Iowa Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will)

Description

How to fill out Certificate Of Heir To Obtain Transfer Of Title To Motor Vehicle Without Probate (Vehicle Not Bequeathed In Will)?

Are you within a position that you need to have files for sometimes enterprise or person reasons just about every time? There are tons of legal record templates available online, but discovering types you can rely isn`t simple. US Legal Forms gives 1000s of kind templates, just like the Iowa Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will), that are created to satisfy state and federal demands.

In case you are presently familiar with US Legal Forms web site and also have a merchant account, simply log in. Next, it is possible to down load the Iowa Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) web template.

Should you not have an accounts and wish to begin using US Legal Forms, follow these steps:

- Get the kind you want and ensure it is for the correct city/area.

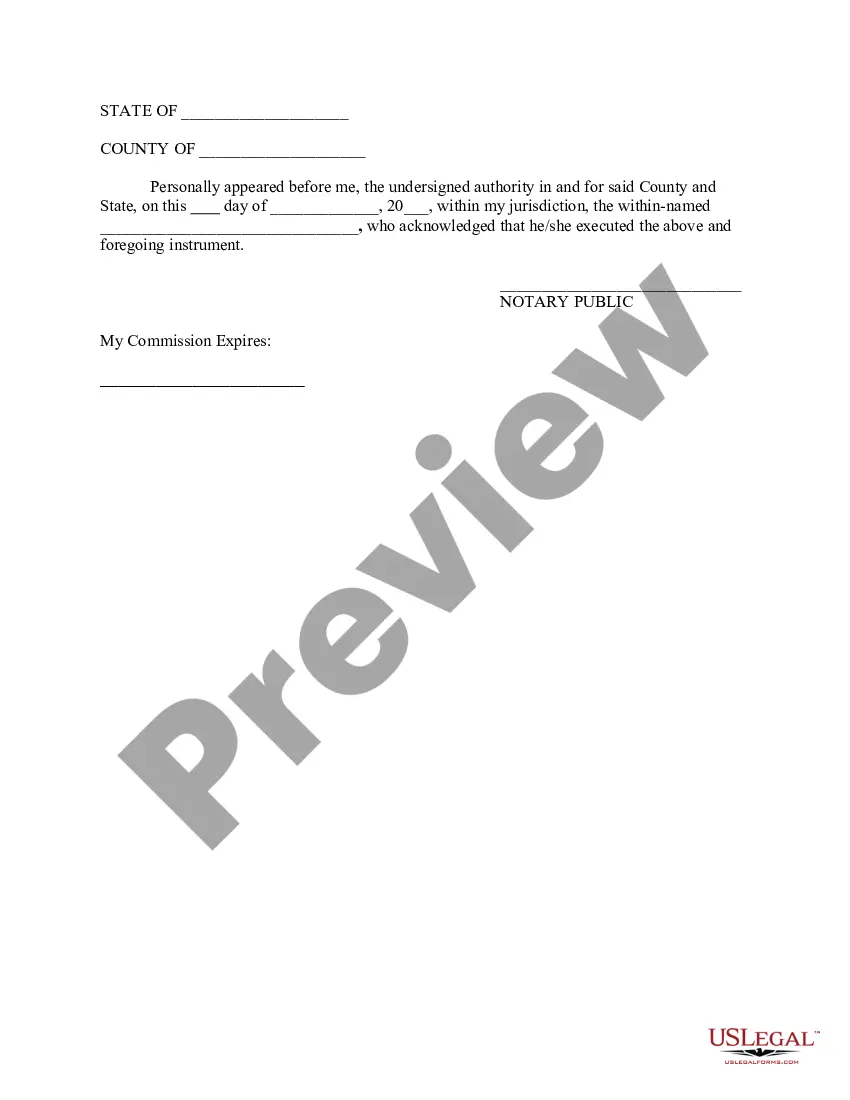

- Use the Review option to analyze the shape.

- Read the information to ensure that you have chosen the correct kind.

- When the kind isn`t what you`re searching for, utilize the Research industry to get the kind that suits you and demands.

- If you find the correct kind, click on Acquire now.

- Pick the costs plan you want, submit the specified info to produce your money, and pay for an order with your PayPal or charge card.

- Pick a handy file structure and down load your version.

Find all the record templates you might have purchased in the My Forms menus. You may get a more version of Iowa Certificate of Heir to obtain Transfer of Title to Motor Vehicle without Probate (Vehicle not Bequeathed in Will) anytime, if possible. Just click on the necessary kind to down load or print the record web template.

Use US Legal Forms, probably the most considerable selection of legal forms, in order to save time and prevent faults. The assistance gives professionally manufactured legal record templates that can be used for a selection of reasons. Make a merchant account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

Transferring Ownership of a Vehicle If the person was listed as transfer on death with the vehicle documents, they will only need to present a copy of the death certificate to proceed along with the completed title transfer form. Once the form is processed, the DMV will issue a new car title in the beneficiary's name.

If your estate does not exceed a certain value (currently $25,000.00) and consists solely of personal property, a probate proceeding may not be required and the estate can be transferred with an affidavit. Creditor claims must still be paid, however.

In Iowa, you can create a revocable living trust to avoid probate for most assets you can own with someone else (real estate, bank accounts, vehicles, etc.). To create a living trust, you need to name a trustor (the person managing the assets) and the trustee (the person benefiting from the assets).

If the estate was not probated but the decedent had a will, under the laws of the State of Iowa and ing to the decedent's will, the person(s) entitled to possession and ownership of the vehicle must apply for a certificate of title and transfer the title to themselves first before selling the vehicle to another ...

What circumstances require probate in Iowa? The short answer is when there are assets that do not automatically transfer by contract (e.g. life insurance) or by law (home held in joint tenancy). The court oversees the transfer of these assets to protect the interest of the deceased person.

A Bill of Sale (PDF) signed by the seller/transferor is required for all title transfers even if the transfer is a gift. A Buyer/Transferee has 30 days to present the properly assigned title to the County Treasurer so that a title can be issued in the Buyer/Transferee name. Penalties will apply after 30 days.

In Iowa, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on.

Since only the car's owner can sell it ? and as the car title owner, transfer its title ? to another person, establishing who is the new legal owner of the car must be handled first. If there is a Will, the person named as Executor of the Estate and/or the beneficiary of the car will be able to sell it.