Title: Understanding the Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift Keywords: Iowa, acknowledgment, charitable institution, educational institution, pledged gift Introduction: In the state of Iowa, charitable and educational institutions play a crucial role in serving communities and promoting philanthropy. To encourage transparency and accountability, the Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift serves as a formal recognition document for pledged contributions. This detailed description aims to shed light on the various aspects of this acknowledgment, its requirements, and potential variations. 1. Purpose and Importance of the Iowa Acknowledgment: The Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift serves as a legal document that confirms the receipt of a pledged gift by charitable or educational institutions in Iowa. It formalizes the relationship between the donor and the recipient, ensuring accurate record-keeping and promoting trust in philanthropic activities. 2. Key Elements of the Iowa Acknowledgment: a. Donor Information: The acknowledgment should include the donor's name, address, and any other pertinent contact details. b. Institution Details: The recipient institution's name, address, and official contact information must be clearly stated. c. Gift Description: A detailed description of the pledged gift, including its nature, monetary value (if applicable), and any specific conditions or restrictions associated with the gift. d. Date of Receipt: The date when the charitable or educational institution received the pledged gift should be specified. e. Institutional Representative: The acknowledgment must include the name, title, and signature of an authorized representative of the institution. f. Statement of IRS Status: Clearly state the institution's tax-exempt status and its tax identification number (EIN) to affirm its eligibility to issue the acknowledgment. 3. Types of Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift: a. Financial Pledge Acknowledgment: This type of acknowledgment is used when a donor pledges a monetary gift to a charitable or educational institution. b. In-Kind Pledge Acknowledgment: When a donor pledges non-monetary items such as equipment, real estate, or marketable securities, this acknowledgment is used. c. Future Pledge Acknowledgment: In cases where a donor commits to making a gift in the future, this acknowledgment outlines the agreed-upon terms and confirms the intent to fulfill the pledge. Conclusion: The Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a vital tool for both donors and recipient institutions. By standardizing the acknowledgment process, it enhances accountability and transparency within philanthropic activities in Iowa. Understanding the different types of acknowledgments, their requirements, and the proper documentation is crucial for both charitable organizations and generous donors participating in Iowa's philanthropy landscape.

Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Iowa Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

