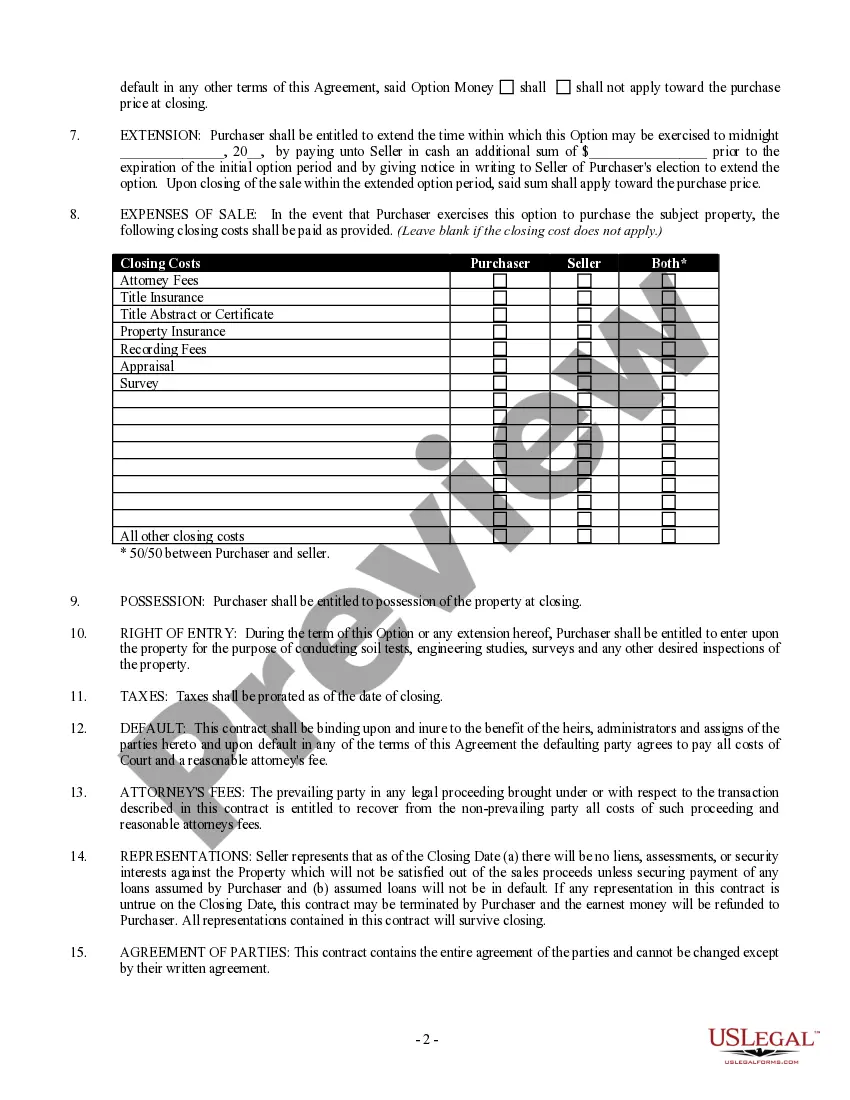

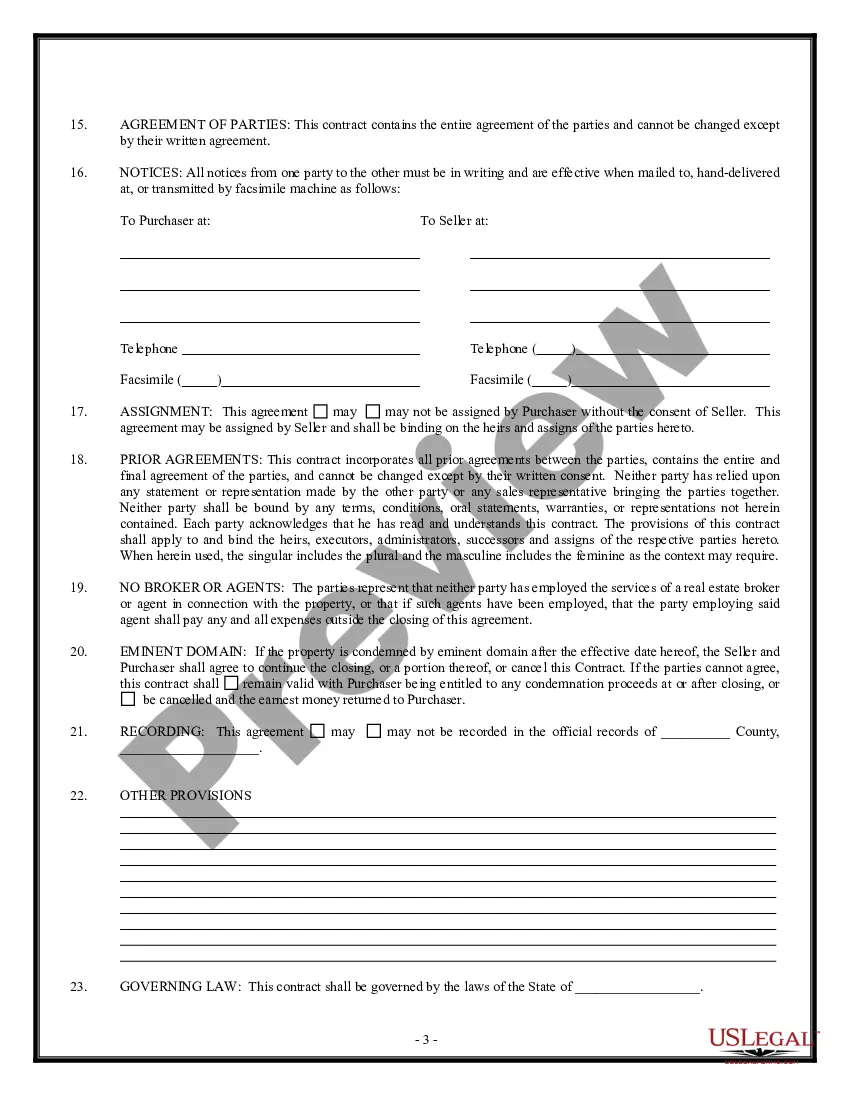

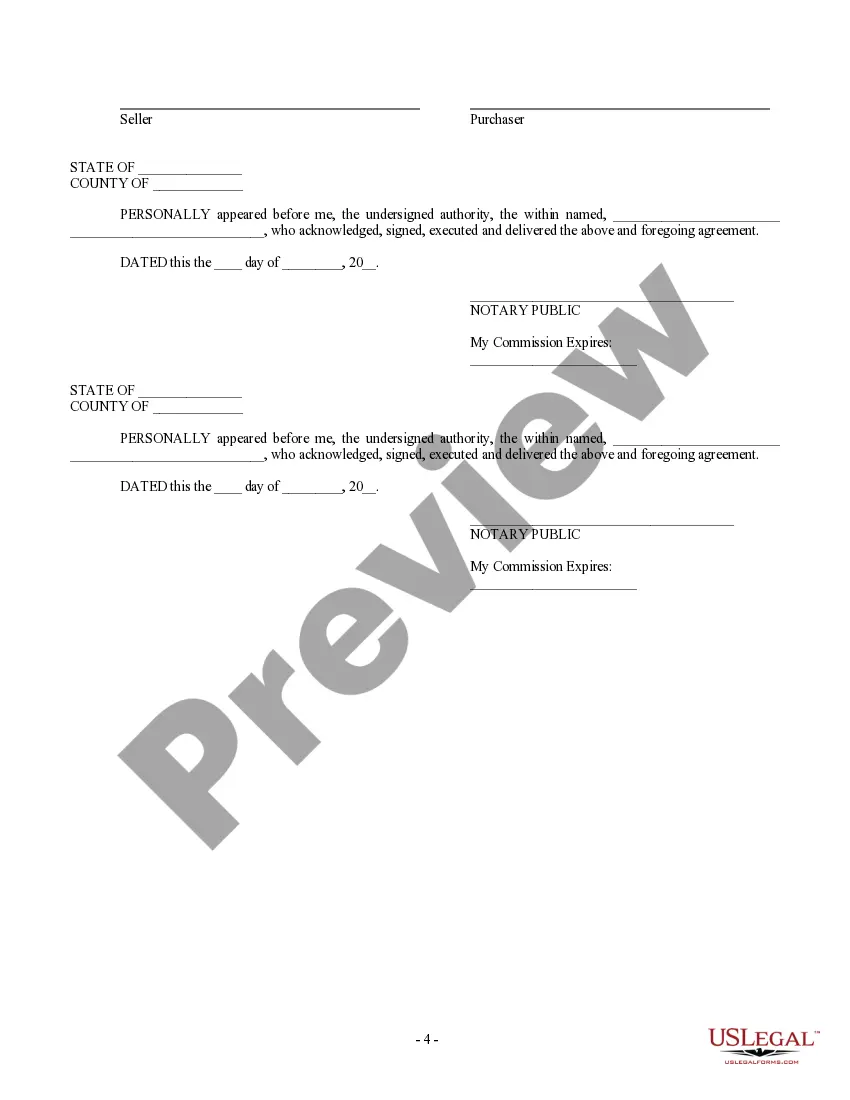

The Iowa Option for the Sale and Purchase of Real Estate — Farm Land is a legal agreement that provides an alternative method for individuals or entities to acquire or sell agricultural properties in Iowa. This option offers flexibility and numerous benefits for both buyers and sellers involved in the transaction. Iowa Option for the Sale and Purchase of Real Estate — Farm Land is a type of contract that grants the buyer the exclusive right to purchase the farm land within a specified timeframe. This option allows the buyer to acquire the land at a predetermined price, regardless of any potential price increases during the option period. The seller, on the other hand, is obligated to sell the property if the buyer exercises their option within the allotted time. The different types of Iowa Option for the Sale and Purchase of Real Estate — Farm Land include: 1. Traditional Iowa Option: This is the standard form of the option agreement, where the buyer pays a non-refundable fee, called an option fee, to secure the exclusive right to purchase