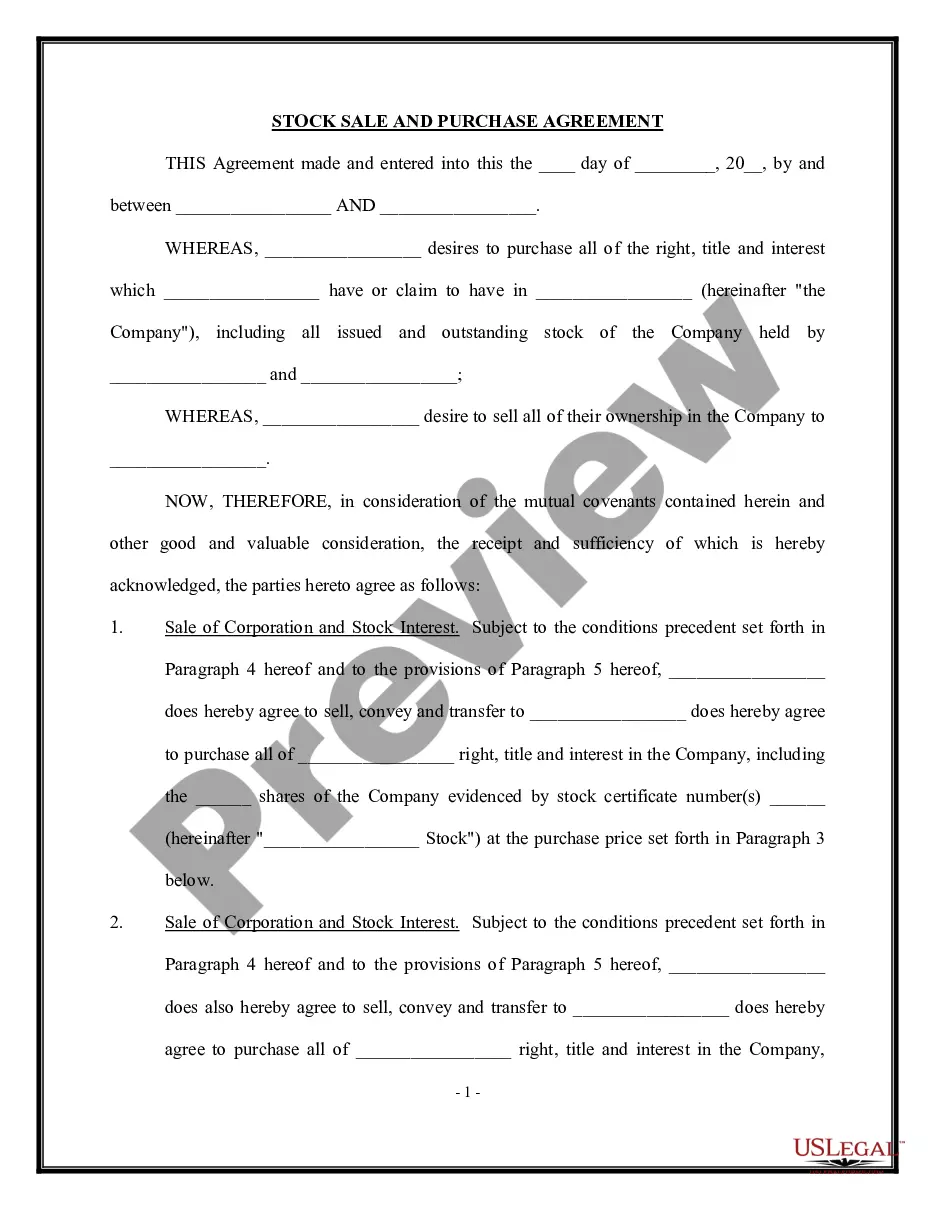

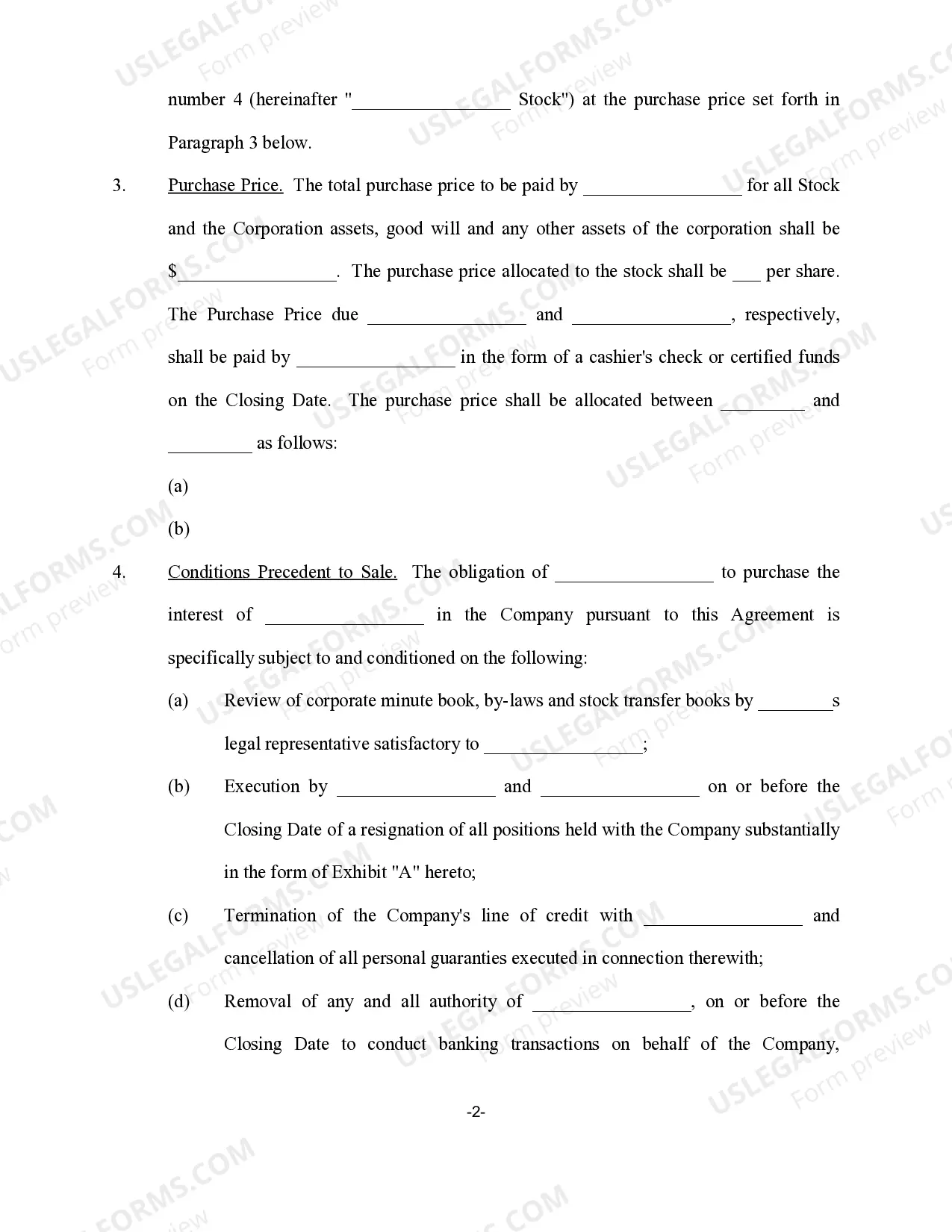

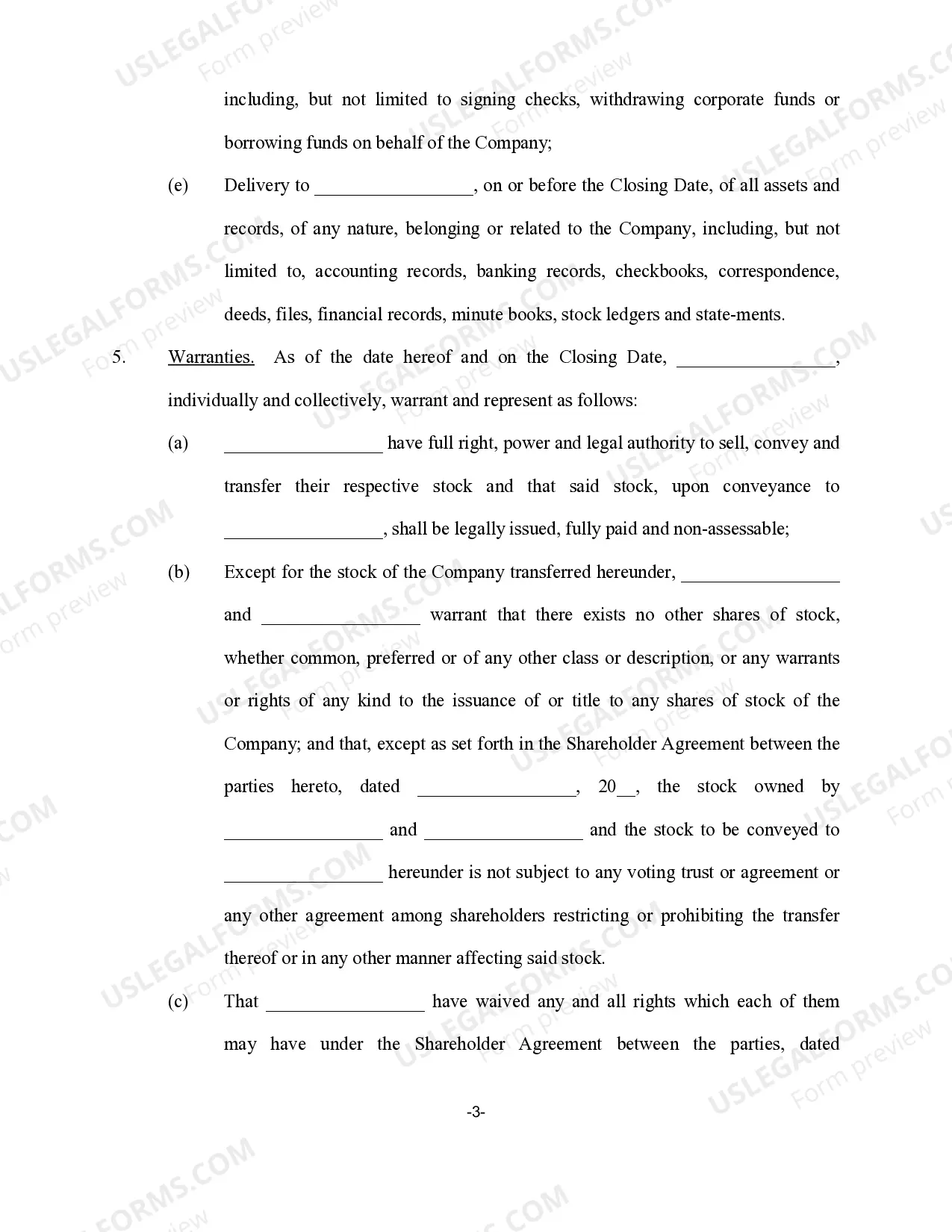

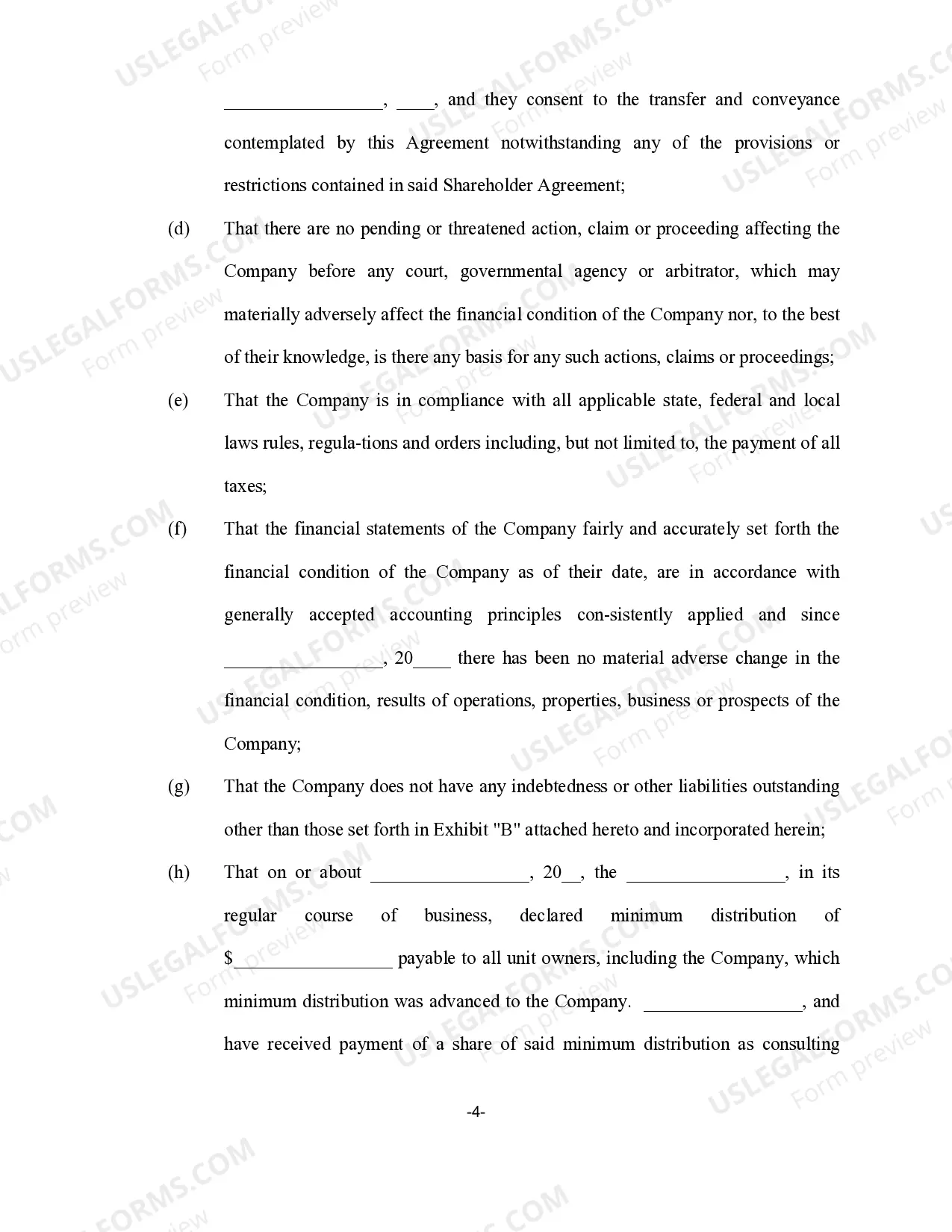

Iowa Stock Sale and Purchase Agreement — Sale of Corporation and all stock to Purchaser is a legal document that outlines the terms and conditions regarding the sale and purchase of a corporation and all of its stock by a buyer (referred to as the "Purchaser"). This agreement is specifically designed for transactions occurring in the state of Iowa. Keywords: Iowa, Stock Sale and Purchase Agreement, Sale of Corporation, Stock, Purchaser. 1. Purpose: The primary purpose of an Iowa Stock Sale and Purchase Agreement — Sale of Corporation and all stock to Purchaser is to legally transfer ownership of a corporation and all its stock from the seller to the buyer. This agreement ensures a smooth and lawful transaction while protecting the interests of both parties involved. 2. Parties involved: The agreement establishes the identity of both the buyer and the seller. The buyer is referred to as the "Purchaser" while the seller is often known as the "Seller" or "Selling Corporation." Identifying the parties is essential in determining the rights and responsibilities of each party throughout the transaction. 3. Stock sale details: The agreement outlines the specific details and terms related to the sale of stock. It includes the total number of shares offered for sale, their type (common or preferred), and the purchase price per share. Additionally, it addresses any representations and warranties regarding the stock being sold, including any restrictions or encumbrances. 