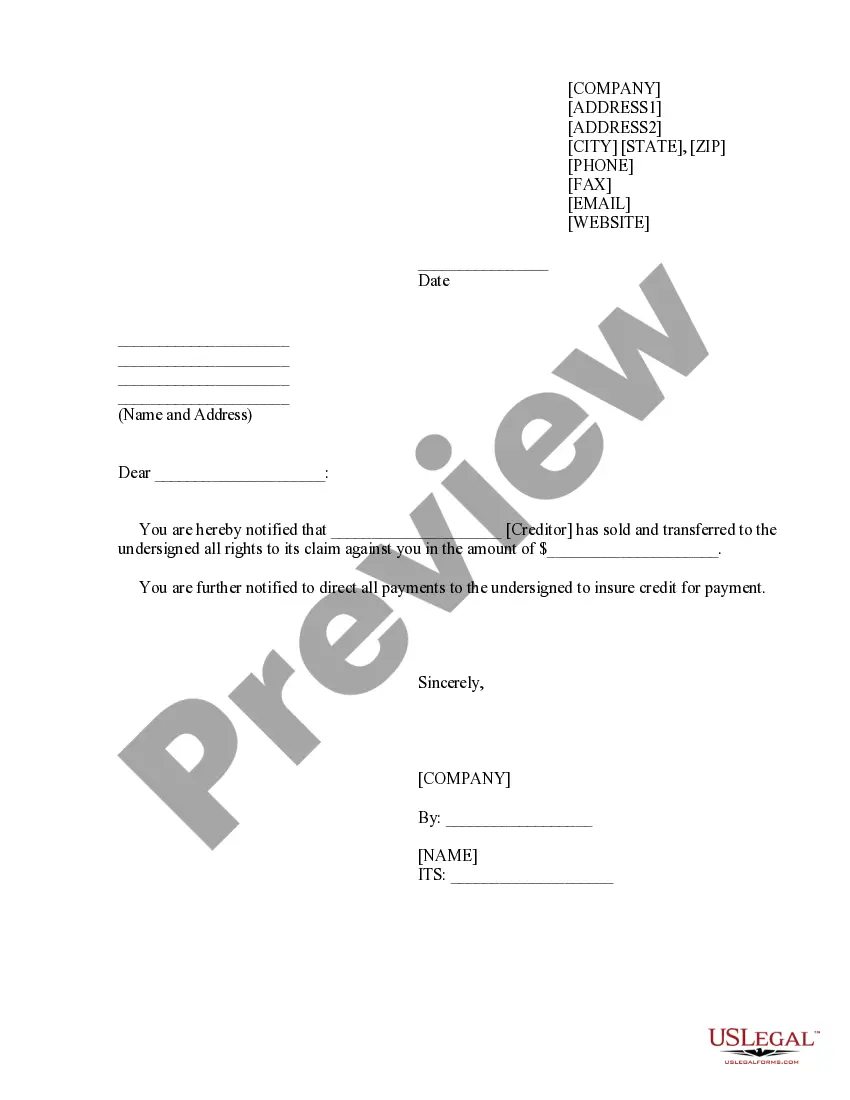

This form is a sample letter in Word format covering the subject matter of the title of the form.

Iowa Sample Letter for Exemption - Relevant Information

Description

How to fill out Sample Letter For Exemption - Relevant Information?

If you require to complete, acquire, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and claims, or keywords. Use US Legal Forms to obtain the Iowa Sample Letter for Exemption - Relevant Information with just a few clicks.

Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download and print the Iowa Sample Letter for Exemption - Relevant Information with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to get the Iowa Sample Letter for Exemption - Relevant Information.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/country.

- Step 2. Utilize the Preview option to review the form's details. Remember to read the information carefully.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have found the form you require, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Iowa Sample Letter for Exemption - Relevant Information.

Form popularity

FAQ

When writing a request letter for tax exemption, start with a formal greeting and clearly state your intention. Include your contact information, details about your organization, and a precise explanation of why you qualify for the exemption. Using the Iowa Sample Letter for Exemption - Relevant Information can help you craft a compelling request that meets all necessary criteria.

exempt determination letter typically includes the name of the organization, its address, and the specific section of the tax code under which the exemption is granted. It may also outline the type of activities that qualify for tax exemption. For a clearer understanding, refer to the Iowa Sample Letter for Exemption Relevant Information, which can provide you with examples and formats.

Filling out a certificate of exemption requires you to enter your details such as your name, address, and the type of exemption you are claiming. Ensure that you accurately describe the goods or services that qualify for the exemption. For comprehensive guidance, the Iowa Sample Letter for Exemption - Relevant Information is an excellent resource to help you complete this process correctly.

To fill out an Iowa sales tax exemption certificate, begin by providing your name, address, and the reason for your exemption. Next, include your sales tax number, if applicable, and the name of the seller from whom you are purchasing. Remember, the Iowa Sample Letter for Exemption - Relevant Information can guide you through the specific requirements needed for your situation.

The Homestead Credit is calculated by dividing the homestead credit value by 1,000 and multiplying by the Consolidated Tax Levy Rate. That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding.

You may claim a $40 personal exemption credit even if you are claimed as a dependent on another person's Iowa return. If you were 65 or older on or before January 1, 2023, you may take an additional personal credit.

When you buy a home, you can apply for a homestead credit. You apply for the credit once and the tax credit continues as long as you remain eligible by owning and occupying the property as your homestead.

To be eligible, a homeowner must occupy the homestead any 6 months out of the year, but must reside there on July 1. This exemption is a reduction of the taxable value of their property amounting to a maximum $4,850 or the amount which does not allow the taxable value to be less than 0.

Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500. Exemptions are a reduction in the taxable value of the property, not a direct reduction of how much property taxes a homeowner pays.

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return.