Iowa Direct Deposit Form for Chase

Description

How to fill out Direct Deposit Form For Chase?

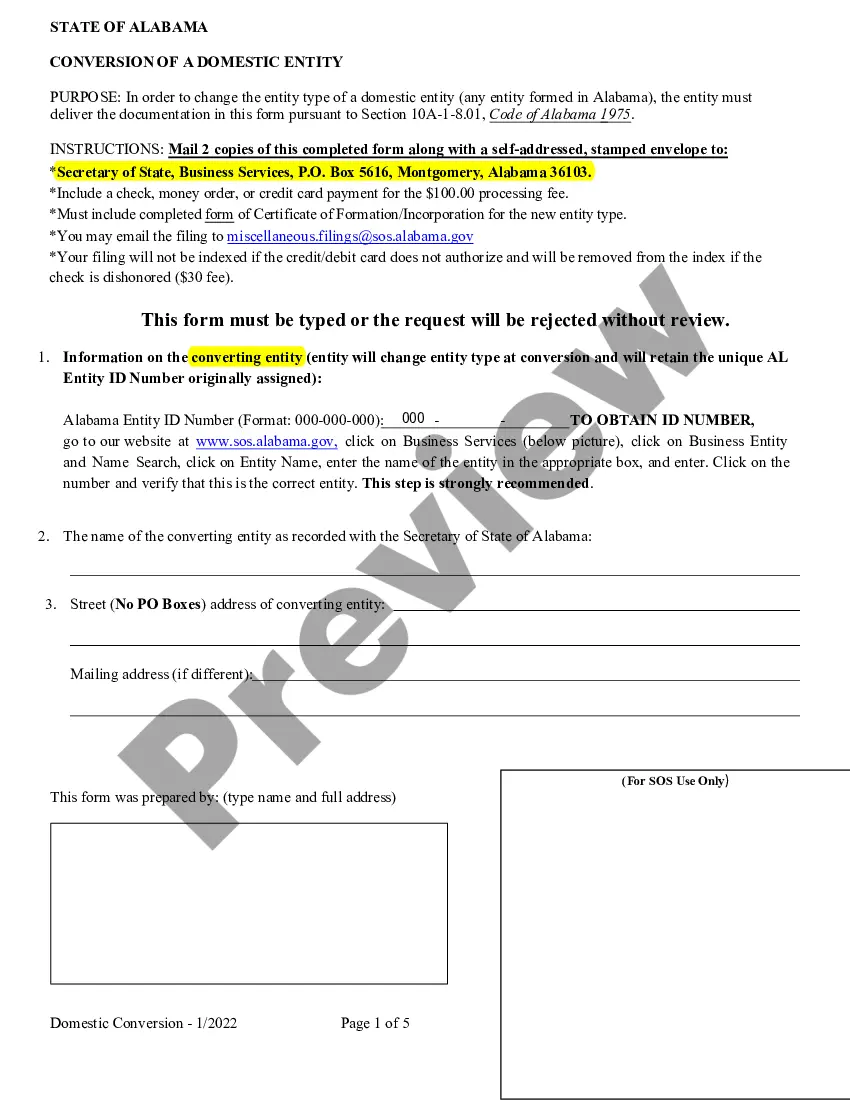

You are able to commit hrs on-line attempting to find the authorized papers format that meets the federal and state demands you want. US Legal Forms supplies a large number of authorized varieties that happen to be evaluated by experts. It is possible to acquire or print the Iowa Direct Deposit Form for Chase from the service.

If you already possess a US Legal Forms bank account, you can log in and then click the Down load button. After that, you can comprehensive, edit, print, or indication the Iowa Direct Deposit Form for Chase. Each and every authorized papers format you get is your own eternally. To get an additional duplicate of any obtained develop, check out the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms website the first time, follow the basic guidelines below:

- First, make certain you have chosen the right papers format for that area/metropolis of your choosing. Look at the develop outline to ensure you have picked the proper develop. If readily available, utilize the Review button to check throughout the papers format as well.

- In order to find an additional model in the develop, utilize the Lookup discipline to discover the format that suits you and demands.

- Once you have found the format you would like, click on Purchase now to move forward.

- Select the pricing strategy you would like, type in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You may use your charge card or PayPal bank account to purchase the authorized develop.

- Select the formatting in the papers and acquire it to the system.

- Make changes to the papers if possible. You are able to comprehensive, edit and indication and print Iowa Direct Deposit Form for Chase.

Down load and print a large number of papers themes using the US Legal Forms Internet site, that offers the greatest collection of authorized varieties. Use professional and condition-particular themes to take on your small business or person requires.

Form popularity

FAQ

Get your personalized pre-filled direct deposit form Sign in to chase.com or the Chase Mobile® app. Choose the checking account you want to receive your direct deposit. Navigate to 'Account services' by scrolling up in the mobile app or in the drop down menu on chase.com. Click or tap on 'Set up direct deposit form'

JPMorgan Chase Bank, National Association 4,907 domestic locations: 49 states and 0 territories.

From the My Accounts page, choose the account for which you want to view a statement and click the ?Statements? link. Note: an exclamation point icon will appear next to the ?Statements? link when a new statement is available.

After signing in, tap the account where you want to receive your direct deposit. Swipe up and tap "Set up direct deposit form" Check that the info is correct or make updates, then tap "Create form" Download, print or email the form.

How To Find Chase Direct Deposit Form - YouTube YouTube Start of suggested clip End of suggested clip And direct deposit. Form okay so once you click there you're going to see the chase direct deposit.MoreAnd direct deposit. Form okay so once you click there you're going to see the chase direct deposit. Form you can see right here at the top. And this is branded as Chase.

Ask for a written or online direct deposit form. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks and credit unions, including the Capital One and Bank of America direct deposit forms.

After signing in, tap the account where you want to receive your direct deposit. Swipe up and tap "Set up direct deposit form" Check that the info is correct or make updates, then tap "Create form" Download, print or email the form.