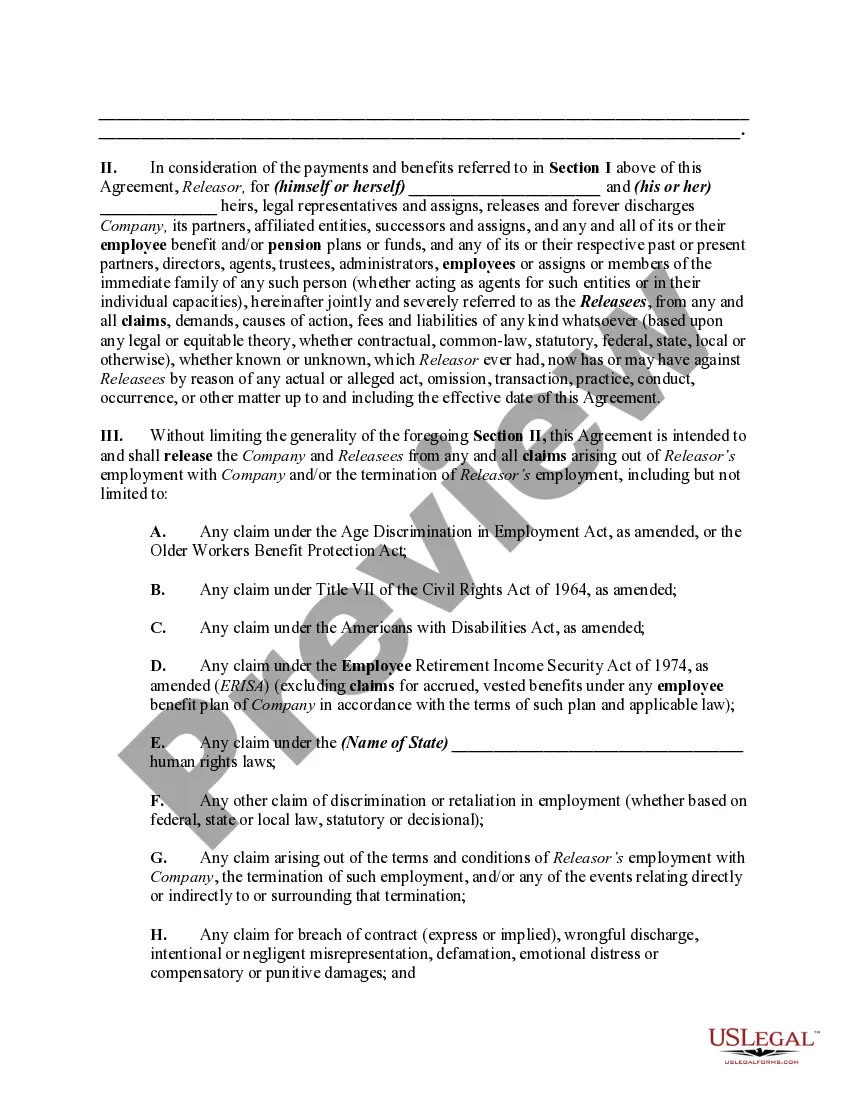

In this form, as a result of a lump sum settlement, a former employee is releasing a former employer from any and all claims for breach of contract or wrongful termination as well as any claim under the Employee Retirement Income Security Act of 1974, as amended (ERISA); any claim under the Age Discrimination in Employment Act, as amended, or the Older Workers Benefit Protection Act; any claim under Title VII of the Civil Rights Act of 1964, as amended; any claim under the Americans with Disabilities Act, as amended; and any other claim of discrimination or retaliation in employment (whether based on federal, state or local law, statutory or decisional);