the farm land within the agreed-upon timeframe. If the buyer decides not to exercise the option, the option fee is forfeited. This type of option is commonly used for long-term purchases or situations where the buyer needs more time to secure financing. 2. Lease with Option to Purchase: This type of option agreement combines a lease and an option to purchase the farm land. The buyer leases the property for a specific period, typically one to three years, with the option to buy it at a predetermined price before the lease expires. A portion of the rent paid during the lease term may be credited towards the purchase price, providing financial benefits to the buyer. 3. Purchase Option with Rent Credits: Similar to the lease with option to purchase, this type of option agreement allows the buyer to rent the farm land with an option to buy it in the future. A percentage of the rent paid is credited towards the purchase price, which helps the buyer accumulate equity while renting. This option is particularly useful for buyers who are not currently ready to secure financing but still want to secure the property for future purchase. 4. Seller-Financed Option: In this type of option agreement, the seller provides financing to the buyer for the purchase of the farm land. The buyer pays an agreed-upon down payment and subsequent monthly installments, typically with interest, to the seller until the full purchase price is paid. This option is convenient for buyers who may have difficulty securing traditional financing through banks or other financial institutions. The Iowa Option for the Sale and Purchase of Real Estate — Farm Land is a versatile tool that can be tailored to meet the specific needs of buyers and sellers in Iowa's agricultural real estate market. Whether it involves long-term planning, leasing arrangements, rent credits, or seller financing, this option provides a legal framework that benefits both parties in the transaction.

Iowa Option For the Sale and Purchase of Real Estate - Farm Land

Description

How to fill out Iowa Option For The Sale And Purchase Of Real Estate - Farm Land?

You may spend hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal documents that are vetted by professionals.

You can download or print the Iowa Option For the Sale and Purchase of Real Estate - Farm Land from our platform.

