Iowa Financial Statement Form - Husband and Wife Joint

Description

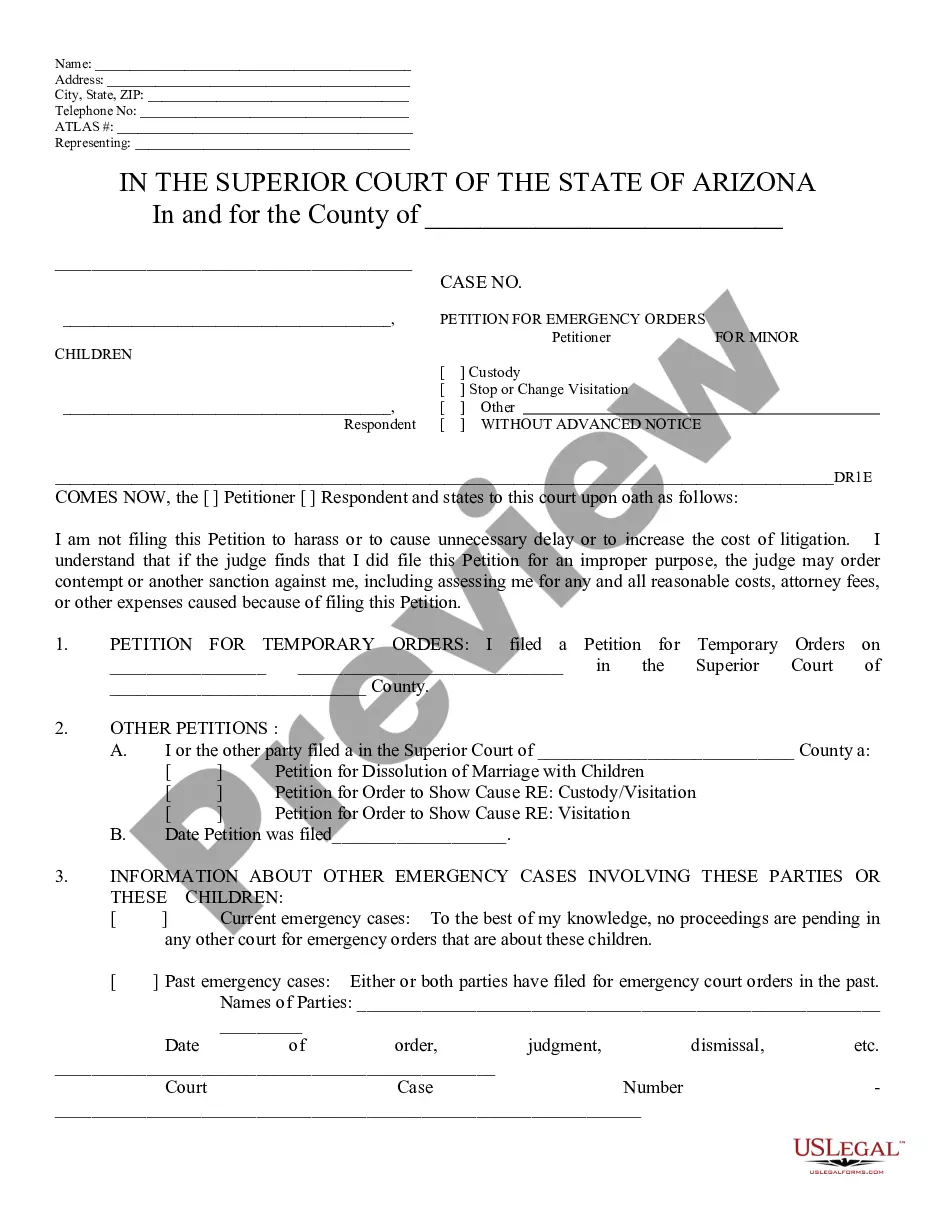

How to fill out Financial Statement Form - Husband And Wife Joint?

If you need to gather, obtain, or produce authentic document templates, utilize US Legal Forms, the largest selection of official forms available online.

Employ the site’s straightforward and convenient search tool to locate the documents you require.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours forever. You have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

Obtain, download, and print the Iowa Financial Statement Form - Husband and Wife Joint with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to acquire the Iowa Financial Statement Form - Husband and Wife Joint with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Iowa Financial Statement Form - Husband and Wife Joint.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Preview feature to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative templates of the legal form.

- Step 4. After you find the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your credentials to create an account.

- Step 5. Complete the payment process. You can use a credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Iowa Financial Statement Form - Husband and Wife Joint.

Form popularity

FAQ

When couples file their taxes jointly, both spouses hold equal responsibility for the tax return and any taxes owed. This means the IRS can pursue either spouse for any unpaid tax liabilities. Therefore, it is crucial to accurately complete the Iowa Financial Statement Form - Husband and Wife Joint to avoid potential gaps in financial responsibility. By using our platform, you can efficiently navigate these legal requirements and ensure compliance.

The married filing joint status allows couples to file their taxes together, combining income and deductions. This status typically offers several tax benefits, like a larger standard deduction and favorable tax brackets. To assist with the filing process, consider using the Iowa Financial Statement Form - Husband and Wife Joint, which helps simplify gathering necessary information.

Yes, Iowa does allow married couples to file their taxes separately. However, it's important to consider the potential drawbacks, such as fewer tax benefits and higher rates. To understand the implications better, consider consulting the Iowa Financial Statement Form - Husband and Wife Joint, which can provide clarity on your filing options.

No, both spouses do not have to file as married filing separately (MFS). One spouse can choose to file jointly while the other files separately, but this might not be the most tax-efficient decision. Analyzing your situation with the Iowa Financial Statement Form - Husband and Wife Joint will help clarify the best filing approach for both of you.

To file a married filing joint, both spouses need to gather their income information and fill out the appropriate tax forms together. It's essential to include all income, deductions, and credits that apply to both parties. Using the Iowa Financial Statement Form - Husband and Wife Joint simplifies this process, ensuring you don't miss any necessary details.

Typically, filing taxes as a married couple offers greater advantages, including access to favorable tax rates and deductions. Filing separately should be a careful consideration based on unique circumstances, such as income levels and specific expenses. To figure out the best option for you, the Iowa Financial Statement Form - Husband and Wife Joint can serve as a valuable resource.

Generally, couples filing jointly receive a larger tax return due to benefits such as higher tax credits and deductions. Filing separately often results in losing some valuable deductions, which can impact your return negatively. If you want to make an informed decision, consider the Iowa Financial Statement Form - Husband and Wife Joint for a clearer picture.

Married couples may decide to file separately if one spouse has significant medical expenses or unreimbursed business costs. Additionally, filing separately might be beneficial if one spouse has a complicated tax situation. It's essential to weigh the pros and cons carefully. Utilizing the Iowa Financial Statement Form - Husband and Wife Joint can help clarify your circumstances.

An affidavit of financial status is a formal document that outlines an individual's financial condition in detail. This affidavit often accompanies the Iowa Financial Statement Form - Husband and Wife Joint to provide a comprehensive view of income, assets, liabilities, and expenses. Courts rely on this information when making decisions about asset distribution and support obligations. Therefore, accuracy in this document plays a vital role in your divorce proceedings.

Yes, a financial affidavit often needs to be notarized to ensure its authenticity. By notarizing the Iowa Financial Statement Form - Husband and Wife Joint, you confirm that the information provided is accurate and legally binding. Notarization adds credibility, which can be crucial during court proceedings. Utilizing services from USLegalForms simplifies obtaining a notarized document, ensuring compliance with legal requirements.