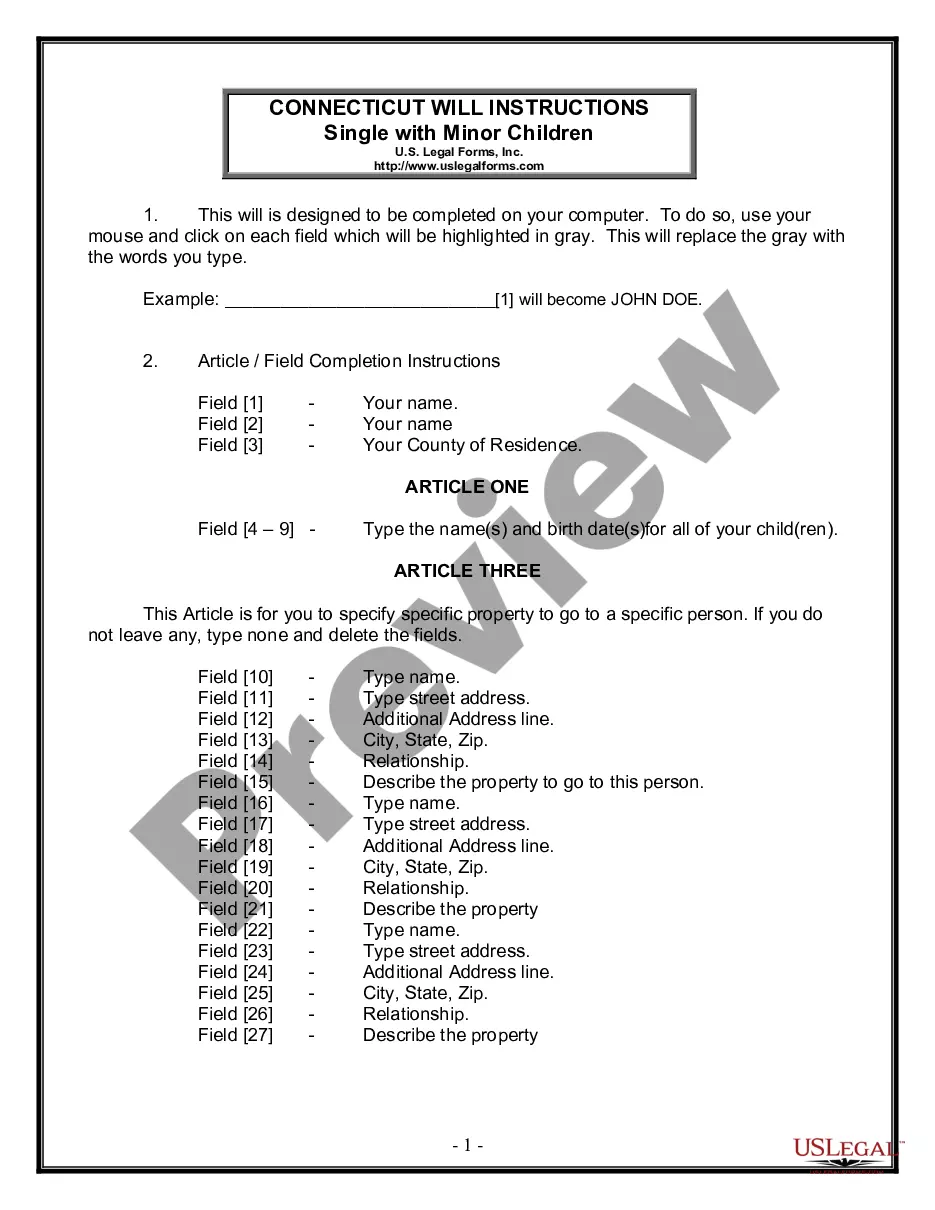

You may invest hours online trying to find the lawful document format which fits the federal and state specifications you need. US Legal Forms supplies 1000s of lawful kinds which can be evaluated by specialists. It is possible to download or print the Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift from the services.

If you have a US Legal Forms bank account, you may log in and then click the Obtain button. After that, you may full, edit, print, or signal the Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift. Each lawful document format you acquire is your own permanently. To have yet another duplicate for any obtained type, proceed to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site initially, keep to the basic directions listed below:

- First, make sure that you have chosen the right document format to the state/area of your choosing. Read the type information to make sure you have selected the right type. If available, take advantage of the Preview button to check with the document format as well.

- If you would like locate yet another edition in the type, take advantage of the Search discipline to get the format that meets your requirements and specifications.

- Once you have found the format you want, click on Buy now to carry on.

- Select the rates prepare you want, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the transaction. You can use your Visa or Mastercard or PayPal bank account to fund the lawful type.

- Select the formatting in the document and download it to the device.

- Make alterations to the document if possible. You may full, edit and signal and print Iowa Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift.

Obtain and print 1000s of document templates making use of the US Legal Forms Internet site, which offers the greatest collection of lawful kinds. Use specialist and state-particular templates to handle your company or specific requires.

Form popularity

FAQ

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

You should always have the following information on your donation receipts: Name of the organization. Donor's name. Recorded date of the donation. Amount of cash contribution or fair market value of in-kind goods and services. Organization's 501(c)(3) status.

Here are basic donation receipt requirements in the U.S.: Name of the organization that received the donation. A statement that the nonprofit is a public charity recognized as tax-exempt by the IRS under Section 501(c)(3) Name of the donor. The date of the donation. Amount of cash contribution.

Dear [DONOR NAME], Thank you for your generous donation to [ORGANIZATION NAME], a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code ([EIN #]). On [DATE], you made a contribution of [AMOUNT] in support of our mission. This gift was processed as credit card transaction.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Example 1: Individual Acknowledgment Letter Hi [donor name], Thank you for your contribution of $500 to [nonprofit's name] that we received on [date received]. We provided no goods or services in exchange for your contribution.

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.