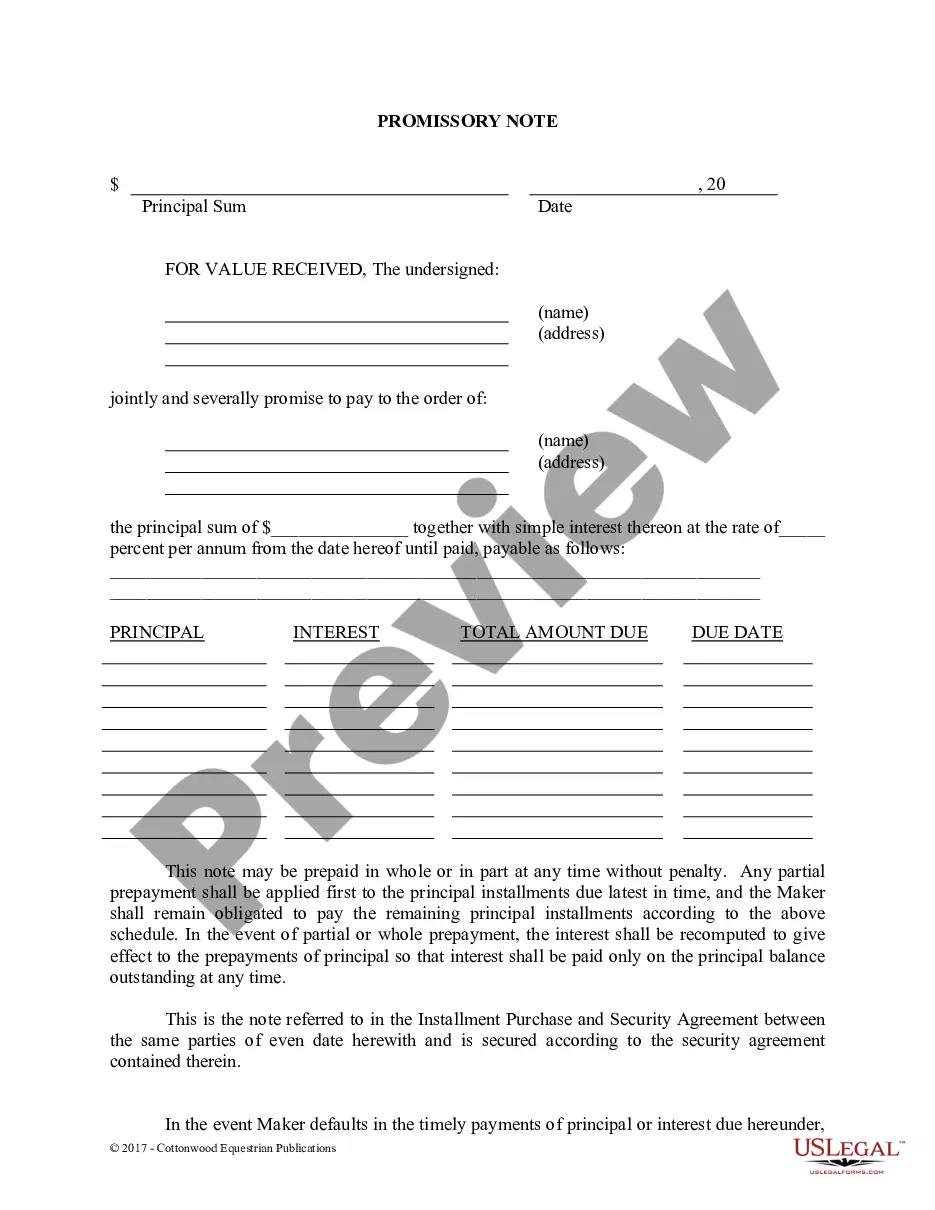

Iowa Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

It is feasible to spend hours online seeking the sanctioned document template that aligns with the federal and state stipulations you need.

US Legal Forms provides a vast selection of legal templates that are evaluated by professionals.

You can easily download or print the Iowa Balloon Unsecured Promissory Note from your service.

If needed, utilize the Review button to look through the document template simultaneously. If you wish to find another variation of your form, use the Search field to locate the template that satisfies your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Afterward, you can complete, modify, print, or sign the Iowa Balloon Unsecured Promissory Note.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- First, make sure you have selected the appropriate document template for your state/city of choice.

- Review the form description to ensure you have chosen the correct document.

Form popularity

FAQ

Negotiating a balloon payment involves discussing terms with your lender before finalizing the agreement. Consider requesting a longer repayment period or lower final payment to ease financial strain. For those utilizing an Iowa Balloon Unsecured Promissory Note, clear communication and understanding of terms can lead to mutually beneficial adjustments.

Yes, an unsecured promissory note is indeed considered a security, even though it does not have collateral. It represents a borrowing agreement where the lender takes on more risk based on the borrower's creditworthiness. Understanding this designation, especially in terms of the Iowa Balloon Unsecured Promissory Note, is essential for both lenders and borrowers.

An unsecured promissory note can indeed be considered a form of security, despite lacking collateral backing. This kind of note relies on the borrower's creditworthiness for assurance. Understanding the nature of your Iowa Balloon Unsecured Promissory Note can guide your financial decisions.

Yes, a promissory note is often classified as a type of security as it represents a financial obligation. However, its classification can depend on its structure and the specific terms under which it is issued. The Iowa Balloon Unsecured Promissory Note has unique characteristics that set it apart in this category.

In Iowa, the statute of limitations for enforcing a promissory note is generally ten years. This timeframe begins from the date the payment was due. If you hold an Iowa Balloon Unsecured Promissory Note, it’s crucial to be aware of this limitation to protect your rights.

Promissory notes, including the Iowa Balloon Unsecured Promissory Note, may be exempt from certain securities regulations. Generally, this depends on factors such as the note's duration and the nature of the transaction. Understanding these exemptions can help you navigate legal complexities.

To fill out a promissory demand note, you should start by clearly identifying the involved parties. After that, specify the principal amount being borrowed, the interest rate, and repayment terms. It's also advisable to include a statement outlining that the repayment is due upon demand. Consider using a template from US Legal Forms to ensure all crucial details are included correctly.

An example of an on-demand promissory note is a simple agreement stating that one party will repay another party the borrowed amount upon request. Specifically, the Iowa Balloon Unsecured Promissory Note can serve as a practical illustration. This type of note allows the lender to demand repayment at any time, offering flexibility. It’s important both parties understand the conditions outlined in the note.

You can obtain a copy of your promissory note by contacting the lender or financial institution holding the original document. If you have an Iowa Balloon Unsecured Promissory Note, you may need to provide identifying information to assist in locating your record. Keeping track of such documents is essential for managing your finances.

To locate your promissory note, check your personal files or contact the lending institution that issued it. If you hold an Iowa Balloon Unsecured Promissory Note, it’s important to keep a copy for your records. Keeping organized documentation helps in managing your financial agreements.