Iowa Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Employment Contract Of Consultant With Nonprofit Corporation?

You can spend numerous hours online trying to locate the official document template that meets the national and state requirements you need.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

It is easy to download or create the Iowa Employment Agreement of Consultant with Nonprofit Corporation from the service.

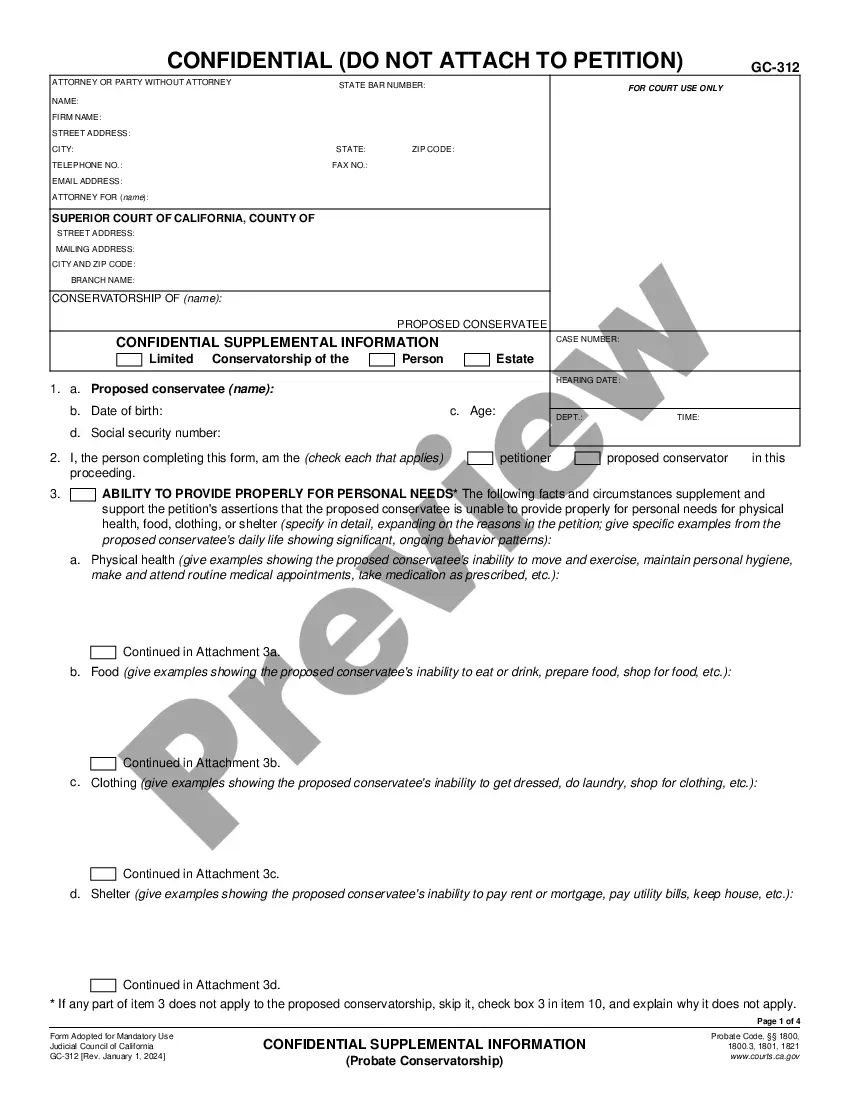

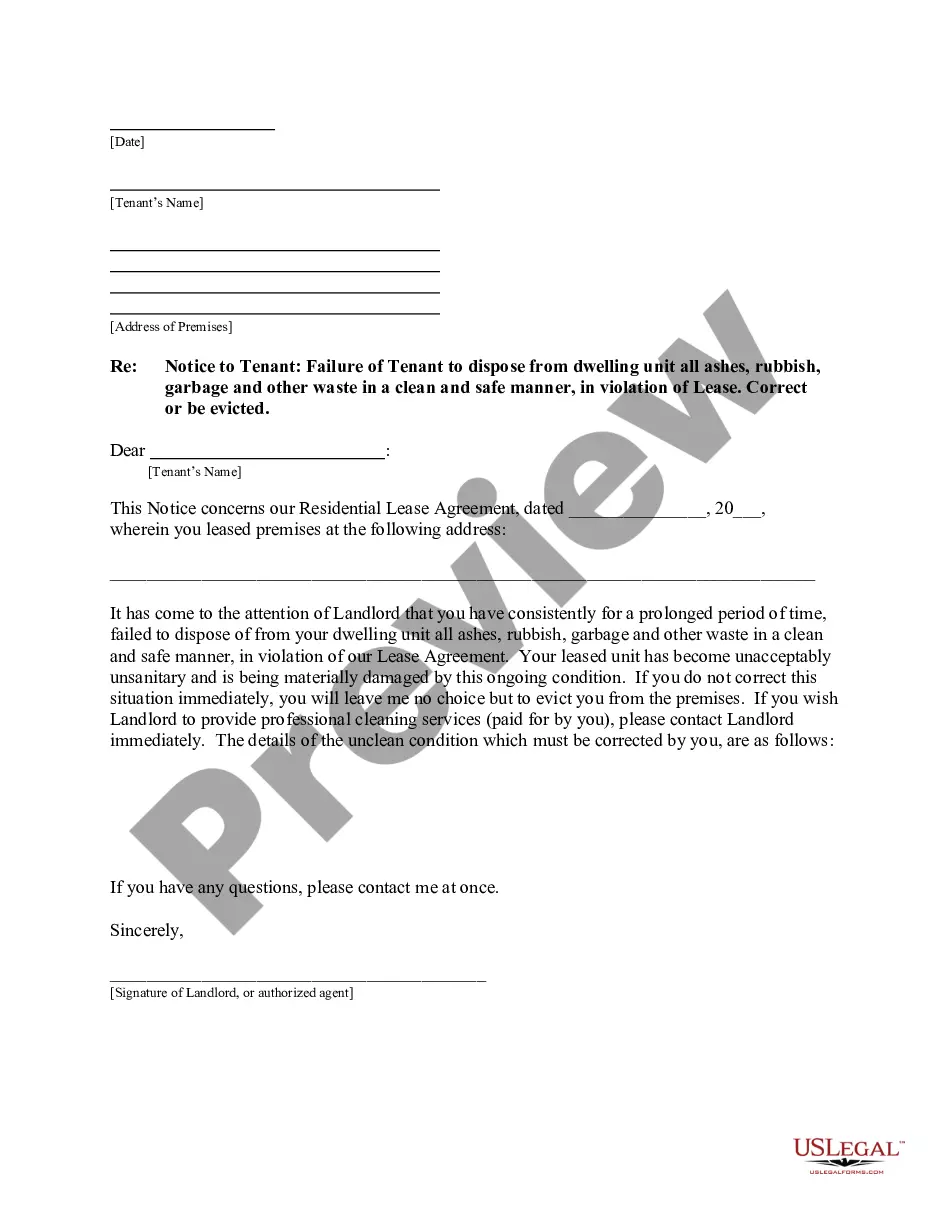

If available, utilize the Review option to explore the document template as well.

- If you possess a US Legal Forms account, you can sign in and select the Acquire button.

- After that, you can fill out, edit, print, or sign the Iowa Employment Agreement of Consultant with Nonprofit Corporation.

- Every legal document template you download is yours forever.

- To obtain another copy of any downloaded form, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for your region/area of interest.

- Review the document description to confirm you have selected the right form.

Form popularity

FAQ

Creating a non-profit organization in Iowa requires you to file Articles of Incorporation with the state. It’s essential to include your mission statement and ensure it aligns with non-profit regulations. After incorporation, consider drafting an Iowa Employment Contract of Consultant with Nonprofit Corporation to define the terms of engagement clearly. Using US Legal Forms can provide you with the necessary templates to easily navigate this process.

To start a corporation in Iowa, you first choose a unique name and appoint a registered agent. Next, file your Articles of Incorporation with the Iowa Secretary of State. Once established, you may also want to draft an Iowa Employment Contract of Consultant with Nonprofit Corporation, which clearly outlines roles and responsibilities. Utilizing resources from US Legal Forms can help ensure your incorporation is successful and legally compliant.

Consultants can secure contracts through networking, referrals, and online platforms that connect them with organizations seeking their expertise. Creating an impressive portfolio and conducting outreach can increase one's chances. Additionally, having an Iowa Employment Contract of Consultant with Nonprofit Corporation ready demonstrates professionalism and readiness, making it easier to finalize agreements.

A consultancy agreement should include the consultant's duties, payment terms, duration of the agreement, and any confidentiality clauses. In an Iowa Employment Contract of Consultant with Nonprofit Corporation, it's vital to cover additional elements such as termination conditions and intellectual property rights, ensuring both parties understand their responsibilities and rights.