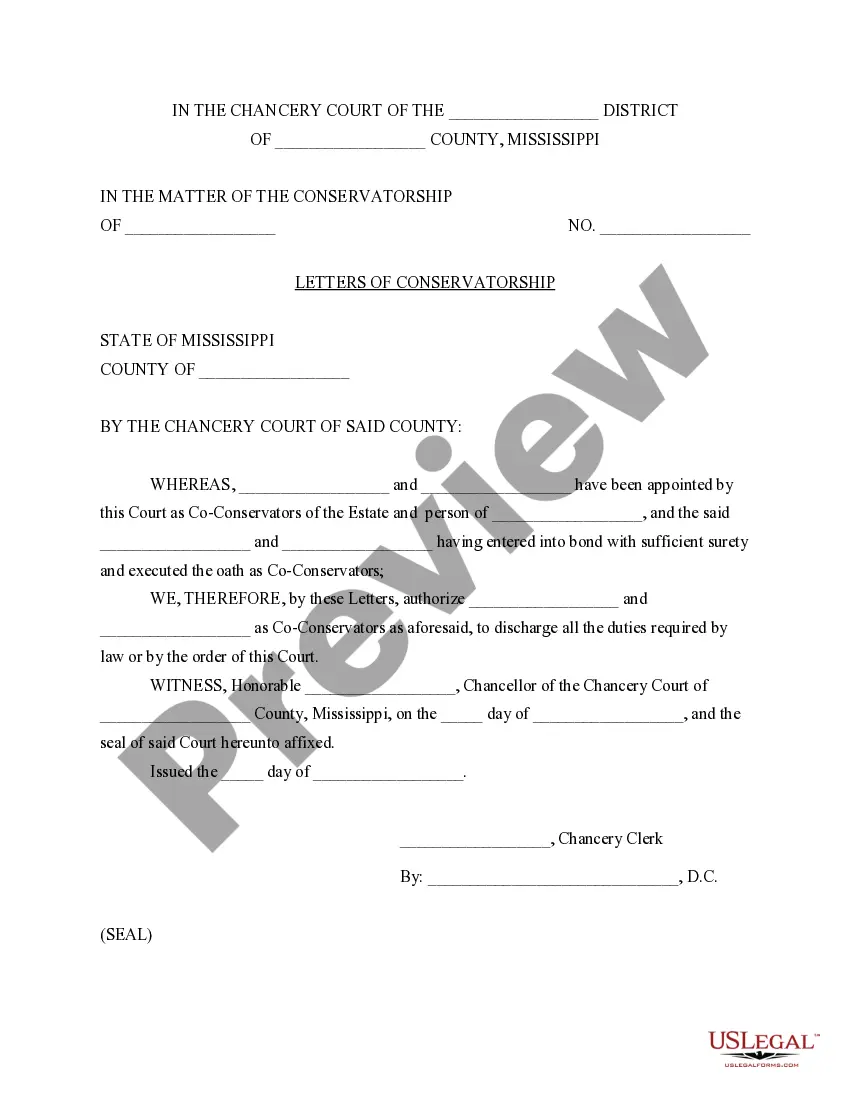

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Then, you can complete, modify, print, or sign the Iowa Option For the Sale and Purchase of Real Estate - Farm Land.

- Every legal document template you obtain is yours forever.

- To get an additional copy of any purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

To become sales tax exempt in Iowa, you need to apply for a sales tax exemption certificate through the Iowa Department of Revenue. Certain organizations, such as non-profits and government agencies, may qualify based on their purpose and use of purchased items. Make sure to maintain accurate documentation and include all pertinent details when submitting your application for tax-exempt status.

To obtain a farm tax exemption in Iowa, you must first meet the qualifications outlined by the state. Next, gather all required documentation to prove your agricultural use, and submit an application to your county assessor's office. Utilizing resources like the USLegalForms platform can help you prepare the necessary documents and streamline the application process.

In Iowa, homeowners who occupy their property as their primary residence may qualify for the homestead exemption. This benefit applies to individuals who own the home and are responsible for property taxes. To take advantage of this exemption, ensure you submit your application by the deadline and provide necessary proof of residency.

In Iowa, to qualify for farm tax exemption, the land must primarily be used for agricultural production. This includes raising crops, livestock, or conducting related activities. It is essential to demonstrate that your farmland meets these criteria through documentation and evidence of your farming operations.

Iowa plays a large role in the nation's agriculture. Partly due to its nice climate; the state has great crop growth and over 90% of the land is designated to agriculture. With these two contributing factors, Iowa is ranked as the third most productive agricultural state following California and Texas.

At a Farmland Owners Update webinar, Johnson said he estimates that Iowa farmers, on average, will receive about $95 an acre in federal payments for the 2020 corn crop.

Farm land is a real estate niche that deals with the purchase and sale of Arable land. This niche requires the real estate agent to have very particular knowledge about the land and farming industry.

Mark Buskohl practices conservation tillage, leaving crop residue like corn stalks, to protect his valuable Grundy County topsoil. Grundy County has some of the best farmland in the nation, if not the world.

To start a small farm, the cost ranges from $600 to $10,000. Outlook, location, type of equipment, size of farm, type of labor required, invested time, farm products, and if you already own a property, or you are borrowing from relatives, or would rent, greatly determines the cost of starting a farm.

The 2021 ISU Land Value Survey shows the average value of an acre of Iowa farmland skyrocketed 29 percent over the past 12 months to $9,751/acre as of November 1, 2021.