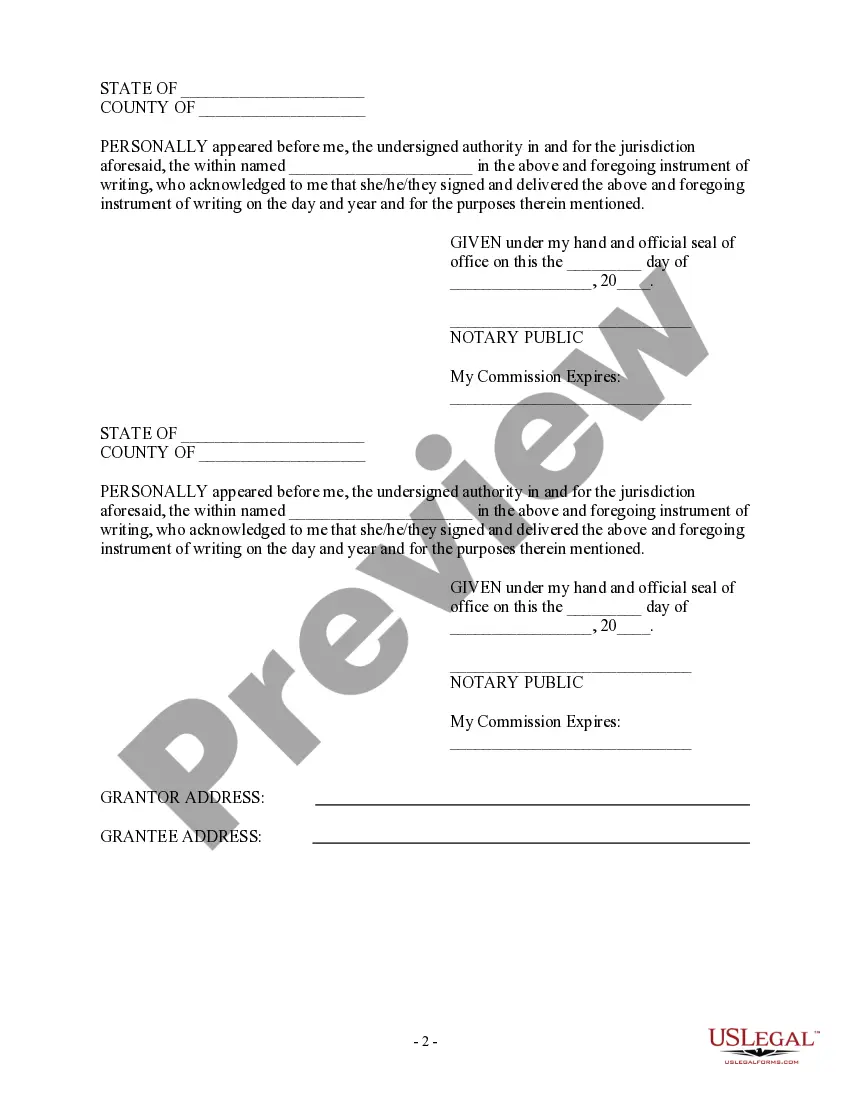

The Iowa Bill of Sale of Mobile Home with or without Existing Lien is a legal document used to transfer ownership of a mobile home from one party to another in the state of Iowa. This document is crucial in establishing the transfer of ownership and protects both the buyer and the seller. The Bill of Sale should contain relevant information regarding the mobile home, including its make, model, year, size, and vehicle identification number (VIN). It should also include the current address and contact information of the buyer and seller. If there is an existing lien on the mobile home, it is essential to include this information in the Bill of Sale. This will ensure that the buyer is fully aware of any outstanding debts or obligations associated with the mobile home. The lien holder's name, contact details, and the amount owed must be accurately documented in the Bill of Sale. In Iowa, there are different types of Bill of Sale forms used for mobile homes depending on whether there is an existing lien or not. The two main types are: 1. Bill of Sale of Mobile Home with Existing Lien: This document is used when there is a lien on the mobile home. It includes additional sections that address the lien holder's information and the details of the outstanding debt. This type of Bill of Sale ensures that all parties involved are aware of the lien and its implications. 2. Bill of Sale of Mobile Home without Existing Lien: This document is used when there is no existing lien on the mobile home. It mainly focuses on transferring ownership and providing a clear record of the transaction. Both types of Bill of Sale should clearly state the purchase price or consideration agreed upon by the buyer and seller. Additionally, it is essential to mention that the mobile home is being sold "as-is," indicating that there are no warranties or guarantees provided by the seller regarding the condition or performance of the mobile home. To make the Bill of Sale legally binding, it should be signed and dated by both the buyer and the seller in the presence of a notary public. The document should also include the notary's acknowledgment stating that the parties appeared before them and affirmed the accuracy of the information and their signatures. It is important to consult with an attorney or use an approved template when drafting an Iowa Bill of Sale of Mobile Home with or without Existing Lien to ensure compliance with state laws and to protect the rights of all parties involved in the transaction.