For beginners, writing a contract starts with understanding the basic components: the parties involved, scope of work, payment terms, and duration. When creating an Iowa Employment Contract of Consultant with Nonprofit Corporation, make sure to be clear and precise to avoid misunderstandings. Utilizing templates or platforms like uslegalforms can simplify the process and enhance your confidence.

The choice between a statement of work and a consulting agreement depends on the project's nature. If you have a complex project that requires detailed specifications, a statement of work may be better suited. However, for general consultancy, an Iowa Employment Contract of Consultant with Nonprofit Corporation works more effectively, as it outlines the overall relationship and expectations.

To write a contract as a consultant, start by defining the scope of work and including essential elements like payment terms and deadlines. When drafting an Iowa Employment Contract of Consultant with Nonprofit Corporation, ensure clarity in roles and responsibilities. You may also want to include confidentiality clauses and termination conditions for a comprehensive agreement.

A consultant contract is a legal agreement between a consultant and a client, outlining the terms of the services provided. In the context of an Iowa Employment Contract of Consultant with Nonprofit Corporation, this document specifies the roles, responsibilities, payment terms, and duration of the consultancy. Having a well-defined contract helps protect both parties and clarifies expectations.

The best way to file for a 501c3 involves careful preparation and organization. Begin by gathering all necessary documents, including your bylaws and articles of incorporation. After that, complete IRS Form 1023 accurately, paying attention to detail, and ensure it reflects your Iowa Employment Contract of Consultant with Nonprofit Corporation. Finally, consider using services like US Legal Forms to guide you through the process and enhance your filing experience.

The process to apply for 501c3 status in Iowa involves several steps. First, establish your nonprofit corporation by filing the appropriate documents with the state. Then, submit the IRS Form 1023 application, detailing your nonprofit’s purpose and planned operations. Be sure to include your Iowa Employment Contract of Consultant with Nonprofit Corporation, as this helps demonstrate your commitment to the nonprofit sector.