4. Sale of corporation: The agreement goes beyond the sale of stock to encompass the transfer of the entire corporation itself. It sets out the terms for transferring title and ownership of the corporation, including any liabilities, assets, contracts, and permits. The agreement may also address any necessary regulatory approvals to ensure a lawful transfer. 5. Purchase price and payment terms: One crucial aspect covered in this agreement is the purchase price of the corporation and stock. It specifies the amount agreed upon by both parties and the payment terms, whether it is a lump sum payment or installment payments. This section may also incorporate provisions for adjustments, escrow accounts, or earn-out provisions. 6. Representations and warranties: To protect the interests of both parties, the agreement includes provisions for representations and warranties. These statements outline the accuracy and completeness of the information provided, financial statements, tax liabilities, third-party claims, pending legal actions, and any material agreements related to the corporation. 7. Closing conditions: The agreement addresses the conditions that must be met before the closing of the transaction. These conditions may include obtaining necessary consents or approvals, satisfying legal requirements, and completing due diligence processes. Types of Iowa Stock Sale and Purchase Agreements — Sale of Corporation and all stock to Purchaser: 1. Simple Stock Sale and Purchase Agreement: This type of agreement is used for straightforward transactions involving the sale and purchase of a corporation and all its stock without any complex terms or additional provisions. 2. Stock Sale and Purchase Agreement with Earn-Out Provision: This agreement includes an earn-out provision, which allows the purchaser to make additional payments to the seller based on certain future financial performance milestones of the corporation. This provision helps bridge valuation gaps and incentivize the seller. 3. Stock Sale and Purchase Agreement with Escrow: In transactions where there may be potential liabilities or disputed claims, an escrow agreement can be included. This ensures that a portion of the purchase price is held in escrow for a specified period to cover any post-closing claims or contingent liabilities. 4. Stock Sale and Purchase Agreement with Seller Financing: In cases where the purchaser is unable to secure traditional financing, a stock sale and purchase agreement with seller financing can be established. This allows the seller to provide financing to the buyer, often in the form of a promissory note or loan, enabling the completion of the sale. Note: It is essential to consult legal professionals when drafting or reviewing any legal document, including Stock Sale and Purchase Agreements. The specific terms and conditions may vary based on individual circumstances and legal requirements in Iowa.