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

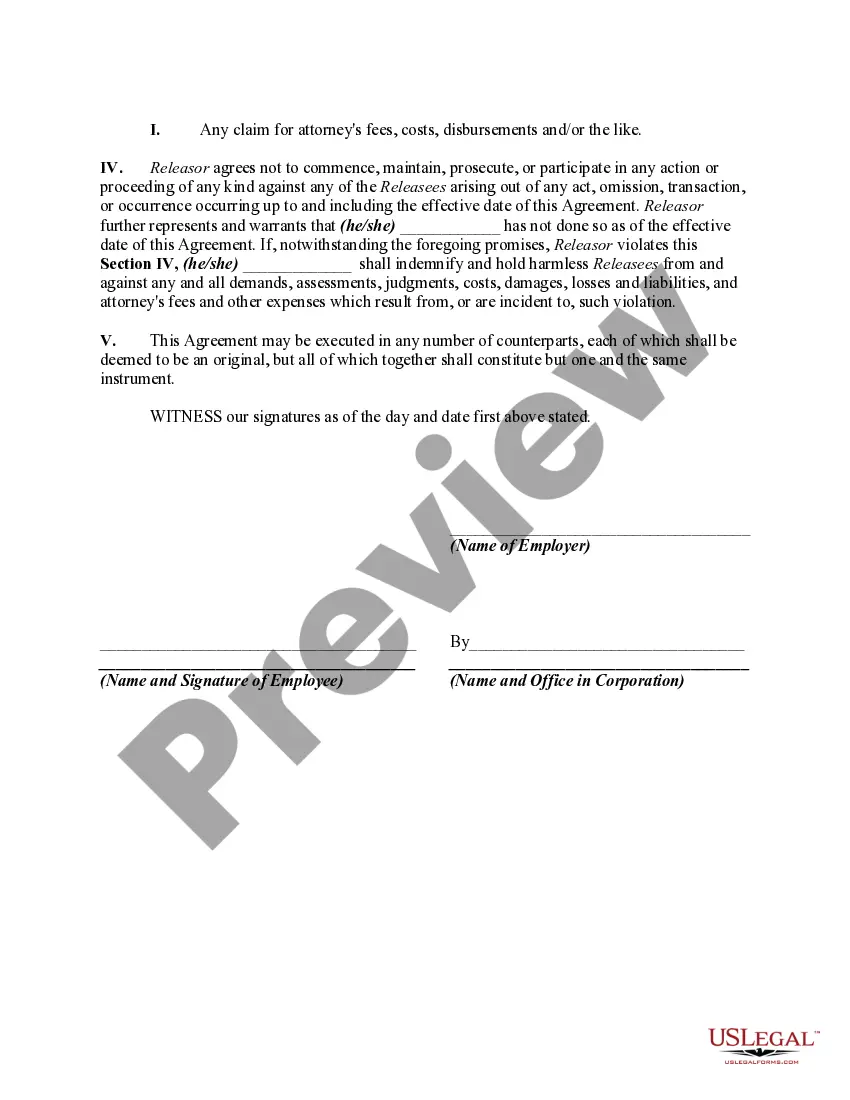

Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal document that outlines the agreement between an employee and employer upon termination of employment in the state of Iowa. This release is crucial in settling any potential claims or disputes between the parties involved and encompasses the release of rights and grievances pertaining to employee benefits and pension plans. Here's a detailed description with relevant keywords: I. Overview: The Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legally binding agreement between an employee (referred to as "Releaser") and employer (referred to as "Company") to conclude any disputes or claims that may have arisen due to the termination of the employee's employment. This release also specifically addresses the release of claims related to employee benefit and pension plans. II. Employee Benefit Plans and Funds: The release covers all employee benefit plans and funds provided by the employer during the employee's tenure. These may include but are not limited to health insurance, dental insurance, life insurance, disability insurance, retirement plans, stock options, or any other compensation or benefits the employee may have received as a part of their employment. The purpose of including this section is to ensure that the employee relinquishes any claims or potential claims regarding these benefits and plans. III. Pension Plans and Funds: The release extends to all pension plans and funds, such as 401(k) plans, pension funds, or any other retirement savings plans provided by the employer. The Releaser agrees to release and forever discharge any claims or grievances against the employer concerning these pension plans and funds. This section aims to prevent any legal actions or demands for further benefits or compensation related to retirement savings. IV. Specific Claims and Grievances: The Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds allows the Releaser to list any specific claims, charges, grievances, or issues that they want to release the employer from. This may range from wrongful termination claims to discrimination claims, unpaid wages, or any other potential legal disputes arising from the employment relationship. V. Consideration and Legal Advice: The release includes provisions regarding the consideration received by the Releaser in exchange for signing the agreement. It outlines any monetary compensation, severance pay, or other benefits provided to the employee upon termination. Furthermore, the agreement highlights that the Releaser has been advised to seek legal counsel prior to signing the release to ensure they understand their rights and implications of signing the document. VI. Severability and Governing Law: This section emphasizes that if any provision of the release is found to be invalid or unenforceable, it shall not affect the validity or enforceability of the remaining provisions. Additionally, the release specifies that Iowa state law governs the interpretation, validity, and enforceability of the agreement. The aforementioned description covers the general aspects of an Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds.Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legal document that outlines the agreement between an employee and employer upon termination of employment in the state of Iowa. This release is crucial in settling any potential claims or disputes between the parties involved and encompasses the release of rights and grievances pertaining to employee benefits and pension plans. Here's a detailed description with relevant keywords: I. Overview: The Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds is a legally binding agreement between an employee (referred to as "Releaser") and employer (referred to as "Company") to conclude any disputes or claims that may have arisen due to the termination of the employee's employment. This release also specifically addresses the release of claims related to employee benefit and pension plans. II. Employee Benefit Plans and Funds: The release covers all employee benefit plans and funds provided by the employer during the employee's tenure. These may include but are not limited to health insurance, dental insurance, life insurance, disability insurance, retirement plans, stock options, or any other compensation or benefits the employee may have received as a part of their employment. The purpose of including this section is to ensure that the employee relinquishes any claims or potential claims regarding these benefits and plans. III. Pension Plans and Funds: The release extends to all pension plans and funds, such as 401(k) plans, pension funds, or any other retirement savings plans provided by the employer. The Releaser agrees to release and forever discharge any claims or grievances against the employer concerning these pension plans and funds. This section aims to prevent any legal actions or demands for further benefits or compensation related to retirement savings. IV. Specific Claims and Grievances: The Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds allows the Releaser to list any specific claims, charges, grievances, or issues that they want to release the employer from. This may range from wrongful termination claims to discrimination claims, unpaid wages, or any other potential legal disputes arising from the employment relationship. V. Consideration and Legal Advice: The release includes provisions regarding the consideration received by the Releaser in exchange for signing the agreement. It outlines any monetary compensation, severance pay, or other benefits provided to the employee upon termination. Furthermore, the agreement highlights that the Releaser has been advised to seek legal counsel prior to signing the release to ensure they understand their rights and implications of signing the document. VI. Severability and Governing Law: This section emphasizes that if any provision of the release is found to be invalid or unenforceable, it shall not affect the validity or enforceability of the remaining provisions. Additionally, the release specifies that Iowa state law governs the interpretation, validity, and enforceability of the agreement. The aforementioned description covers the general aspects of an Iowa Release by Employee of Claims against Employer related to Terminated Employment Including the Release of Employee Benefit and Pension Plans and Funds.