Iowa Bill of Sale of Mobile Home with or without Existing Lien

Description

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

Selecting the appropriate legal document format can be a challenge.

Certainly, there are numerous templates accessible online, but how will you find the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Iowa Bill of Sale of Mobile Home with or without Existing Lien, which can be utilized for business and personal use.

First, ensure you have selected the correct form for your city/state. You can review the document using the Review button and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already a registered user, Log In to your account and then click on the Download button to obtain the Iowa Bill of Sale of Mobile Home with or without Existing Lien.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents section of your account and retrieve another copy of the document you require.

- If you are a new customer of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Yes, you can conduct a title search on a mobile home to uncover details about ownership and any existing liens. Local government offices, such as the DMV or county assessor's office, typically offer these services. Utilizing the Iowa Bill of Sale of Mobile Home with or without Existing Lien can provide essential information during your search, allowing for a smoother transaction.

Transferring ownership of a trailer in Iowa involves completing a title transfer form and submitting it to the Iowa Department of Transportation. You may also need to provide the Iowa Bill of Sale of Mobile Home with or without Existing Lien to validate the transaction. It’s important to ensure all parties sign the necessary documents to avoid future complications.

Yes, a lien can be placed on your property without your explicit knowledge. This often occurs due to unpaid debts, such as taxes or contractor fees, and may not always be communicated directly to you. To ensure clarity, using the Iowa Bill of Sale of Mobile Home with or without Existing Lien can help you discover any existing liabilities when transferring ownership.

To find out if there is a lien on your mobile home, start by checking public records in your county. You can visit the local courthouse or access online databases that track property liens. Additionally, you can consider using the Iowa Bill of Sale of Mobile Home with or without Existing Lien documentation, which may help clarify lien status during a sale.

If you only have a bill of sale, you can still obtain a title by visiting your local Iowa Department of Motor Vehicles (DMV) office. Bring the bill of sale and any other required documents, such as proof of identification. Depending on the item, you may need to complete additional forms. Consider drafting an Iowa Bill of Sale of Mobile Home with or without Existing Lien to ensure all pertinent information is included for a smooth process.

When writing out a bill of sale, start with the date of the transaction, followed by the full names and addresses of both the seller and buyer. Next, include a detailed description of the item being sold, such as make, model, and condition. Ensure both parties sign the document to validate the sale. Utilizing a format similar to the Iowa Bill of Sale of Mobile Home with or without Existing Lien can help structure your document effectively.

Filling out an Iowa bill of sale involves writing down essential details such as the seller's and buyer's names, addresses, and contact information. Clearly describe the item being sold, including any relevant identification numbers. Finally, both parties must sign and date the document. Using a standard template like an Iowa Bill of Sale of Mobile Home with or without Existing Lien can simplify this process.

Yes, you need a bill of sale to register a trailer in Iowa. An Iowa Bill of Sale of Mobile Home with or without Existing Lien serves as proof of ownership for mobile homes and trailers alike. When you present this document during registration, it simplifies the process and clarifies any existing liens if applicable. Consider using uslegalforms to obtain a compliant bill of sale that meets all legal requirements.

To transfer a mobile home title in Iowa, you first need a properly filled-out Iowa Bill of Sale of Mobile Home with or without Existing Lien. Both the seller and buyer must sign the document to ensure a legal transfer. After completing the sale, you will take the bill of sale to your local county treasurer’s office to register the title in the buyer's name. This process secures the ownership transfer and protects both parties.

A bill of sale for a mobile home in Iowa is a legal document that records the sale of the mobile home. It outlines key details, such as the names of the buyer and seller, the description of the mobile home, and mentions any existing liens. Utilizing an Iowa Bill of Sale of Mobile Home with or without Existing Lien ensures that all parties are protected and that the sale transaction is formally recognized.