Iowa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Iowa Stock Sale And Purchase Agreement - Sale Of Corporation And All Stock To Purchaser?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords.

You will discover the latest forms such as the Iowa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser in just a few minutes.

Read the form summary to confirm you have chosen the right one.

If the form doesn’t meet your needs, use the Search box at the top of the page to find the one that does.

- If you already possess a subscription, Log In and download the Iowa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser from your US Legal Forms library.

- The Get button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your state/region.

- Click the Review button to check the form’s content.

Form popularity

FAQ

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of a corporation. While there are many considerations when negotiating the type of transaction, tax implications and potential liabilities are the primary concerns.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount.

In an asset acquisition, the buyer is able to specify the liabilities it is willing to assume, while leaving other liabilities behind. In a stock purchase, on the other hand, the buyer purchases stock in a company that may have unknown or uncertain liabilities.

In a sale of shares between two parties, a draft SPA is normally drawn up by the buyer's legal representatives, as it's the buyer who is most concerned that the SPA protects them against post-sale liabilities.

What's Included in a Stock Purchase Agreement?Term 1. Parties and Agreement Date.Term 2. Price and Shares.Term 3. Purchase and Sale.Term 4. Warranties and Representations.Term 5. Choice of Law.Term 6. Payment Terms.Term 7. Due Diligence.Term 8. Closing Date and Time.More items...

A stock purchase agreement is a contract to transfer ownership of stocks from the seller to the purchaser. The key provisions of a stock purchase agreement have to do with the transaction itself, such as the date of the transaction, the number of stock certificates, and the price per share.

A stock purchase agreement, also known as an SPA, is a contract between buyers and sellers of company shares. This legal document transfers the ownership of stock and detail the terms of shares bought and sold by both parties.

More info

What is a share purchase agreement (Spas)? Share purchase agreements A stock purchase agreement is a common type of contract made between two parties whereby the buyer of the contract guarantees to buy a predetermined amount of shares of a publicly traded corporation. There are several types of shares purchase agreements, including: a sale of shares or other securities at a pre-determined price. A sale of a class of shares, which may have fixed or floating dividend, etc. a sale of a specific number or quantity of shares of a class which have a certain strike price. A sale of a class of shares, which have a “going market price”. A stock exchange-based “put” option to buy shares for a specified price at a specified date and time. 2. What is a stock purchase agreement?